The Forex market is known to be the largest financial platform in the world. The biggest banks exchange currencies here and huge amounts are invested here to profit from the difference in exchange rates (speculation). Meanwhile, to get started one needs only a trading account, desire to make money (sounds as a cliché, but still) and a laptop, of course.

Forex market does not forgive mistakes, but at the same time it gives an opportunity to increase any amount. This is the “toughest" market and in order not to lose the deposit, the trader needs not only knowledge and skills, but also a bit of luck and cool mind.

Forex trading is a practice which requires competence, wisdom and a strong awareness of the financial markets. It comprises researching the economy thoroughly, singling out and grabbing chances and having a control over your emotions. And do not forget about such aspect as risk. Thus, as a novice to the financial markets, one should always start from the very beginning in order to achieve something weighty. For this purpose, demo account is just a perfect solution for your first steps in trading. It`s your chance to learn how to make profit from trading in financial markets and to trade without being scared to lose real money. Also, in such a way you can get familiarized with the trading terminal and get ready for Forex trading psychologically. All your positions will be executed through virtual tools, so you don't need to be afraid to miscalculate or to mess up. To support and to help forex newcomers get settled in before jumping in trading with both feet, most brokers provide clients with the option of opening a demo account in order to get some (at least basic) training.

Demo accounts comprise a vast range of benefits which assists beginner traders burst into the trading.

Opening Forex demo account, one is able to:

- Novices have an opportunity to enter the market in order to try and see if it`s what they are looking for

- Open any position without any risk - the capital you're trading with on a training account is not real

- Access the currency exchange market and exercise trading under authentic market circumstances

- Explore different trading strategies and try them one by one in order to find the perfect one, adjust them if needed

- Go through and familiarize with your trading terminal

- Convenient for all novice traders who is eager to train and evolve notwithstanding the absence of the experience and the lack of knowledge

With the help of training account, one has a chance to feel the crazy rhythm of the volatile market firsthand, to realize how essential the risk management is and will for sure find out the importance of the technical and fundamental analysis.

So, the main purposes of the demo account are:

- First, before starting real trading it is important to study thoroughly the interface and all the functionality of the working terminal. You need to configure hot keys that allow you to immediately open and close current positions. It also takes some time to properly set up the chart on the monitor screen and understand how the auxiliary technical tools work.

- Secondly, the usefulness of the demo account is that it provides an excellent opportunity to perform detailed testing of the trading strategy, followed by revealing a negative or positive mathematical expectation. You can find out if your risk management rules are working and what is the maximum percentage the chosen algorithm gives you.

- THIRDLY, once you`ve mastered two abovementioned factors, immediately switch to real account, the more time trader spends on the demo account, the more difficult will it be to dispose of psychological limits. However, the main thing is to protect yourself from the common mistake and overcome the comfort zone problem that may arise.

Going back to the account itself, almost all the brokerage companies encourage their clients to trade on the practice accounts. These practice accounts obtain all the features of a “real” account. Some people might be wondering why it is for free. The answer is pretty simple - it’s because the company needs you to learn how to trade on their platform and they are interested in you enjoying risk-free trading, so you fall for them and open live account.

Keep in mind that if you can’t wait to start making “money” on a demo account, then there’s no chance you’ll be profitable live when real funds and emotions are taken into consideration.

Opening forex demo account

By choosing MetaTrader terminal you can appreciate a great variety of automated systems (advisers), indicators, signals, as well as VPS specifically created for assured steady trading. Demo Account is accessible for all the traders using forex demo accounts. There are two ways to open a demo account.

Via your brokerage company

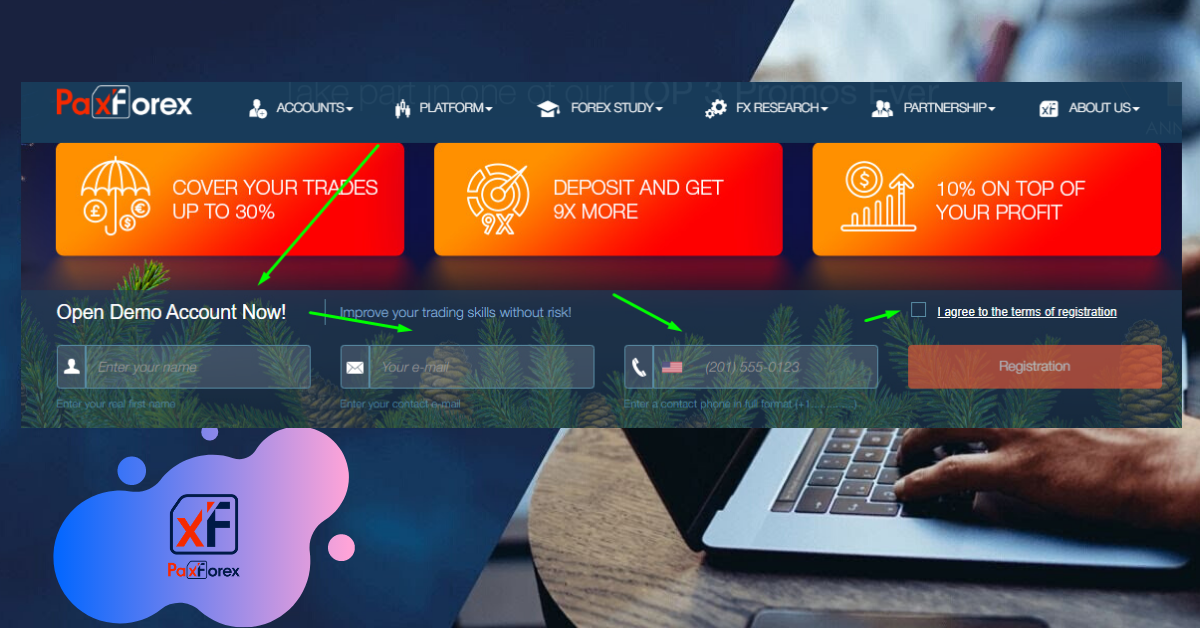

Create a forex practice account on the broker`s website (https://paxforex.org/)

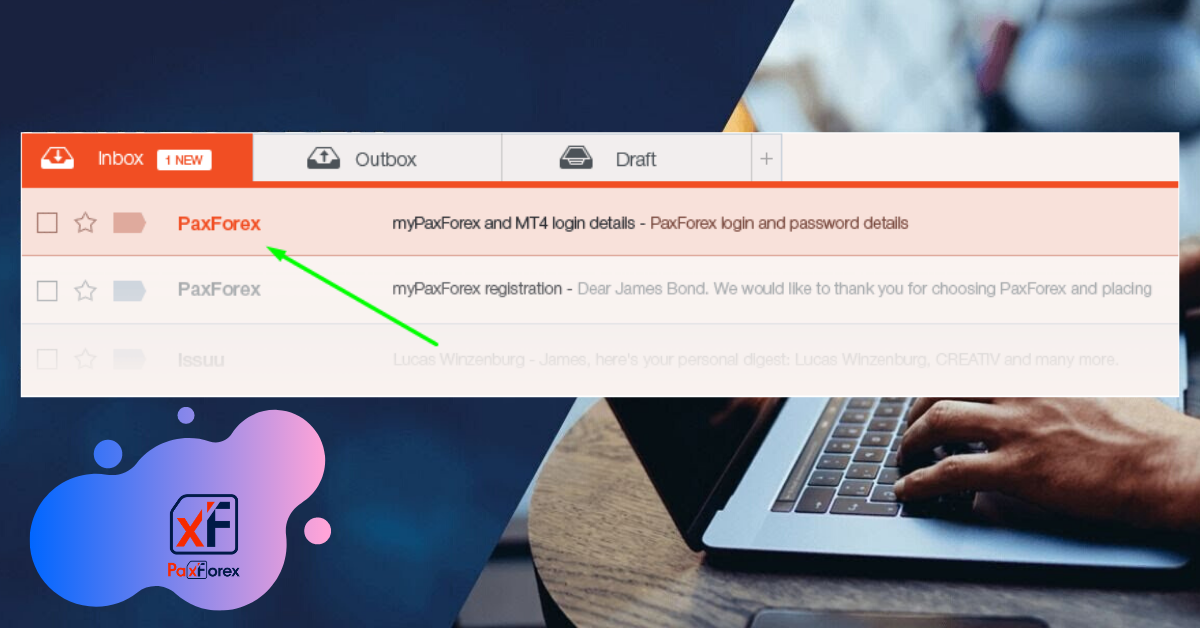

Receive email with the login credentials

Download MetaTrader 4 (https://paxforex.org/metatrader4/download_MT4) and login with your account number and password

Start your training

Directly through the MetaTrader terminal.

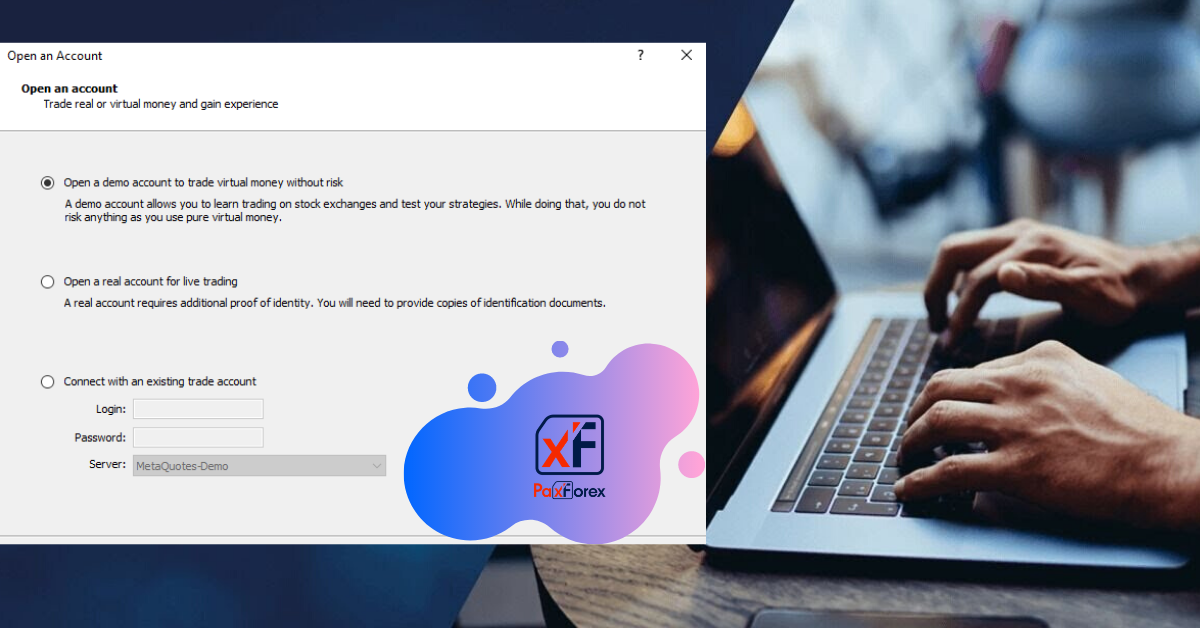

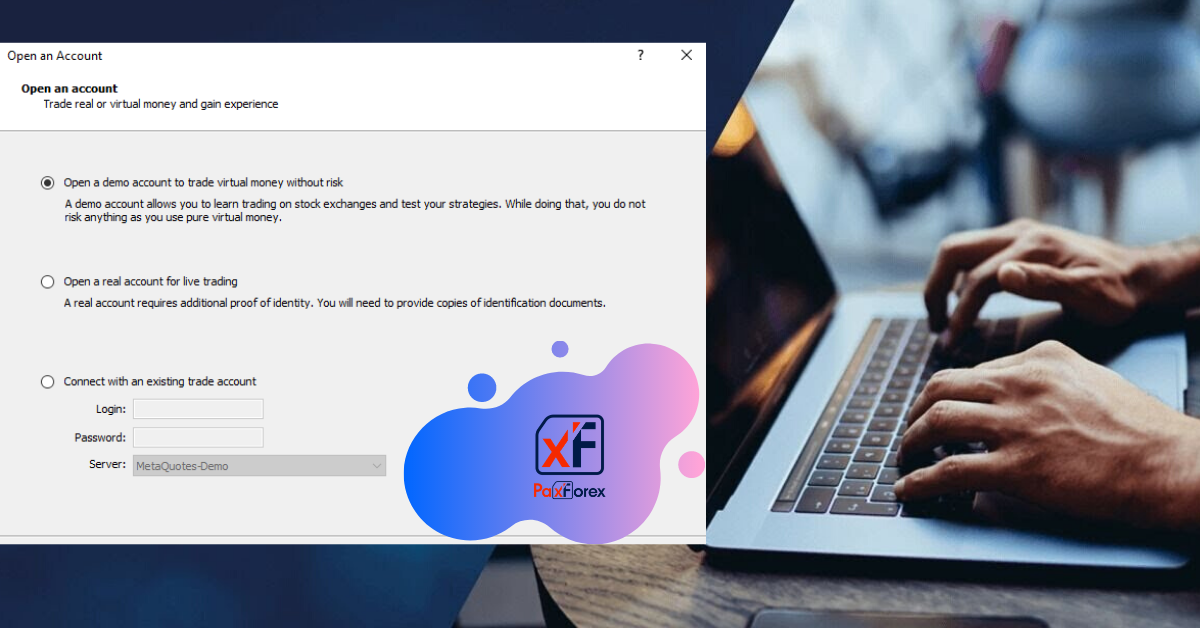

Hit the “File” and choose “Open an Account” from the appeared menu

Now you have to choose the type of account you want to create or you can just login to the existing one. Since we are opening a new account, just leave it like it is because demo option is here by default

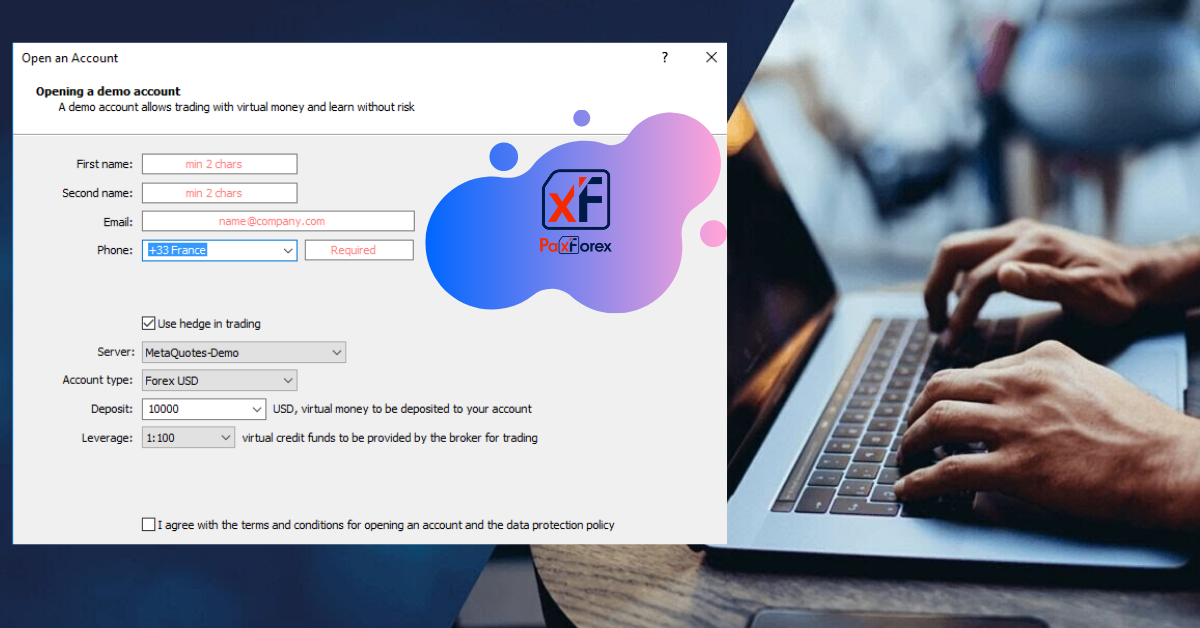

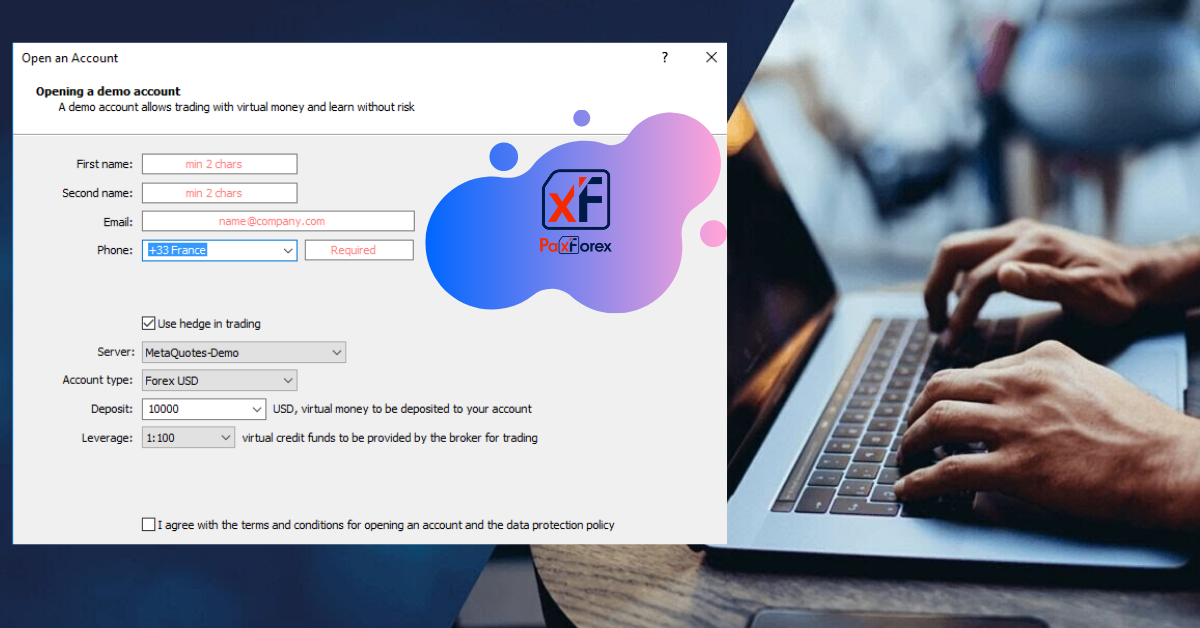

The account opening form requires you to fill in all the personal data, in which red hints are shown on the allowed number of minimum characters. After filling in all fields you have to tick "I agree with …." and hit "Next".

Once account is opened successfully, a message will pop-up with the account information specifying your name, account type, leverage, deposit size, server, login (same as demo account number), master password and investor password (only view account without interfering capability).

Now your demo account is set and you are ready to practice as much as you need, just

remember: the longer you trade on the demo account, the more irresponsible will be your approach to the financial market and your own capital.

Demo account. Pros and Cons

From a psychological point of view, it is much easier to work on the demo account, there is no such tension as if it were all about real money. Therefore, if you decide to start trading on a real account, you should know about the psychology of shifting from a demo account to a real account!

Working with a demo account on Forex, you will not experience the strong emotions that are inherent to real traders: fear, excitement, various worries, gamble, even greed. Therefore, it is not necessary to trade on the demo account for a long time because once you decide to shift to a real account, it may be very difficult morally and psychologically. Most likely, you will understand it yourself when will be a high time to terminate working on the demo account and move to the real account. This should happen when you obtain sufficient skills and master a high technical level. In that case, nothing should stop you from starting to trade with your own (REAL) money.

However, here it is necessary to take into account that demo account has also few disadvantages. If you are trading on a demo account for a long time and then go to work with real money, it will be very tough challenge to adjust. But there is a huge difference between these two processes. If you do not risk your own money while working on the demo account and treated any losses carelessly, now all the losses will be real enough for you to feel it. When trading real money, there should be an understanding that any tiny mistake may be expensive.

Remember, once you start trading with your own funds, you may be disappointed because not everything is happening the way you wanted it to, just be ready for this.

100% you`ve heard from someone that trading on demo account can bring you bad habits, right? This statement is correct and we`ve here several basic rules for you to avoid that:

- Novice traders repeat one common mistake - they start using for trading the entire amount of deposit, which is on the balance of the demo account, as if he/she would start trading live with 10K (maybe some will, but for sure not all of them). Remember and immediately eliminate the virtual deposit approach described. It is necessary to trade on demo with the same amount you are going to trade with on a real account. This is an important safety measure that eliminates the need to consider non-existent figures. Additionally, you adjust the correct mental relationship between the shadowing enemies and the trader's friends. This does not create a subjective vision and you become responsible for the actions taken.

- When trading on a demo account, be sure to use Stop-Loss to limit losses. Please follow the risk management rules you will apply in the real market. Any open position must be accompanied by comfortable risks from both material and psychological point of view. If the trader starts gambling and unreasonably risk on the demo account it will imprint itself in the trader`s subconsciousness and will follow him in real trading.

- Focus on pricing when closing both positive and negative trades. It is necessary to control the realism of the submitted numbers from the demo account. It often happens that virtual returns are overstated and do not correspond to objective reality.

- When trading on a demo account, regularly apply the following obligatory condition, which will make your trading as real as it can be on demo account. Try to reproduce the emotional state of live trading. Make your brain believe that this is real money you are working with. Thus, you automatically launch natural instincts and can determine how inadequate behavior becomes after negative and positive trades.

- You should switch to a real trading account when the following factors determining the trader's readiness are fulfilled: First of all, the trader should thoroughly master the trading platform. Additionally, both hot keys and charts must be configured with all necessary technical analysis tools. As a rule, there should be maximum automatism everywhere, especially when setting, removing or replacing current orders.

The second equally important criterion is the final outcome of the trading strategy. Many beginner traders are deeply mistaken when they start to assert that negative results of demo-account are not categorical. Such subjective representation pre-determines the fate of the future trading. As soon as real trading begins, all negative factors pop-up.

Remember, if you do not show positive trading on the demo account (for a certain time period) with a probability of 101% any attempts to go to the real market will become critical for the deposit and your psychology. Sharpen trade strategy and iron discipline until you see the fruits of your work, expressed in facts and figures. The subjective argument that “trading will automatically improve once I move to a real account” will not work here. Please be patient and use demo account until really positive mathematical expectation is on your side.

In the first month of real trading, watch carefully the level of emotionality, do not rejoice at each positive trade and do not get stressed out after any negative position. The balanced number of positions that are closed by Stop-Loss is present in any trading strategy. Such situations should be treated as overhead costs for your business. Naturally, such costs should be limited by risk management rules.

Now you are armed with a full range of rules, which will allow you to competently dispose of the demo account. This allows you to cope with the psychological moments, work on your iron discipline and learn how to detect errors and then eliminate them.

We wish you successful trades and remember, your main weapon is objective thinking and self-control, carried out by analysis of mistakes you`ve made.

We are one of the fastest growing Forex Brokers in the Market. Trade with PaxForex to get the full Forex Trading experience which is based on...

- Top Effective Educational Tools For All Types Of Traders

- The Reliability in all assets in the market

- Live Multi-language Online Support 24/5