Today we will start with a simple question: What is potentially the most overlooked weapon in the arsenal of central bankers? The use of interest rate cuts as well as increases is probably the best known tool central banks use. More recently quantitative easing has become a very popular experiment from Tokyo to London and from Frankfurt to Washington. One very obvious tool, but often not viewed as one, is communication. Central bankers use communication as a tool in order to prepare financial markets for what is about to come or to leave room to reverse a decision.

The European Central Bank, ECB, hosted a panel today in Frankfurt titled ‘Communications challenges for policy effectiveness, accountability and reputation’ and the world’s top 4 central bankers attended the panel ‘At the heart of policy: challenges and opportunities of central bank communication’. Bank of Japan Governor Kuroda, Bank of England Governor Carney, ECB President Draghi and US Federal Reserve Chief Yellen discussed communication and the importance of it. In general market participants have made fun of what has been labeled ‘open mouth operations’ or the purchase of government securities in the open market in order to manipulate the short-term yield curve.

As ‘open mouth operations’ lost their hype, they were replaced by an ‘upgrade’ in the form of forward guidance. The idea was to communicate to the markets what is going to happen in order to keep volatility low as steps materialized. The biggest problem with forward guidance is and remains to be that central bankers don’t back their words with actions and when they do act it is often dismissed as a policy mistake. This has made central bankers more of a comedy to watch than an entity which should be taken serious.

Regardless of central bank monetary policies in the form of interest rate increases and quantitative easing recalibrations, PaxForex offers a trading environment which allows forex traders to grow their account balance regardless of economic and fiscal developments; follow PaxForex’ team of analysts and get profitable trading recommendations.

While each central banker had a sightly different point of view on how to implement effective market communication, one undisputable fact for all four is that they have failed to convince markets that they know how good or bad the economy actually is. One of the biggest mistakes is that all four central bankers always paint a very bright economic future which often blinds them to economic reality. This places them always behind the curve and in a position to catch up to reality, rather in one that would allow them to lead. Here are three ways to profit from central bank ignorance.

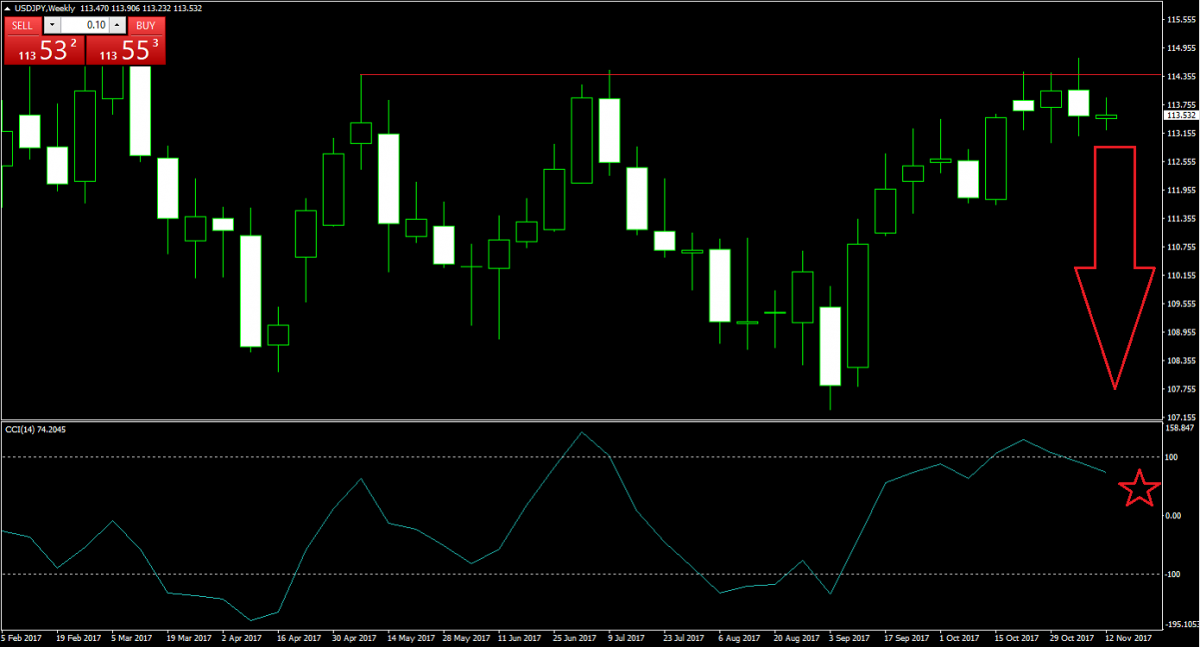

Forex Profit Set-Up #1; Sell USDJPY - W1 Time-Frame

The USDJPY has advanced strongly from its most recent low of 107.318 which was reached on September 3rd, but the move lost momentum as this currency pair ran into a very strong resistance level. The deflation of momentum resulted in the formation of a triple top formation which is a very bearish trading signal. Price action was rejected three times during a major bullish advance. Forex traders should expect a retracement of at least 50% or down to around the 111.000 mark from where more downside is possible.

The CCI already completed a breakdown below the key 100 level which added to downside pressure in this currency pair. Any level above 113.500 represents a good short entry opportunity. Add this trade to your forex portfolio at PaxForex and profit more per trade from tight spreads.

Forex Profit Set-Up #2; Buy EURCAD - D1 Time-Frame

Economic data out of the Eurozone remains robust and as we have mentioned last month, the trend for the Euro remains to the upside. The Canadian economy has moved along, but with the Eurozone predicted to hit a golden period the Euro is set to advance further. Canada remains dependent on commodities and is not well diversified. This currency pair has bounced higher after touching the ascending support level from its symmetrical triangle formation and is now approaching the resistance descending level from where a breakout is anticipated to open the path for more upside.

The CCI is now trading well above the -100 mark and also eclipsed the 0 level which has added to upside momentum. Any retracement below 1.4900 should be taken advantage of with buy orders. Always make sure that you operate your forex account in a professional trading environment such as the one offered by PaxForex.

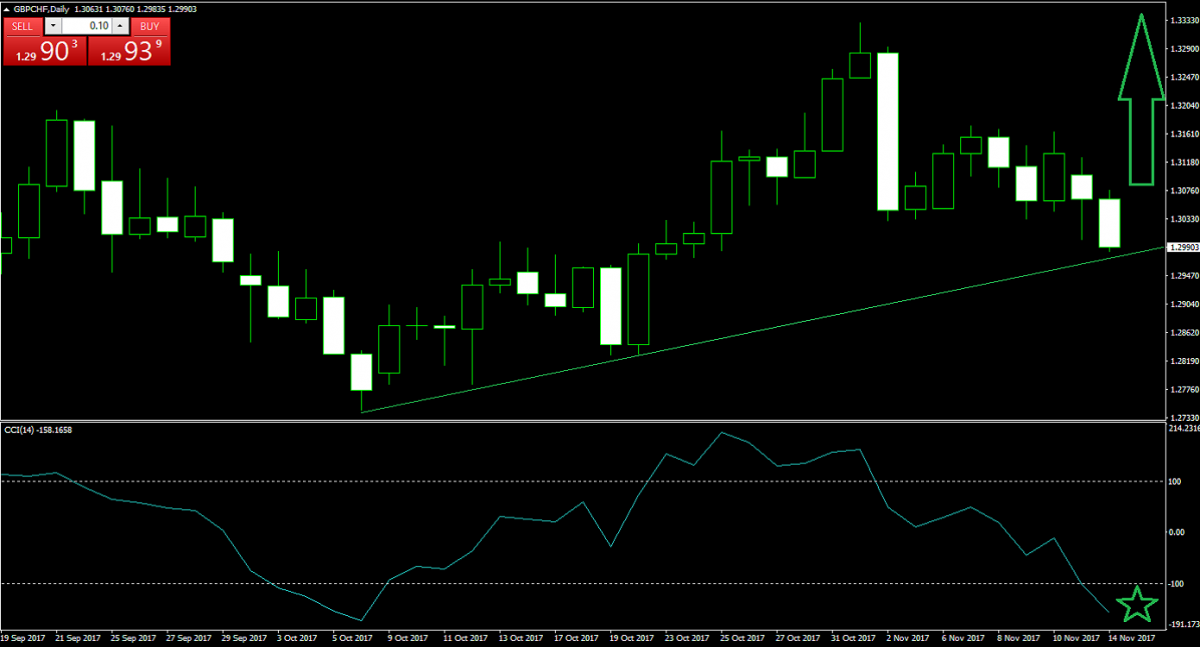

Forex Profit Set-Up #3; Buy GBPCHF - D1 Time-Frame

The pessimism for the British Pound is not justified, but it did create a great buying opportunity in the GBPCHF currency pair which has now touched its ascending support level. This was accompanied by a collapse of the CCI below -100 which represent an extreme oversold condition. The 1.3000 level additionally represents a very strong psychological support level as well as the next big round number forex traders are advised to monitor. Buy orders should be placed just below the 1.3000 mark.

Don’t miss profitable trading recommendation and subscribe to PaxForex’ trading recommendations in order to assure that your portfolio will perform profitably regardless of what central bankers decide to say and how they act. Sometimes it is crucial to ignore mass media and focus on those who know their business. When it comes to forex, PaxForex knows their business!

To receive new articles instantly Subscribe to updates.