Last Friday, as US President Trump promised, the US increased tariffs on $200 billion worth of Chinese imports from 10% to 25%. China has retaliated by imposing tariffs on $60 billion worth of US imports, but rather than applying a blanket tariff on all items it has tariffs which range from 5% to 25%. China continues to exclude auto imports from the list of tariffs and appears to have fine-tuned the list to imply pressure with minimal harm to their economy. Now the US prepared a list for an additional 25% tariff on $300 billion worth of Chinese imports which will essentially cover almost everything imported from China. The new Chinese tariffs will take effect on June 1st while the new US tariffs are scheduled to kick in at the end of June.

The timing from the US side is key as US President Trump is scheduled to meet Chinese President Xi on the sidelines of the G-20 Summit in Japan which will be held June 28th through June 29th. While Trump has often repeated his mistaken assumption that China is paying the price for the trade war and that the US is filling its coffers, it is the US consumer as well as US businesses who eventually pay a much steeper price. Should the latest rounds of tariffs kick in as scheduled, it will apply even more pressure on US consumers. President Xi doesn’t have to worry about re-election, but President Trump needs consumers to vote for him in order to win a second and final term. China can play the long game here while the US is under pressure to ease the burden on its own citizens.

Despite the increase in tension between the US and China, President Trump remains optimistic as he stated “You never really know, right? But I have a feeling it’s going to be very successful.” He went on to warn China about retaliating against US actions and added “There can be some retaliation, but it can’t be very substantial.” It is expected that tension will increase before there may be a chance for a piece meal solutions. China is in no rush to agree to a bad trade deal and the US cannot afford to remain in a trade war going into this fall’s election cycle. The fact that the next round of US tariffs is not scheduled after Trump is expected to meet Xi may leave the door open for a compromise.

The Japanese Yen has attracted safe haven bids while the US Dollar mat come under more pressure as the US Fed could feel forced to cut interest rates in order to further support the economy. The Swiss Franc, which has been punished by forex traders this year, is also expected to be a main beneficiary of the trade escalations between the US and China. Gold is anticipated to shine above all. How much worse will the tension get and are they here to stay as the global trade order is reshuffled? Open your PaxForex Trading Account now and join our fast growing community of profitable forex traders!

Trump is risking the loss of support from the business community who is opposed to his trade policies. The CEO of the National Retail Federation, Matthew Shay, noted that “The latest tariff escalation is far too great a gamble for the US economy.” Trump tweeted “I say openly to President Xi & all of my many friends in China that China will be hurt very badly if you don’t make a deal because companies will be forced to leave China for other countries. You had a great deal, almost completed, & you backed out!” Trump appears to stay on course for the time being, but will he be forced to change direction due to market forces exercising pressure on his administration? Then there is the Chinese wild card, its massive holdings in US Treasuries, which could be sold off to directly attack the US Dollar and send rates soaring for US consumers and businesses. While the US prepares the next round of tariffs, here are three forex trades which will prepare your portfolio for the next round of profits!

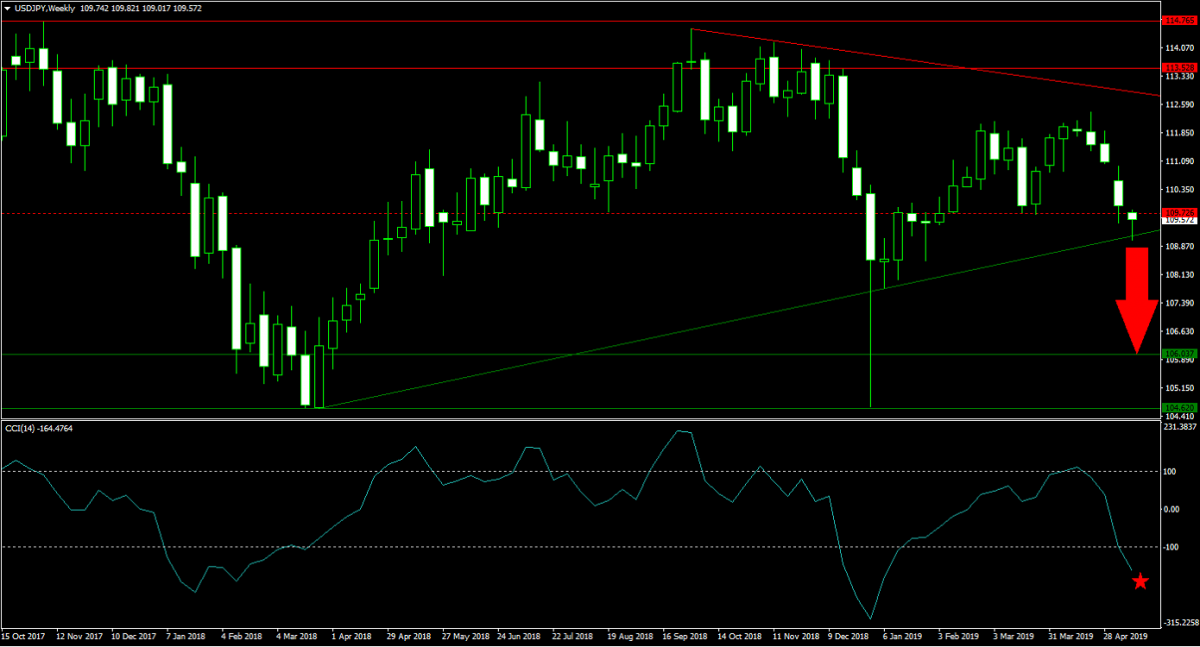

Forex Profit Set-Up #1; Sell USDJPY - W1 Time-Frame

The Japanese Yen is set to emerge as one of the biggest winners of a prolonged and intensified trade war between the US and China. Over the past four trading sessions the USDJPY has retreated as its primary descending resistance level injected a spike in bearish momentum. This has pushed price action below its horizontal support level and turned it into resistance, but this currency pair stabilized at its primary ascending support level. An extended sell-off down to the lower band of its next horizontal support area is favored and forex traders are advised to sell any rallies up into its horizontal resistance level.

The CCI quickly retreated from extreme overbought conditions into extreme oversold levels, but remains well off of its previous low. This suggests more downside in the USDJPY is possible. Download your PaxForex MT4 Trading Platform and allow our expert analysts to guide you through the forex market yielding over 500 pips per month in profits!

Forex Profit Set-Up #2; Sell CADCHF - W1 Time-Frame

Another beneficiary of the next round of tariffs will be the Swiss Franc while the Canadian Dollar may find itself under more selling pressure due to is heavy dependence on commodities. The CADCHF pitches two commodity currencies against each other, but the Swiss Franc has the added bonus of being a safe haven currency. Following an advance into its horizontal resistance level, price action receded and moved into its primary ascending support level. An extension of the sell-off into the upper band of its horizontal support area is expected, and selling rallies into its horizontal resistance level remains the favored trading set-up.

The CCI has recorded a trio of lower highs and pushed below the 0 mark which resulted in a bearish momentum change. This technical indicator is now expected to accelerate down into extreme oversold territory. Follow the PaxForex Daily Fundamental Analysis and grow your forex portfolio trade-by-trade!

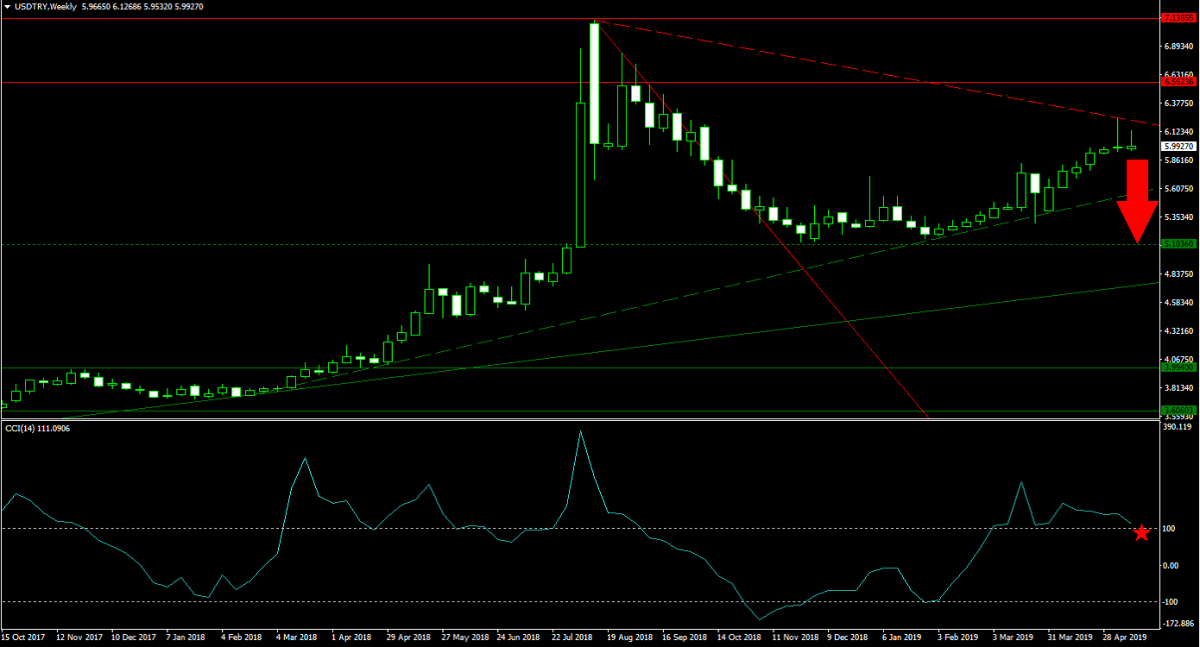

Forex Profit Set-Up #3; Sell USDTRY - W1 Time-Frame

The Turkish economy has rebounded which will favor the Turkish Lira over the US Dollar, especially if the next round of tariffs will take effect at the end of June. Price action was rejected near the lower band of its horizontal resistance area and bullish momentum is fading. This makes the USDTRY vulnerable to more short-term selling on the back of profit taking. Bearish pressure is favored to take this currency pair below its secondary ascending support level and back down into its next horizontal support level. Forex traders are recommended to sell any rallies up into the lower band of its horizontal resistance area.

The CCI is trading in extreme overbought conditions, but well off of its previous highs which points towards a loss in bullish pressures. This momentum indicator is now expected to drop below the 0 level from where more selling pressure is anticipated. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account!

To receive new articles instantly Subscribe to updates.