The 2018 trading year is officially on its way and as with every start of a new trading year, there are many forecasts and themes which analysts and market watchers claim as vital for a profitable year. Today we will look at three forex themes which every trader should keep in mind, regardless of time horizon, in order to increase the pips earned over the next twelve months. Understanding and taking advantage of major trends will not only increase profits, but also decrease losses. Volatility is expected to increase as compared to 2017 which will create more trading opportunities in the forex market.

The first major theme each traders needs to look out for is continued US Dollar weakness. The US currency had a 2017 which saw it depreciate and the trend is set to continue in 2018. The Federal Reserve may not be able to hike as much as they planned to do which will put downward pressure on the USD. While many pay attention to the monthly NFP reports, inflation is what will really decide in which direction the USD will move. The US central banks together with its global counter-parts, remains puzzled why inflation as well as inflationary pressures remain largely subdued or absent. Should the US economy weaken on top of low inflation, the USD is set for a sharp move to the downside.

The second major theme is a stronger Euro. The Euro had a stellar advance in 2017, and while there are several headwinds for an extended move, the Eurozone currency is set to finish 2018 higher than it entered it. Forex traders should not expect a move similar to last year and the advance for this year is predicted to be a bit more choppy. As major forex traders are selling USD, their capital has to find a home elsewhere in the forex market, and the Euro is in a good position to capture the free capital flows. Economic activity is set to cool from current levels, but to continue to expand which will provide a floor under the Euro. Buying the dips is a great long-term strategy throughout the year.

PaxForex offers traders a highly professional trading environment which allows new traders and seasoned professionals to grow their forex portfolio trade-by-trade. Fund your trading account today, and start building your trading account into a powerful money earning instrument which will better your life. Find out why tens of thousands of forex traders are proud to call PaxForex their home.

The Japanese Yen, the number one safe haven currency, is also predicted to attract plenty of new net inflows as volatility spikes and uncertainty increases. From a monetary perspective, the Bank of Japan is set to keep stimulus in place the longest while at the same time attracting nervous forex traders who seek to reduce their overall risk exposure. As more and more unanswered questions pile up, the Japanese Yen should increase its slow advance which will further complicate the central banks decision making. Enjoy a very profitable trading year and keep our three themes for a profitable 2018 in forex in mind as you adjust your trading account.

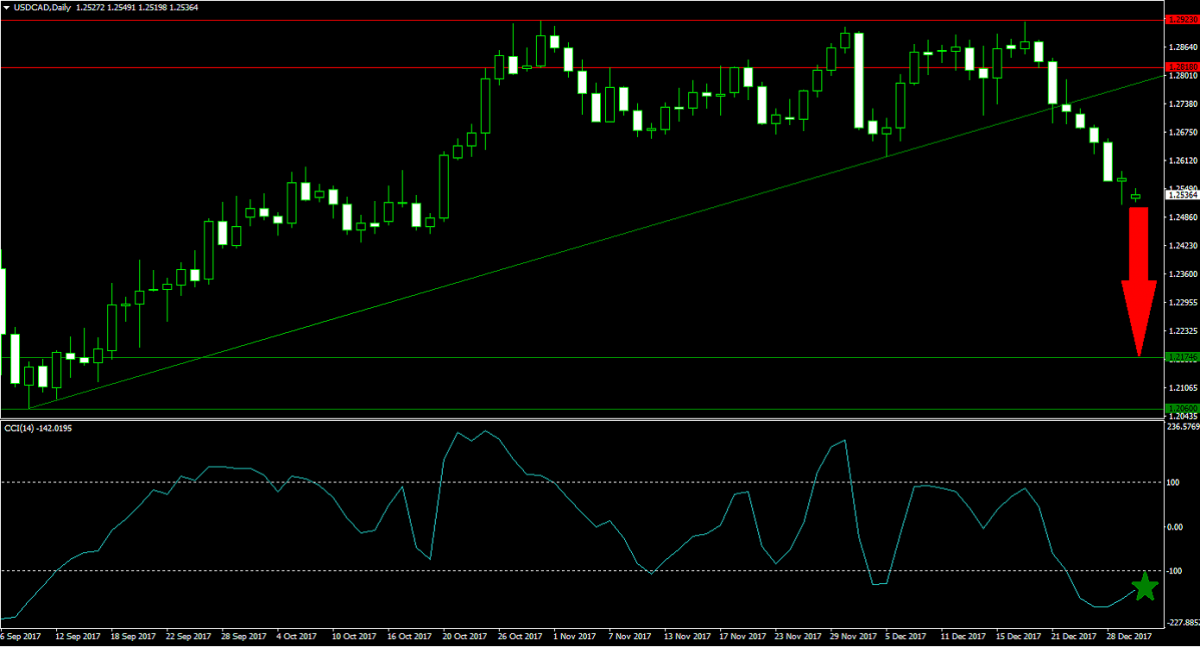

Forex Profit Set-Up #1; Sell USDCAD - D1 Time-Frame

The USDCAD is in the middle of a correction after its most recent horizontal resistance area rejected a further advance. A breakdown took this currency pair into its ascending support level which failed to stabilize the move lower. This lead to another breakdown which accelerated the sell-off which is now on course to take the USDCAD back down into its horizontal support area. Price action needs to monitored once it reaches it in order to evaluate more potential downside. Any level above 1.2570 represents a solid entry level for new short positions.

The CCI confirmed the collapse in price action and dip well below the -100 mark which represents extreme conditions. A sideways trend may emerge in order to normalize the conditions before the next move to the downside will develop. Download your MT4 Trading Platform today in order to ad this trade to your forex portfolio.

Forex Profit Set-Up #2; Buy EURUSD - MN Time-Frame

After the EURUSD stabilized inside of its horizontal support area, a momentum change occurred and this currency pair completed a breakout above its support area from where more buying pressure carried the Eurozone currency to the upside. The move is set to resume until price action will run into its descending resistance level from where another breakout is possible if momentum carries on. The EURUSD has recovered about half of its correction from its most recent high and could make a full recovery.

The CCI initially spiked above the 100 level which is indicative of extreme overbought conditions, but has since drifted below this level. Buying the dips is highly recommended as plenty of upside remains embedded into this trade. Open your PaxForex trading account today and take advantage of a low risk-high reward trade with a long position in the EURUSD.

Forex Profit Set-Up #3; Sell AUDJPY - D1 Time-Frame

The AUDJPY has exhausted its upside potential and the lower band of its horizontal resistance area forced a halt of the advance. A reversal into its descending resistance level is expected to develop from where momentum may be strong enough to force a breakdown. This will take the AUDJPY back down into its horizontal support area. Any level above 88.000 marks a good entry level for new sell orders. This trade has limited upside risk with great downside potential and should be added to a well diversified forex account.

The CCI has just completed a breakdown from extreme overbought territory, above the 100 level, which confirmed the initial collapse in upside momentum. A move below the 0 mark would complete a full reversal from bullish to bearish momentum. Switch to PaxForex today and enjoy the best trading conditions in the forex industry today, earn more with every trade.

To receive new articles instantly Subscribe to updates.