John Bollinger is an American writer and well-known financial markets analyst, who largely contributed to the field of technical analysis by developing an indicator based on his theory. Initially the indicator was used specifically for trading options, however with time it transitioned to all other markets, including the foreign exchange. Fun fact about the now registered trademark - Bollinger Bands - is that it was given its name in a very carefree manner. When first introduced to the Financial News Network, the indicator had no specific name. Only after the bands were pointed out by the interviewer, Bollinger casually said: “Let’s call them Bollinger Bands”.

BB are built from the simple Moving Average - an indicator that connects all of the average values of an asset with a line. Moving Average serves as a base for many different strategies and additional indicators, which use pre-established percentages to add more elements to the chart. In Bollinger Bands, however, the supporting elements are calculated with an account for volatility. This means that the indicator is capable of self-adjusting according to the market conditions and providing the trader with all possible information about the price.

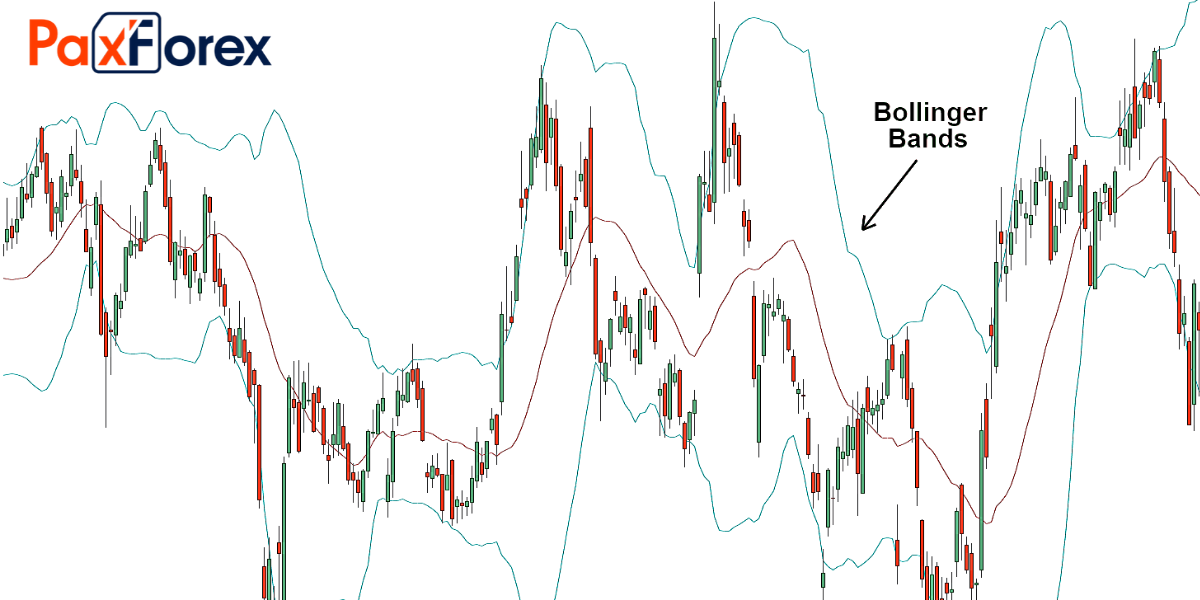

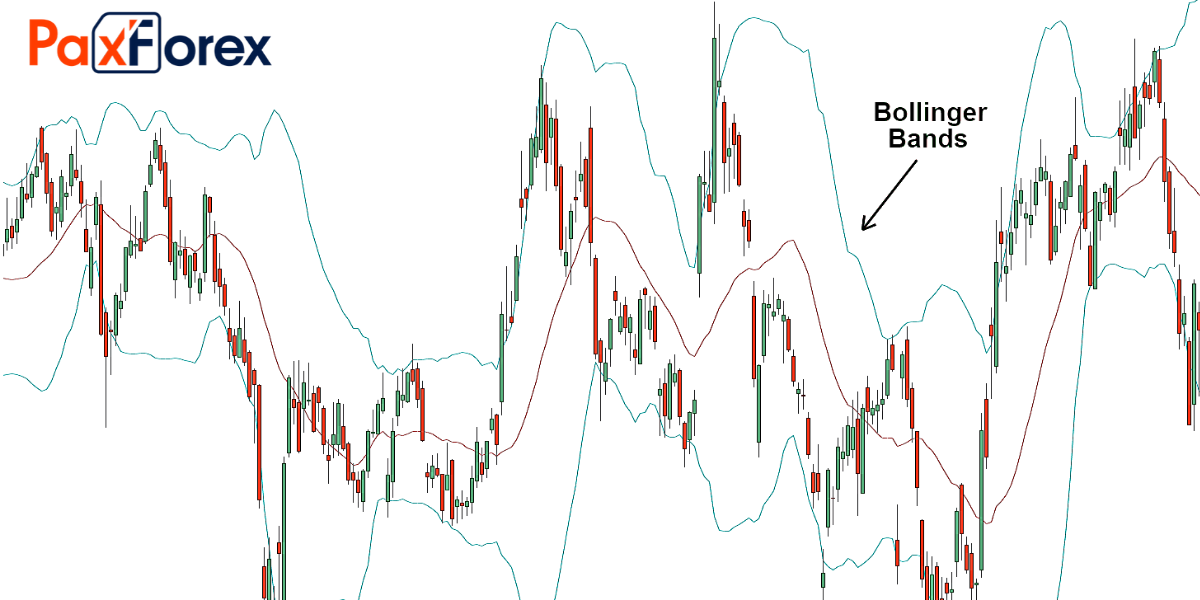

One way of measuring volatility of the Forex market is by using a mathematical formula referred to as standard deviation. This formula exists to measure the rate of deviation or dispersion in mathematics and physics. The higher is the value calculated, with the assistance from standard deviation formula - the wider is the range of possible values of an asset. Based on this logic the BB indicator, first calculates both positive and negative deviation and then applies it to the chart in the form of two bands. The bands are located at the top and the bottom of the price movement and tend to stay in semi-sync with the Moving Average. To better understand how the bands are constructed, let’s take a closer look at the Bollinger Bands formula.

Bollinger Bands formula

Bollinger Bands are used by traders to outline the extreme short-term price points of the chosen currency. In other words, the BB can be used to judge the market from the volatility point of view and select the best moments to place an order, both long and short.

As we have already mentioned, standard deviation formula is used to form the bands. To calculate standard deviation, you first need to find the variance value. In manual calculation this would be done by averaging all values through first adding them together and then dividing by the number of added values. A trader, very obviously, will not have to do it, since this is the sole purpose of the simple Moving Average indicator. The standard deviation is a square root from the variance value. And the Bollinger Bands are formed through addition and subtraction of this value from the variance value, also known as the MA.

This way, by applying the BB indicator we have the following result: the Moving Average at the default setting of 20 is now locked in the corridor between the two bands. The bands are used to assess trend’s continuity and reversals, outline the periods of consolidation, predicting big breakouts of volatility, indicate the possible levels of support and resistance and find the most suitable spots for entering and exiting a trade.

So far, we can state three things about the Bollinger Bands indicator:

- The levels can be used to represent dynamic levels of support and resistance

- The higher level means higher price and the lower level means lower price

- The distance between the bands is proportional to market’s volatility

These three statements can help you understand the picture before you. However, comprehending what you see is not always enough to successfully trade. In order to fully implement this indicator we need to study its behaviors and find sources of trading signals.

A trading signal is a suggestion that a certain point of the market is a good place to either enter or exit the trading process. Signals come in many forms: from specific data exhibited by an indicator to vague instructions provided by signal selling services. Bollinger Bands are capable of providing several useful signals. And the trader’s main job is to timely recognize them.

Before we go further, please note that all examples in this article are based on the indicator’s default setting.

The most basic way of reading Bollinger bands is by recognizing squeezes and bounces. A squeeze can be described as a very tight corridor formed by the bands around the price. The main conditions for a proper squeeze are: narrowing of the bands after a wider period and a candle that closed beyond one of the bands. If the price closed above the top band, it will most probably continue to move up, and vice versa - closing below bottom is a good chance of downward movement.

Bounces are based on the logic that price tends to always strive towards the middle. And since we have agreed to use BB as our levels of support and resistance, it is very easy to interpret the next possible move. More specifically, if the price reached the top band without crossing it, it will most certainly bounce down and if it reached the bottom band - bounce up.

Apart from the basic scenarios, there are also some that are slightly more complex. They are usually built on specific formations of the bands that give the trader an understanding of the current market’s situation. These include patterns like M-tops and W-bottoms, for instance.

M-top can be interpreted as a downtrend signal and resemble a very shaky letter M. The confirmation of this pattern includes several stages: first a price closes high above the upper band, thus forming a first M top, then there is a pull back towards the middle, that might or might not cross the MA, another high then forms, but doesn’t reach the top band. At this point it is a very strong signal for the upcoming downtrend, which can be confirmed by the price breaking the lower band shortly after the second M top appeared.

W-tops are formed similarly and can predict upward movement. The W’s are formed near the bottom band and tend to be slightly steadier than W’s. There are also several stages of confirming this pattern: at first a reaction law forms either below the bottom band or really close to it, then the price pulls itself back to the middle, the next low is lower than the previous one, however it holds above the bottom band, therefore confirming the weakness of the downward movement. The pattern confirms through a sharp exit from the second law and a break through the resistance level.

These are just few of the many available Bollinger Band patterns that can be used in Forex trading. Depending on your trading strategy you might use some existing ones or start to identify your own signals. The good news is - in currency trading creativity and ability to act beyond existing rules is very welcomed and usually tends to bring very visible results to the traders who take such approach.

Next, we are going to talk about specific trading strategies that are based primarily on the Bollinger Bands indicator. For the purpose of keeping this to the point, we will only include the methods, that in our opinion deserve most attention. However, as previously mentioned, traders are always encouraged to think outside the box and make adjustments in accordance with their individual preferences.

Effective Bollinger Bands trading strategies

Before we go into the technicalities, it is important to spend a few moments discussing the significance of Forex trading strategies in general. Adopting a trading strategy gives traders a benefit of consistency and with it - stability. Simply put, strategies exist to help traders stay in control under any kind of circumstances.

There are some very important aspects of strategy based trading. First and foremost, a trader has to invest a good amount of time and effort into looking for the most suitable strategy. To better understand what strategy will work best for you, start by evaluating what kind of trader you are. This will include deciding on how much time you have to trade on a daily, weekly and monthly basis, how much do you know about trading and whether you are willing to learn more, your financial capabilities and much more. It may seem confusing at first, but as long as you take your time and pay appropriate respects to the process, you’ll do just fine.

Then there is also the testing step. Some strategies can sound perfect in theory but prove to be useless in action. And vice versa. The best way for a trader to know whether a certain method should be taken to the real market is by giving it a go in simulation mode first. This can be done through a demo account, offered by the broker. Demo accounts are free to use and do not require any deposits whatsoever. Which means that you're not risking a single penny when trading in demo.

Open a demo account and start practicing the strategies that you either found online or came up with on your own. Since the demonstration is based on the live market conditions, the turnout of each trade will be identical to what it would have been like in real life. With only difference being - there is no actual money involved. This way you can take your time, polishing off the strategy’s rules and adjusting them if necessary. And once your mind is set on the specific method - go right ahead and try it out on your live account for Forex trading.

Last but not least, strategies have to be followed religiously. If you have made a decision to trade with the assistance from a certain method, you have to make sure that you follow the rules precisely. This means exiting when the strategy suggests and not allowing your emotions overpower your system. This will be very hard at first, because sometimes the market just keeps on bringing new opportunities your way. But as long as you focus on staying strong no matter what, it will come to you naturally after some time.

Now it’s time we get specific and discuss some of the most effective Bollinger Bands based strategies. Below are the examples of three strategies, two of them are basic and one is more suitable for advanced traders. Let’s get to it.

Bollinger Bands 5 minute scalping

Instruments (currency pairs): Majors, tested on GBP/USD and EUR/USD

Timeframe: 5 minutes

Trading sessions: Based on the instrument

Indicators: Bollinger Bands at default setting

Scalping is the most fast-paced trading style. Although it is believed that intraday trading with Bollinger Bands brings fewer results than larger frame trading, this particular strategy has proved itself very effective. The main condition for this method is that price movement needs to stay as flat as possible, meaning that there are no huge leaps up or down and it looks like a shaky horizontal corridor. This condition is often referred to as market ranging and can be described as a chart segment with several highs and lows at the same level.

To place a long trade (to buy) you will need to wait for the BB to become as flat as possible and wait for the price to go down, reaching the bottom band. When this happens, and only if it happens, you can go ahead and buy. Set the stop loss order 8 to 10 pips below the entry point and either take profit manually when the price reaches the top band or set a take profit at or near that level.

To go short (to sell) wait for the Bollinger Bands to get as flat as possible and wait for the price to reach the top band. If this happens - open your short position and set stop loss at 8 to 10 pips above the point of entry. Take profit manually when the price reaches the bottom band or set a take profit at or near that level.

The main disadvantage of this strategy is the same as of any other scalping method - it doesn’t allow traders to gain big. In scalping each profit is measured in mere pips, and only makes a visible difference over time, when several victories gather up into one significant account balance. On the other hand, this approach is ideal for those who do not have a lot of time to trade and are patient enough to be satisfied with winning small but often.

Bollinger Bands horizontal support and resistance

Instruments (currency pairs): Any

Timeframe: 1 hour, 4 hours

Trading sessions: Based on the instrument

Indicators: Bollinger Bands at default setting

Horizontal support and resistance are more popular than dynamic or angled for one simple reason - they are easier to grasp. There are multiple ways to build these levels and one of them includes using Bollinger Bands. In this particular strategy the same line can serve as both support and resistance, by starting as one and turning into another. For example, to build such a level in the downtrend, wait for two lows at the same level and connect them with a horizontal line, forming support. As the price continues on going down this line is going to start serving as resistance. And vice versa.

To buy, using this strategy find a broken resistance line by outlining two confirmed highs at the same level. This resistance can now be used as support. Next step is to wait for the price to head down towards the bottom band, which will be roughly in the same area as the support. As this happens, place a pending buy order 2 to 3 pips above the high point of the candle that touched the bottom band. Stop loss can be 4 to 5 pips below the same candlestick. You choose to take profit either when the price reaches the middle section or when it goes all the way up to the upper band.

To sell, using this method find a broken support line by outlining two confirmed lows at the same level. And just like in the buy example, the broken support now becomes resistance. Wait for the price to head up towards resistance which will be very near the upper band and place a pending sell order 2 to 3 pips below the bottom of the candlestick that touches the band. Stop loss is set 4 to 5 pips above the high of the same candlestick and take profit can either happen when the price reaches the middle section or the bottom band.

This is another good example of intraday trading with Bollinger Bands and it can prove itself very useful on a nearly daily basis. One thing you should keep in mind, while using this approach is the subjectiveness of support and resistance levels. Meaning, that even when a trader is certain that the line they created will hold the pressure, it might not always follow through. Again, the best way to go about it is to practice various techniques of building levels of resistance and support in demo and only then take the chosen method to the real market.

20 period Bollinger Bands strategy

Instruments (currency pairs): Majors and selective minors

Timeframe: 4 hours

Trading sessions: Based on the instrument

Indicators: Bollinger Bands at 20 period and 2 deviation setting (default)

This strategy might appear slightly more advanced, but it is also straightforward enough to be mastered by any kind of trader over time. Before the strategy is implemented there are several conditions that need to be met: BB has to be adjusted to 20 period and 2 deviation, unless this is the default setting on your MT4, the trader needs to have a good understanding of uptrends and downtrends and the price absolutely has to touch the middle line for any type of trade to take place.

To buy, a trader has to first confirm that the market is trending upwards. When the price comes back to the middle from the upper band, a pending buy stop needs to be set 3 to 5 pips above the top of the candlestick that touched the middle line and the stop loss is set 5 to 8 pips below the bottom of the same candlestick. You can choose from three available option to take profit using this method: a) manually buy at the market price as soon as a candle touches the upper band; b) calculate the number of pips a price traveled during the down movement before it touched the middle at set a take profit at the same number of pips; c) set take profit at the level of the previous high.

To sell, confirm that the market is trending downwards and wait for the price to reach the middle band. The candlestick that touched the middle band is used to set a pending sell stop 3 to 5 pips below the bottom of it and a stop loss 5 to 8 pips above its top. An optional step is to wait and see if a reversal candle forms prior to placing an order. Similar to buying, there are also three ways to exit: a) manually sell at the market price when the candle forms touching the lower band; b) calculate the pip equivalent of the upward swing towards the middle and set a take profit at the same number of pips; c) set take profit at previous low.

Because there are several exit options in this strategy, it will require some experience and critical thinking to implement. The very obvious upside of this approach is lower risk rates, based on narrow stop losses. The main disadvantage of this strategy is that it only performs well in a trending market, which is not always the case. Once again, only through experience and practice, the trader can correctly evaluate the market conditions and implement appropriate trading techniques.

Although each of the above strategies only focused on using the BB indicator, it is always a good idea to confirm the signals with a couple of other indicators. In the next short segment we will talk about the best indicator to use with Bollinger Bands.

Indicators are tremendously helpful in technical analysis of the Forex market. But just as any other trading related tool, they require a certain level of knowledge and skill. While Bollinger Bands indicator is very self-sufficient, it is important to remember that it is also somewhat relative. This means that even if math proves to be very much relevant at the market, sometimes the action unravels in the completely random direction. One of the best ways to avoid this relativity is by combining indicators to confirm each other.

The best way to combine indicators is to use one from each category. We have already established that Bollinger Bands measure volatility. Some of the other volatility indicators are ATR (Average True Range) and SD (Standard Deviation). Now, there is a total of four indicator categories: volatility, trend, momentum and volume. And since the volatility aspect is covered by BB, we just need to focus on the other three.

Trend indicators are simple in their logic, yet they prove to be very helpful in many scenarios with different levels of complexity. Trend indicators of the Forex market include: ADX (Average Directional Movement), MA (Moving Average), MACD (Moving Average Convergence Divergence) and others. We also already know that BB by default includes data similar to the MA indicator, presented by the middle band, however we can also choose to add EMA indicator (Exponential Moving Average) that tends to act faster and more effectively than a simple MA, thus providing us with more precise information.

Momentum on Forex can be measured with the indicators like: RSI (Relative Strength Indicator) or Stochastic. RSI is most commonly combined with the Bollinger Bands, as it can perfectly expose the overbought and oversold conditions. When the market is neither overbought or oversold it can strongly signal a reversal, and one way to confirm that reversal is by comparing the RSI data with the BB formation. The one thing to keep in mind is that these reversals can be quite lengthy and the best solution in this case is to base your decisions purely on your own experience.

Finally, the volume can be measured with the help of indicators, such as: EMV (Ease of Movement), OBV (On Balance Volume), FI (Force Index) and more. Since volume and volatility are usually very connected, the idea of adding the indicators from these two categories can be both a win and a loss. The biggest disadvantage of combining the two is that the chart becomes slightly harder to comprehend. However, with the right amount of experience and attitude this too can become a piece of cake.

Just before we wrap up, it would make sense to briefly go over some tips for trading with the Bollinger Bands indicator. These tips are applicable for most BB based strategies and for traders with all sorts of background and experience.