A forex trading order is an instruction with defined parameters to your broker to take a specific action in the market, either now or in the future. An order is for immediate execution or pending execution. Pending means prices must behave in some specific way before the order is ready for immediate execution. A market order is for immediate execution, at the best bid or ask the broker can offer to you as a function of the broker's data feed and liquidity providers.

Market Orders

The market order is probably the most basic and often the first order type traders come across. Just as the name implies, market orders are traded at market! This means if you want to get into the market immediately, you can trade a market order and be entered at the prevailing price. A market order is used when you want to execute an order immediately at the market price, which is either the displayed bid or the ask price on your screen.

Limit Orders

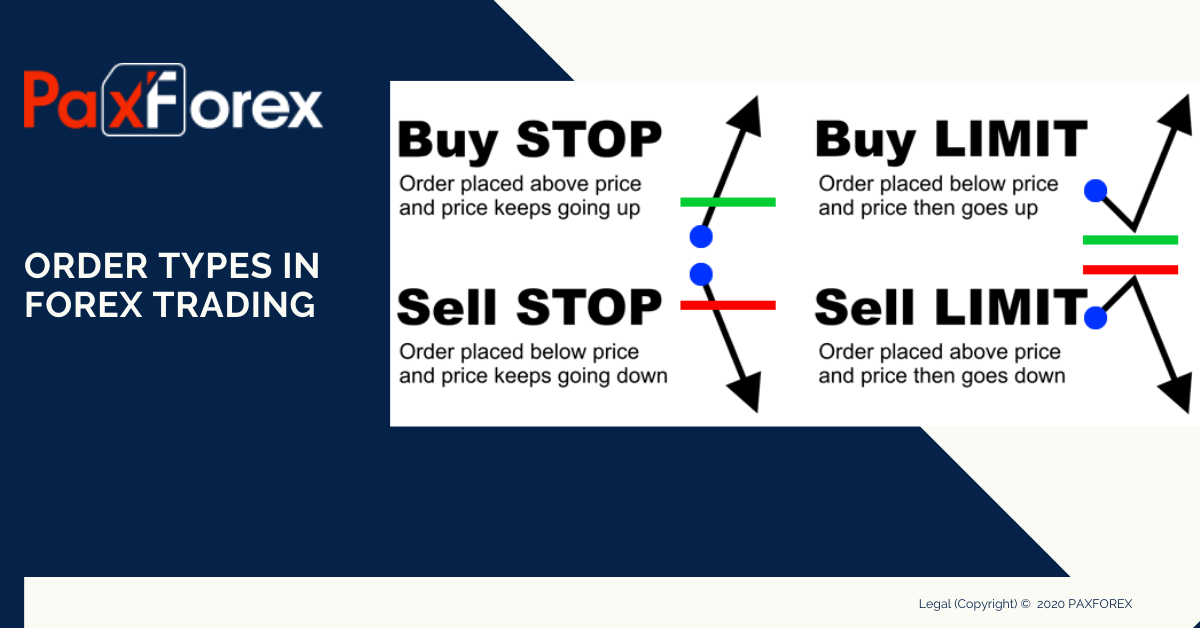

A limit order is an order placed to buy or sell at a certain price. The order essentially contains two variables, price and duration. The trader specifies the price at which he wishes to buy/sell a certain currency pair and also specifies the duration that the order should remain active. A limit-buy order is an instruction to buy the currency pair at the market price once the market reaches your specified price or lower, and is lower than the current market price. A limit-sell order is an instruction to sell the currency pair at the market price once the market reaches your specified price or higher, and it is higher than the current market price.

Stop orders

A stop order is also an order placed to buy or sell at a certain price. The order contains the same two variables, price and duration. The main difference between a limit order and a stop order is that stop orders are usually used to limit loss potential on a transaction whilst limit orders are used to enter the market, add to a pre-existing position and profit taking. One of the most effective ways of limiting your losses is through a predetermined stop order, which is commonly referred to as a stop-loss. However, stop loss orders can be also used to protect your profit once the trade will get in a positive territory.

OCO Orders

OCO stands for ‘One Cancels the Other’ and refers to two separate orders that are linked together on the same market. The first of the linked orders to be triggered and filled is entered into a live position, whilst the second order is subsequently deleted, I.e. one order filled will cancel the other. Forex raders use OCO orders when they sense that one of two scenarios may play out in a certain currency pair. Placing the appropriate order can help investors take the maximum benefit from the profit-making opportunities presented by the forex market.