Hopes were not high for the second summit between President Trump and Supreme Leader Kim Jong-un, but the pressure to actually produce something meaningful and with substance was elevated. After the historic first meeting between the leadership of the US and North Korea last year in Singapore, there was plenty of positive commentary while nothing was actually accomplished. The second summit collapsed under the pressure as Trump walked out of the meeting after pressing North Korea for more concessions without success. The silver lining remains the agreement to continue negotiations for a potential future deal between both nuclear armed countries.

Trump did acknowledge that North Korea was willing to dismantle its main nuclear reactor at Yongbyon, but after the US side presented North Korea with evidence of other stealth sides it was unwilling to agree on more. Trump told reporters that “Sometimes you have to walk. I could have signed an agreement today and then you people would have said, ‘oh, what a terrible deal.’” US Secretary of State Pompeo pointed out that even without Yongbyon operational, North Korea would possess everything required to maintain its nuclear program.

One of the stumbling blocks was the sanctions in place on North Korea. According to Trump “It was about the sanctions. Basically they wanted the sanctions lifted in their entirety, and we couldn’t do that.” The two sides were supposed to have a working lunch at the Sofitel Legend Metropole, but reporters were ushered out and a change of schedule was announced by the White House. Motorcades for both leaders then left separately and Sarah Huckabee Sanders, the White House Press Secretary, added that both leaders “had very good and constructive meetings in Hanoi” and that both “discussed various ways to advance denuclearization and economic driven concepts. No agreement was reached at this time, but their respective teams look forward to meeting in the future.”

Financial markets were surprised by the collapse of the summit and regional equity markets drifted lower as safe have assets such as the Japanese Yen and the Swiss Franc rose. Analysts will now seek more clarity in order to determine why Trump walked out of the summit. Open your PaxForex Trading Account now and allow our expert analysts to help you create a profitable portfolio!

This was not the first time Trump ended a meeting, he felt was not going his way, early. He walked out on Democrats after they didn’t want to fund his border wall. Did the US push too far with North Korea? IG Asia Market Strategist Jingyi Pan noted “The market did not have high hopes for any deals to be made seeing the Singapore summit as a base case scenario. That abrupt end announcement does however induce concerns over whether talks could have taken a negative turn.” While both sides agreed to let their respective teams continue negotiations, Trump added “I want to take off the sanctions so badly because I want that country to grow. But they had to give up more.” The second Trump-Kim Summit collapsed, but here are three forex trades which will build your balance further!

Forex Profit Set-Up #1; Sell USDCHF - D1 Time-Frame

Despite low hopes for the 2nd Trump-Kim summit, traders were rather disappointed that it was cut short. This boosted demand for safe haven assets such as the Swiss Franc which rallied through the trading session. Price action now entered a bearish price channel which is expected to guide this currency pair further to the downside. A breakdown below its primary ascending support level will clear the path for the USDCHF to challenge the upper band of its horizontal support area. Forex traders are recommended to sell any rallies into the upper descending resistance level of the bearish price channel.

The CCI already moved below -100 and into extreme oversold conditions. It does remain well of its previous low and therefore has more room to extend its slide which supports more weakness in the USDCHF. Download your PaxForex MT4 Trading Platform today and join our growing community of profitable forex traders!

Forex Profit Set-Up #2; Buy USDZAR - D1 Time-Frame

Following a healthy counter-trend correction in the USDZAR, the uptrend has been confirmed and higher prices are expected. Price action briefly pierced its horizontal support level to the downside, but the contraction was reversed after this currency pair met its primary ascending support level. The South African economy is facing bigger headwinds than the US economy and the uptrend in the USDZAR should continue until a breakout above its primary descending resistance level will take price action to the lower band of its next horizontal resistance area. Forex traders are recommended to buy the dips down into its horizontal support level.

The CCI corrected from extreme overbought territory and momentarily dropped below the 0 mark. This move was quickly reversed and the momentum indicator pushed back into bullish territory. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market; earn over 500 pips per month!

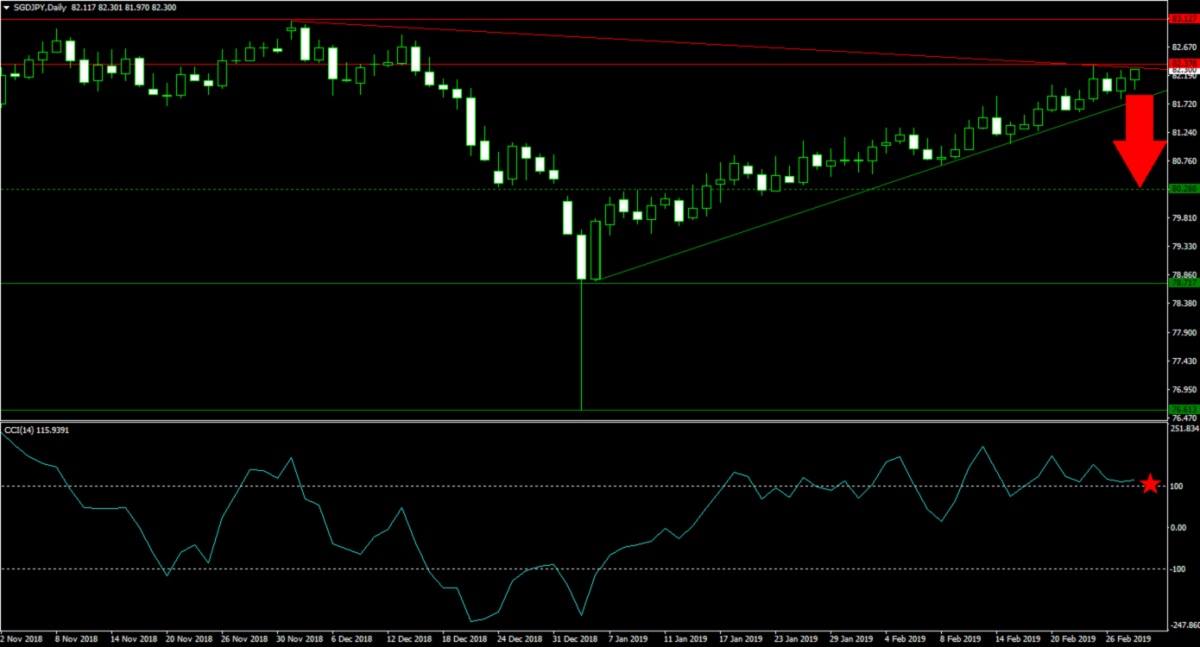

Forex Profit Set-Up #3; Sell SGDJPY - D1 Time-Frame

Japanese Yen bears rode this cross the furthest to the upside, but the SGDJPY has now reached the lower band of its horizontal resistance level which is being enforced by its primary descending resistance level. The increase in appetite for save haven currencies is likely to trigger a sell-off on the back of profit taking. Bearish pressures are on the rise and a breakdown below its primary ascending support level will allow the SGDJPY to accelerate to the downside until it will reach its next horizontal support level. Forex traders are advised to sell the rallies into the upper band of its horizontal resistance area.

The CCI is sliding lower, but remains in extreme overbought conditions with a contraction in bullish momentum. This technical indicator is now anticipated to drop below 100 which may trigger the sell-off. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades from our expert analysts into your own account!

To receive new articles instantly Subscribe to updates.