The majority of forex traders are currently focused with the US Federal Reserve and its interest rate cut, how Brexit will play out or, where the China-US trade war is headed or how much weaker the Eurozone economy can get. This morning’s data showed the key Eurozone Business Climate Indicator for July drop into negative territory with a -0.12 reading. This overshadowed a rare piece of positive news for the Euro after the German Constitutional Court ruled that the 2014 EU Banking Union, more specifically the Single Supervisory Mechanism and the Single Resolution Mechanism, don’t violate the German constitution. Opponents have argued that national regulators have lost their powers while tax payers money is at risk.

Emerging markets often get ignored which creates great trading and profit potential. South Africa is not new to crisis, but the planned Eskom split-up as a result of the de facto insolvency has resulted in massive foreign capital outflows. Foreign investors have sold $4.8 worth of South African assets, mainly in fixed income. The South African Rand has been under pressure, but given the issues surrounding the US Dollar and the Euro, a divergence has occurred. The overall consensus remains bearish the South African currency as economic worries may pick-up before they improve.

According to JPM analysts Anezka Christovova and Robert Habib, “South Africa’s fundamental picture remains very challenging with a ballooning fiscal deficit and structurally low growth.” Credit ratings agencies all rate South African debt as junk while Moody’s is the only one ranking it above with a negative outlook. South Africa is the continent’s most industrialized economy. It is easy to either ignore the South African Rand or jump on the bearish bandwagon as foreign capital is headed for the exits.

Is the South African Rand a Buy? Emerging markets and exotic currency pairs are often ignored as forex traders have a tendency to follow trends and crowd trades. While this may generate a feeling of security, it also misses great opportunities. Subscribe to the PaxForex Daily Fundamental Analysis now and allow our expert analysts to guide you through the world of forex trading, yielding over 500 pips in monthly profits!

As foreign investors are fleeing South Africa, local demand remains strong. The countries equity market returned increased by 11% so far in 2019, if adjusted to the US Dollar. This compares to a rise of just 8.2% in the MSCI Emerging Market Index. He bond market has also rewarded traders with an adjusted US Dollar return of 7.4%. Who will ultimately be correct, foreign investors who are fleeing or local investors who are adding to their holdings? There are plenty of unknowns for the South African Rand, but also plenty of upside potential for the right type of forex trader. Is the South African Rand a Buy? Here are trades which will elevate your profits as traders sort through the South African currency!

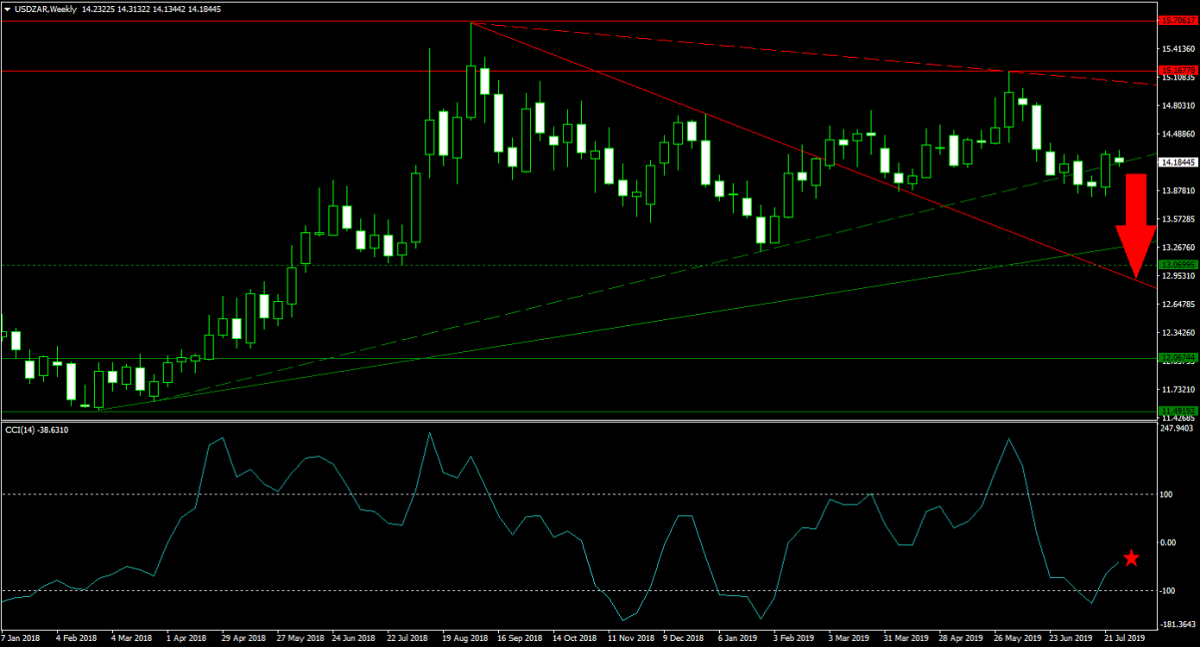

Forex Profit Set-Up #1; Sell USDZAR - W1 Time-Frame

With the US Fed poised to cut announce an interest rate cut tomorrow and with economic data pointing towards more hardship, the US Dollar is expected to come under selling pressure. The USDZAR is trading above and beyond its secondary ascending support level with bearish momentum on the rise. Price action is expected to complete a double breakdown, below its primary ascending support level as well as below its horizontal support level, and extend its slide until it can challenge its primary descending resistance level. Forex traders are recommended to sell any rallies in the USDZAR into its secondary descending resistance level.

The CCI renounced from extreme oversold conditions, but bullish momentum is not expected to carry this technical indicator above the 0 mark. Open your PaxForex Trading Account today and find out why more profitable forex traders every day prefer to manage their assets at PaxForex!

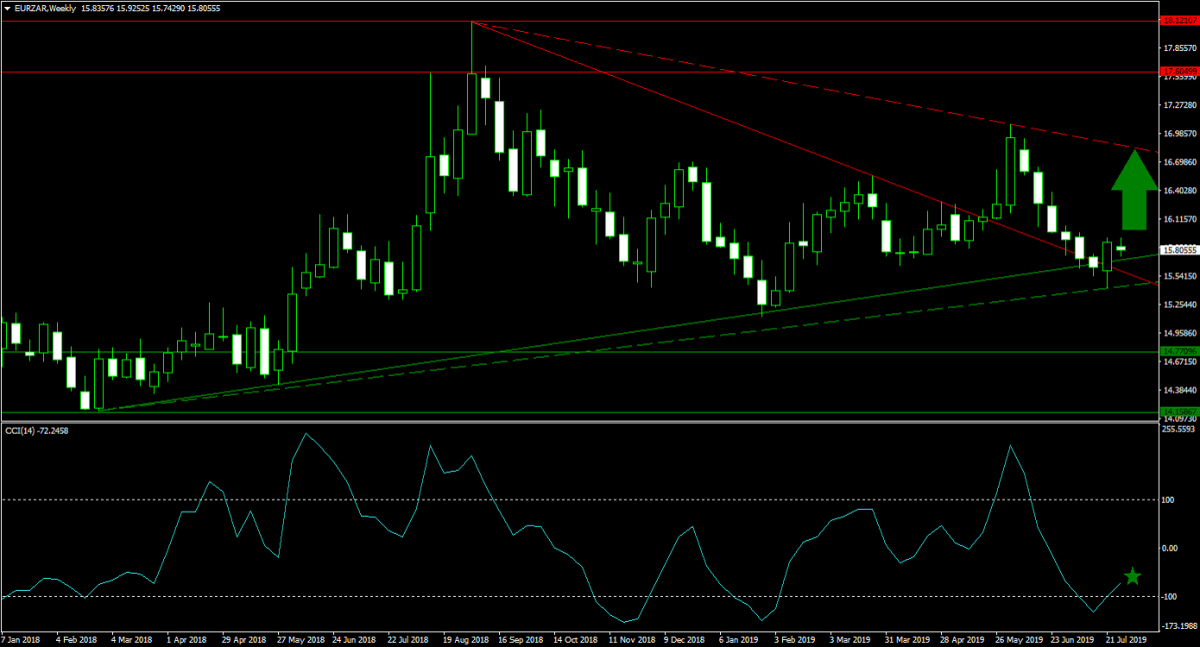

Forex Profit Set-Up #2; Buy EURZAR - W1 Time-Frame

Forex traders who seek to profit from potential short-term South African Rand weakness can take advantage of the EURZAR which started to recover off of its primary and secondary ascending support levels. The ECB decided to keep interest rates unchanged which allowed this currency pair to enter a short-covering rally. As bullish momentum is on the rise, price action is expected to move higher until it will reach its secondary descending resistance level. Forex traders are advised to buy any sell-off in the EURZAR, down to its primary descending resistance level which acts as temporary support.

The CCI pushed out of extreme oversold conditions after recording a higher low and is now favored to extend to the upside for a bullish momentum crossover above 0. Download your PaxForex MT4 Trading Platform now and join our fast growing community of profitable forex traders!

Forex Profit Set-Up #3; Buy BTCUSD - W1 Time-Frame

With expected US Dollar weakness ahead and foreign capital fleeing established emerging markets such as South Africa, Bitcoin is becoming an attractive alternative to park cash. Bitcoin has started to amass the reputation of digital gold and the most recent sell-off in BTCUSD below $10,000 has created a great entry opportunity to he upside. Price action is expected to spike back into its primary descending resistance level from where a further breakout could push this cryptocurrency to new 2019 highs. Buying any dips in BTCUSD down to its secondary descending resistance level, which currently acts as support, remains the favored trading approach.

The CCI descended below 100 and out of extreme overbought conditions and while the downtrend in this momentum indicator could briefly pierce below 0, a reversal is anticipated over the next few weeks. Follow the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account!

To receive new articles instantly Subscribe to updates.