The last Federal Open Market Committee (FOMC) meeting of the US Federal Reserve for the year 2017 will start today. All meetings last two days and the Federal Chairman will announce the results during a press conference after the meeting has been concluded. Many Fed watchers predict the outgoing Federal Chairwoman Janet Yellen will announce an interest rate increase of 25 basis points. This will leave the official Federal Funds Rate at an upper bound level of 1.50% and a lower bound level of 1.25%. This compares to the current upper bound level of 1.25% and to the lower bound level of 1.00%. Most traders have already accounted for an interest rate increase tomorrow.

There is economic data which would support the expected interest rate adjustment. Last Friday’s November NFP report showed that the US labor market once again surprised to the upside on the headline figures. 228K jobs were added, beating economists forecast of 195K job additions. The unemployment rate remained unchanged at 4.1%. Consumer sentiment also remains robust, household net worth in the US is expanding and consumer credit is also increasing. While there are economic reports which favor an increase in interest rates and a normalization of monetary policy, there are other reports which suggest that the US economy is not as healthy as the US Fed needs it to be.

The same NFP report which would support an increase in interest rates delivers a counter signal as well. Average hourly earnings, which essentially are much more important than the NFP headline figure and the unemployment rate, have not shown the type of increase which would boost inflation. November average hourly earnings rose just 0.2% monthly and 2.5% annualized. This compares to October’s decrease of 0.1% monthly and increase of 2.3% annualized. Tomorrow’s CPI report for November is predicted to show an increase of 0.4% monthly and of 2.2% annualized. This would mean that US employees don’t see an earnings boost. The absence of inflation has been the biggest worry to the US Federal Reserve as well as other central banks.

Forex traders need to make sure that they trade with a forex broker who offers the best trading terms and conditions in order to capitalize from all trading opportunities. PaxForex is at the top of its class and always innovates in order to give all its traders a competitive edge. Open your trading account today and join the tens of thousands of profitable traders already earning at PaxForex.

This will be Fed Chairwoman Yellen’s final FOMC meeting as she was, essentially, fired by President Donald Trump. Jerome Powell will take over as new Federal Reserve Chairman next year. Many believe and some hope that he will continue to normalize the interest rate environment and reduce the Fed’s swollen balance sheet. This will not be possible without a pick-up in inflation and inflationary pressures, which are currently all but absent. Boost your earnings and protect you forex portfolio with out three pre-FOMC announcement trades. Volatility in the US Dollar is likely to spike following the FOMC announcement.

Forex Profit Set-Up #1; Buy USDCAD - H1 Time-Frame

Our first trade is a short-term buy position in the USDCAD. As the Federal Reserve is widely expected to increase interest rates, this currency pair could see a boost from those who remained cautious on the sidelines. The USDCAD corrected down into a solid horizontal support area which is being intersected by an ascending support level. Any level above the 1.2815 mark represents a good entry point for a move to the upside in this currency pair.

The CCI remains inside oversold conditions with a reading below -100, but has recovered from its lows. A move above -100 is likely to trigger new buy orders as well as a short-covering rally. Stay up-to-date with trading recommendations issued by PaxForex analysts which can help you earn over 500 pips per month.

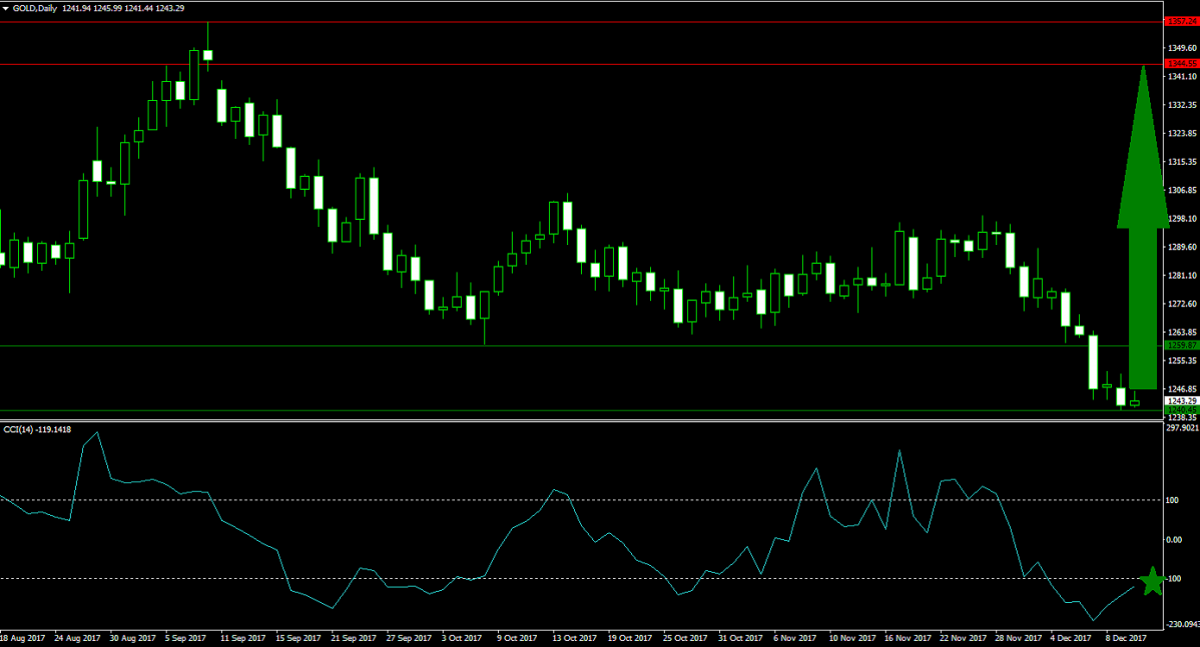

Forex Profit Set-Up #2; Buy Gold - D1 Time-Frame

In order to hedge your forex account from volatility or even a surprise move by the US Federal Reserve tomorrow, buy Gold. This commodity has been on the retreat and is currently deflating bearish pressures inside of it new horizontal support area. Downside pressure remains limited from current levels with good upside potential. Tomorrow’s FOMC announcement as well as US CPI data could give Gold traders enough reasons to push this commodity to the upside. Look for entries around the 1,240 level.

The CCI is recovering from its most recent lows and is currently in an up-trend towards the -100 level. A breakout above it would mark the end of the bearish grip on Gold and more upside is expected. Download your MT4 trading platform now and hedge your open currency positions with this commodity.

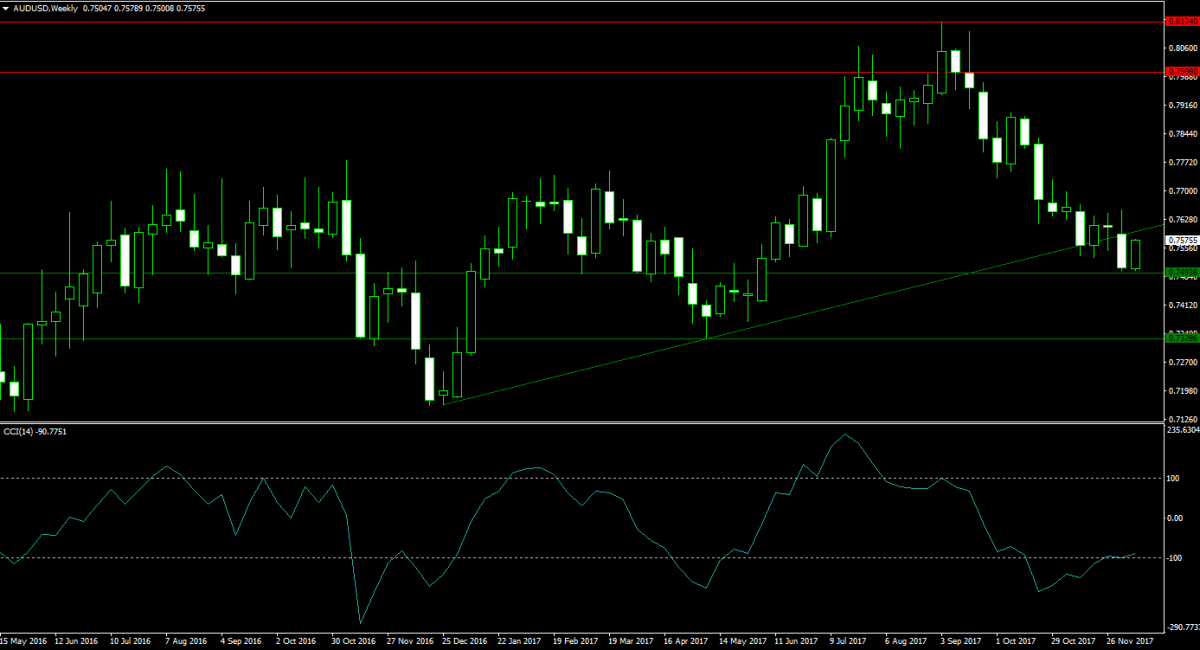

Forex Profit Set-Up #3; Buy AUDUSD - W1 Time-Frame

There is of course the chance that Yellen’s statement will disappoint interest rate hawks which would send the US Dollar tumbling, at least in the short-term. The AUDUSD is a great way to gain exposure with tremendous upside potential. This currency pair was rejected by its horizontal resistance area and quickly dropped down into its horizontal support area while also breaking below a strong ascending support level. This week it bounced to the upside and is expected to recover part of its most recent contraction.

The CCI has confirmed a pending momentum shift with a breakout above the -100 mark. This breakout is set to resume above the 0 mark from where the momentum shift would be confirmed and new net long positions should be accounted for. Follow the PaxForex Fundamental Analysis section in order to understand what moves the forex market.

To receive new articles instantly Subscribe to updates.