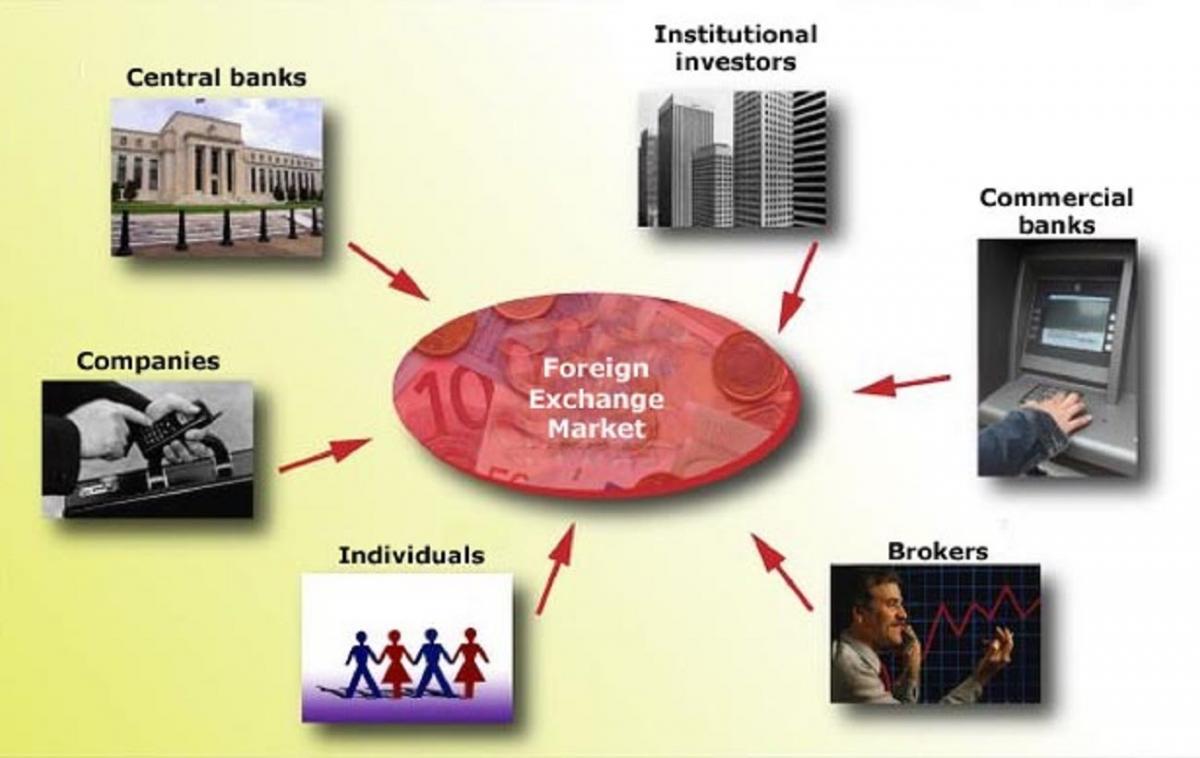

Foreign currency exchange trading is a fast growing business industry worldwide. The currency exchange takes place on a very large scale and this market has a global presence as currency exchange market participants are from all around the globe. There are various participating entities taking part in forex trading. Unlike the stock market - where investors often only trade with institutional investors (such as mutual funds) or other individual investors - there are more parties that trade on the forex market for completely different reasons than those in the stock market.

The forex market is a world unto itself, with all manner of players, from individual traders like you, all the way up to the interbank network and central banks. As an individual retail trader you are the smallest fish, you have the ability to buy and sell the same currency pairs as other participants, but you are have to go through a longer transaction chain than others in order to get hold of liquidity, as such you don’t receive the same prices as participants further up the hierarchy. You are also unable to affect the market with your trades because you are far too small to make any waves. Your role is to react to what is going on in the wider market and to position yourself accordingly.

Major forex trading in the wholesale forex markets is undertaken by banks – popularly known as interbank market. In this market, banks and non-bank financial institutions transact with each other. They undertake trading on behalf of customers, but majority of trading is undertaken for their own account by proprietary desks. Besides banks and non-bank financial institutions, multinational corporations, hedge funds, pension and provident funds, insurance companies, mutual funds etc. participate in the wholesale market.

Commercial banks as one of the largest participants conduct operations with money rates both for own benefit with the help of own funds and through speculations. Unlike commercial banks, the main goal of Central Banks is regulating of currency on the foreign markets so that sharp shift of export-import balance won't happen as well as economic crisis and abrupt jumps of national currency will be prevented. Central Banks can directly impact on prices in the form of currency interventions or make indirect impact through regulating money mass and interest rates.

The largest and most controversial speculators on the forex market are hedge funds, which are essentially unregulated funds that use unconventional and often very risky investment strategies to make very large returns. Think of them as mutual funds on steroids. Given that they can take such large positions, they can have a major effect on a country's currency and economy. Thanks to marginal trading, individuals can now tale part in forex market through intermediating brokers or dealing centers, banks etc. As a rule, the main goal of private forex traders is obtaining profit via speculations.

To receive new articles instantly Subscribe to updates.