The Italian economy slipped into a recession in the fourth-quarter of 2018, data released Istat showed. A recession is usually defined by two consecutive quarters of negative growth. Fourth-quarter Italian GDP contracted by 0.2% quarterly or twice the expected contraction, which followed the third-quarter’s decrease of 0.1% quarterly. While economists anticipated technical recession, the severity of it may suggest a worse economic foundation moving forward. This was the first recession for the Italian economy since 2013 and is increasing the pressure for the coalition government which is slowly moving into opposite directions.

Market reaction in Italian bond as well as the Euro was muted. Aberdeen Standard Investments Portfolio Manager James Athey added that “The growth forecasts on which the budget was based have already been blown out of the water and Eurozone growth continues to weaken. Italy is going to have to face up to some real problems.” Istat singled out the industry and services sector for the bigger than expected contraction. Deputy Premier Luigi Di Maio blamed the previous pro-EU government for the recession and claimed the government lied to the population, never taking Italy out of the previous financial crisis.

Projections for the 2019 Italian GDP call for a 0.6% annualized increase. This compares to the Eurozone projections which stand at 1.6% annualized, following a downward revision. While Italy slipped into a recession, some start to wonder if the EU will be next? German growth for 2019 is currently only expected at 1.0%, the smallest pace of expansion in six years. Germany is the growth engine of the EU. Germany retail sales released this morning plunged in yet another sign for a slowing economy. Eurozone GDP showed a fourth-quarter expansion of just 0.2% quarterly and PMI data points towards a sharp deceleration across the Eurozone.

The Euro is likely to be caught in the crossfire of an economy which grinds to a standstill at a time when the ECB has halted its quantitative easing program. How will the Euro perform against other G-10 currencies, many which face a similar fundamental set-up? Open your PaxForex Trading Account today and start planting the seed for a profitable tomorrow!

While the verdict for the Eurozone economy is still out there, Italian business owners are not dragging their feet. Mevis CEO Federico Visentin noted that “We aren’t just waiting for the storm to pass. We reduced our costs without renewing temporary contracts and shifted even more production to our plants in Slovakia and China.” Mevis is located in the industrial north of Italy which is dependent on the German automotive market. President Emeritus of Ca’ Foscari University Carlo Carraro added that “Fears over lower growth in Germany inevitably reflect on the companies of this part of Italy, not only those which are directly exposed to that market.” Italy slips into a recession, is the EU next? Here are three forex trades to keep the pips rolling into your forex trading account!

Forex Profit Set-Up #1; Sell EURCHF - D1 Time-Frame

A sharp rally took the EURCHF from its horizontal support area through its primary descending resistance level and into its secondary descending resistance level, located slightly below the lower band of its next horizontal resistance area. Bullish momentum is now collapsing which makes price action vulnerable for a reversal on the back of profit taking. A contraction below its primary ascending support level down into its secondary ascending support level is expected and forex traders are advised to sell the rallies into its secondary descending resistance level.

The CCI is trading in extreme overbought territory, but started to retreat from its peak. The build-up in bearish momentum is anticipated to push this technical indicator below the 100 mark which may ignite the sell-off. Download your PaxForex MT4 Trading Platform now and join our growing community of profitable forex traders.

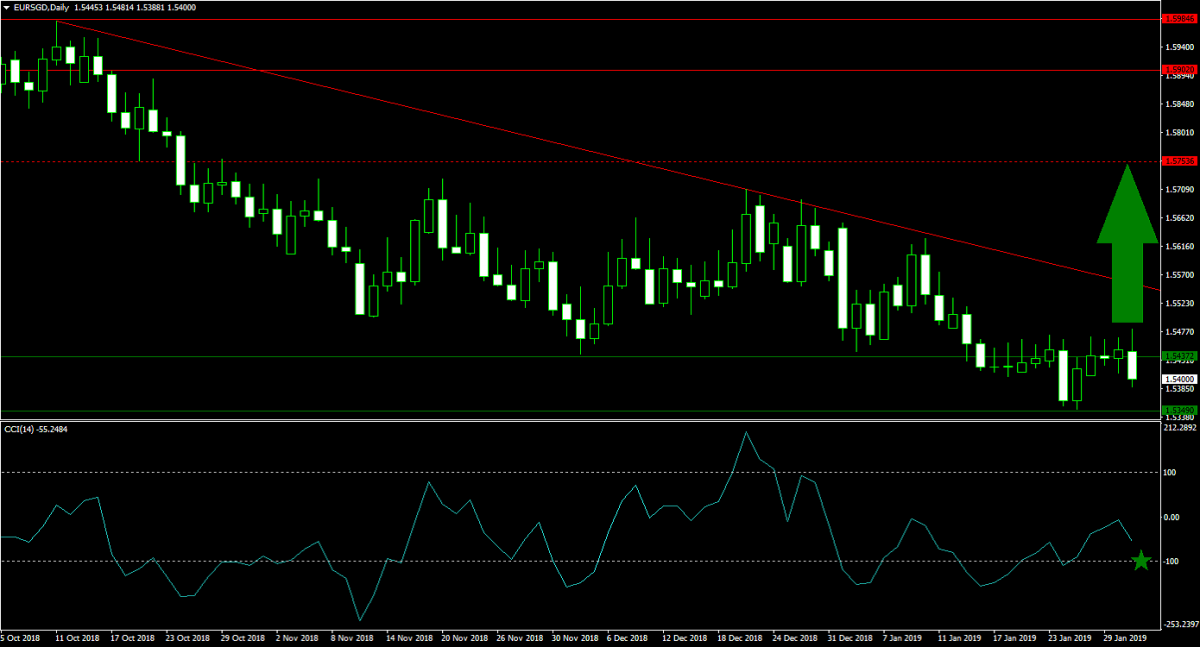

Forex Profit Set-Up #2; Buy EURSGD - D1 Time-Frame

Forex traders looking for a bullish trade in the Euro will find an excellent opportunity in the EURSGD. Price action is currently stabilizing inside of its horizontal support area as bullish momentum is building up. A breakout above the upper band is expected to carry this currency pair above its primary descending resistance level and back into its next horizontal resistance level. Forex traders are recommended to spread their buy orders inside the horizontal support area.

The CCI already completed a breakout from extreme oversold conditions as a positive divergence formed and provided the required bullish push. As momentum is set to accelerate, a move above the 0 level is expected to follow. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market yielding over 500 pips in profits.

Forex Profit Set-Up #3; Sell EURSEK - D1 Time-Frame

While the Swedish economy is exposed to the trade war between the US and China, the impact is less than the Euro’s exposure to the slowing Eurozone economy. An extension of the rally in the EURSEK was rejected by its horizontal resistance level which is being enforced by its secondary descending resistance level. A count-trend move is now expected to take this currency pair down into its primary descending resistance level which turned support following the breakout. Selling the rallies into the secondary descending resistance level is favored.

The CCI spiked into extreme overbought territory, but is in the midst of a sharp reversal from its peak. This is expected to result in a breakdown below the 100 mark from where new sell orders are anticipated to add to bearish pressures in the EURSEK. Follow the PaxForex Daily Forex Technical Analysis and copy the recommended trades from our expert analysts into your own trading account!

To receive new articles instantly Subscribe to updates.