Germany is the export powerhouse of the European Union, the largest economy on the continent and the driving force behind EU surpluses as well as fiscal and political policies. Chancellor Merkel is approaching the end of her political career and her as well as her party, the CDU, have already suffered losses in regional elections. Her own election victory marked the worst showing for her party since World War II. With a slowing global economy and a leadership change during the next German elections, Merkel’s team as well as other officials are undecided on how to proceed.

The German economy is slowing down and likely to enter a recession, but German voters are unaware of economic issues. Consumer confidence remains just shy of record highs which suggests that there is a disconnect between what voters know and reality. The official stance of the German government is for a very brief recession before growth will accelerate once again, but unofficially the same individuals seem to prepare for a prolonged economic slowdown. CDU officials are worried that the economic slowdown may become evident to voters before the next election which could alter the German government and ring in a new direction.

Two senior CDU officials cited worries that an economic shock during a leadership transition will catch voters off-guard and push them to different parties which will campaign on the back of changes away from Merkel’s rule and policies. Some analysts point out that the apparent rush to force a merger between Germany’s two biggest banks, Deutshe Bank and Commerzbank, in order to create a national champion which will see over 30,000 job losses is another sign that officials are very concerned about the economy moving forward. Job cuts are a very sensitive issue in Germany and the willingness to take a political hit of this size suggests that the problems in the economy may be more structural.

Economic data out of the Eurozone, led by Germany, have printed disappointing numbers and while the US is in trade negotiations with China in order to end their trade war, his next target is likely to be the German auto industry which is leading Germany’s export engine. How will the Euro react to prolonged economic weakness out of Germany? Open your PaxForex Trading Account now and join our fast growing community of profitable forex traders!

Another sign of growing problems for the German economy is the willingness of the weak, ruling coalition to lower constitutional restrictions on deficit spending. This suggests that officials are preparing to step in and stimulate the economy as they believe it will be necessary. CDU lawmaker Matthias Heider noted “There are many global risks currently overshadowing the economy. If global risks accumulate further, it might be too much for growth to be sustained.” Other officials noted that the government could use a series of tax cuts and investments in order to boost the lagging economy. How weak is the German economy? As more data trickles in, analysts will get a much clearer picture. In the meantime, here are three forex trades which will deliver strong growth to your portfolio!

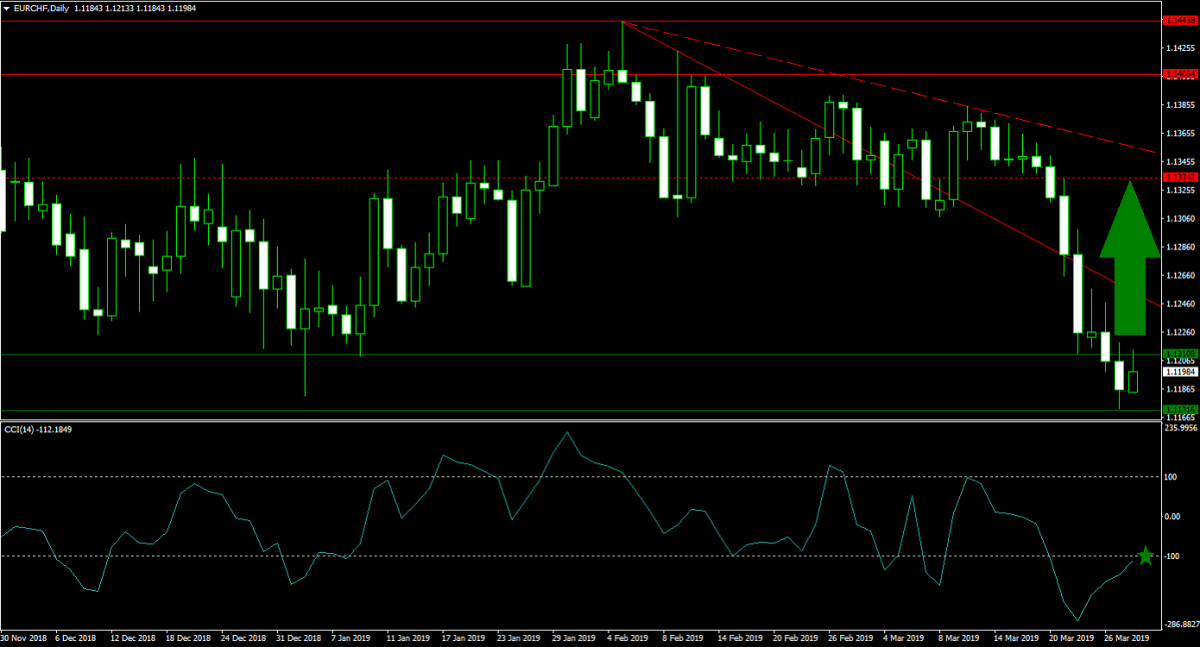

Forex Profit Set-Up #1; Buy EURCHF - D1 Time-Frame

Over the past trading sessions, the EURCHF quickly dropped into its horizontal resistance area from where bearish momentum started to recede. Price action is now in the process of stabilizing which could lead to a push above the upper band of its current horizontal support area and the start of a short-covering rally. This is expected to lead to a breakout above its primary descending resistance level and back into its next horizontal resistance level which is being approached by its secondary descending resistance level. Forex traders are recommended to buy the dips down into the lower band of its horizontal support area.

The CCI plunged deep into extreme oversold territory, but started to recover off of its lows. This momentum indicator is now anticipated to push above -100 which is likely to trigger a broader rally in the EURCHF. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market; earn over 500 pips per month!

Forex Profit Set-Up #2; Buy EURSGD - D1 Time-Frame

As global trade weakens, the Singapore Dollar is expected to feel the impact of the regional economic slowdown. The Euro is already under pressure from disappointing economic data which makes the EURSGD a great candidate for a short-term counter-trend advance. A breakout above its horizontal support area is anticipated to push price action through its secondary descending resistance level and into its primary descending resistance level, bot located below its next horizontal resistance level. Buying the dips in the EURSGD is the favored trading approach.

The CCI reached extreme oversold conditions, but remains well of off its previous lows and an imperfect positive divergence formed. This is likely to force a move to the upside in this technical indicator which will further fuel the anticipated advance in price action. Download your PaxForex MT4 Trading Platform today and start building a profitable forex portfolio with the help of our expert analysts.

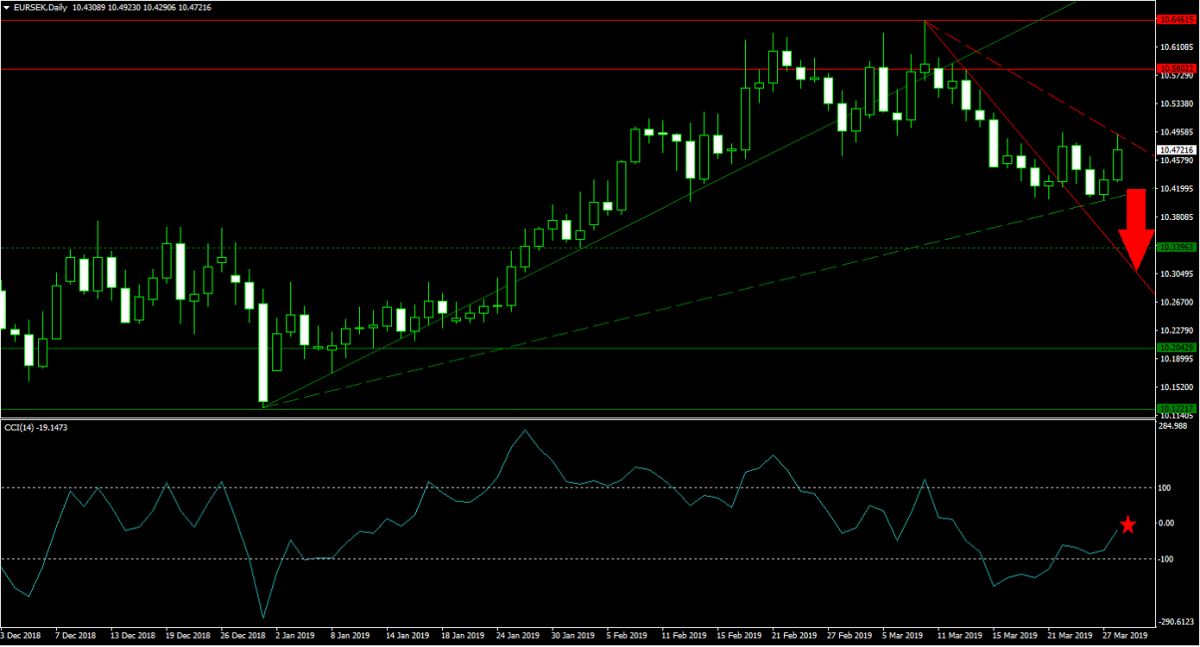

Forex Profit Set-Up #3; Sell EURSEK - D1 Time-Frame

Forex traders looking to add to bearish Euro positions can take advantage of the most recent bounce in the EURSEK. Price action is currently trading between its secondary ascending support level and its secondary descending resistance level. The ongoing trade talks between the US and China in order to resolve their trade war will benefit the Swedish economy and could pressure the German auto sector as Trump is set to focus on it next. The EURSEK is therefore expected to reverse direction and move down into its primary descending resistance level, which now acts as temporary support, which is located below its next horizontal support level. Forex traders are advised to sell the rallies from current levels.

The CCI recovered from extreme oversold territory, but the accumulation in bullish momentum is unlikely to suffice for a sustained push to the upside; a bullish momentum crossover is not expected to take place. Follow the PaxForex Daily Forex Technical Analysis and copy the recommended trading recommendations into your portfolio; our expert analysts do the hard work so you can reap the easy profits!

To receive new articles instantly Subscribe to updates.