Last year at this time, the majority of forex traders and market professionals were talking about parity between the Euro and the US Dollar as the EURUSD dropped to as low as 1.03373 on an intra-day level. Price action had plenty of downside momentum and the phrase ‘the trend is you friend’ was thrown around. As with all trend, they do reverse and the Euro entered an explosive growth spurt. Twelve months later the EURUSD recorded an intra-day high of 1.25358. Now many traders are trying to determine if the Euro party is over or if it will continue pushing higher and if it continues what could derail it?

The Eurozone economy has been firing on all cylinders. Manufacturing and service sector growth is very strong, unemployment is contracting and consumer as well as business confidence is on the rise, but a global economic recession should not be ruled out and may arrive sooner that many are ready for. While the trend in 2017 was firmly to the upside, the possibility of a short-term counter-trend move to the downside should not be ruled out and would be healthy for a longer term up-trend. The election of French President Macron was viewed as very EU and therefore Euro positive, but as more clarity prevails it appears that it cold be the very reason for a Euro correction.

Prior to Macron’s victory, his opposition made it clear to voters that he will depend on German Chancellor Angela Merkel and that no matter who won the French election a female would be the next leader. This was in reference to either Marine LePen or Angela Merkel calling the shots in Paris. Macron has been very vocal about his future for Europe and with his proposals for deeper integration from defense to the economy he has also alienated many Europeans. Now even Germany is turning its back on Macron as four individuals familiar with German coalition negotiations stated that Macron will be disappointed by the outcome. This will leave him in a very weak state and draw him closer to the comparison with a macaron, a French desert with which Macron is often compared.

The Euro has rallied last year, but without a minor correction the up-trend could be jeopardized. Earn more pips per trade with a PaxForex trading account and join tens of thousands of profitable forex traders. Open and fund your account today and take advantage of the next move in the Euro before it unfolds.

As Germany has reached its limit of support, goodwill and patience with Macron other EU members have grown tired of him as well. Hungary and Poland will not play to his tunes and have very good reasons to do so. Fidesz party parliamentary leader, Gergely Gulyas, stated that ‘If we’re going to play the game that western European countries want to launch rule-of-law procedures against eastern European countries because of differences over values, then that’s not going to work. That would destroy the Union. Macron’s proposals are like a smorgasbord that includes items of varying quality. It’s worth taking on board some but not others.’ This cleary shows the divide within the EU and begs the question if Macron is ending the Euro party. Here are 3 forex trades to pip your trading account.

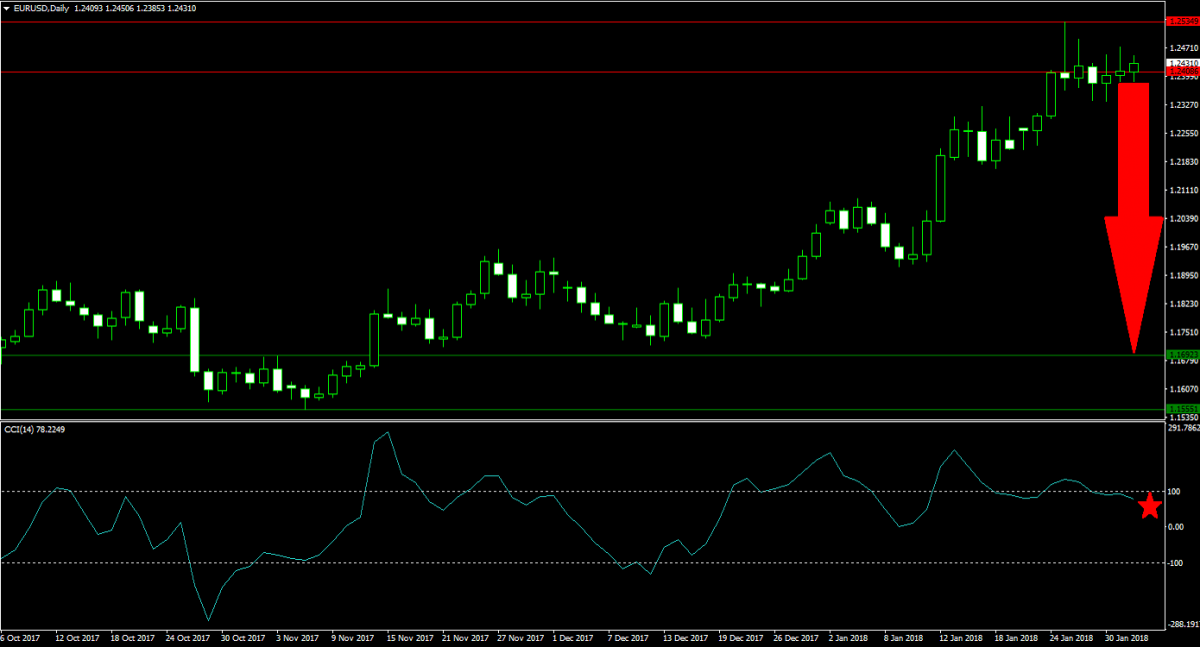

Forex Profit Set-Up #1; Sell EURUSD - D1 Time-Frame

The EURUSD has added over 2,000 pips during its rally, but is now in the process of identifying a new medium-term horizontal resistance area. The longer price action remains stuck around this area, the likelier a small correction becomes. This would be healthy and could signal more up-side to come, but for now bearish pressures are building and forex traders should account for a counter-trend move. A combination of profit taking and growing political problems within the EU together with a potential economic peak in the Eurozone warrant a weaker Euro over the next few trading weeks. Levels between 1.2400 and 1.2540 represent good short entry opportunities.

The CCI already completed a breakdown below the 100 level which took it away from extreme overbought conditions, but there is plenty of momentum left to take this momentum indicator through the 0 mark and down into oversold territory. A negative divergence has formed on top of the downward momentum. Download your MT4 Trading Platform now and add this currency pair to your portfolio.

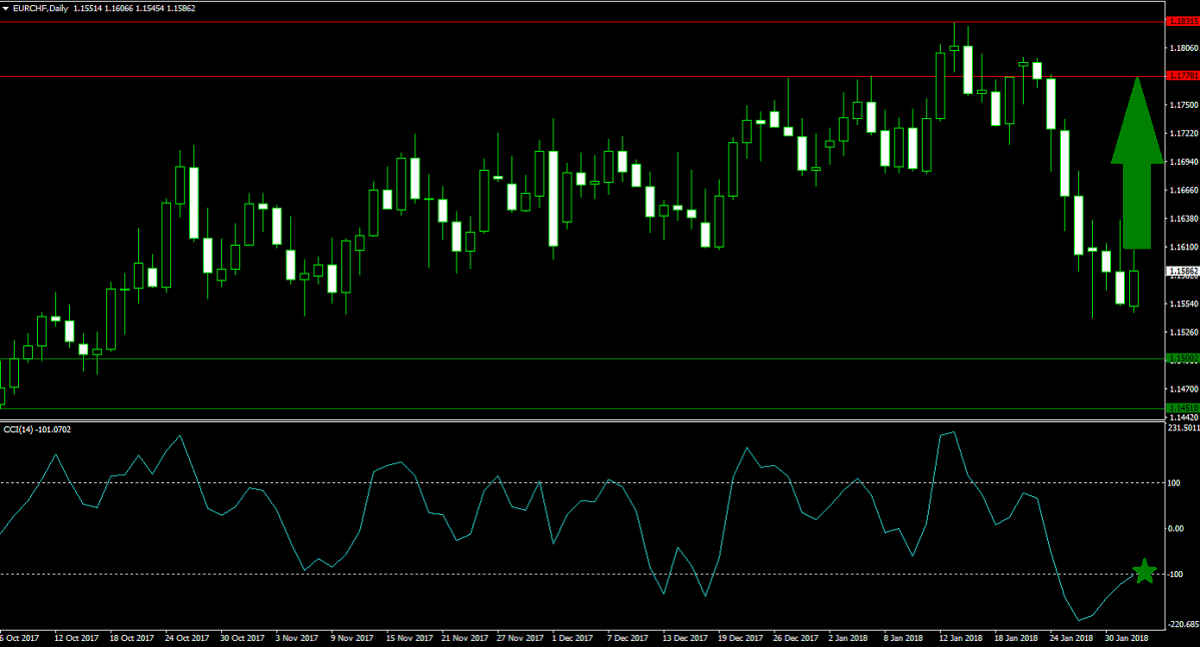

Forex Profit Set-Up #2; Buy EURCHF - D1 Time-Frame

This EURCHF buy recommendation represents a great hedge to the EURUSD short recommendation. While the Euro is predicted to weaken in the short-term, this currency pair has led the contraction in price action. Since the long-term prospects for the Euro remain to the up-side, forex traders are advised to stagger their buy orders between 1.1450 and 1.1550. Euro perma-bulls are expected to rotate from other Euro positions into the EURCHF currency pair which offers limited downside risk with great up-side potential.

The CCI is in the early phases of a recovery from deep below the -100 level and is now trading in-and-out of the -100 mark. This indicator has enough bullish momentum to cross above the 0 mark which would result in more buy orders due to the shift in momentum. The Daily Forex Technical Analysis provided by PaxForex offers traders the most profitable technical trading opportunities; follow our expert signals and grow your trading account.

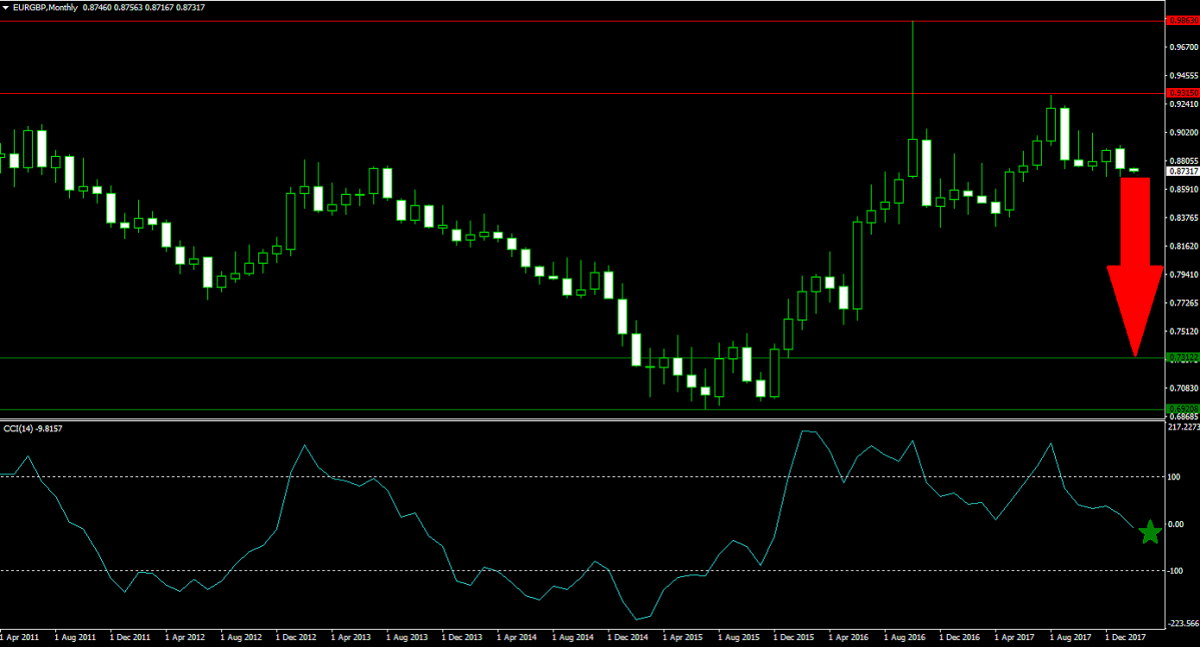

Forex Profit Set-Up #3; Sell EURGBP - MN Time-Frame

The EURGBP is set for a move to the downside. The predicted combination of a weaker Euro and stronger British Pound make this currency pair ripe for a larger corrective phase. Price action was rejected twice from extending its advance, another parity call last year which faltered the same way the EURUSD one did. The first rejection came from the upper end of its current horizontal resistance area and the second one from the lower end. The path is now clear to the downside which could see the EURGBP pierce the 0.7000 mark. Forex traders are advised to place their sell orders between the 0.8750 and 0.8900 area.

The CCI already completed a breakdown below the 100 mark and also crashed through the 0 level which resulted in a momentum shift from bullish to bearish. A continuation of the contraction should be accounted for. The PaxForex Daily Fundamental Analysis section proved forex traders the most important and market moving fundamental trades each session. Profit from our expert and add over 500 pips every month to your forex trading account.

To receive new articles instantly Subscribe to updates.