The main task of a trader is to buy cheap and sell expensively. It is what actually brings profits and makes us all happy. For example, by buying stocks for $120 and selling them for 180 after some time, the investor earns 50% per annum. But how do you find these incredible bargains? The answer is there - you need undervalued stocks. And there is no better time for that as right now. During the time of global sell-off caused by the pandemic, it will be a mistake to miss such an opportunity.

This article will give all the information needed on how to know if stock is undervalued, what indicators should be taken into account, as well as some examples of companies you can invest in right away.

What Are Undervalued Stocks?

As can be defined by the term itself, an undervalued stock is a security with an underestimated market value. Simply put, it means that the current share price does not reflect the issuer's positive prospects and the value of the asset is likely to rise in the future. The antipode of an undervalued stock is an overvalued one, the price of which exceeds the real prospects of the business. Basically, the market strives for a fair price, so the shares of undervalued companies sooner or later grow to the right value. And if an investor has managed to locate such a stock, he will definitely get a decent return on such an investment.

There is an opinion that undervalued shares are always issued by startups or small companies, which still have not proved themself. But in reality, such stocks can also be expensive securities, which are expected to increase in value. Also, the longer an issuer is on the market, the more accurate the forecast of its behavior is.

Knowing which stocks are undervalued, you can buy them in a falling market and wait for a bullish reversal, and then sell them at huge profits. It should be noted that investments in undervalued shares are associated with risk. The company may fall under severe sanctions and not get out. The debt burden may be excessive. There may be some fundamental problems in the management of the company. As a result, the bearish trend may continue, and the share price may gradually become fair. And the investor will not be able to make money on it. Therefore, it is necessary to analyze thoroughly the reasons why the stock was underestimated. Sometimes it does not come from a good life. And sometimes it is because of temporary difficulties. In the latter case, the stock should be bought, in the first one - no.

How to Find Undervalued Stocks

Undervalued stocks can be found in any industry. Most often, they are issued by companies whose operations are cyclical. At certain periods, the profitability of such organizations may decline drastically, resulting in a downfall in demand for their shares. Over time, productivity will normalize, and, accordingly, asset values will increase again. The challenge is to buy at the moment of «low» prices.

Various methods of fundamental analysis are used to find "cheap" stocks and to calculate the ratio between their market and actual value. Below we will consider the main methods of searching for undervalued stocks.

It is essential to understand that the decision to buy stocks must be balanced and sensible. Otherwise, the whole trading will be reduced to news trading. Accordingly, you should not run to buy any shares, if today you saw a program about the "unprecedented" growth potential of any company. It is not a technical analysis that is determined by figures. But it is better to get information from the sources that you yourself find, not those that have found you.

Investors use several indicators to determine whether a stock is overvalued or undervalued relative to the company's fundamental data. None of them alone can give an objective assessment of the paper, but all of them in total help to find truly promising assets.

Price to Earnings Ratio (P/E)

The price/earnings multiplier allows estimating prospects of buying shares of different companies. The meaning of the multiplier is in how much money investors are willing to pay today for each dollar of the resulting profit tomorrow. By its nature, the price/earnings ratio shows the amount, for example, of dollars that an investor must invest in a company in order to get one dollar from its profit.

P/E is calculated as the ratio of the current market value of a company to its net profit - P/E = Price/Earnings.

The P/E ratio allows you to quickly compare several absolutely different companies in terms of capitalization and make the right choice in favor of those that are currently the most advantageous in terms of profitability.

For example, if the current share price of Microsoft (MSFT) is $216 and earnings per share for the last 12 months are $5.76, then P/E will be 216/5.76 = 37.5.

Generally speaking, a high price/earnings multiplier suggests that investors are expecting higher profits in the future compared to a company with a lower P/E. It is also often a sign of stock overvaluation. A low coefficient may indicate either that the company is currently undervalued or that it has been doing much better in the last period than in previous periods. When the company has no profit and shows losses, it is impossible to calculate the price/earnings ratio. In this case, you can see "N/A" in line P/E instead of the value, or just a dash.

Remember that the P/E ratio should be measured relative to country and industry - compare the value to the industry average. The P/E>20 ratio is very likely to indicate that the company is overvalued by the market, while the P/E around ten means a fair valuation. At the same time, investors should be cautious with low P/E values. Particularly, when analyzing cyclical companies.

Price to Earnings Growth Ratio (PEG)

As you could notice, in some cases, the P/E ratio of many companies is above the industry average. Does this mean that this company does not deserve attention? Not at all.

The PEG indicator - price to earnings growth ratio - helps to understand this. PEG is calculated by dividing the P/E coefficient by the company's profit growth. Yes, if the company's P/E ratio is 15 and analysts expect that in the next few years, the company's profit will increase annually by 20%, then the PEG of this company is 0.75. It is a pretty favorable ratio.

It is believed that the PEG value < 1 indicates that investors overpay for the shares of this company - the current P/E ratio is not justified by the expected profit growth. Investors give preference to businesses with PEG values below 1. It should also be noted that the PEG of a particular stock, as well as the coefficient P/E, should be considered at the same time as the average PEG value for the industry to which the analyzed company belongs.

PEG ratio is used to determine the " fairness " of the price/earnings ratio value, slightly complementing it. A company with a high P/E ratio may not be overvalued, but may even trade at a discount if it has high earnings per share ratio. Thus, one of the positive aspects can be considered a factor of growth in the profit of firms

Price to Book Ratio (P/B)

The P/B ratio (or you may find P/BV - Price/Book Value Ratio) is an indicator that reflects the ratio of the market value of shares to the current net asset value (Net Asset) after all costs, in case of immediate liquidation.

In simple words, the P/B ratio is the ratio of the value of one share to the company's inventory. This inventory refers to everything that belongs to owners after the repayment of the debt.

P/B < 1 indicates that the market evaluates the business lower than its assets, which means it is a good time to invest.

But it doesn't mean that you should run headlong looking for a company with a P/B ratio < 1.Peter Lynch said that it is reckless to buy shares of crisis companies blindly, one should avoid those who have tremendous debt obligations.

The P/B ratio multiplier may indicate that the current value of shares is correct, while the financial community usually interprets the indicators as follows:

P/B > 2 - is very likely to indicate that the company is overvalued;

P/B = 1-2 fair value;

P/B < 1 - the enterprise is undervalued.

But such conclusions are not applicable in all cases. Let's look at the example. A company develops software to automate business processes and, of its tangible assets, it has only a small building - the rest of its employees work remotely around the world, and the value of its shares may be undervalued even if the multiplier P/B = 4.

The calculation of this ratio does not apply information about the profitability of companies and many other analytical data.

This ratio is applicable when comparing companies in the same segment, for example, when valuing shares of several banks operating in the same region. In the case of companies where there are very few tangible assets and where products or services generate huge profits, the P/BV ratio is an incorrect tool for valuing shares.

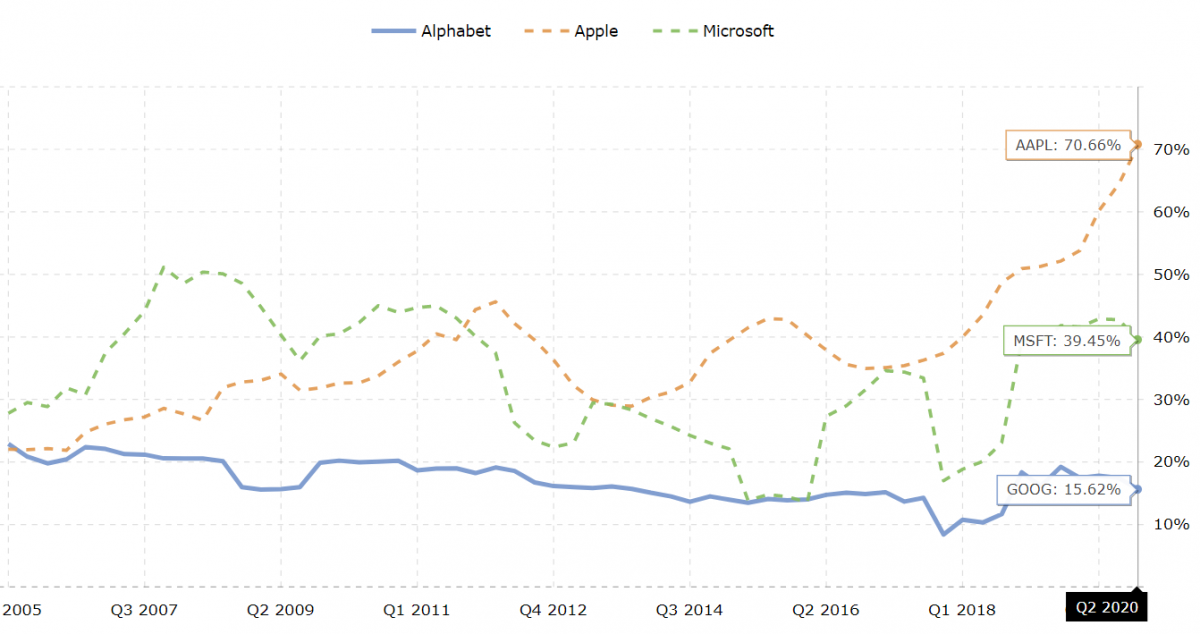

Return on Equity (ROE)

Most investors call this indicator "the essence of the business" and one can agree with it to some extent, because it is ROE that shows the company's ability to make a profit to its shareholders, and also clearly reflects the effectiveness of management actions.

ROE is the ratio of the issuer's net profit to equity.

ROE = Net income / shareholder equity * 100%.

Shareholder equity is determined by the difference between all assets and liabilities of the company. In essence, this is the third section of the balance sheet.

Thus, the higher the ROE, the more effective the business generates profit from equity. If ROE = 25%, then for every 100 dollars invested, the company gets 25 dollars net profit. Also, ROE reflects the average return on equity only (as opposed to ROA), which makes it a more useful (visual) multiplier for investors.

For example, here is a chart showing the comparison of Apple, Alphabet, and Microsoft ROE.

Simply by taking a quick look at ROE, you can see if it is reasonable to deal with this company or not. A comparison of ROE with the current market rate of return (r) will clearly show the owners how effectively shareholders' funds are used "compared to the market".

In case the ROE is constantly worse than the market rate of return, you should consider avoiding this business and investing in assets that bring market yield. For example, if a bank deposit or government bond gives a 5% yield and ROE = 2% without a tendency to improve, then what is the point of continuing such a business?

Absolutely the same story applies to investors. If a company works less efficiently compared to the relatively risk-free rate of return on the market, it would not be quite logical to expect that such an investment will be successful. Naturally, this approach makes sense only for a sufficiently mature business, and also has many exceptions. For example, with a negative net profit or own capital (which is not uncommon), the ROE indicator becomes useless.

As a result, ROE is a reflection of the real profitability of the business. It is the interest rate at which the shareholders' money works. That is why it is so significant.

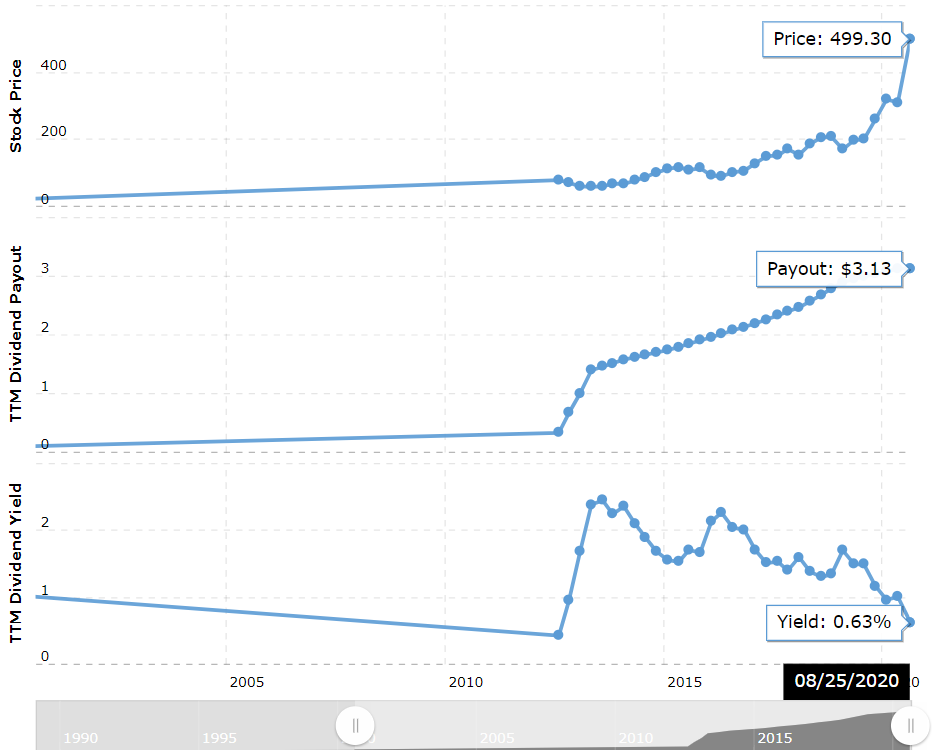

Dividend Yield

This financial indicator allows the investor to determine the payback of investments and their value. It is a method of evaluating the cash flow received by the investor for each unit of currency invested in the equity of the firm.

The dividend yield is calculated using the following formula:

Dividend yield = (annual dividend per share / share price) * 100%

For example, here is a dividend yield of Apple shares:

One of the most attractive types of companies for investors is the so-called dividend aristocrats. Investments in such companies are considered the best option for the formation of passive income.

Dividend aristocrats are companies that systematically increase dividend payments to shareholders. An essential criterion for awarding such a status is the payment and increase of dividends over at least the last 25 consecutive years.

The list of "aristocrats" usually includes no more than 100 companies. It is because the dividend yield of shares must be maintained at a consistently high level for a very long time. Such companies have high stability, as well as excellent growth potential in the long-run relative to their competitors.

There is the S&P 500 Dividend Aristocrats Index, which is made up of 50 corporations included in the S&P 500 Index. Such companies are good-looking for investors by their profit potential, but it should be understood that high profitability is synonymous with increased risk. The higher the yield increases, the greater the risk of stock collapse at the exchange under the pressure of unfavorable situations, as every dollar paid out as a dividend is a dollar that was not invested in the company itself.

Three Undervalued Stocks for 2020

In the first quarter of 2020, the markets experienced a powerful shock. The spread of the new coronavirus has reached the scale of the pandemic. It could not but struck many sectors of the economy, which manifested itself in quotes on the stock market. At the end of the quarter, the American Dow Jones index fell by 23.2%. As a result, even the best-performing stocks are traded at a sell-off price, being too far from the fair price. Let's have a look at some of the undervalued stocks for you to add them to your watchlist.

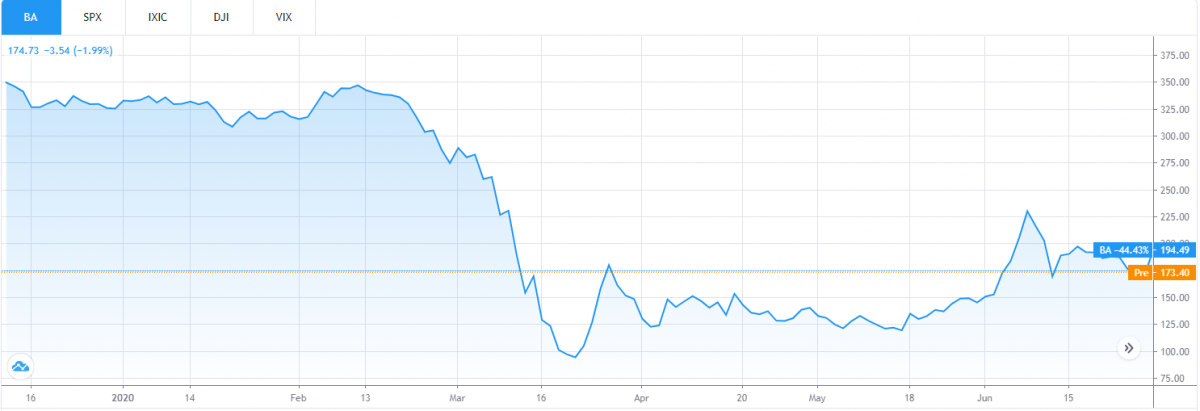

- Boeing

Decreasing demand for air travel and flight restrictions in many countries caused a lot of issues for all the aircraft manufacturers and their suppliers.

As a result, Boeing has shown the worst performance among the Dow companies, dropping almost half its value in 2020. In 2019, the company had to face the difficulties associated with the launch of a new line of aircraft 737 MAX, grounded as a result of two fatal accidents.

Despite all efforts to get the planes back on track, regulators of the U.S. Federal Aviation Administration and similar bodies abroad were not so interested in a prompt resolution of the problem.

Nevertheless, the Boeing stocks were still doing good until the beginning of the pandemic, which basically stopped air traffic and put into question the viability of airline business models in the future. Even now, more than six months after coronavirus began to spread around the globe, airlines are facing enormous uncertainty.

Naturally, for air carriers to buy planes, they need to be in a staged financial state. Accordingly, the manufacturers of aircraft will be successful. Until the coronavirus crisis is finally resolved, Boeing may have problems with preserving any strong rebound from its worst level.

Given that there are no new problems with the 737 MAX, it is unlikely that Boeing shares will re-test those lows achieved in March. The company has a solid portfolio of aerospace products that will survive the pandemic and any subsequent economic downturn. As soon as airlines are finally able to take to the air, Boeing will regain its greatness.

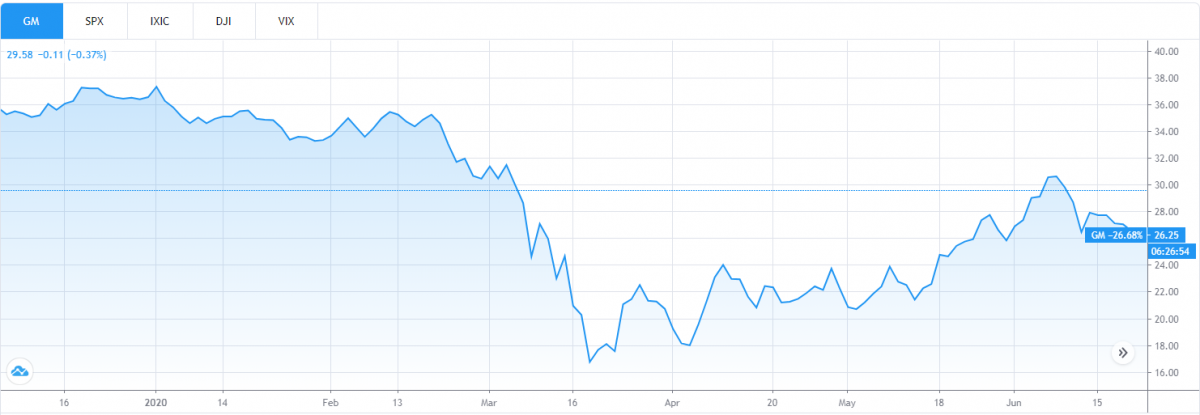

- General Motors

Car factories in North America are closed, and it is not clear when they will reopen.

First off, as a rule, buying good companies in difficult times can be a great move for investors. More precisely, buying car manufacturers during downturns can be a particularly good investment, because car stocks tend to make impressive steps up in the early stages of recovery.

At the moment, General Motors is looking for ways to cut costs and has attracted about $16 billion from its credit lines to increase its liquidity. Since the beginning of the crisis, GM stocks have dropped 30.9%.

Goldman Sachs predicts that demand for General Motors cars will increase after the car market recovers. The company's advantage is also a reliable position in the segment of pickups. After the restoration of real estate construction, the demand for such models will increase.

Another factor, which indicates the prospects for shares of this car manufacturer, is the company's emphasis on the Chinese market. It is quickly recovering from the pandemic, which will have a positive impact on the revenue of the corporation. GM also expects to invest about 20 billion dollars in the development of electric cars and autonomous machines by 2025. GM shares have a low EPS (5.9), which is a meaningful indicator to buy these undervalued stocks.

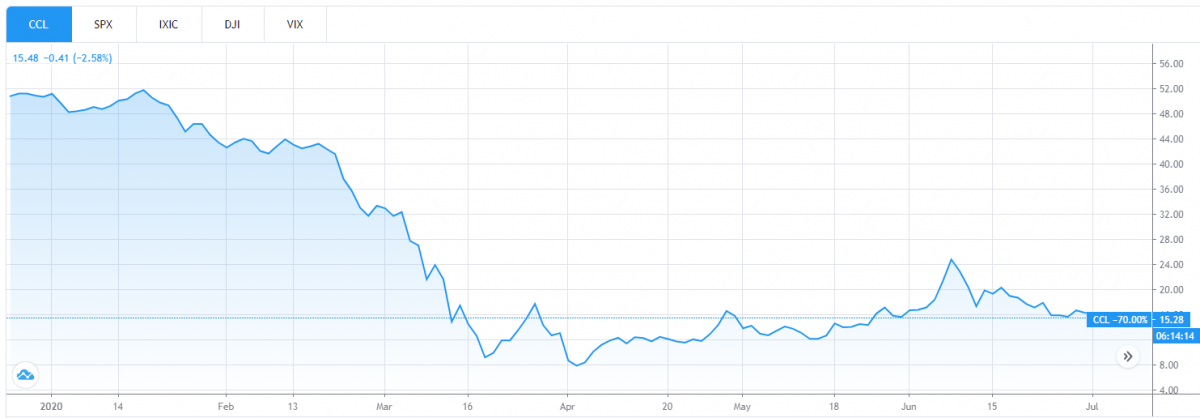

- Carnival

Given the outbreak of the pandemic, the cruise industry faced a historically complex challenge. As many countries have banned tourism and closed borders, cruise companies have joined airlines in that difficult trial. Carnival, a leading player in the cruise industry with nine different cruise brands, was no exception. The companies had to face a large number of cancellations, as people called off their vacation plans.

A recent earnings report shows the financial damage caused by a coronavirus. Passenger ticket revenue fell 86.3 percent year on year to just $446 million in the second quarter of 2020, while total revenue fell 84.7 percent year on year to $740 million. The company reported an operating loss of $4.2 billion for the quarter.

Carnival's stock price to date has fallen 69 percent year on year, although it almost doubled from a low of about $8 in early April

However, the positive news has also emerged this month as some of the company's cruise brands are set to resume sailing in September. AIDA Cruises will resume operations from September 6, with the first ships sailing from German ports.

Taking into account the current price and the prospects of the company, Carnival can be considered as one of the best-undervalued stocks to pay attention to.

How to Trade Undervalued Stocks

To trade undervalued stocks, start by analyzing the eight ratios described above. Remember that while these ratios are useful, they should only form part of your fundamental analysis. It, in turn, should be combined with thorough technical analysis for complete market analysis.

Once you have identified the stocks you want to trade, you will need a CFD broker in order to speculate on the price fluctuation. To get started, open a live account with PaxForex and download the trading terminal MetaTrader 4.

To place a buy order, find the symbol of the company in the left side list and double-click it. In the window appeared, choose the volume and press Buy by market. And, of course, do not forget to set Stop-Loss so you comply with the risk management rules.

Why Trade Undervalued Stocks With Paxforex?

Investing in undervalued stocks with PaxForex allows you to get the best trading experience powered by the most convenient and fastest platform MetaTrader 4. With the specially designed different accounts, each trader can find the best one meeting his requirements. Given the best trading conditions on the market and an amazing Support team, undervalued stocks investing has never been better before.

Open an account right now and get the most out of trading a stocks seel-off!