Sentix, the pioneer in behavioural finance since 2001, has released its June 2019 report which offered a recession signal for the German economy. The trade war the US initiated with China is having an effect on investor confidence readings across economies as the global economic slowdown intensifies. PMI readings, industrial and manufacturing production data as well as factory orders have all clocked in below expectations for several months. Employment data has now joined the chorus of economic indicators which suggest that a global recession is around the corner. Even the US Fed has communicated that an interest rate cut may be warranted which send the US Dollar to a two-and-a-half month low.

The Sentix Eurozone Investor Confidence Index for June slumped to -3.3 while the Expectations sub-component came in at -12.3. The biggest worry for Euro bulls should be the Sentix German Investor Confidence Index which was reported at -0.7, the lowest reading since March 2010 and a clear recession signal. Expectations plunged to -14.0. Germany is the largest economy in Europe, and a recession there will drag down the rest of the continent. The Bundesbank has now cut its growth forecast for 2019 to 0.6% annualized. Is your forex investment properly shielded for the ripple effects of a German recession and the impact it will have on the Euro?

The ECB is open to more quantitative easing, further cuts in its already record low interest rates which would push them deeper into negative territory as well as other adjustments to its current stimulus. ECB president Draghi stated last week that “The key issue is: how long can the rest of the economy be insulated from a manufacturing sector that keeps on being weak? I think that’s what the Governing Council had in mind when they said they stand ready.” The Sentix US Investor Confidence Index dropped to 6.5, the lowest reading since February 2016, as Expectations clocked in at -16.0. The Trump administration’s trade war is showing negative impacts for the US economy which are expected to accelerate.

Forex traders now need to properly account for the position of the Euro in a global economy which is expected to contract in unison at a time the US Dollar is anticipated to face further downside pressure. Open your PaxForex Trading Account now, join our fast growing community of profitable forex traders and find out why PaxForex is one of the prime MetaTrader 4 brokers!

As Austria suffered huge declines in its components after the collapse of the Austrian government, Switzerland has diverged and offered the sole bright spot. The Sentix Swiss Investor Confidence Index rose to 19.9, the highest reading since September 2018, while Expectations increased to 3.8. In regards to the global outlook, the Sentix report added “The hope that the phase of economic weakness around the turn of the year 2018/2019 could be quickly brought to an end seems to have vanished. Although the cause of the problem is easy to identify, it is not necessarily easy to solve in view of the increasingly tough political fronts.” While today’s Sentix report offered the latest recession signal, here are three forex trades which will boost your returns in the midst of economic disappointment!

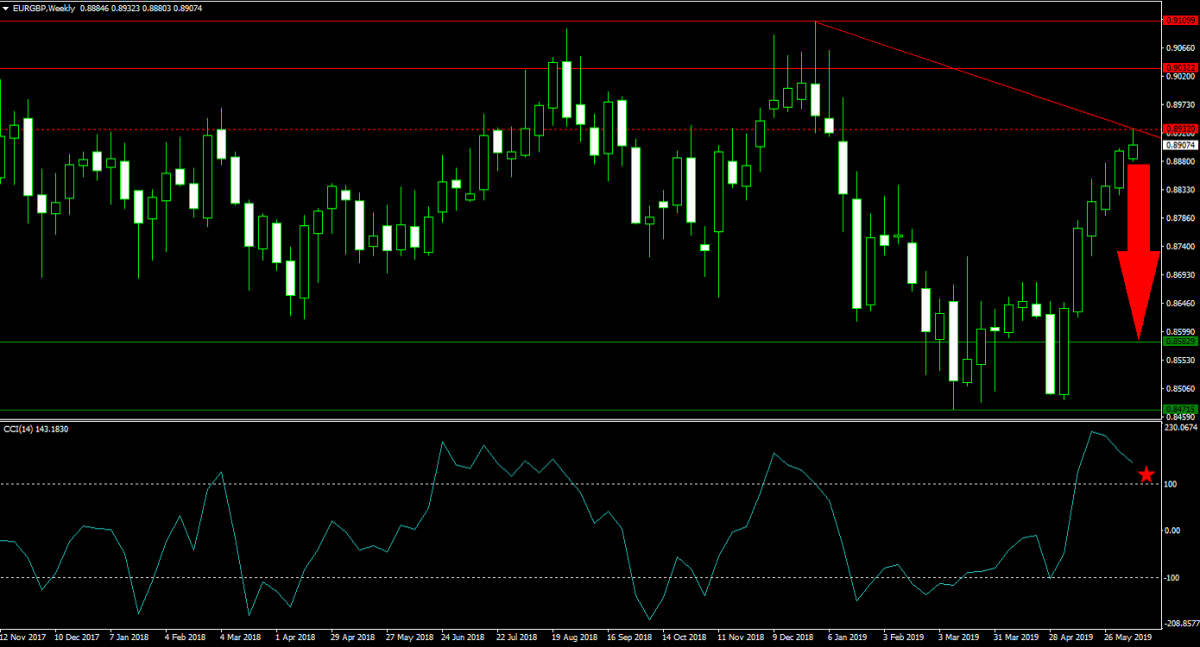

Forex Profit Set-Up #1; Sell EURGBP - W1 Time-Frame

The Euro enjoyed a solid rally against the British Pound, but this trend has been exhausted now as a fresh wave of disappointing Eurozone economic data was published. The EURGBP rallied into its horizontal resistance level which is enforced by its primary descending resistance level. This caused a sharp drop in bullish momentum as an inverted hammer candlestick formed. Price action is now expected to retrace its advance in the back of profit taking which is favored to take the EURGBP down into the upper band of its next horizontal support area.

The CCI remains deep in extreme overbought conditions, but started to revert from its intra-day high as bullish momentum is fading. This technical indicator is now expected to descend below 100 which is likely to attract a fresh wave of sell orders. Download your PaxForex MT4 Trading Platform, get your MetaTrader 4 login and start building your forex portfolio.

Forex Profit Set-Up #2; Sell USDCHF - W1 Time-Frame

While the US economy is struggling with a mounting volume of negative economic reports and a sharp slump in investor confidence, Switzerland is moving in the opposite direction which should boost the Swiss Franc further. The USDCHF started its corrective phase with a breakdown below its horizontal resistance area. Price action also dropped below its primary ascending support level which further increased bearish momentum while the secondary ascending support level provided temporary relief. The USDCHF is now anticipated to complete another breakdown and accelerate down into its next horizontal support level. Forex traders are advised to sell any rallies into its primary descending resistance level.

The CCI plunged into extreme oversold territory, but remains well off of its lows which suggests that more downside is possible. A brief spike above -100 should be accounted for from where a renewed descend is expected to initiate the next phase of the sell-off. Subscribe to the PaxForex Daily Fundamental Analysis where you will grow you balance trade-by-trade!

Forex Profit Set-Up #3; Sell CADJPY - W1 Time-Frame

As recession signals increase, the Japanese Yen is likely to attract more capital from forex traders who seek a safe-haven trade. The Canadian Dollar could come under pressure due to its dependency on the commodity sector which will suffer under a recession. The CADJPY advanced into its secondary descending resistance level from where a breakout is unlikely to materialize. Bearish pressures are favored to pressure price action to the downside until the CADJPY can challenge the lower band if its horizontal resistance area. Forex traders are recommended to sell any rallies up into its next horizontal resistance level.

The CCI accelerated out of extreme oversold conditions, but bullish momentum is not expected to carry this momentum indicator above the 0 mark. A reversal of the most recent advance is expected. Follow the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own portfolio!

To receive new articles instantly Subscribe to updates.