The Euro has rallied all year long and there are many bullish factors behind the strong advance. The Eurozone economy is expanding at its best pace in six years which was confirmed with the preliminary third-quarter GDP increasing by 0.6% quarter-over-quarter and by 2.5% year-over-year. PMI reports are at very strong readings, consumer confidence is on the rise and unemployment is decreasing. With many positive economic news circulating, it is very easy to ignore potential headwinds which could derail the current move to the upside.

The last place many forex traders may look to for potential issues is the very place which has primarily driven the move to the upside; Germany. The Eurozone has many hotspots where the next crisis may emerge from, but Germany has been the safe haven for the Euro. The majority believes that Germany will handle the issues, no matter what. The most recent German elections have created an issue for German Chancellor Merkel as she delivered the worst election results for her ruling party since 1949; Germany has never conducted new elections due to failed coalition talks and the SPD opted against a grand coalition and went into opposition. A minority government has also never been attempted.

Her CDU is now stuck in four-party coalition talks with differences ranging from financial regulation to immigration and from security to economic as well as environmental policies. Making the matter worse, Merkel has imposed a week-end deadline to unlock actual coalition negotiations after one month of exploratory talks which ended with infighting an no agreements reached. The Green Party will have a meeting on November 25th in order to vote on any potential coalition proposal which poses a risk to the self-imposed deadline.

Forex traders need to make sure that their portfolios enjoy the benefits of a professional trading environment which allows them to approach any potential crisis not with fear, but with the mindset of a seasoned trader seeking profitable trade entries regardless of circumstances. Open your PaxForex trading account now and trade with confidence.

The biggest overlooked threat to Euro bullishness appears to be the lack of a positive outcome from German coalition talks and the potential fallout from this. Germany has never faced a political situation like this and maneuvers in unchartered territory. Of course the hope is that there will be a majority coalition government, but if the Green Party decides to remain an opposition party then the two outcomes left for Merkel would be a minority government or new elections. The Euro will react to any negative news out of the coalition talks in a negative way and here are three ways you can limit your downside exposure to a negative outcome, but also profit from the upside potential of depressed Euro trades.

Forex Profit Set-Up #1; Buy Silver - D1 Time-Frame

All the commodity hype is often reserved to Gold which does enjoy a safe haven status, but this also makes it a very crowded trade. Silver offers the upside potential, but often with less volatility. The market is of course much smaller and price action moves don’t gyrate in the same fashion as Gold, but should the overlooked threat to the Euro rally materialize, forex traders will enjoy a nice hedge to their currency positions with a long trade in Silver.

The chart shows a symmetrical triangle formation and together with the CCI above 0 indicates a mildly bullish scenario which can accelerate as German coalition talks play out. In the event of a positive outcome, Silver has limited downside potential from current levels which makes this trade a one-two win for traders. Make sure to add it through your PaxForex trading terminal.

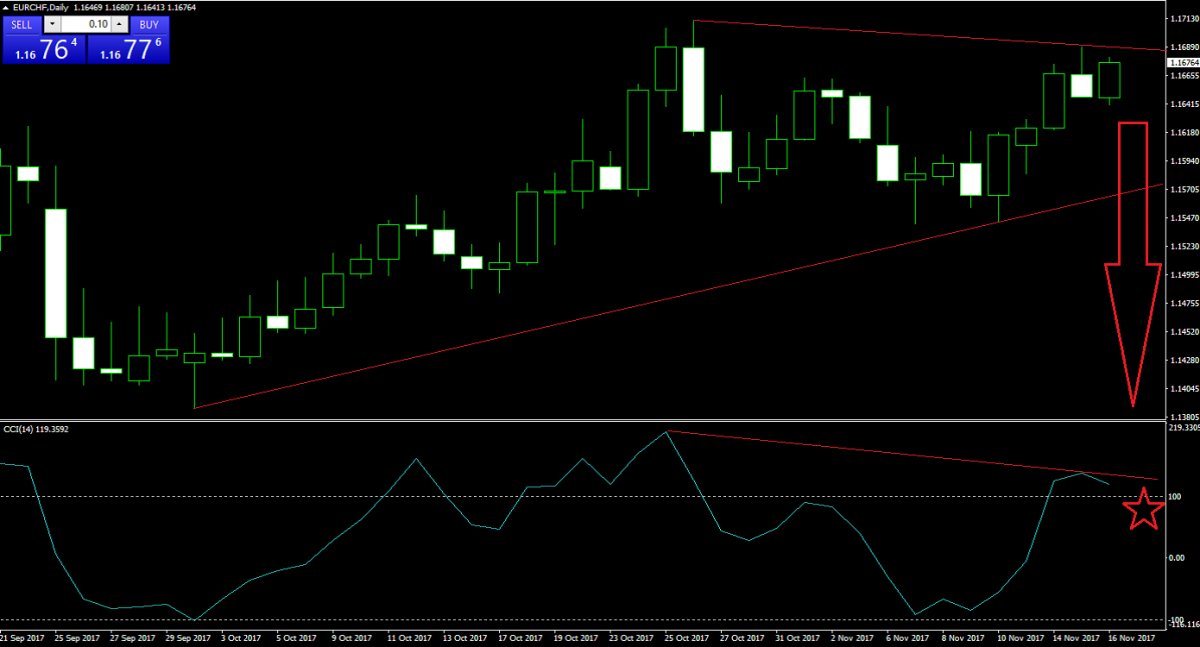

Forex Profit Set-Up #2; Sell EURCHF - D1 Time-Frame

The EURCHF and its bullish move is under pressure from multiple fronts. A rising wedge formation has formed, which is a bearish chart pattern. In addition there is a potential for a double top formation, which would be another bearish trading signal. Bullish momentum is collapsing as this currency pair continues to drift higher, but a breakout above 1.1700 is unlikely and has been rejected before. The descending resistance level of its falling wedge formation is adding downside pressure.

The CCI is trading above 100 which indicates an extreme overbought condition, but the trend is to the downside and a breakdown is expected to result in profit taking as well as an increase in sell orders. Forex traders should monitor the CCI and act on a breakdown. Make sure to also subscribe to PaxForex trading recommendations in order to remain up-to-date.

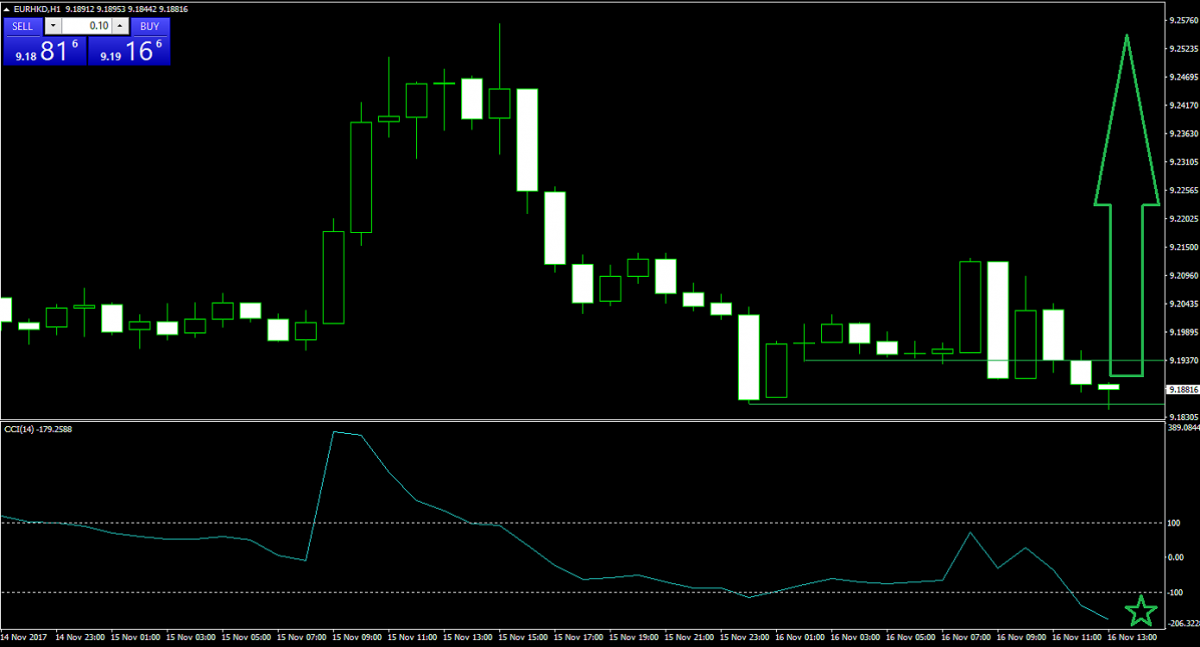

Forex Profit Set-Up #3; Buy EURHKD - H1 Time-Frame

We are going exotic on this one, the EURHKD has sold-off from its most recent high yesterday and is currently deflating selling pressure inside of an establish support zone from where a breakdown is currently not expected. We are looking at the H1 chart, but zooming out into the W1 also shows an ascending support level giving a boost to bullish momentum. This exotic currency pair is ripe for a strong bounce-back, after which price action should be monitored further.

The CCI collapsed below -200 and is currently trading just above this level. Such a move is not sustainable and in a thinly traded currency pair as the EURHKD, volatile swings should be expected and profited from. Keep an eye out for fundamental factors which can influence this trade set-up and stay tuned to our fundamental analysis section here at PaxForex.

To receive new articles instantly Subscribe to updates.