Developments in Asia are heating up and changes are on the horizon. Many of the Asian currencies are thinly traded or out of reach for the retail sector, but the Japanese Yen is the go-to currency when it comes to carry trade, hedging, risk management and Asian exposure. Many often overlook the Australian Dollar, a major currency, as well as its smaller neighbour the New Zealand Dollar. Analysts expect turbulences and uncertainty ahead for the Asian region and today we will take a closer look at the Australian Dollar and the New Zealand Dollar.

Let’s take a look at four very important areas of interest every forex trader should have on their screen. The trade war between the US and China has been put on the back-burner for now, but is far from over. The disagreements as well as initial tariffs remain in place and could grow into a much wider conflict covering the entire global. China and Japan are warming up relations in a positive development, analysts believe this is due to their fear of losing control and influence of potential power-shifts in the region. China is key in the region and the Australian Dollar reacts heavily to developments related to China.

Another market moving event was the meeting between North Korea and South Korea which opened the door for a meeting between US President Trump and North Korean Leader Kim Jong-un at an yet undisclosed location. In a sign of goodwill, North Korea released three US prisoners yesterday. While a meeting would be historic, many doubt that the relations will warm to the point where North Korea will give up its nuclear program, especially after the US is pulling out of the Iran nuclear deal and will reimpose sanctions.

Open your PaxForex Trading Account now in order to have access to the world of forex. Profit with the help of our expert analysts and start creating a wealthier future for you and your family. Join our growing community of profitable forex traders and earn more pips per trade thanks to our excellent trading conditions.

The Malaysian election results yesterday added the latest round of volatility to the Asian markets as 92-year old former Prime Minister Mahathir will return to power in what many call a historic power-shift. While non of the above four developments has a direct impact on Aussie or Kiwi, the ripple effects will have an impact on both commodity currencies. The Aussie is the preferred currency, but the Kiwi has plenty of potential to pip your forex portfolio. The Australian Dollar versus the Kiwi Dollar, which one should you add to your portfolio? How about both, here are three forex trades you need to know about in order to profit from developments in Asia.

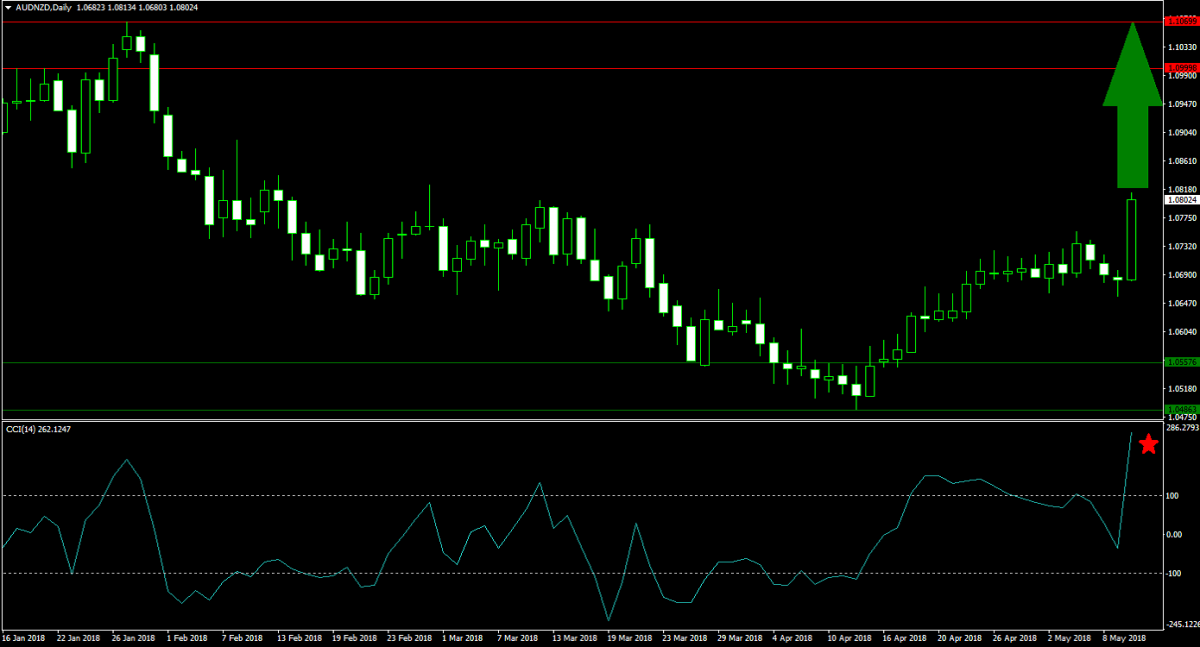

Forex Profit Set-Up #1; Buy AUDNZD - D1 Time-Frame

This puts the Aussie directly against the Kiwi. The AUDNZD is on a solid advance following the breakout above its horizontal support area. Price action is currently mid-way through its expected advance as there is no resistance for this currency pair until it will challenge its the lower band of its horizontal resistance area. Forex traders are recommended to buy the dips in the AUDNZD as momentum favors more upside from current levels.

The CCI did spike deep into extreme overbought conditions, but as this currency pair is expected to dip slightly, this technical indicator will also move closer to neutral territory. Make a deposit today and enter this trade to your portfolio before price action accelerates to the upside. This is a great way to diversify your Bitcoin and Ethereum holdings into real cash.

Forex Profit Set-Up #2; Sell EURNZD - D1 Time-Frame

The EURNZD covered the distance between its horizontal support area and its horizontal resistance area in a short time. Following the most recent surge in price action, this currency pair is now ripe for a counter-trend reversal. Profit-taking should be expected which could pressure the EURNZD back down into its horizontal support area. Forex traders are advised to sell the rallies in order to profit from the price action reversal.

The CCI briefly flirted with extreme oversold territory, but bounced higher together with price action. As this currency pair is set to contract from current levels, this momentum indicator is also bound for more downside. Get the latest technical trading set-ups directly from the PaxForex Daily Forex Technical Analysis section and never miss a trading recommendation.

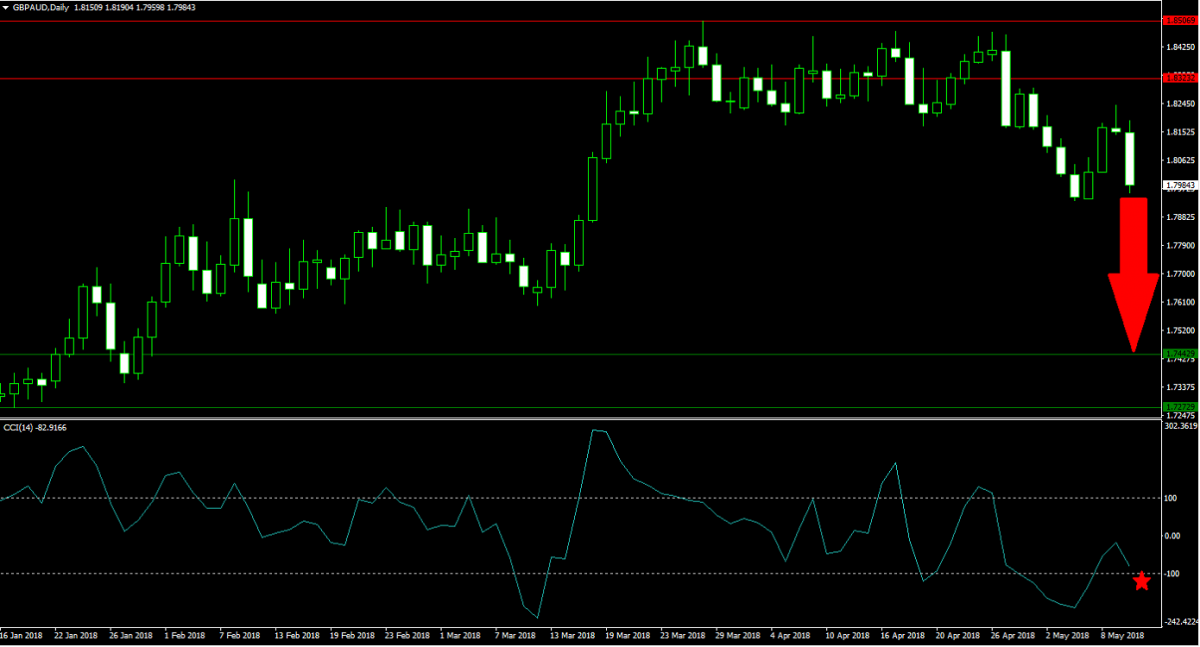

Forex Profit Set-Up #3; Sell GBPAUD - D1 Time-Frame

Forex traders who seek to enter a slightly more matured trade can benefit from the GBPAUD which is now in the early stages of a confirmed corrective phase. After price action failed to complete a breakout above its horizontal resistance area, a reversal took this currency pair below it which was followed by a bearish sentiment shift. Forex traders should sell the rallies as this trade has plenty of downside potential and limited upside risk.

The CCI is trading in and out of extreme oversold conditions, but as the GBPAUD is bound for more bearish pressures this technical indicator is also expected to contract further. Make sure to subscribe to the PaxForex Daily Fundamental Analysis and earn over 500 pips per month with the help of our expert analysts.

To receive new articles instantly Subscribe to updates.