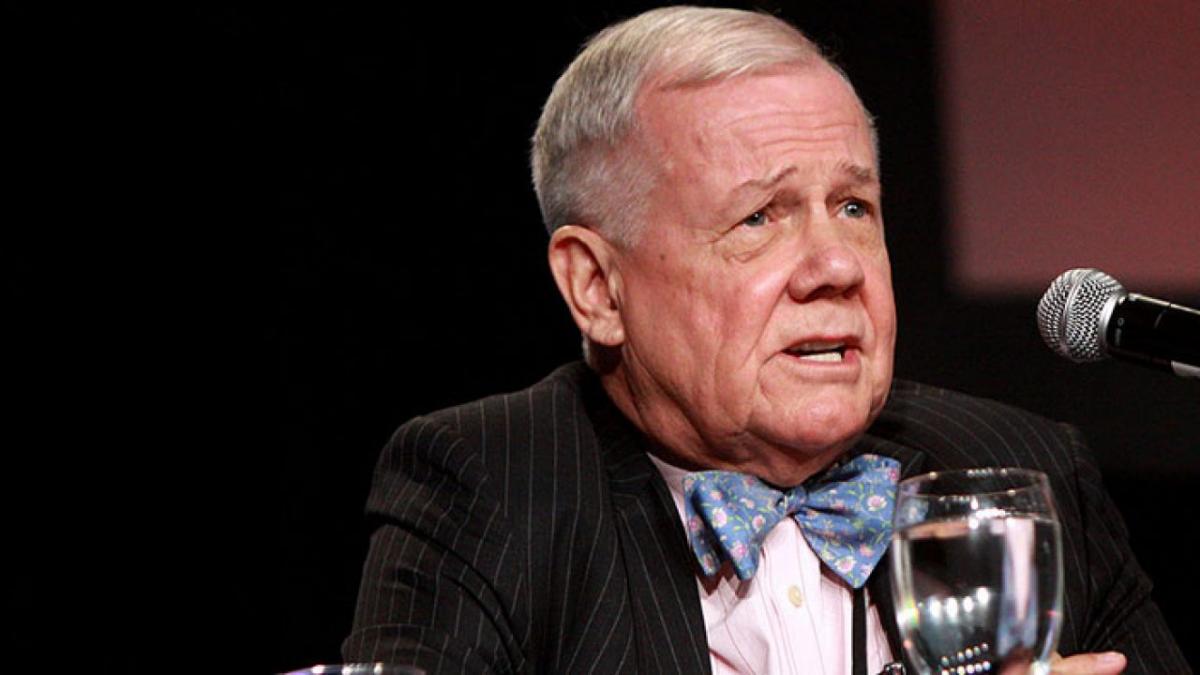

“Experience taught me that experts are wrong most of the time. The reason for my success in the financial markets is the fact that I see the world from another point of view.” – Jim Rogers

Jim B. Rogers was born in October 19, 1942 (Baltimore, Maryland, USA, though he was raised in Demopolis, Alabama). He first experienced business at a tender age of 5 when he sold peanuts and empty bottles left by some sports fans. When he graduated in History from Yale University in 1964, he worked at Dominick & Dominick – a Wall Street firm. Then, he got his 2nd BA degree in Philosophy, Politics and Economics from Balliol College, Oxford University in the year 1966.

He worked alongside George Soros, starting from 1970, at an investment bank called Arnhold and S. Bleichroder. Together with George, he founded the Quantum Fund, whose portfolio was increased 42 times in 10 years. This means they outperformed the S&P by more than 893 times. That Fund was really marvelous. He’s currently the head of Rogers Holdings and Beeland Interests, Inc. and the creator of RICI (the Rogers International Commodities Index). That Index keeps tabs on the indices as one way to speculate in the index. Jim has always espoused trading agricultural products.

In 1980 Jim quit working at Quantum Fund and started a world tour on a bike. After this, he engaged in some interesting activities, but soon, he started his journey through China, including the world (1990 - 1992). This feat was a record one hundred and sixty thousand kilometers spanning six continents. As a result of this, he made the Guinness Book of World Records. Yet, from January 1, 1999, to January 5, 2002, he made another Guinness World Record by hiking through one hundred and sixteen lands, in a custom-made Mercedes. He started in Iceland and ended up returning to New York on January 5, 2002. He’s written a number of best-selling books including ‘Investment Biker,’ ‘Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market,’ ‘Adventure Capitalist,’ and ‘A Gift To My Children’ (the latest one).

Lessons

What can we learn from Jim?

I call Jim Rogers the Nostradamus of the markets because of his trading approaches and style. He does what many traders wouldn’t want to do, and he achieves extraordinary results and records that many can’t achieve. When it comes to his perception of the markets, his views could be strange to many, but they’re true. For example, unlike what most peculators in the world thinks, Jim says the commodity market is the best market in the world. Do you believe this? How about other financial markets? The best answers are found in his book: Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market.

What is the best city to live in the world? OK, to be precise, where is the best part of the world in which one can live as an investor? Jim is no longer living in the US, for he’d sold his mansion in New York and relocated to Singapore. He’d have settled in China or Hong Kong if it wasn’t for the perceived high level of pollution in those lands. According to him, the UK was the best place to invest in the early 19th century, and the USA was the best place to invest in the early 20th century.

Now there are economic power shifts, so the best place to invest in the early 21st century is Asia. Even certain small lands like Cambodia and Sri Lanka are fertile markets for investors (although he was pessimistic about the future of Indian economy, for he believes that India might not survive another 30 or 40 years). This means that, the UK and the US are no longer the ideal places to invest. Apart from Jim, many assiduous investors and market analysts have often mentioned this fact.

Jim declares that Russia and the Commonwealth of Independent States (CIS region) have what it takes to be the leader in agricultural products. He said people should put less attention on stocks and focus on commodities and agriculture. He pointed out that rather than looking forward to Wall Street or the City professions, it pays to learn commodities, agriculture and mining. He was reputed as saying this: “The power is shifting again from the financial centers to the producers of real goods. The place to be is in commodities, raw materials, natural resources” In May 2012 he remarked during an interview with Forbes Magazine: ‘There’s going to be a huge shift in American society, American culture, in the places where one is going to get rich. The stock brokers are going to be driving taxis. The smart ones will learn to drive tractors so they can work for the smart farmers. The farmers are going to be driving Lamborghinis. I’m telling you. You should start Forbes Farming.”

For those who idolize the English language, well this mayn’t be the unwelcome fact. English language mayn’t be the most important language in the world in the foreseeable future. The Chinese Mandarin is the language with the most speakers in the world (even the Chinese population is far higher than all the population of the 54 counties in Africa). The fact that I can speak English doesn’t make me the greatest man in the world, nor does the fact that you can’t speak English make you the most unfortunate man in the world. Perhaps some people (including me) idolized English language because of the reasons that are beyond the scope of this article.

Don’t those who speak 2 or more languages have advantages over those who can only speak one language? Well, Jim’s first daughter is being taught Mandarin so as to get her prepared for the future. Why? Jim revealed that the Chinese are highly enthusiastic, inspired and industrious; and that’s the kind of environment in which one should be. That was how the USA and Europe used to be. Think of heavy machinery, electronics, goods and many more that are coming from Asia. More than half of all the robots in the world are in Asia. I was even amazed to learn that most of these robots help build ships and many other industrial goods with unbelievable speed. Are you prepared for the future? Do you prepare your children for the future?

With all these, Jim has always been, and remains, a successful trader. He knows where the best markets are and how to take advantage of them. This has really added to his expertise and profile. Are you ready to take the challenge and trade your way to financial freedom?

Conclusion: Speculation has to do with taking advantage of opportunities that most others fail to see; and this is usually done before others see the opportunities. Unless in some obvious cases, the most common means to harness gains in the markets is when the price moves downwards after a short position is opened, or when the price moves upwards after a long position is opened.

This piece is concluded with more quotes from Jim:

“Do not buy the hype from Wall St. and the press that stocks always go up. There are long periods when stocks do nothing and other investments are better.”

“Those who cannot adjust to change will be swept aside by it. Those who recognize change and react accordingly will benefit.”