Every day, traders try to gain an edge in the markets in order to boost their profits. This often requires plenty of outside-the-box thinking and making correlations where others fail to look. Many forex traders tend to focus on forex only and therefore often miss why their trades moved. Money flows through the global financial system and crosses asset classes. Therefore it is always a smart trade to make sure to know what’s happening across the board in order to make the best trading decisions. Today we will take a trading clue from one of 2017’s most crowded trades which is on a course for a potential crash.

Emerging Markets (EM) bond funds have enjoyed the biggest capital inflows since the last global financial crisis, but many warnings for a 2018 crash have also followed. In 2017 alone, investors have added $75 billion into the EM Bond Market which awarded them with good returns while developed market central banks have delayed interest rate increases or acted slower than expected, while keeping balance sheets bloated with bonds issues in developed market. As central banks bought the highest investment grade bonds, it left less supply for traders an investors which had to look elsewhere to invest their capital.

One reason bond traders and investors may want to be concerned about is the around $600 billion worth of EM bonds will mature in 2022 by which time many expected a more normalized monetary policy by developed central banks. This would slow down capital inflows at a time emerging markets need to repay their debt. Societe General strategist Jason Daw wrote in his December report that 'It’s an increasingly uncomfortable equilibrium.' IMF strategists have also issued warnings that 2018 could be the year which could lead to an EM Bond Market Crash. When capital has to move, it often crosses asset classes and creates plenty of attractive trading opportunities.

As a forex trader you need to partner with a broker who has your best interest at heart and who can not only deliver a highly professional trading environment, but also the type of outside-the-box analysis which will allow you to identify profitable trading opportunities many will not have access to to. Open your PaxForex trading account today and get the edge you and your forex portfolio deserve.

Some are more optimistic about the ability of the EM Bond Market to withstand a potential lethal combination. Sacha Tihanyi from TD Securities noted that 'So long as higher funding costs come from economic growth and a Fed hiking rates for positive reasons, there’ll likely be an offset.I wouldn’t be overly concerned in general about emerging-market corporates having trouble refinancing or servicing hard-currency debts.' As borrowing costs are set to increase across the board and many predict a recession on the horizon, it is very important to keep an eye out on emerging markets. Here are three medium-term trades which will allow forex traders to be positioned well for a potential EM Bond Market crash.

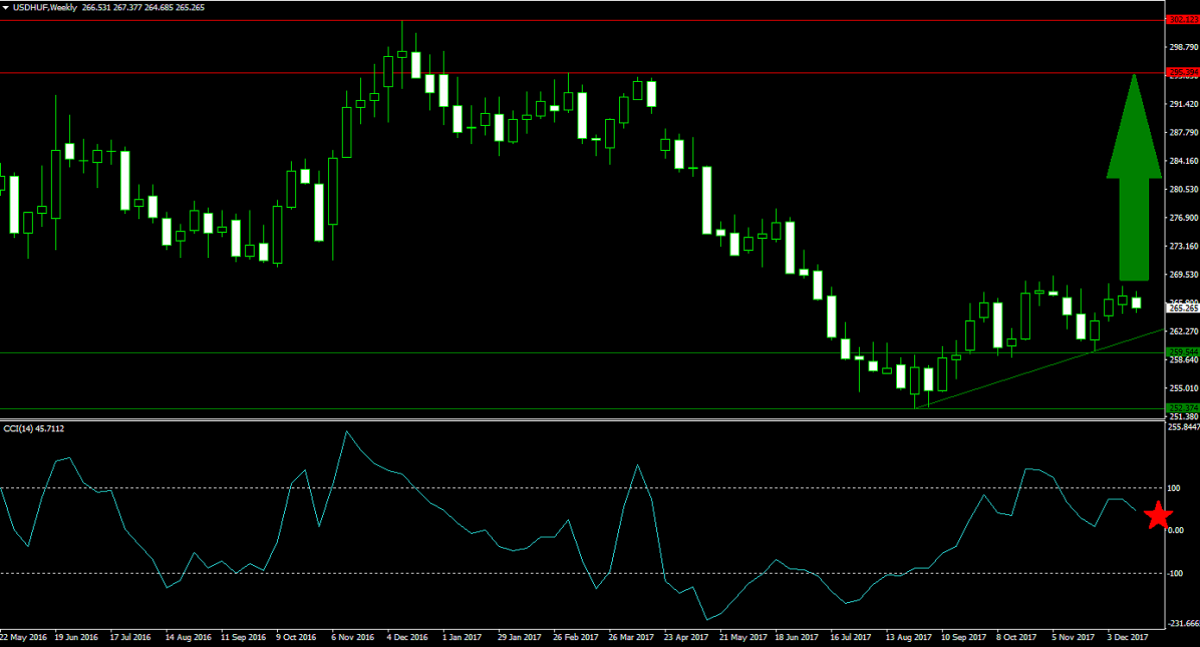

Forex Profit Set-Up #1; Buy USDHUF - W1 Time-Frame

The USDHUF has reversed price action after dropping to the low point of its horizontal support area. The US Dollar could see a boost early next year as fund managers rotate positions and many believe the Fed may hike more than the dot plot chart currently indicates. Adding to technical bullish pressures is an ascending support level which supplies upward pressure. Any dip in this currency pair down to 263.000 should be taken as a solid buying opportunity which will give traders plenty of upside potential just above good support levels.

The CCI has retreated from extreme overbought territory above 100 and its current down-trend could take it close the 0 mark which would roughly coincide with a retreat in price action to the 263.000 level. Download your MT4 trading platform and enter this long trade before the next move to the upside materializes.

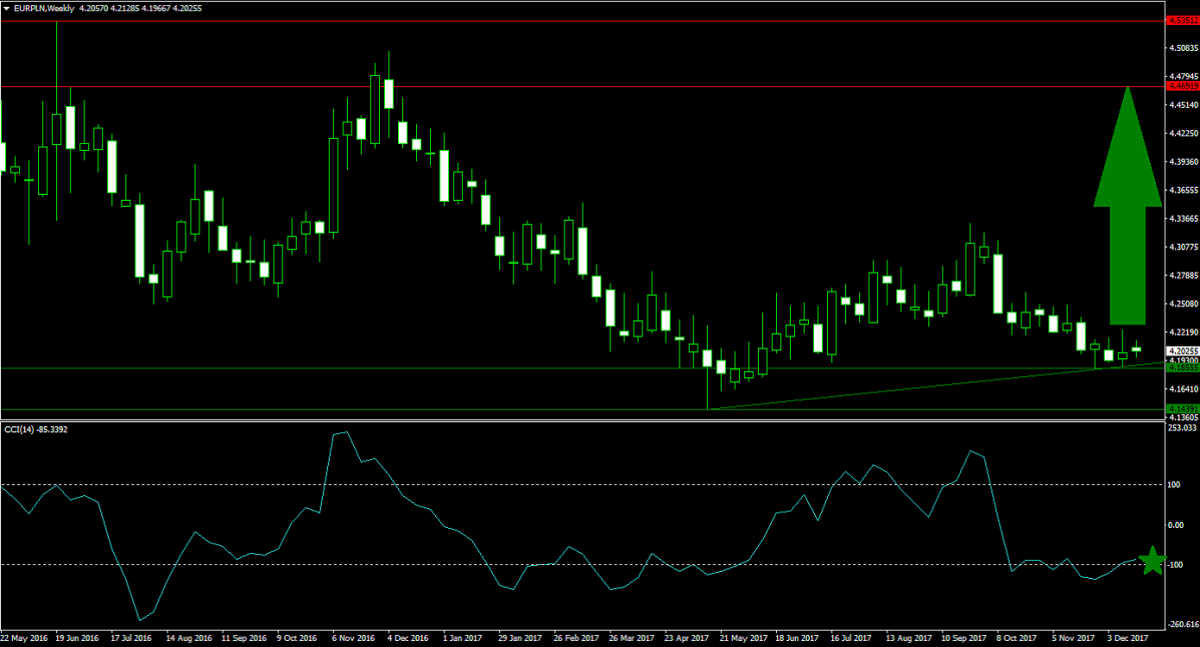

Forex Profit Set-Up #2; Buy EURPLN - W1 Time-Frame

As the Euro is expected to resume its move to the upside, the EURPLN is set for a strong rally. Price action has stabilized just above its current horizontal support area which is being enforced by its ascending support level. This limits downside and opens this currency pair up for an advance. The showdown between the EU and Poland could further boost the Euro against the Zloty which further reduces risk in this trade. The Eurozone economy has performed exceptionally well in 2017 and is set to resume its course in the first-quarter of 2018.

The CCI just completed a breakout above the -100 mark which indicates the first step of a pending momentum reversal. After this currency pair freed itself from extreme oversold territory and is now set to drift into the 0 mark from where a breakout would confirm bullish momentum in charge. Make sure to stay up-to-date with the latest trading recommendations from PaxForex.

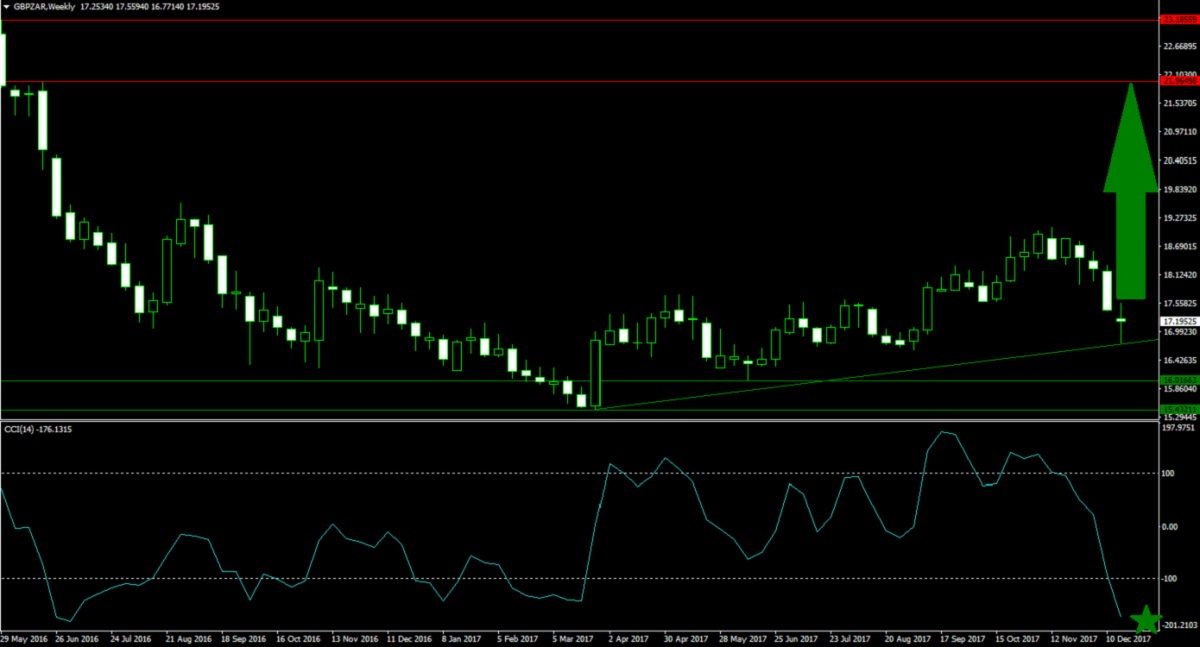

Forex Profit Set-Up #3; Buy GBPZAR - W1 Time-Frame

The GBPZAR offers traders a very interesting set-up as this currency pair interrupted shallow up-trend and corrected down to an ascending support level which has previously intersected its horizontal support area. The GBPZAR is expected to use its ascending support level in order to resume its advance. Forex traders are advised to enter their long positions below 17.1000 in order to maximize their upside potential with reduced downside risk.

As a result of the most recent correction, the CCI has plunged well below the -100 level and is currently trading in extreme oversold conditions. A share reversal in this indicator will further confirm the end of the move to the downside. Follow the PaxForex Fundamental Analysis section and get the best trades right from the desks of our analysts.

To receive new articles instantly Subscribe to updates.