Sweden doesn’t make the headlines very often as it used to be a very peaceful, Nordic economy usually ranked in the Top 5 countries to live in. A well educated population, wealthy and great living standards. Things have changed over the past decade and the September 9th election are deemed historical as it could change politics in Sweden dramatically. The Social Democrats are predicted to suffer heavily for the policies they pushed and for ignoring voters concerns. Their governing coalition could collapse as opposition parties add to their voter base.

Immigration, healthcare and a rise in crime have caused voters to flee the Social Democrats. The Sweden Democrats, which promise to fight immigration and crime, are surging in the polls and next week's election is wide open for a new coalition to emerge and change the course Sweden will take in the future. Healthcare is one aspect Sweden has always been proud of, but it has been neglected and resulted in angry voters. The rise in crime, often tied to immigration, is also causing unrest amongst citizens who are used to a tranquil environment to raise families.

The Swedish Krona has now dropped to crisis levels which were last seen during the global financial crisis of 2008. While the potential political shift is a major cloud over the Swedish currency, it is not the only one. Forex traders are worried that the Riksbank, the Swedish central bank, will not increase interest rates and decide to wait longer in order to get a better picture on inflation. Some speculate the Riksbank also wants to see the election results before hiking interest rates.

Weak Swedish retail sales added to selling pressure in the Krona, but is it a crisis or an opportunity? With the consumer on the retreat, an uncertain election and an interest rate decision three days before a historic election, it may very well come down to the traders time horizon and risk appetite. Open your PaxForex Trading Account today in order to turn a crisis into an opportunity.

The effects of a global trade war are also pressuring the Swedish Krona as the economy relies heavily on exports. Swedbank Strategist Anders Eklof noted 'On top of all that we have the Swedish general election, which not least foreign investors have seen as a risk event with the Italian election, the UK Brexit vote and election of Trump fresh in mind.'. He further added that 'It seems that the krona lately has begun pricing in a higher risk that the Riksbank will push back its first rate increase into next year.'. Swedish Krona, crisis or opportunity? Here are three forex trades too add to your portfolio in order to turn a crisis into an opportunity.

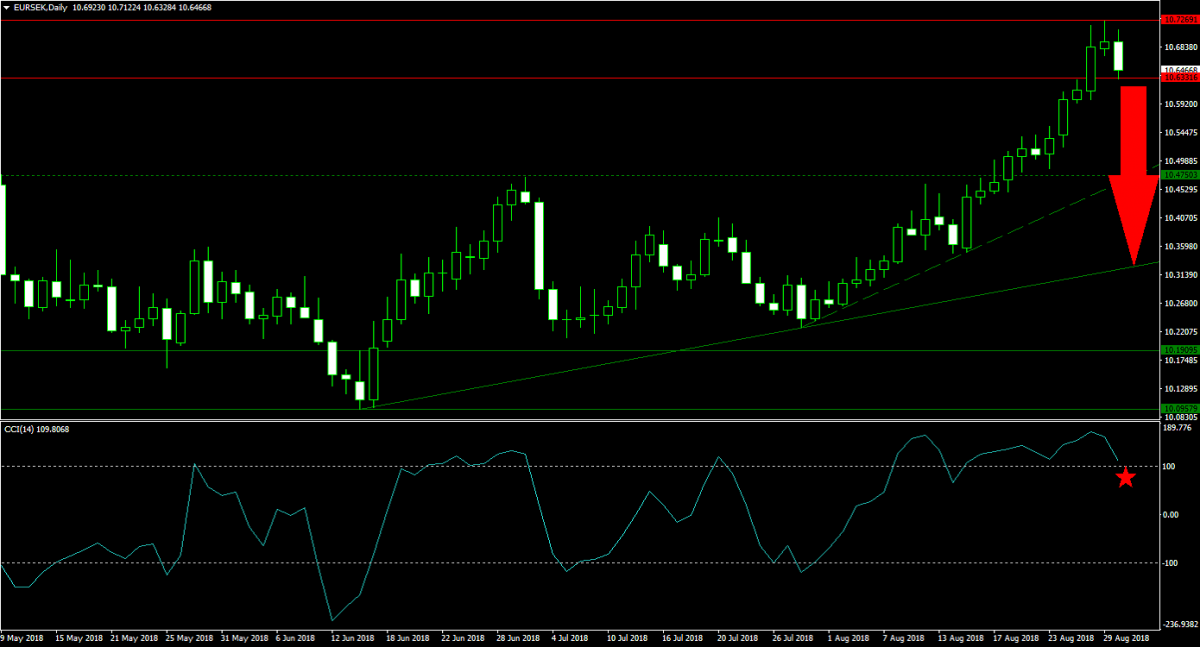

Forex Profit Set-Up #1; Sell EURSEK - D1 Time-Frame

After the EURSEK reached crisis levels not seen in a decade, bullish momentum is receding as price action is validating its horizontal support area. A move below the lower band could trigger profit taking which will push this currency pair into its secondary ascending support level which intersects its next horizontal support level. An extension of the sell-off into its primary ascending support level is anticipated. Forex traders should place their sell orders in the EURSEK just above the lower band of its horizontal resistance area.

The CCI is trading in extreme overbought conditions, but is off of its highs and in line with the decrease in bullish momentum. A breakdown below 100 could act as the trigger for a move to the downside on the back of profit taking. Subscribe to the PaxForex Daily Forex Technical Analysis and never miss a profitable trading opportunity again. Simply copy our technical trading recommendation into your own forex account!

Forex Profit Set-Up #2; Buy GBPDKK - D1 Time-Frame

A double breakout ended the correction in the GBPDKK as price action initially spiked above its horizontal support area and then move past its secondary descending resistance level. The path is now cleared to the upside until this currency pair will reach its next horizontal resistance level. As the GBPDKK is gathering bullish momentum, an advance into its primary descending resistance level is expected to materialize. Forex traders are recommended to buy the dips in this currency pair.

The CCI completed a breakout from extreme oversold territory, which was preceded by the formation of a positive divergence, and momentum carried this technical indicator above the 0 mark as well which completed a bullish momentum shift. Follow the PaxForex Daily Fundamental Analysis and let our expert analysts guide you to over 500 pips in profits per month. Let us do the work so you can earn the rewards!

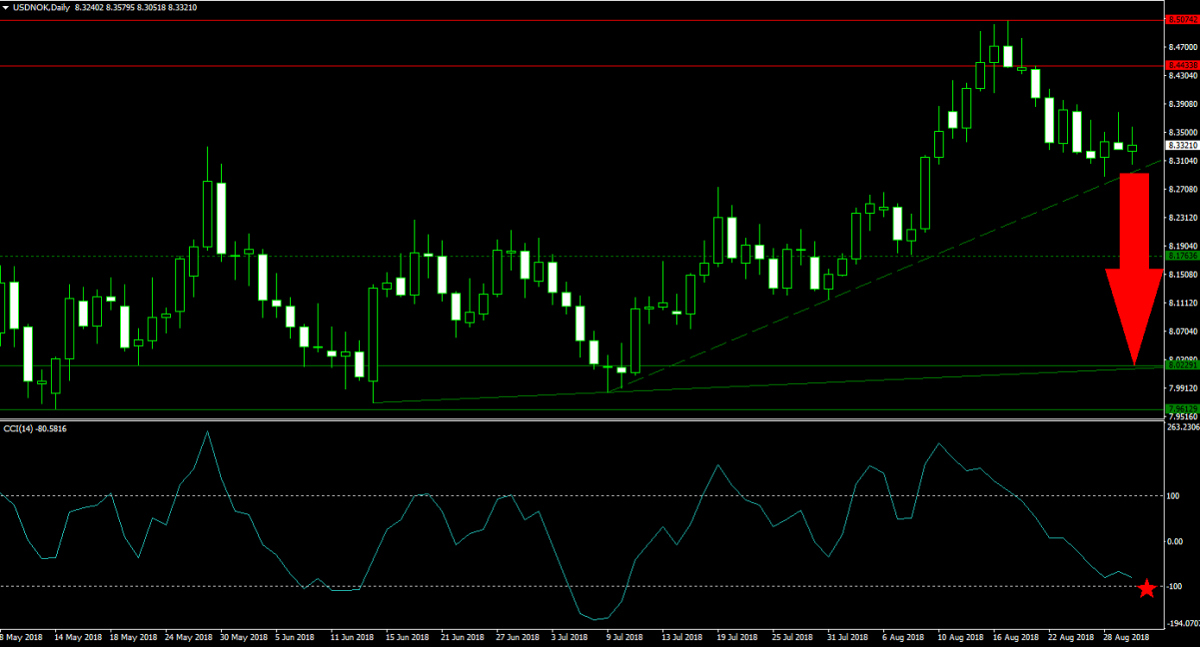

Forex Profit Set-Up #3; Sell USDNOK - D1 Time-Frame

The USDNOK already completed a breakdown below its horizontal resistance area and is now challenging its secondary ascending support level. A breakdown is expected to advance the sell-off into its next horizontal support level. Given the accumulation in bearish momentum, the USDNOK is on course to complete another breakdown which will clear the path into its next horizontal support area which is enforced by its primary ascending support level. Forex traders are advised to sell the rallies.

The CCI descended from extreme overbought conditions and completed a breakdown below the 0 barrier which resulted in a bearish momentum change. More downside in this momentum indicator is expected. Make a deposit into your PaxForex Trading Account now and earn more pips per trade with PaxForex. Join our growing community of successful forex traders!

To receive new articles instantly Subscribe to updates.