With the Brexit mood souring again as EU President Donald Tusk is visiting the UK and the start of March ringing in the final twelve months of Brexit negotiations before the UK will leave the world’s largest trading bloc, the EU, some may not pay as much attention to what could move the Euro next: Italian elections. Italians will go the polls on Sunday, March 4th and many Italian voters are still undecided. The Italian election results are very likely to cause wild volatility swings in financial markets when they open for business on Monday morning.

Forex traders are advised to prepare their forex portfolio before the close of trading tomorrow in order to capitalize from the expected volatility as well as to shield it from the fallout. A delicate balancing act is required in times of post-election trading sessions. It appears very likely that there will be a change in the Italian government as current Prime Minister Paolo Gentiloni is battling an uphill battle. The Italian economy is the worst performing economy in the Eurozone. Gentiloni may argue for more time for his economic reforms to work ad Italy did print the best GDP figures last year in a decade. Voters remain frustrated.

The two parties which are set for a very good outcome is Forza Italia, former Prime Minister Silvio Berlusconi’s party, together with its allies from the Northern League led by Matteo Salvini and the anti-establishment Five Star Movement. Italy has an ageing population and is the world’s oldest country behind Japan. 29.4% of the Italian population is over 60 and Forza Italia with the Northern League proposed a minimum pension of €1,000. This is likely to attract many 50+ voters. In addition to the minimum pension, the coalition wants to unwind the Democratic Party’s increase in the retirement age. The EU will certainly disapprove of any such measure, but EU approval of Italians is the second worst behind Greece.

The Italian election results are expected to move forex markets, especially currency pairs associated with the Euro, next week and traders can increase their earnings if they take full advantage of the trading opportunities which will be created as a result. Open your PaxForex Trading Account today and position yourself to profits from the Italian post-election trading sessions. Learn how you can earn over 500 pips every month with the help of PaxForex and join our growing community of profitable forex traders.

Turnout could become an issue after the last election in 2013 drew the lowest amount of Italians to the polls post-World War II. The Five Star Movement tries to convince voters to allow them to end established rule with the promise of lower taxes and more spending on the poor. 33% of voters mentioned high taxes as a prime concern. Forza Italia and The Northern League also vow to fight immigration as Italians as the most worried country in the EU about immigrants. The 2016 refugees crisis is on every Italians mind. Italy is also heavy on debt and the three major parties fighting for power are all set on spending a lot more than the government will take in. There is plenty of stake on Sunday for Italians, for Europeans and for the Euro. Is your Forex Account Ready For Italian Elections? Here are three forex trades to put on on a profitable path post-election.

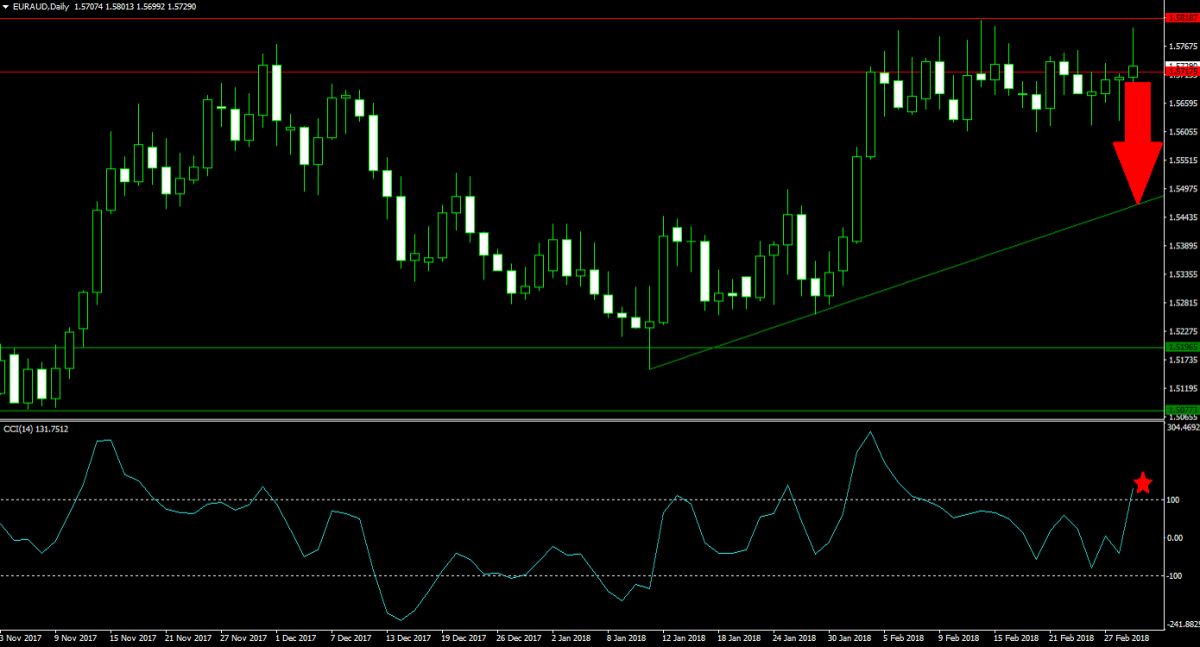

Forex Profit Set-Up #1; Sell EURAUD - D1 Time-Frame

The EURAUD enjoyed a strong advance, but has lost steam as it reached its horizontal resistance area. The Italian elections will provide a good reason to take profits which could push this currency pair back down into its ascending support level. Price action could ride it down on the back of high volatility amid uncertainty of what the new Italian government can and will do. Forex traders are advised to spread their buy orders inside the 1.5715 and 1.5815 zone which will reduce risk and increase profit potential as profit taking in the EURAUD will take place.

The CCI spiked above the 100 level which indicates extreme overbought conditions, but it remains well below its previous peak which creates a bearish trading signal. A breakdown below 100 could attract more sell orders in this currency pair. Take advantage of the PaxForex Daily Fundamental Analysis where our expert analysts highlight the most profitable trades each day and help you earn over 500 pips per month.

Forex Profit Set-Up #2; Buy EURZAR - D1 Time-Frame

South Africa has political and economical issues of its own, and the South African Rand has been advancing throughout the storm. The EURZAR is ready for a reversal of its trend and if forex traders view the Italian election results favorable, this currency pair could complete a breakout above its horizontal support area. A further breakout above the descending resistance level will clear the way for a bigger advance into its horizontal resistance area. Forex traders are advised to buy any dips from current levels below 14.4950.

The CCI, a momentum indicator, is moving higher after a positive divergence formed in extreme oversold territory below the -100 mark. Following the breakout this indicator also eclipsed the 0 level which resulted in a momentum shift from bearish to bullish. The Daily Forex Technical Analysis published by PaxForex expert analysts bring all forex traders the best technical trading set-ups each trading session.

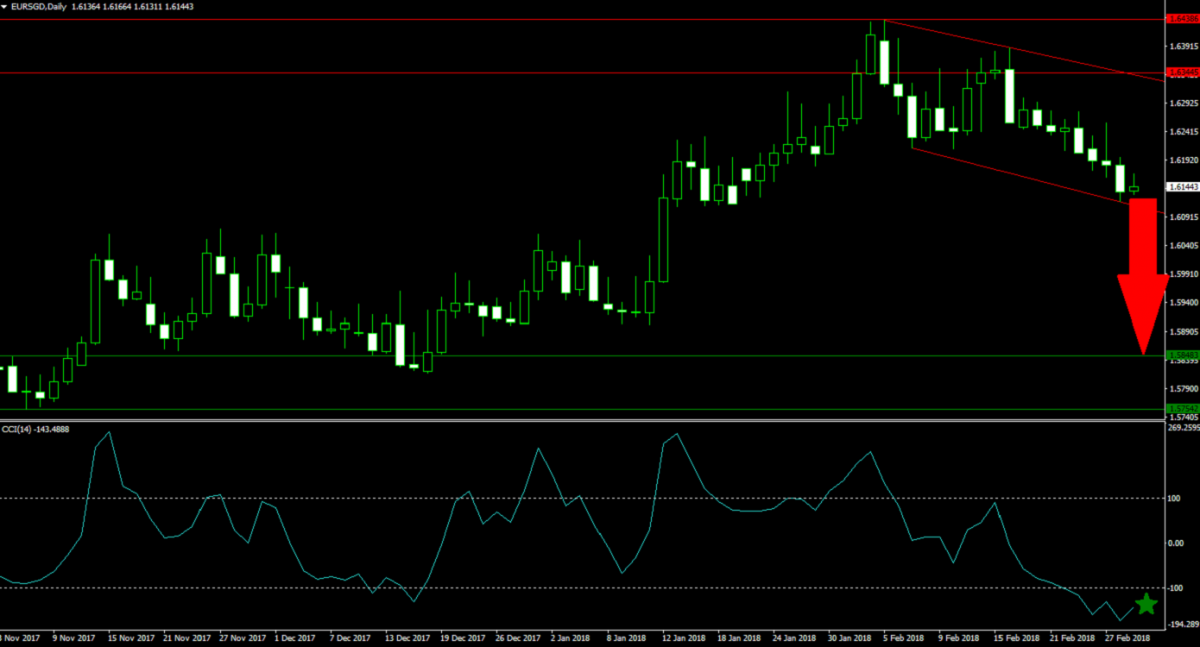

Forex Profit Set-Up #3; Sell EURSGD - D1 Time-Frame

Price action in the EURSGD is currently being guided lower inside a bearish price channel. This chart pattern formed following the breakdown below its horizontal resistance area and partial retracement. It is expected that the current down-trend will remain intact with small rallies into the descending resistance level of its bearish price channel. Forex traders area recommended to sell all potential counter-trend rallies inside the current chart formation. The Italian election results could prompt a breakdown in the EURSGD.

The CCI has reached extreme oversold conditions and this indicator has also move below its previous low which generated our final bearish trading signal for this currency pair. More downside should be anticipated. Download your PaxForex MT4 Trading Platform now and add this trade to your forex portfolio before a potential breakdown and acceleration in this currency pair will materialize.

To receive new articles instantly Subscribe to updates.