President Xi addressed the Chinese political elite in an unusual meeting which was later described as a “seminar”. This event took place on the same day the country reported its weakest GDP expansion in almost ten years and offered a fresh sign that the ruling party is worried about the social impacts of a slowing Chinese economy. Some analysts have pointed out that annualized GDP growth below 7.0% would result in social problems, especially in rural communities. GDP growth slowed down to 6.4% annualized in the fourth-quarter of 2018.

Xi told the Chinese Communist Party that “The party is facing long-term and complex tests in terms of maintaining long-term rule, reform and opening-up, a market-driven economy, and within the external environment. The party is facing sharp and serious dangers of a slackness in spirit, lack of ability, distance from the people, and being passive and corrupt. This is an overall judgement based on the actual situation.” This is not the first warning he issued, but it is the strongest one so far which indicated a rise in domestic problems which often occur when an economy changes from emerging to developed.

A lot of pressure is now on Xi to turn around the economic slowdown, especially since a constitutional change last year gave him a mandate to rule without limitations. Over the past, Xi has assembled the Central Committee’s 200 members in order to study important issues for China, but this was the first meeting without assembling the full committee. China continues to be entangled in the trade war US President Trump started, and Trump was quick to tweet yesterday evening that “China posts slowest economic numbers since 1990 due to U.S. trade tensions and new policies. Makes so much sense for China to finally do a Real Deal, and stop playing around!”

The steps the Chinese government ultimately takes will have an impact on the forex market as well. While the Yuan is likely to weaken further, forex traders use the Australian Dollar as a proxy due to its availability. The Japanese Yen flash crash earlier this year impacted the Australian currency as well. Open your PaxForex Trading Account now and take the first step into a profitable forex trading future.

Adding to the potential of social unrest is a year filled with key dates for China. They include the October 1st 2019 which marks the 70th anniversary of the founding of China and June 4th 2019, the 30th anniversary of the Tiananmen Square crackdown. Dennis Wilder, a Georgetown University Professor added that “That’s a cocktail that could be explosive as people realize the CCP is no longer delivering the goods on the social contract. The slowdown of the economy to rates not experienced in the reform area is uncharted territory for this generation of leaders of the Communist Party.” President Xi calls for political stability and here are three trades for a stable forex trading account!

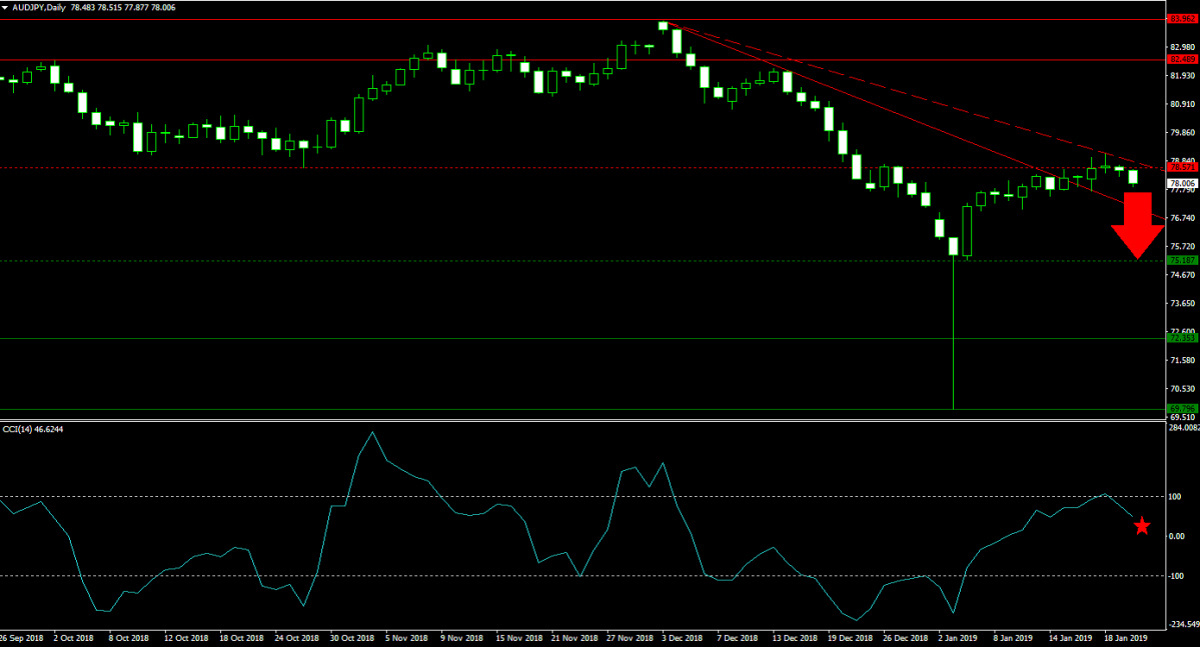

Forex Profit Set-Up #1; Sell AUDJPY - D1 Time-Frame

Forex traders use the Australian Dollar as a Yuan proxy due to its availability. The dependency of the Australian economy on China makes it a very good substitution. The AUDJPY has recovered from its flash crash, but price action ran into triple resistance which is expected to force profit taking. This currency pair is now trading above its primary descending resistance level, but below its secondary descending resistance level as well as below its horizontal resistance level. A move down into its next horizontal support level is expected and forex traders are recommended to sell the rallies in the AUDJPY.

The CCI briefly advanced into extreme overbought territory, but quickly reversed below the 100 mark as bearish momentum is building up. A descend below the 0 mark will result in a bearish momentum shift and is expected to attract new sell orders. Download your PaxForex MT4 Trading Platform today and start building an income generating forex portfolio with the help of our expert analysts.

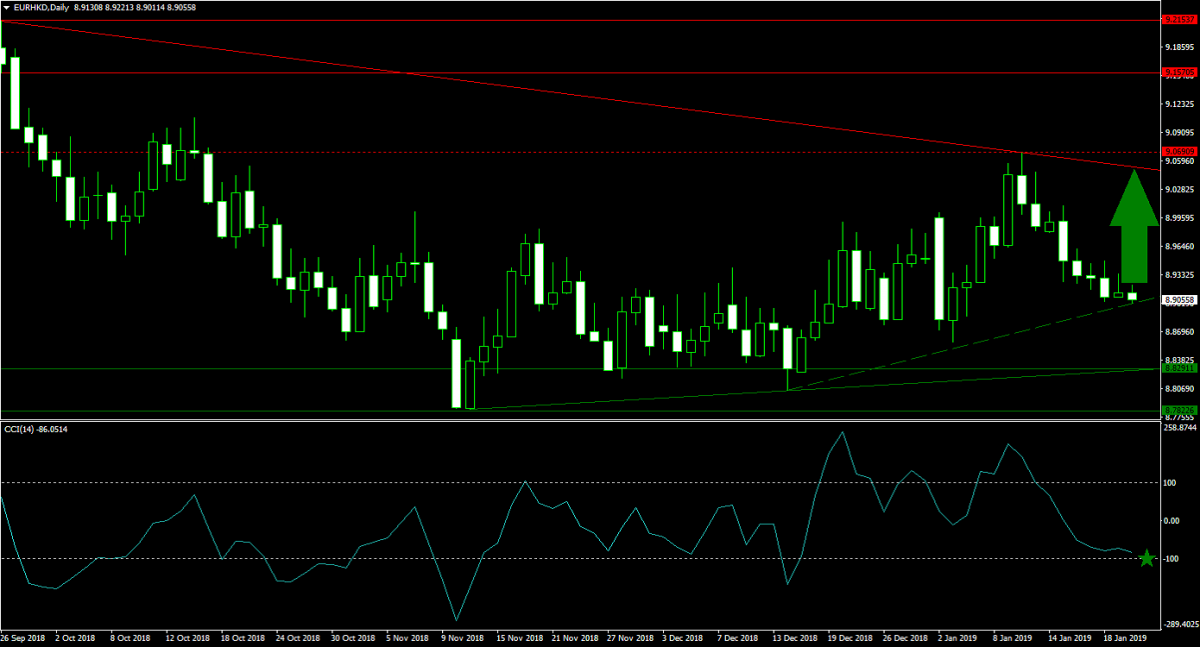

Forex Profit Set-Up #2; Buy EURHKD - D1 Time-Frame

While the Euro faces a slowing economy of its own, short-term forex traders may focus more on China which could weaken the Hong Kong Dollar, another Yuan proxy currency. The EURHKD contracted from its horizontal resistance area, with additional bearish pressures from its primary descending resistance level, into its secondary ascending support level. A short-covering rally is expected to materialize which will drive the EURHKD back up into its primary descending resistance level. Buy orders above the secondary ascending support level are favored.

The CCI has contracted from extreme overbought conditions, below the 0 level and into an ascending support level for this momentum indicator which is located above the -100 mark. A move back above 0 is expected to lead price action higher. Follow the PaxForex Daily Forex Technical Analysis and grow your trading account by copying the recommended trades from our expert analysts into your own forex portfolio.

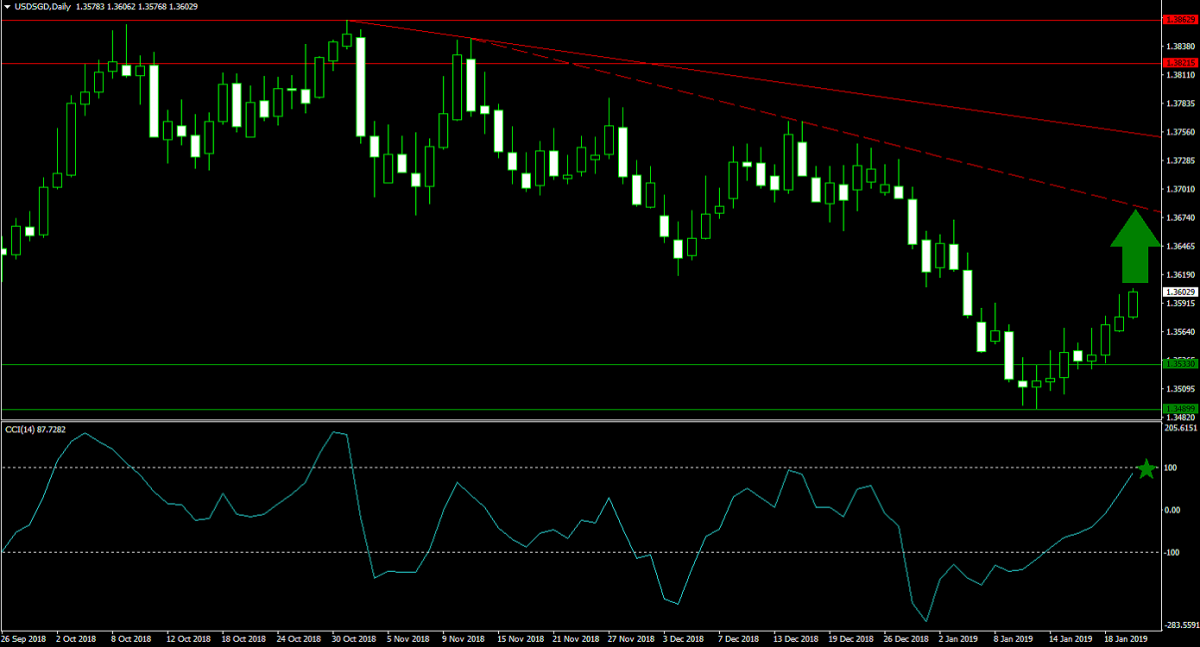

Forex Profit Set-Up #3; Buy USDSGD - D1 Time-Frame

This currency pair is in the middle of a short-covering rally which was initiated after the USDSGD completed a breakout above its horizontal support area. While the US Dollar remains under pressure overall, the Singapore Dollar which is another Yuan proxy currency is under temporary selling pressure of its own. The current rally is expected to extend into its secondary descending resistance level. Forex traders are advised to buy the dips in the USDSGD from current levels.

The CCI has solid bullish momentum following a reversal from extreme oversold territory which catapulted this technical indicator above the 0 level. A move into extreme overbought conditions is expected. Subscribe to the PaxForex Daily Fundamental Analysis and allow out expert analysts to guide you through the forex market; earn over 500 pips per month, trade-by-trade.

To receive new articles instantly Subscribe to updates.