US President Trump took to Twitter in order to criticize the valuation of the Euro and how this puts the US at a disadvantage. While many grew accustomed to Trump tweeting his dislikes at odd times about many different things, is the Euro undervalued? According to the purchasing-power-parity model used by the Organization for Economic Cooperation and Development (OECD), Trump is correct in his anger. The model suggests that the Euro is undervalued by 22% against the US Dollar. This makes it the third most undervalued currency, trailing only the Mexican Peso which is undervalued by almost 106% and the South Korean Won which is undervalued by roughly 39%.

Some analysts created what is know as the “Big Mac” analysis which looks at how much a Big Mac costs in different countries if purchased in US Dollars. This shows that the Euro is undervalued by 15%. The Chief Global FX Strategist Kit Juckes at Societe Generale agrees and added “The euro’s definitely undervalued on most measures. A persistent current-account surplus when unemployment is falling makes it hard to argue the currency isn’t undervalued.” Will there be a change and how may this impact forex trading online? Over the past twelve months, the Euro depreciated roughly 4% against the US Dollar as the US Fed has increased interest rates. A trend which is likely to reverse over the coming months.

This brings another favorite Trump target in play, his own central bank. The increase in interest rates, which he publicly criticized, have had an impact on Euro valuation. We have a globally connected financial system and a development on one end has ripple effect throughout the system. The Head of Currency Strategy at Rabobank, Jane Foley, pointed out that “The fact that the Fed has been the only Group-of-10 central bank to ratchet up a significant amount of policy normalization since 2015 certainly helped support the USD.” Trump’s trade war with China may have put the US Fed in a position to cut interest rates and weaken the US Dollar.

A cheaper US Dollar would make US exports more competitive, but it may not deliver the overall desired impact on the economy long-term. Will the US manipulate its currency and weaken it in order to keep fighting Trump’s trade war? How to trade forex as the US Dollar is poised to correct and the how will the Euro trade? Open your PaxForex Trading Account today and let our expert analysts guide you to over 500 pips in profits per month!

Not everyone is quick to agree with Trump’s anger. The US Fed inflation-adjusted, traded-weighted Dollar Index is currently 6% above its 20-year average while the Euro is 6% below its average since its inception in 1999. The Chief Currency Strategist at RBC Capital Markets, Adam Cole, noted that “It’s well within the normal range of valuation. I don’t think there’s a policy of maintaining an undervalued currency, or holding it at undervalued levels.” With the global economy heading towards a recession, it remains to be seen which currency suffers more and by how much the valuation difference between the Euro and the US Dollar will change. While Trump expresses his frustration on Twitter about the undervalued Euro, here are three forex trades to boost your forex portfolio.

Forex Profit Set-Up #1; Buy EURUSD - W1 Time-Frame

As the US Dollar is in the early stages of a contraction, the EURUSD completed a breakout above its horizontal support area. This provided a strong boost to bullish momentum. Price action also moved above its secondary descending resistance level which turned it into support. This currency pair is now anticipated to extend its breakout and move above its primary descending resistance level until it can challenge its next horizontal resistance level. Forex traders are recommended to buy any dips in the EURUSD down into the lower band of its horizontal support area.

The CCI accelerated out of extreme oversold territory and bullish momentum pushed above the 0 mark which attracted more buy orders. More upside is favored over the coming trading weeks. Download your PaxForex MT4 Trading Platform and join our fast growing community of profitable forex traders!

Forex Profit Set-Up #2; Sell EURAUD - W1 Time-Frame

This currency pair is at an exhausted stage of its rally and with the ongoing trade developments between the US and China, the Australian Dollar is favored to attract bids. The EURAUD advanced into its horizontal resistance level which is being intersected by its primary descending resistance level. Price action is now expected to reverse its gains and complete a double breakdown, below its horizontal support level and below its secondary ascending support level. This will take the EURAUD down into its primary ascending support level. Forex traders are advised to sell any rallies into the lower band of its next horizontal resistance area.

The CCI is trading in extreme overbought conditions, but has retreated from its highs. This momentum indicator is now expected to drop below the 100 level which is likely to attract new sell orders. Subscribe to the PaxForex Daily Fundamental Analysis and find out why more and more profitable forex trader operate their portfolios at PaxForex, one of the premier MetaTrader 4 brokers!

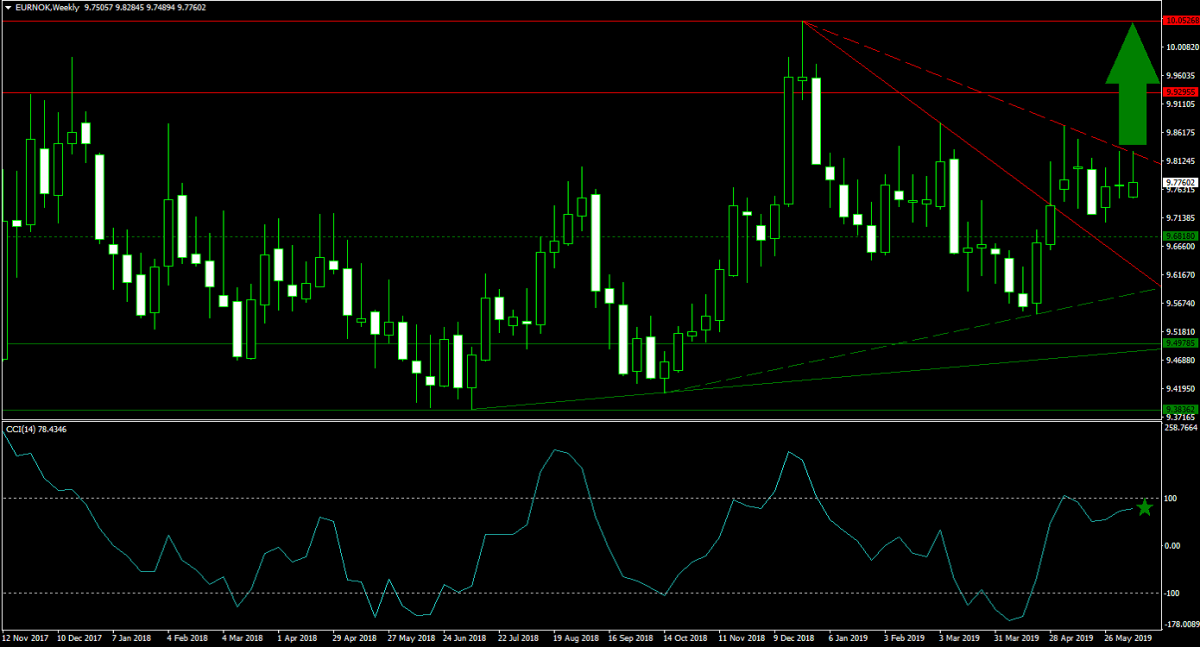

Forex Profit Set-Up #3; Buy EURNOK - W1 Time-Frame

The most recent pull-back in the EURNOK has opened up a good entry opportunity into a long position. Price action is currently trapped between its primary and secondary descending resistance level, but above its horizontal support level. As bullish momentum is expanding, this currency pair is anticipated to launch a breakout attempt above its secondary descending resistance level. This will clear the path for an extended move back into its horizontal resistance level. Buying any dips in the EURNOK down into its horizontal support level remains the favored trading approach.

The CCI retreated from extreme overbought territory, but remains well above the 0 mark in neutral territory. This technical indicator is anticipated to attempt another push above 100. Follow the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account!