While the US Federal Reserve attempted to lead an interest rate rise cycle, few answered the call which resulted in the first major global interest rate policy divergence since the last global financial crisis. The US central bank ended its campaign in December of 2018 amid heavy political pressure as well as a global economy which started to come to grips with the severity of the trader war the US started with China as well as other trade spats the Trump administration ushered in. The US Dollar enjoyed the tailwind provided by the central bank as it was the only major central bank which was increasing interest rates while other central banks kept interest rates are or near all-time lows.

Many analysts and economists have warned against the increase in interest rates in the current global economic environment while a small number have highlighted that the US central bank could cut interest rates as soon as the end of 2019. James Bullard, the St. Louis Federal Reserve President, has now opened the possibility for such a move. He noted that an “interest rate cut may be warranted soon”, and added “The Fed faces an economy that is expected to grow more slowly going forward, with some risk that the slowdown could be sharper than expected due to ongoing global trade regime uncertainty.” Global PMI data has slowed more than economists expected over the past months and the trend is likely to accelerate. Plenty of forex traders have not fully priced in the much weaker than expected economic outlook and will have to catch up. This is expected to add more short-term volatility to the forex market.

Did the Reserve Bank of Australia fire the first shot this morning? The RBA, after remaining on the sidelines over the past three years, announced a 25 basis point interest rate cut from 1.50% to 1.25%. RBA Governor Philip Lowe stated “Today’s decision to lower the cash rate will help make further inroads into the spare capacity in the economy.” He further pointed out “There has been little further inroads into the spare capacity in the labor market of late”, and “Downside risks stemming from the trade disputes have increased. Growth in international trade remains weak and the increased uncertainty is affecting investment intentions in a number of countries.” The Australian Dollar is the top currency used for Chinese Yuan proxy trade in forex trading as the Australian economy is heavily dependant on the Chinese one.

Just like other developed economies, Australia is suffering from a lack of inflationary pressures which the RBA believes will change as the labor market tightens further. How to trade forex with the elevated degree of risk in the markets and a global economy headed for a recession? Start by opening your PaxForex Trading Account now and join our fast growing community of profitable forex traders!

Will other global central banks follow the RBA in cutting interest rates? The Bank of Japan and the European Central Bank have slashed rates to negative and zero respectively. The Bank of England is at a record low and may keep a reserve until Brexit has materialized. It is likely that more QE will be pumped into the financial system with the BoJ and ECB leading. The ECB may be forced to act by market pressures and Citigroup fixed-income strategist Jamie Searle added “To fight back, the ECB needs to out-dove the market. That’s unlikely to be achieved via TLTRO pricing or forward guidance changes. It needs to be stronger and unexpected, like a hint that QE can be restarted.” In the meantime, the Reserve Bank of India could lead emerging market central banks into an interest rate cut cycle. Indranil Sen Gupta, economist at Bank of America Merrill Lynch, noted “Fading fiscal/rupee risks, after PM Modi’s re-election, should allow a cut greater than 25 basis points, in line with Governor Das’ out-of-the-box proposal.” Is a Global Interest Rate Cut Cycle Imminent? Here are three forex trades to imminently boost your profitability!

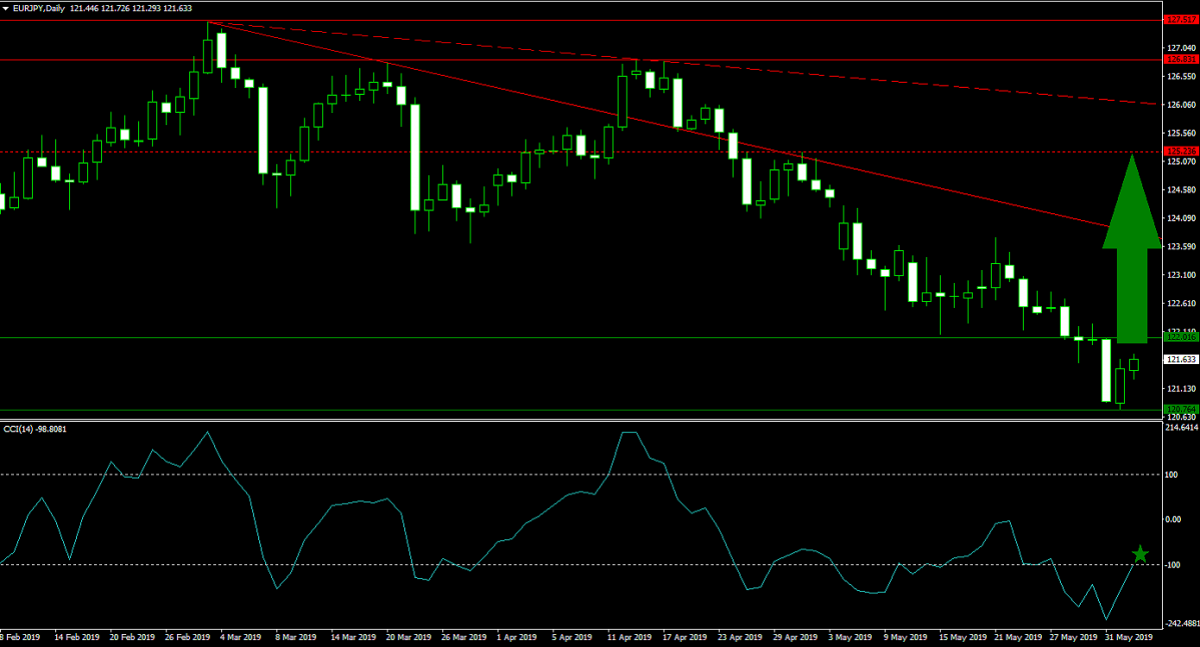

Forex Profit Set-Up #1; Buy EURJPY - D1 Time-Frame

The ECB and the BoJ have slashed interest rates to record lows and each central bank has flooded its economy with quantitative easing. The BoJ has already pointed out that more QE is needed which is expected to pressure the Japanese Yen to the downside, especially against the Euro. The EURJPY just carved out a new horizontal support area from where bearish momentum is fading. A breakout is expected to follow suit which is expected to take price action into its primary descending resistance level. Bullish momentum is favored to suffice for a second breakout which will take the EURJPY into its next horizontal resistance level. Forex traders are recommended to spread their buy orders inside its horizontal support area.

The CCI is currently trading in-and-out of extreme oversold conditions after it recovered from its lows. A sustained move above 100 is anticipated to attract more buy orders into this currency pair. Download your PaxForex MT4 Trading Platform now and start growing your portfolio trade-by-trade!

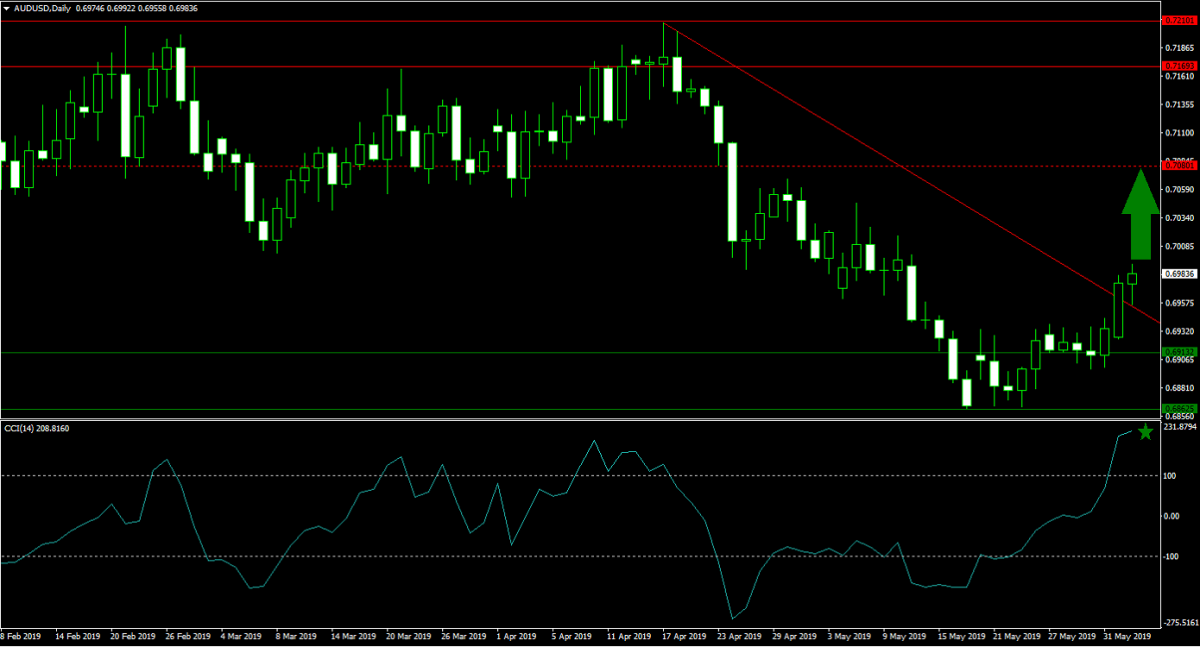

Forex Profit Set-Up #2; Buy AUDUSD - D1 Time-Frame

After the RBA announced its 25 basis point interest rate cut, the Australian Dollar advanced across the board. Before the announcement, the AUDUSD already completed a breakout above its horizontal support area as bullish momentum was on the rise. The spike following the RBA announcement pushed price action above its primary descending resistance level which further added to bullish sentiment. This is expected to result in an extension of the advance until the AUDUSD can challenge its next horizontal resistance level and forex traders are favored to buy any dips down to the lower band of its horizontal support area.

The CCI moved deep into extreme overbought conditions and recorded a new high. Given the amount of bullish momentum more upside is likely, especially after a brief pull-back below 100. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market; earn over 500 pips per month!

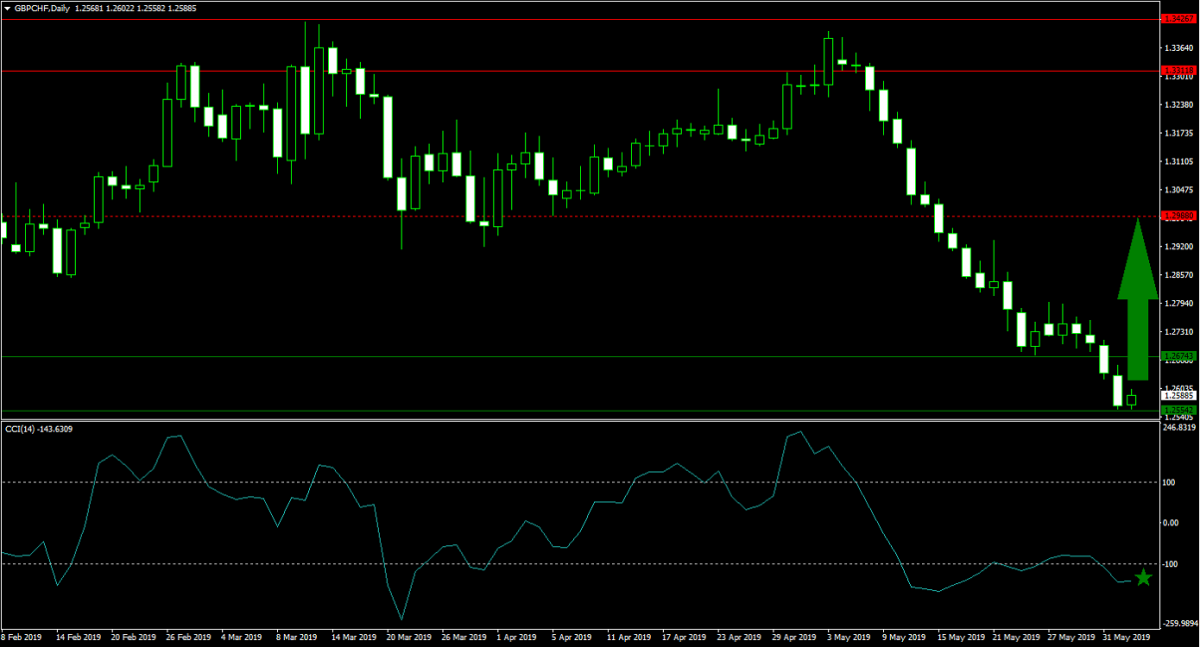

Forex Profit Set-Up #3; Buy GBPCHF - D1 Time-Frame

Following a month long contraction, the GBPCHF is trying to stabilize inside of its horizontal support area. Brexit uncertainty and Prime Minister May’s announcement to resign have pushed the British Pond lower. At the same time, safe-haven demand has boosted the Swiss Franc. As bearish pressures are depleting, a breakout is favored to materialize. With no resistance in its way, price action is clear to accelerate to upside and into its next horizontal resistance level. Forex traders are advised to spread their GBPCHF buy positions between the lower and upper band of its horizontal support area.

The CCI is trading I extreme oversold territory, but a shallow positive divergence formed which is a bullish trading signal. A push above the -100 mark is expected to ignite a short-covering rally. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account!

To receive new articles instantly Subscribe to updates.