Two of the biggest forex moving pieces of economic data are GDP and CPI figures. Since the financial crisis, central banks flooded and to a certain degree continue to flood the market with quantitative easing. A lot of market participants have therefore paid less attention to GDP and CPI data, since central banks were meddling in the markets, printing money and buying bonds as well as equities in the case of the Bank of Japan. Now that central banks decided to slowly roll back stimulus, forex traders should focus more on key pieces of economic data in order to determine the health of economies and their respective currencies.

While GDP and CPI were never completely ignored, their significance was diminished. As the global financial system is in the process of normalization, forex traders are set to react more towards key economic data than over the past decade. Over the next few years, the battle of GDP’s and your forex account should once again play a key role in your trading decision making. Let’s start with the world’s largest single currency union, the Eurozone. Second-quarter GDP slowed down to a growth rate of only 0.3% quarterly and 2.1% annualized. This marked the sixth year of economic growth for the EU, but the figures are not painting a picture of a strong overall economy.

Most of the growth can be attributed to Germany’s export machine which has enjoyed the Chinese economic boom. As China is poised to slowdown, so will Germany and therefore the EU. Italy, the Eurozone’s third largest economy, reported even worse GDP figures with GDP growth at 0.2% quarterly and 1.1% annualized. This was the slowest growth rate since the third-quarter of 2016. Italy has remained almost stagnant and is home to the Eurozone’s worst performing economy. At the same time as Eurozone GDP is headed lower, inflation is rising. This may pose a big challenge to the ECB under President Draghi and complicate monetary policy decision making.

Is your forex account ready for the battle of GDP’s? As countries release their GDP, CPI and employment data, trading opportunities will arise and forex traders can profit greatly if they are positioned correctly. Open your PaxForex Trading Account today and access the world of forex trading. Join our growing community of profitable forex traders and find out how the forex market can change your life for the better!

Then there is Sweden, with a second-quarter GDP growth rate twice as strong as expectations which begs the question: What happened? Forex traders will try to determine if this is sustainable or if the short Krona rally will be reverted soon. A downward revision may be on the horizon. Poland on the other side is powering ahead with an above 5.0% GDP growth rate which many in the Eurozone don’t even dare to dream of. Poland as well as Sweden are outside the currency union. With Brexit diluting the UK GDP figures, forex traders may want to brace for an upside surprise down the road. What will Canada report today in regards to their second-quarter GDP? The battle of GDP’s and your forex account have just begun and will intensify over the next few year. Here are three forex trades to beat the market with.

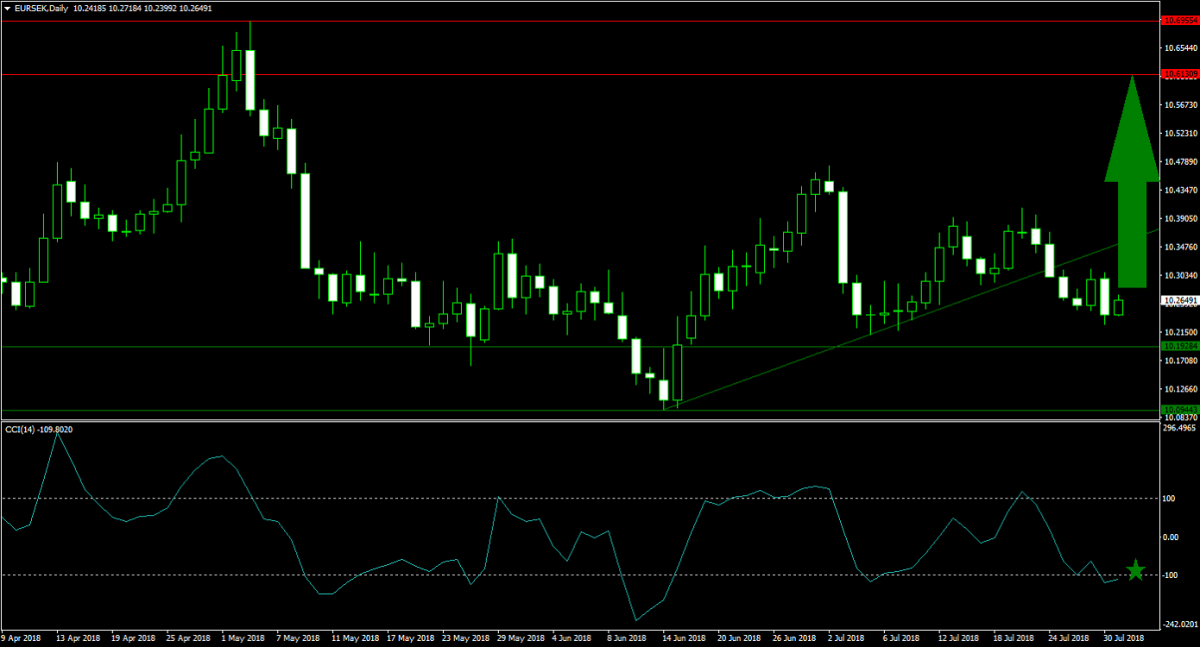

Forex Profit Set-Up #1; Buy EURSEK - D1 Time-Frame

While the Eurozone GDP figures are not great, the threat of a downward revision to Sweden’s GDP is likely to pressure the Krona to the downside against the Euro. Following today’s upside surprise, price action in the EURSEK pushed below its ascending support level from where bearish pressures remain minimal. Downside is limited to the upper band of its horizontal support area and forex traders should spread their buy orders between both support levels in order to capture the pending upside.

The CCI has dipped into extreme oversold conditions below -100, but is well above its previous low. A move above -100 may ignite a short-covering rally which will push the EURSEK back above its ascending support level and above. Download your PaxForex MT4 Trading Platform now and enter this currency pair to your forex portfolio before it will accelerate to the upside.

Forex Profit Set-Up #2; Sell AUDPLN - D1 Time-Frame

The Australian economy continues to rely heavily on China’s appetite for commodities and with China facing a few GDP bumps of its own, the Australian Dollar may fall victim to selling pressure. The Polish Zloty has been punished by forex traders due to political differences between Poland the the EU. During this time, Poland’s strong GDP growth has largely been ignored. The AUDPLN is poised to resume its move down into its horizontal support area as a descending resistance level is providing sufficient bearish momentum. Forex traders are recommended to sell the rallies in this currency pair.

The CCI is currently trading in extreme oversold territory, but any short-term advance in the AUDPLN will take this technical indicator back into neutral levels from where new sell orders are warranted. Make sure to subscribe to the PaxForex Daily Fundamental Analysis section and let our expert analysts guide your forex portfolio to monthly profits in excess of 500 pips!

Forex Profit Set-Up #3; Buy Gold - D1 Time-Frame

Gold has been under bearish pressures amid a US Dollar rally, but forex traders should be prepared for a potential trend reversal in this precious metal. As the USD is set to reverse, Gold may advance. Price action is currently in the process of confirming its horizontal support area. A breakout is likely to follow and bullish momentum should be strong enough to extend the advance past its descending resistance level and beyond. Forex traders are advised to place their buy orders inside of its horizontal support area.

The CCI is trading in and out of extreme oversold conditions and a long positive divergence has formed which represents a strong bullish trading signal. Follow the PaxForex Daily Forex Technical Analysis and never miss another trading set-up posted by our expert analysts. Just copy the recommended trades into your own forex portfolio and profit from the forex market.

To receive new articles instantly Subscribe to updates.