Italy is taking steps to move closer to regaining sovereignty lost since replacing the Lira with the Euro. Italy has struggled more than economists expected and Italian politicians often blame the Euro as well as Eurozone monetary policies for their malaise. The country is home to the third largest economy in the Eurozone and since the election of its populist government which forged an unlikely alliance for the time being, has increased its tough anti-EU and anti-Euro stance. Besides housing the third largest economy, Italy is also home to the Eurozone’s largest debt pile which is adding pressures on Rome to find a solution. What impact will the added uncertainty have on your forex investment?

While coalition partners The League and the Five Star Movement have ruled out an Italian exit, both parties are open to reintroduce the Lira as its national currency. Last week, Italy’s lower chamber of parliament passed a motion to mini-bills of Treasury or mini-BOTs in order to pay government dues owed to private companies. This is widely seen as introducing a parallel currency, illegal under EU Treaties, which would force Italy to leave the Eurozone. The Finance Ministry was quick to respond that there are no plans to issue mini-BOTs, but should Italy be serious about offering a parallel currency it would be planned in private and announced quickly. It was unclear if the passed motion was intended to create mini-BOTs as an exchange medium which would make it a currency in its own right.

Mario Draghi, the ECB President, added in regards to mini-BOTs that “They are either money, and then they're illegal, or they're debt, and then that stock goes up.” Giovanni Tria, Italy’s Minister of Economy, noted that “It would be illegal and useless for Italy to issue bonds to pay its suppliers because that would violate the rules of the European currency and also add more debt to the existing one.” The proposed mini-BOTs would come in denominations of 20, 50, 100 and 200 and bear no interest payments or expiration date. They would also not be issued as bonds during auctions, but at the discretion of the government. This would, in theory, create a parallel currency and allow Italy to bypass EU spending limitations and debt ceilings.

Will Italy go through with the creation of mini-BOTs and create a parallel currency to the Euro? Argentina introduced something similar during its 2002 crisis, but how will this play out in a monetary union? Open your PaxForex Trading Account today and create a market beating forex portfolio with the help of our expert analysts who will deliver over 500 pips in monthly profits!

FT Columnist John Dizard spoke out against mini-BOTs and argued that “The big profits would go to those who would buy mini-BoTs from pensioners and state creditors at a discount, say 20 or 30 percent. They will then sell the quasi-currency to deep-pocketed buyers of Italian goods and services, or property and equities.” Germany is also against this move and would prefer if Italy would leave the Eurozone altogether instead of bypassing the EU and ECB with a parallel currency. In the meantime, Italy’s Mafia is suing the old Lira as a parallel currency. Giuseppe Arbore from the Guardia di Finanza stated “We still discover big amounts of liras. When a banknote is accepted by an organization internally, even if it is outside the law as a legal value, it can settle transactions.” As Italy’s parallel currency scare plays out in the markets, here are three forex trades to elevate your balance!

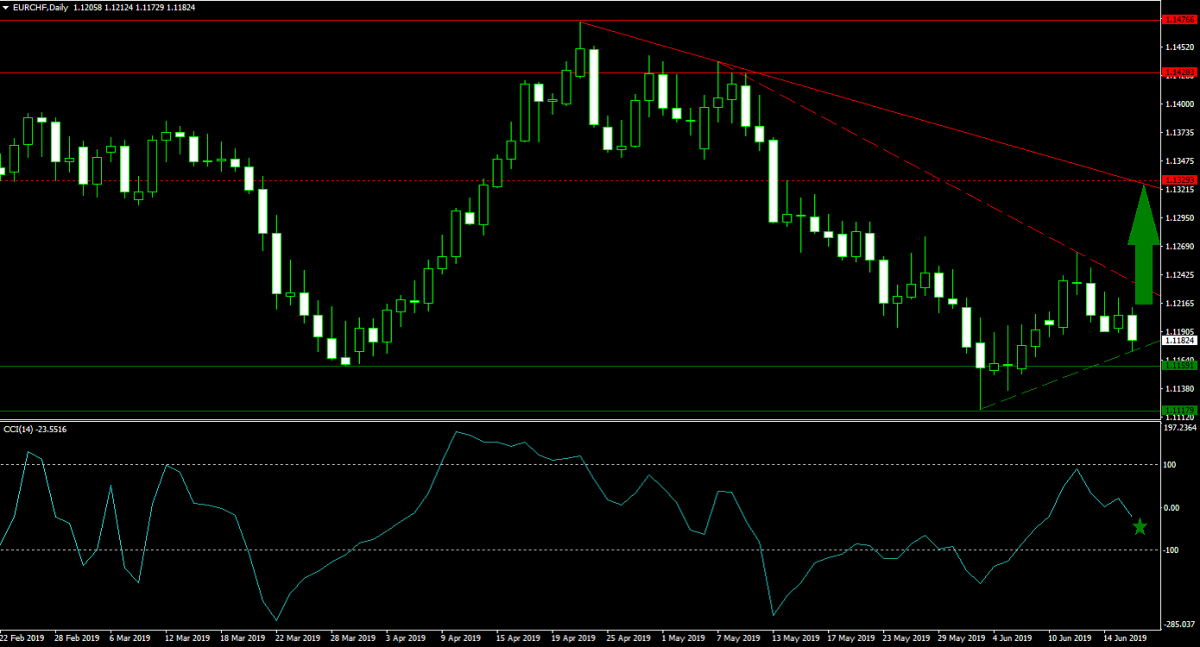

Forex Profit Set-Up #1; Buy EURCHF - D1 Time-Frame

Italy’s parallel currency scare remains just that for the time being. It could turn into a serious for the Euro if Italy does indeed take steps to leave the monetary union or create a parallel currency, but the currency has more immediate issues such a low inflation and the threat of more stimulus by the ECB. Some of those potential Euro bearish news appear to be priced into the market to a certain extend which could see the EURCHF move higher in the short-term until it can challenge its next horizontal resistance level. The Swiss Franc attracted plenty of bids over the past few weeks and a counter-trend reversal is likely to materialize. Buying any dips in the EUURCHF down into the lower band of its horizontal support area remains the favored trading approach.

The CCI just crossed below the 0 mark for a bearish momentum crossover which is expected to remain short-lived. A push above 0 could trigger a new wave of buy orders which will drive price action into resistance. Download your PaxForex MT4 Trading Platform, get your MetaTrader4 login and join our fast growing community of profitable forex traders.

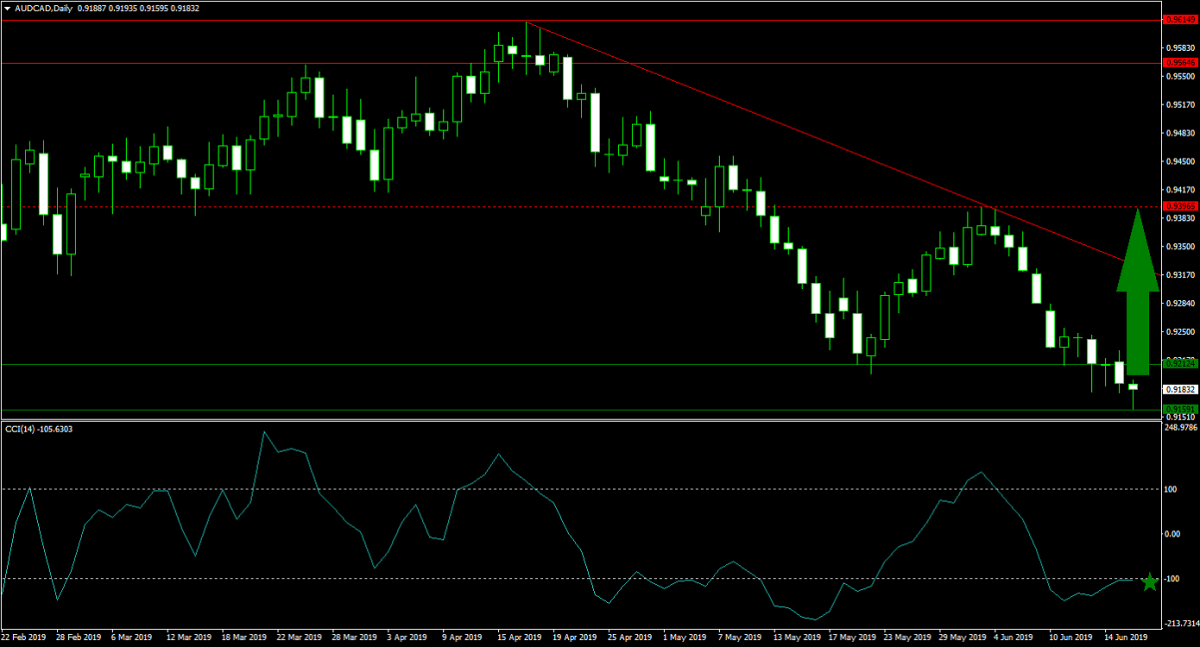

Forex Profit Set-Up #2; Buy AUDCAD - D1 Time-Frame

The Australian Dollar, a Chinese Yuan proxy currency, has been pushed to the downside and is carving out new support levels. Given the overall dynamic of the Trump administration’s trade war, the Australian currency is extremely oversold and offers forex traders a great buying opportunity. This is especially true against the Canadian Dollar with the AUDCAD trading inside of its newly confirmed horizontal support area. A breakout is favored which will take this currency pair back into its next horizontal resistance level and forex traders are advised to spread their AUDCAD buy orders inside of its horizontal support area.

The CCI remains in extreme oversold conditions, but a positive divergence has formed which represents a strong bullish trading signal. A push above -100 could initiate a short-covering rally. Follow the PaxForex Daily Fundamental Analysis and find out why more and more profitable forex trader prefer to operate their prime accounts at PaxForex!

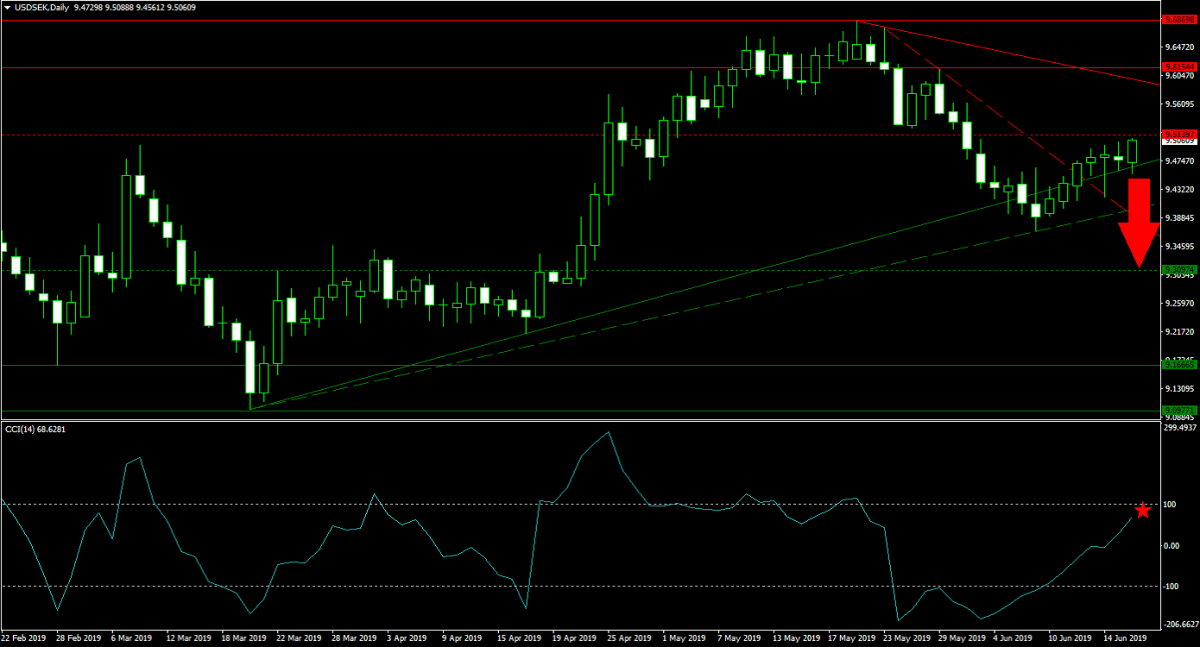

Forex Profit Set-Up #3; Sell USDSEK - D1 Time-Frame

The USDSEK was able to recover from its correction, but the current chart formation indicates a bull trap. The US Fed starts its two-day meeting today and is unlikely to announce an interest rate cut tomorrow, but its press release could signal a cut is possible in the second-half of this year. Bullish momentum is exhausted and price action is favored to extend its sell-off until it can challenge its next horizontal support level. Forex traders are recommended to sell any rallies in the USDSEK up into its primary descending resistance level.

The CCI has advanced out of extreme oversold territory and eclipsed the 0 level for a bullish momentum crossover. This momentum indicator is expected to reverse its gains and accelerate to the downside. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own forex account!

To receive new articles instantly Subscribe to updates.