While MiFID III will come into effect next month and many companies struggle with what this will mean for their business, many have already put the Basel III framework out of their mind. Basel III affect banks and capital requirements they need to have on their balance sheets in order to be able to withstand future financial crisis. Central banks around the world have approved the new rules which are intended to make banks more safe and secure. Basel III took several years of work and as with most other multi-year projects, there is always unfinished business.

Forex traders are advised to keep one particular weak spot in Basel III in mind as it may impact forex trades, especially in the event of an unforeseen financial event. One of the main areas of concerns is how sovereign bonds are treated on the banks balance sheet. Banks transact in their own government’s debt and almost all banks view them as essentially risk free. This type of thinking causes a severe decrease in financial stability. Regulators always treat their own countries sovereign debt denominated in their own currency as free of risk.

This allows banks to purchase as much domestic sovereign debt as they wish without the need to raise additional funds. Basel III doesn’t impact those trades and therefore decreases financial stability. Bubbles are fueled by this type of behaviour which always leads to a market crash and a financial crisis. Forex traders need to be aware of this sovereign debt doom loop. In the event that investors perception of those bonds changes, banks would be faced with heavy losses. Governments may need to step in and issue more bonds in order to cover the short-falls which will further depress prices and send yields soaring.

Spin the New Year Roulette today exclusively at PaxForex! Secure great prizes which will ring in 2018 with a bang. Boost your overall forex portfolio and increase your profits with every trade. Join our growing forex community and become one of tens of thousands profitable forex traders who earn more per trade at PaxForex.

Banks may use their domestic sovereign debt holdings as collateral for other higher risk investments. A regulatory change could force banks to sell their holdings which may result in a sovereign debt crisis and have a ripple effect through the financial system. The currencies of those countries would suffer as a result and forex traders should expect a spike in volatility. An event such as the Swiss Franc de-pegging from the Euro could be repeated. Therefore, it is important that forex traders monitor the sovereign debt market in order to be prepared for a potential crisis. We have prepared three trades for Basel III and how it may impact your forex strategy in 2018.

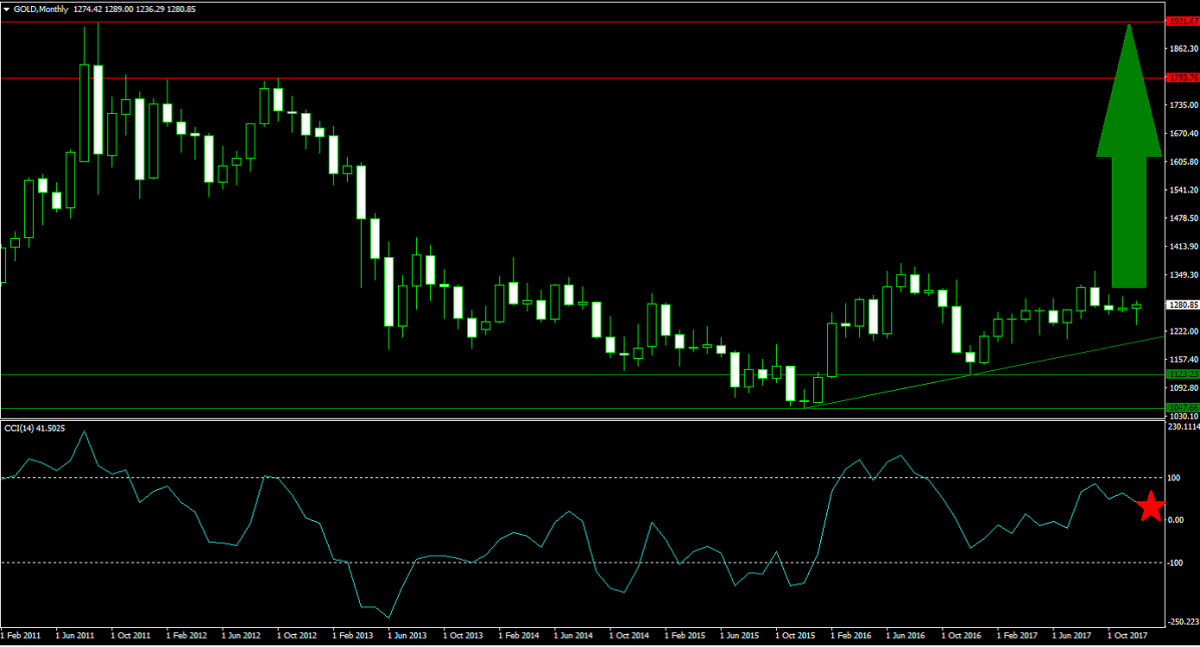

Forex Profit Set-Up #1; Buy Gold - MN Time-Frame

Gold should be part of any forex portfolio in 2018 due to its safe haven status as well as excellent currency hedge abilities. Looking long-term at the MN chart shows how this commodity is drifting higher following the breakout above its horizontal support area. A brief pull-back into the upper end of its support area confirmed an increase in bullish momentum which is expected to take Gold higher over the course of the next few months. An ascending support level is providing additional bullish pressures to this trade.

The CCI is currently trending lower inside neutral territory and traders are advised to monitor the move down below the 20 mark before placing new buy orders. Download your MT4 trading platform today and add this Gold long hedge to your forex portfolio in order to reduce your downside risk and diversify your portfolio.

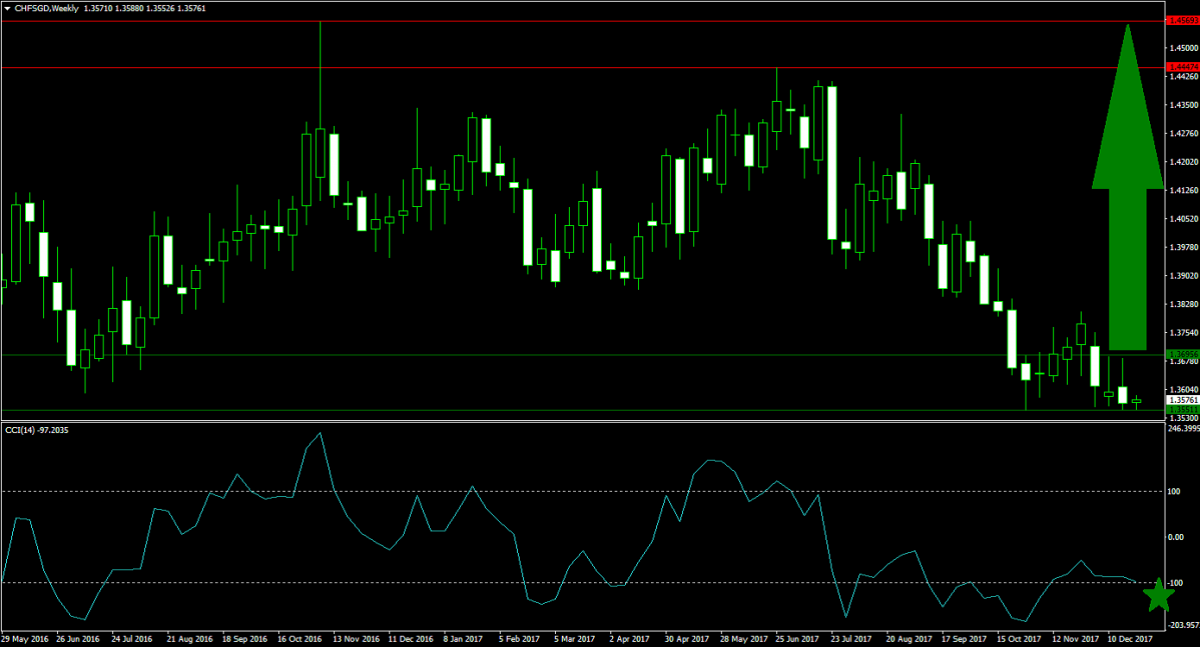

Forex Profit Set-Up #2; Buy CHFSGD - W1 Time-Frame

This currency pair offers great protection for any forex portfolio. The Swiss Franc may be the most stable currency for 2018 as it is already past the phase where it would shock forex traders. The Swiss economy has undergone changes which made it more diverse and the Swiss Franc has benefited. The CHFSGD has lagged the overall bullishness and has plenty of room to the upside in order to catch up. Bullish pressures are mounting inside of its horizontal support area from where a breakout and strong advance are anticipated to materialize in the first-quarter of 2018.

The CCI has already advanced from extreme oversold conditions below -100 and is expected to drift slowly to the upside as bullish pressures are accumulating. Open your PaxForex trading account today, spin the New Year Roulette and enter this trade in order to ensure very good upside potential with limited downside risk.

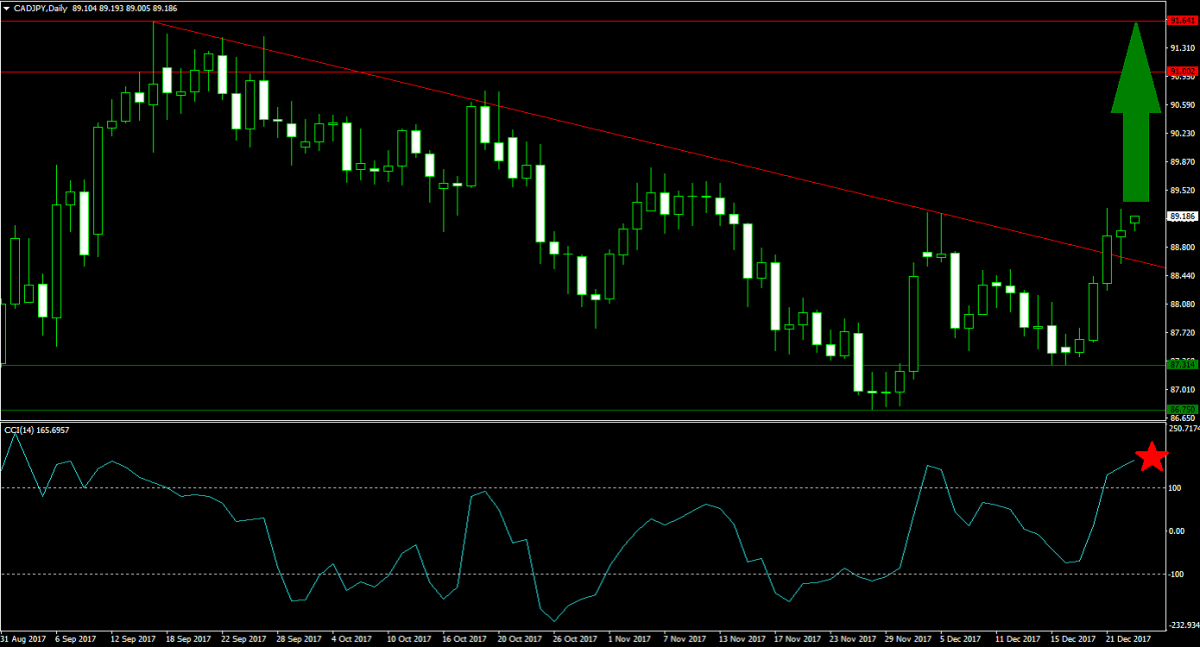

Forex Profit Set-Up #3; Buy CADJPY - D1 Time-Frame

The CADJPY offers a very interesting trade as it is in the midst of an up-trend which led to a breakout above its descending resistance level. The Canadian Dollar moves with commodities while the Japanese Yen offers a layer of protection and this combo is set to take this currency pair further to the upside. Forex traders may witness a risk-on start to 2018 which will further benefit the CADJPY. Forex traders should look for dips below 89.000 which represents solid buying opportunities.

The CCI is currently trading in extreme overbought conditions above 100, but any pull-back in price action will lower this indicator. A sideways trend may emerge before the next move to the upside will form. Enjoy a professional trading environment at PaxForex and find out why more and more traders prefer to grow their account right here!

To receive new articles instantly Subscribe to updates.