A lot of forex analysts and traders are now wondering if the collapse in the Turkish Lira is over, or if another round of selling is around the corner. The Turkish currency has been losing value against the US Dollar and the Euro for since August of 2017. The reason was the economic policy which Turkey embraced. This resulted in Turkish companies borrowing heavily in foreign currencies and made Turkey heavily dependent of foreign capital inflows, creating one of the world’s worst current account deficits.

Tensions between the two NATO allies surged over the detention of American pastor Andrew Brunson, who is currently under house arrest. He has been accused of espionage and terrorism relating to the failed coup attempt in 2016. Turkey stated that the coup was organized by Turkish business man and cleric Fethullah Gulen who resides in the US. His so called Gulen Movement is designated as a terrorist organization by Turkey who called on the US to extradite him in order to face charges. The US has refused to comply with Turkey’s request so far and Gulen denies any involvement.

US President Trump sanctioned two members of Turkish President Erdogan’s inner circle in parliament and doubled tariffs on Turkish steel and aluminium in order to force Turkey to the negotiating table. President Erdogan stated that threats against his country will not work and that the US is at risk of losing a key, strategic ally in the region. The US uses a base in Turkey for its missions in Afghanistan and Iraq as well as Turkish airspace to cut troop travel time. President Erdogan further stated that Turkey will quickly find new allies for its strong economy.

For now, investors are not convinced that Turkey will deliver on its economic agenda, but is the Turkish Lira collapse over? Three days of heavy selling in the USDTRY took this currency pair to an intra-day high of 7.1244, followed by its second day of retreat. What’s next for the Turkish currency? Open your PaxForex Trading Account now and learn why profitable traders trust PaxForex!

Many call for an interest rate increase of as much as 1,000 basis points, but President Erdogan has spoken out against interest rate increases and the Turkish central bank, in its last meeting, surprised markets by keeping interest rates unchanged at 17.75%. Some analysts fear capital controls may be put in place to stem the collapse in the Turkish Lira. A meeting between White House National Security Advisor Bolton and Turkish Ambassador to the US Kilic resulted in no progress as the US warned that it has nothing to discuss with Turkey until the release of the American pastor. Is the Turkish Lira collapse over? Here are three forex trades to consider.

Forex Profit Set-Up #1; Sell USDTRY - D1 Time-Frame

Volatility is expected to remain high and forex traders should closely monitor how today’s candlestick will close. A wide horizontal resistance area has formed due to the volatile moves, but as some calm is introduced and the Turkish government is likely to step in protect its currency. Turkish President Erdogan stated that 'There is a so much bigger and deeper operation against Turkey.' and that 'The US has targeted not only Turkey but so many other places economically.' Yesterday’s candlestick formed a classic pattern signalling a top and forex traders should sell the rallies in the USDTRY.

The CCI has spiked deep into extreme overbought territory, but started to retreat from its highs. A move below 100 could start a profit taking contraction in the USDTRY which could power a sell-off back down to the 4.8000 mark. Make a Deposit today into your PaxForex Trading account and not only diversify your Bitcoin and Ethereum assets, but also boost your monthly trading income through forex.

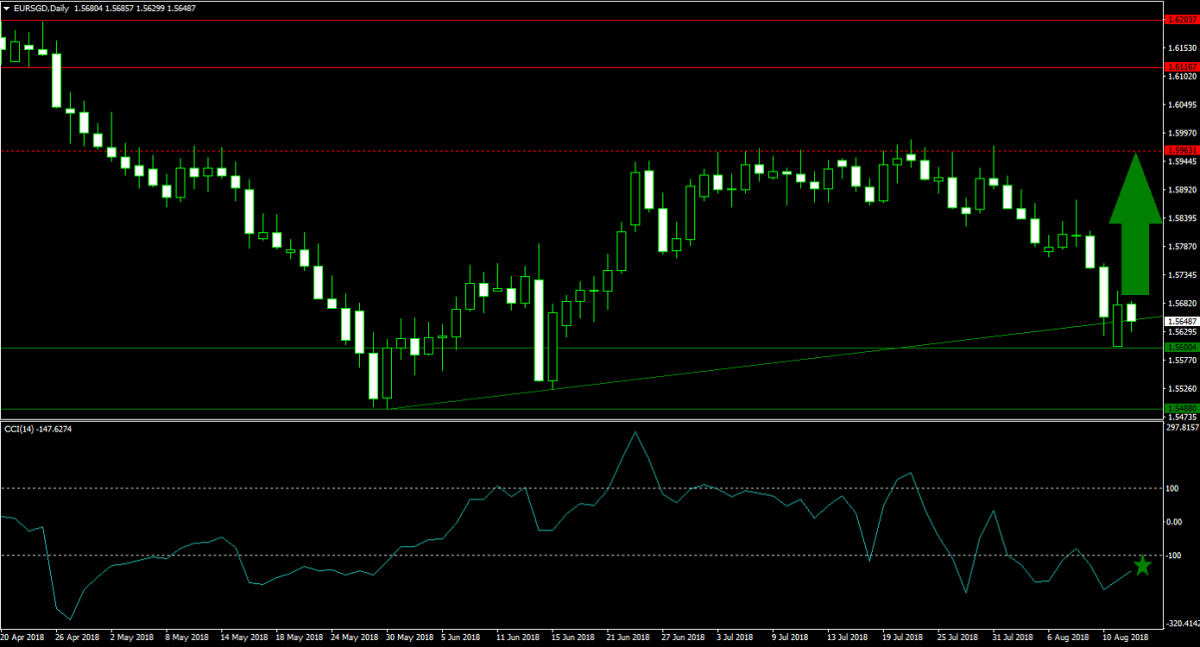

Forex Profit Set-Up #2; Buy EURSGD - D1 Time-Frame

The Euro contracted across the board amid fears of contagion due to the exposure of Eurozone banks to Turkey. This bled the Eurozone currency to multi-month lows. The EURSGD contracted down to a strong support area. Price action is currently trading between the upper band of its horizontal support area and below its ascending support level. As a sense of calm is returning to the markets, forex traders are recommended to buy the EURSGD just above and below its ascending support level.

The CCI descended into extreme oversold conditions, but is well above its previous lows and a positive divergence has formed. This represents a bullish trading confirmation in this currency pair. Follow the PaxForex Daily Forex Technical Analysis and never miss a profitable trading opportunity again. Simply copy the recommended trades into your own forex account.

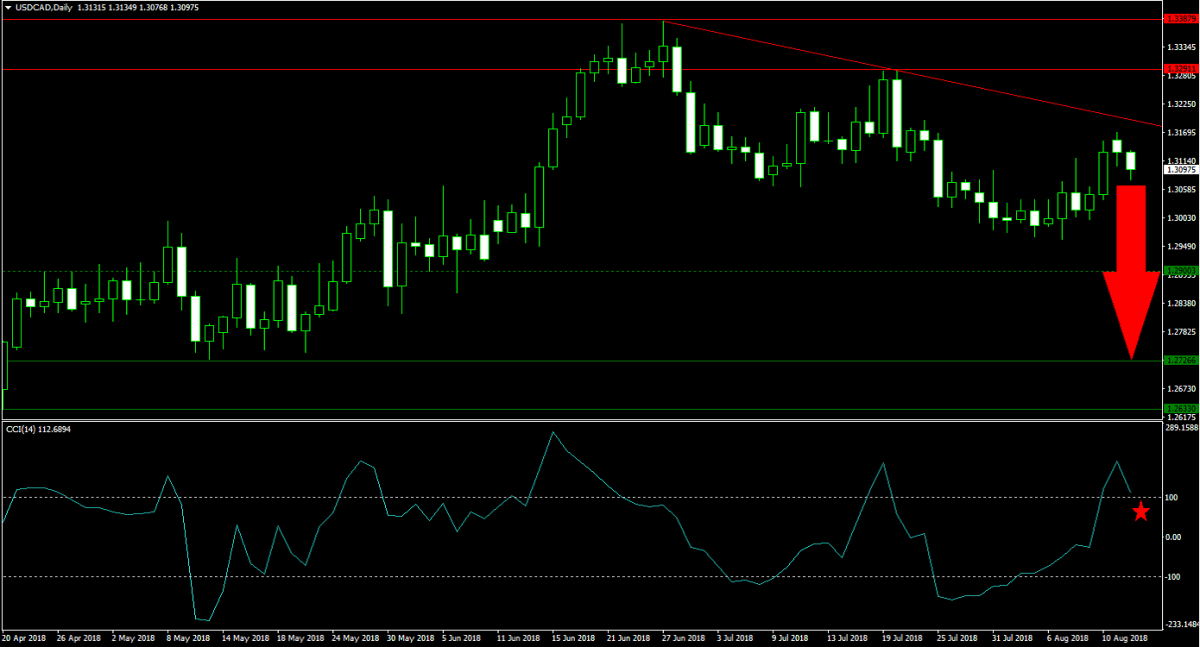

Forex Profit Set-Up #3; Sell USDCAD - D1 Time-Frame

The US Dollar has enjoyed positive inflows as forex traders shunned riskier currencies, but should the situation start to normalize the US Dollar could come under selling pressure once again. The trade war the US is waging against key allies could end up hurting US consumers. The USDCAD is now being pressured lower by its descending resistance level following the breakdown below its horizontal resistance area. Forex traders are advised to sell the rallies in the USDCAD up to its descending resistance level.

The CCI moved into extreme overbought territory, but bullish momentum is fading and this technical indicator is set to move below the 100 level and contract further. This could result in sell-off on the back of profit taking and asset reallocation out of the US Dollar. Subscribe to the PaxForex Daily Fundamental Analysis and let our expert analysts guide you through the exciting world of forex which will yield you over 500 pips per month.

To receive new articles instantly Subscribe to updates.