Some argue that globalization has been the biggest factor on how our daily lives are shaped and point out the positive impact this trend has had around the globe. Since the election of US President Trump and his anti-globalization effort in order to make America great again, fears have risen that globalization is slowing down and could be dead. Before digging deeper into this theory, the fact that the world’s largest economy feels it needs to reign in globalization in order to restore its own economy shows that there remain large issues when it comes to globalization.

In order to fully understand the trend in globalization, one needs to fully understand how to measure it. Many associate it with how many shipping containers loaded with goods leave one port and are delivered across the globe to another one. While this metric may have worked well 75 years ago, it ignores to account for the emergence of the digital economy where services are moved online and are barely measured. As the global economy is changing, so is globalization and economists need to change their models in measuring economic activity.

While US President Trump decided that using tariffs is the right way forward, most countries favor free trade. Tariffs an trade war are slowing down the global economy, but even without them economic cycles come with periods of expansions and recessions. Global central banks have manipulated financial markets and the economy, distorting the natural cycles and created a great deal of uncertainty. This needs to be undone before the global economy, in its new digital shape, can resume a sustainable path which benefits the majority.

How does this change in globalization impact your forex investment? Some economies cope better with changes than other which is reflected in their currencies. Open your PaxForex Trading Account now and start creating a market beating portfolio with the help of our expert analysts!

At the time the US is increasing tariffs, the rest of the world is decreasing them. Supply chains are more interconnected than ever and the digital economy is reshaping spheres of influence. Some argue that we are now in a technology war which could further dampen growth prospects of the global economy as companies have to adjust to this new reality. Innovation is no longer concentrated in a few economies and as long as companies have a global focus, globalization is alive and doing well. Migration has been stable, but business travel and vacation travel has been higher than ever in today’s jet age. Is globalization dead? On the contrary, globalization is evolving and may have an even bigger positive impact to more people moving forward. Here are three trades to have a big positive impact on your account balance!

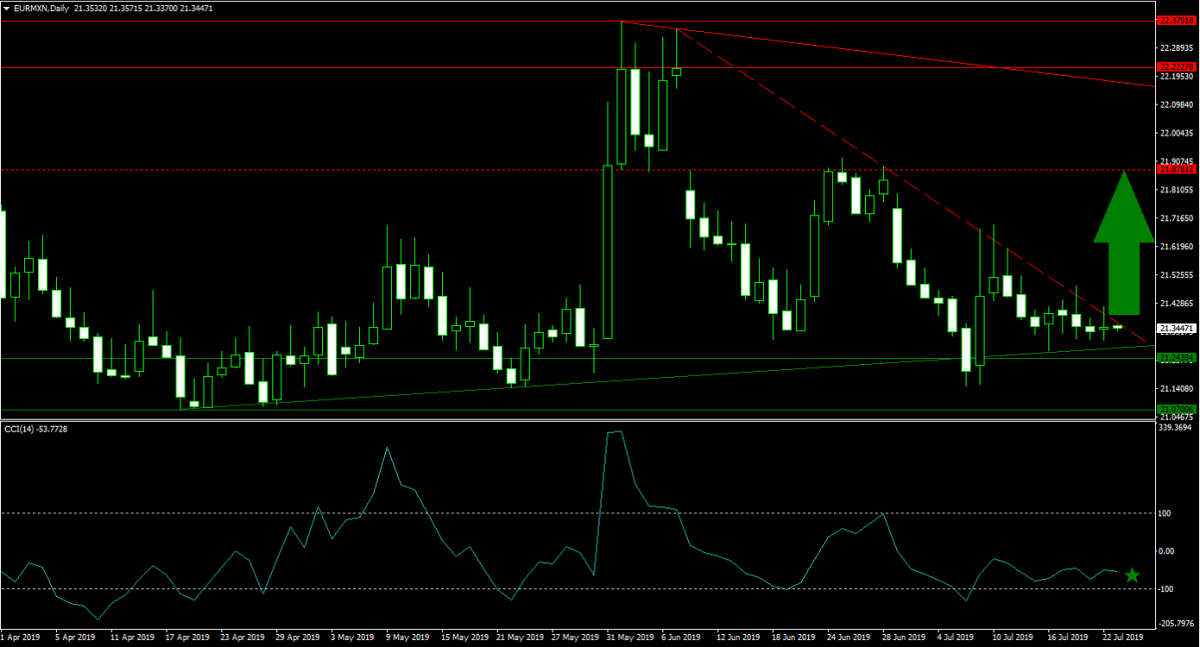

Forex Profit Set-Up #1; Buy EURMXN - D1 Time-Frame

After a sustained sell-off, the EURMXN has reached a very strong support level and is currently stabilizing just above its horizontal support area which is enforced by its primary ascending support level. As the global economy is heading towards a recession, the Eurozone economy can withstand the negative impacts better than the Mexican one which should send price action to the upside. A breakout above its secondary descending resistance level can lift the EURMXN back into its next horizontal resistance level. Forex traders are recommended to buy any dips in price action down to the lower band of its horizontal support area.

The CCI has entered a sideways trend above extreme oversold conditions and is trending higher in a shallow pattern. A move above 0 is expected to invite the next wave of buy orders. Download your PaxForex MT4 Trading Platform now and join our fast growing community of profitable forex traders!

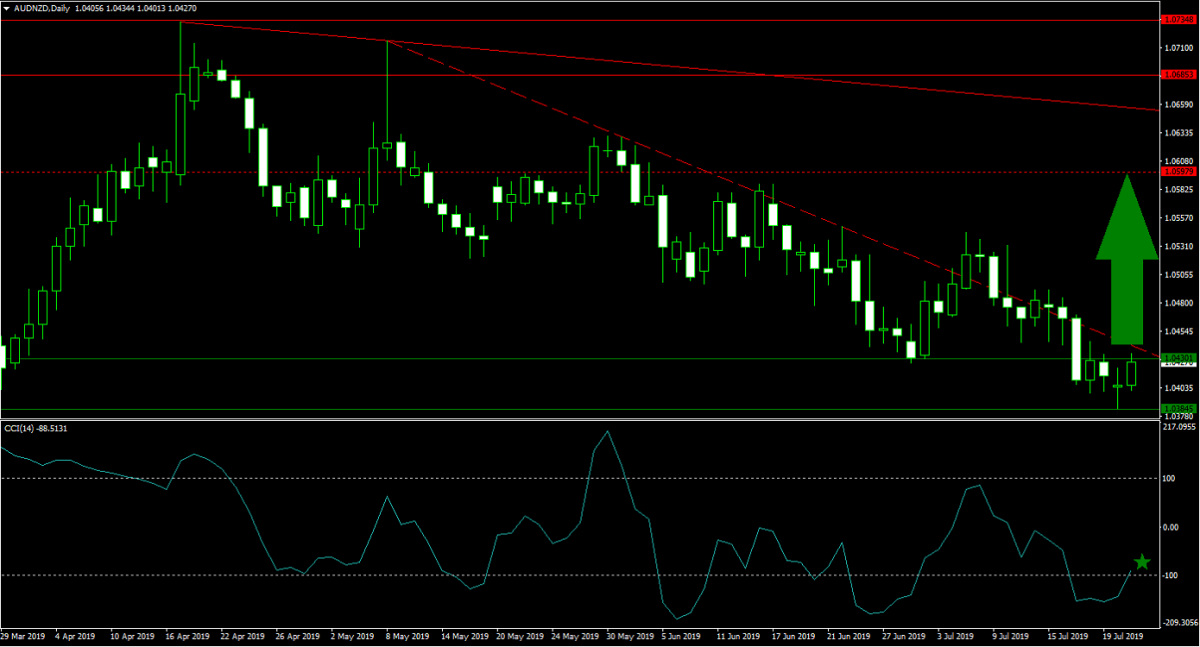

Forex Profit Set-Up #2; Buy AUDNZD - D1 Time-Frame

While globalization is evolving and the digital economy is playing an ever increasing role, hard commodities will continue to be a vital part of it. The AUDNZD puts two of the most prominent commodity exporters against each other and the size of the Australian economy is expected to trump the impact of a global recession on the New Zealand economy. Price action is on the verge of a breakout above its horizontal support area as well as above its secondary descending resistance level from where this currency pair has a clear path into its next horizontal resistance level. Forex traders are advised to place their AUDNZD buy orders inside of the horizontal support area.

The CCI already completed a breakout above extreme oversold territory and bullish momentum is anticipated to extend this technical indicator above the 0 level which favors more upside. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you to over 500 pips in monthly profits!

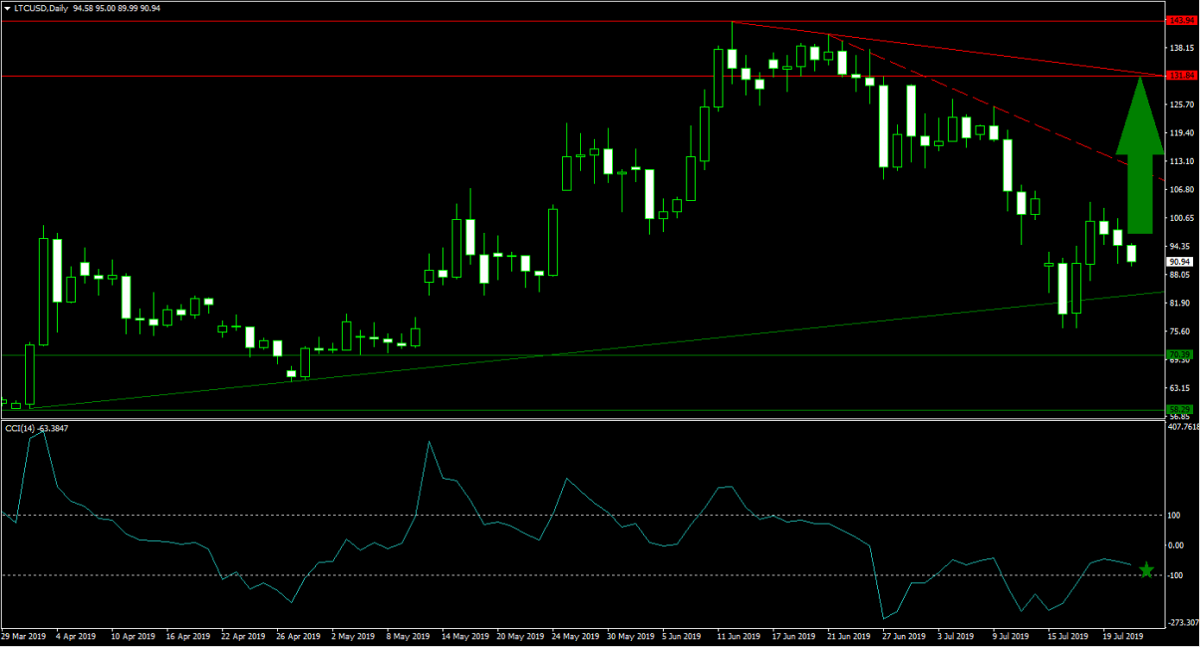

Forex Profit Set-Up #3; Buy LTCUSD - D1 Time-Frame

As the global economy transforms, the emergence of cryptocurrencies should not be ignored. This emerging asset class will play a central role in the digital economy moving forward. LTCUSD offers forex traders a great entry opportunity in into the cryptocurrency sector as price action is nearing the end of its corrective phase. Its primary ascending support level is putting a floor on downside potential and price action is anticipated to launch a reversal. LTCUSD is expected to complete a breakout above its secondary descending resistance level and accelerate back into its horizontal resistance area. Buying any dips in this cryptocurrency down to the upper band of its horizontal support are remains the favored trading set-up.

The CCI already pushed above extreme oversold conditions and a positive divergence formed which represents a strong bullish trading signal. This momentum indicator is now expected to accelerate to the upside. Follow the PaxForex Daily Forex Technical Analysis and find out why more traders prefer to grow their balance at PaxForex!

To receive new articles instantly Subscribe to updates.