- What is Forex Time Frame Analysis

- Choosing the Right Time Periods for Forex Time Frame Analysis

- Long Term Frames in the Multi Timeframe Analysis on Forex

- Medium Term Frames in MTFA on Forex

- Short Term Timeframe in Multiple Frame Analysis

- Comparing the Frames During Forex Multi Time Frame Analysis

- Trends in MTFA

- Momentum in Forex Multiple Timeframe Analysis

- Entry Points in MTFA

- Best Time Frames for Different Trading Styles

- How to Practice MTFA for Free

Every professional currency trader knows that detailed analysis of the market is a guarantee of a productive trade and positive outcome. We also know that there are many approaches to take when it comes to trading on Forex: from various strategies to specific tools and techniques. Same goes for analysis. Depending on the trader’s personal style and previous experience they can choose a different analysis method that will fit them the best. You probably already heard about technical analysis and fundamental analysis. They are the two major categories that consist of many subcategories contributing to the matter. A great example of such subcategory is a technical analysis technique called Forex multiple time frame analysis (MTFA). This type of analytical approach is sometimes neglected by a large number of traders, but it can actually serve as a great supporting tool. Today we are going to discuss what is the multiple time frame analysis in Forex and how to master it to improve your trading experience.

What is Forex Time Frame Analysis

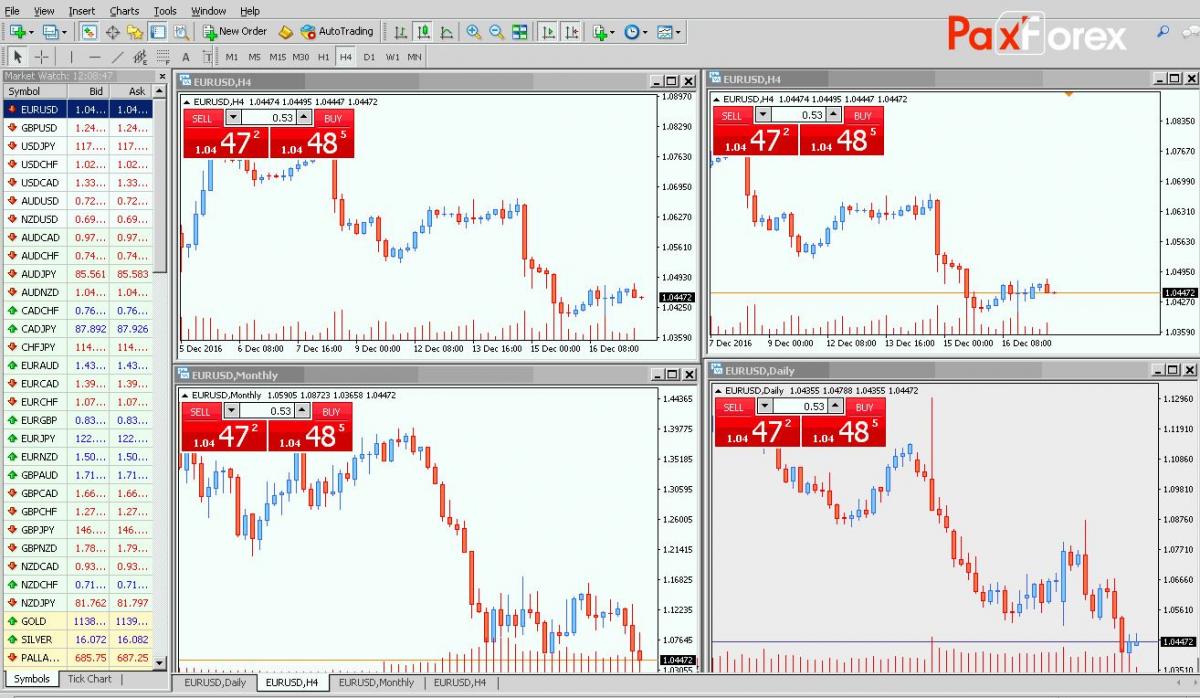

You may already know the definition of time frames in trading from learning about different Forex technical analysis strategies. The time frame is simply a parameter you set in your trading platform to generate a chart that will reflect the situation at the market for your chosen currency pair. The timeframes can go anywhere from mere seconds to weeks and even months. Each type of a frame is used for a different purpose during market analysis. Now, once again depending on the strategy you adopt you might tend to stick with a specific time frame and overlook the big picture. For example, many day traders, swing traders and momentum traders usually focus their attention on short term frames. And while it can prove effective in most scenarios, this can also lead to missing out on promising opportunities that can be indicated from larger time frames. So this is where the multi timeframe analysis for Forex comes in.

The Forex multiple time frame analysis is the strategy that involves comparing the data from several time periods to build a more comprehensive and effective trading plan. By pulling the various time frame charts for the same currency pair the trader then needs to compare and structurize the information on trends, their directions and momentum. There is no specific guideline to how many frames you need to compare to get the best results. The general rule, however, is that if you go to low and only compare two frames you will not get a very informative report and most likely miss the point of MTFA, and if you attempt to compare too many timeframes you will get lost in the wave of so called noise - the unnecessary small details that can confuse the analysis results. This way, the golden ratio for anyone who is trying out the multi timeframe analysis on Forex is to go with three frames: short term, medium term and long term. This brings us to the question: how to choose the right timeframes for the MTFA?

Choosing the Right Time Periods for Forex Time Frame Analysis

As we have already established, that having three charts is sufficient enough for comprehensive analysis, it is now important to decide what particular time setting to go with in these frames. There is a trick that is often referred to as the rule of four and this is how it works:

Start by choosing the medium term or middle time frame. This will largely depend on the overall trading style you tend to follow. This way a day trader can go with an hour period, while a long term position trader might want to set is as a week or even a month.

Then you determine the short term frame by dividing the medium time setting by four. So for the day traders the short term timeframe is going to be fifteen minutes (a quarter of an hour) and for the position traders who went with one month as their medium, the short term will be roughly a week.

For the long term timeframe you will have to multiple the medium value by four. By this logic the one hour turns into four hours and a month turns into four months.

Once again, it is very important that you choose the right medium term setting from the start since the short term traders will have nothing to do with a four months chart, while long term ones will get confused by the fifteen minute chart’s data. As we now have an idea of what type of timeframes to use for the Forex multiple time frames analysis, let’s now focus closer on each one of them to gain a better understanding of MTF analysis.

Long Term Frames in the Multi Timeframe Analysis on Forex

Just as in any other Forex technical analysis strategy that involves using different time settings, while attempting MTFA start by exploring your largest frame - the long term. Disregarding of the trading method you are using, the long term timeframe is the best for identifying the general trends on the big picture. This will not mean that you should build trades from this chart, rather settle on the overall direction and keep the long term chart as a guideline.

By building your trading plan in accordance with ongoing trends you will have a higher chance for success. With that said, it is also fair to mention that in some cases you will benefit more from trading against the trade. This of course, requires a high level of market experience and is mostly applicable to currency trading professionals.

Another important aspect to consider while working with the long term frame during time frame analysis on Forex is the impact of fundamental factors. The fundamentals are various economic, social and political events that can influence certain currency pairs and change the direction of the market overall. Sometimes these events are directly correlated with the financial market and sometimes they have nothing to do with it at all. Nonetheless, every long term trader and sometimes the short term trader as well needs to pay attention to how the fundamental factors reflect on the long term chart. By connecting the two together a trader can get a better understanding of why particular trend is taking place and where is it going to go next. In case you are not experienced enough or simply do not have time to perform your own fundamental analysis, there are handy online resources created to provide you with free daily fundamental analytics. This way you do not have to invest your personal time into this part of long term frame analysis, all you have to do is read and understand the report.

And it is also crucial to consider the factor of interest rates. The rate of interest is perhaps the biggest contributor to the foreign currency market. It is sort of an engine that makes the market not only move on but to exist as well. We will go into more details on interest rates some other time, but what is important to us in terms of MTFA is that the rate always tends to lean towards the highest valued currency in the pair. In simple words, considering the interest rates can help a trader to structure more profitable trades.

Medium Term Frames in MTFA on Forex

As you have identified the trend on the long term chart it is time to take a closer look at it from the perspective of your medium frame. In here you will see the trend in more detail, but not in too much detail. Depending on the specific time you chose in the beginning when determining your time frame sizes, the medium frame will have everything you might need to create an effective trading strategy. From this frame you can also observe the main points of both long term and short term frames, which makes it kind of the go-to frame when you need to make a decision.

Short Term Timeframe in Multiple Frame Analysis

While the most of your trades will be built from the medium chart, there are still going to be some scenarios where the use of a smallest frame chart is necessary. By getting a closer look at the smallest details a trader can select the right entry point as well as identify the character of an ongoing trend. It is also important to mention, that when the short term frame is set anywhere below four hours the fundamental trends will no longer be visible. This creates a better environment for the technical indicators which are often used to assist traders with analyzing the market. The more detailed is the chart the more clear the indicator’s results will be.

Low frames can help better analyze the larger ones as well. The market itself if very repetitive on every scale, this means that by taking a closer look at the taken trend the trader can not only confirm the basis for their actions but also predict the outcome of each trade. For example, when you are building a long strategy based on a daily candle the MTFA can help you to identify if the price will continue right away or if there is going to be a retracement first. This can be done by checking if the price was able to break through the nearby resistance or if it bounced back. Logically, the breakthrough will most likely point to the continuation of the movement while the bounce is a clear indicator for a retracement. Needless to say, this will result in very different actions.

Now, one thing to look out for when dealing with the short term timeframes is the noise. On the chart it will look like random sharp elements that do not align with the overall trend. The trader’s job is to disregard these and build trades according to more solid indications.

Comparing the Frames During Forex Multi Time Frame Analysis

As you have studied all three charts separately, the best step is to put them together by aligning the results. When approaching the chosen pair analysis with the described above top to bottom approach, the trader will increase the success rate of every trade by sticking to bigger trends. This type of trading automatically reduces the amount of risks taken since the price usually ends up following the long term direction.

Comparing the frames can also assist the trader with increasing the level of confidence in a particular trade. For example, if the trend seems to be moving upwards on the long term chart but takes the opposite direction or simply goes slightly lower on the medium and short ones, a trader has to adjust the strategy accordingly by establishing the appropriate profit goals and exit points. In this scenario the best solution would be to go short and pay close attention to the outcome of each trade. The most cautious traders will avoid trading altogether and wait until the data aligns on all three charts, and only then will proceed to go long with confidence.

Multiple time frame analysis is a strong tool when it comes to determining the levels of support and resistance both of which can have a drastic effect on the way a trader operates. Additionally, this strategy helps to find the best possible point of entry as well as exit points. In order to successfully implement the multiple time frame analysis on Forex, let’s briefly discuss some of the key elements, more specifically the trends, momentum and entry points.

Trends in MTFA

A trend on the market chart is a continuous movement of the price of one direction. The trends can be moving upwards also referred to as bullish trends, or downwards or bearish trends. Best way to identify the trend is through the use of technical indicators - specifically designed add ons to a trading platform. Once you have identified the trend you can neither confirm it by using the other set of indicators or by switching between time frames and seeing whether the same trends is relevant in all of them. The key here is to select the right indicators and base both your analysis and your trading strategy on their result data.

Momentum in Forex Multiple Timeframe Analysis

Momentum in MTFA is an indication of overall value change rate of a particular currency’s price. Traders usually use the momentum as the measure of market’s volume. High momentum means that the currency is being sold and bought very fast, which happens when the traders are trying to direct the market in specific direction. In multiple timeframe analysis a momentum can be found by comparing the time frame where the trend was indicated to a lower one. And once you have found both you can use this data to look for entries.

Entry Points in MTFA

There are many ways and tools to choose the right entry. When applied to the conditions of multiple time frame analysis, the entries are usually found at the momentum frame or at the lowest available frame. Similar to finding trends, it is always a good idea to have an additional source to confirm the entry. This can be done with the assistance of various price action tools and through the candlestick analysis.

Best Time Frames for Different Trading Styles

We have already mentioned that the selection of specific time frames will depend on the overall trading strategy. This way intra day traders will benefit from either a day/H4/H1 or day/H1/M15. The even more short term scalpers might consider H1/M15/M5 ( as you can see the rule of four does not directly apply to the short term frame in this case, which shows that even the described model can be flexible to a specific scenario). While the long term traders will find the necessary information from a month/week/day combination. To best determine how to combine the timeframes and how many of them to include, use the following key points for each type:

- Long term frames are best for determining the levels of support and resistance

- The medium term frame will help you to identify and analyze trends and momentum as well as corrections and patterns

- And the short term frames are widely used to locate the entry

How to Practice MTFA for Free

For new traders the concept of market analysis in general and the multiple frame analysis in particular can seem complex and overwhelming. This is very reasonable as many aspects of currency trading are not as simple as they sound and include a require some previous knowledge and experience. The key to mastering any of trading related skills is always practice - once you get the idea of a specific strategy or technique it is always nice to try it out several times to see it in action. Some traders do this in the conditions of the real market by applying the analysis results and trading small amounts. This approach can be effective, although you are still risking your personal assets if you applied the rules of MTFA incorrectly. In this case the best solution is to practice your analysis skills in demo account.

Demo accounts are complete copies of actual trading accounts. The only difference is all of the trading processed in demo are simulated and you do not need to invest or risk any real money. Because demonstration accounts include every detail from the platform, traders get access to all available time frames as well as to every existing technical indicator. This means you can practice the newly obtained analysis skills for as long as you want to without taking any risks. And then once you are comfortable with analyzing the market and applying the analysis results to your trades in demo you can confidently move on to an actual Forex trading account and start earning.