How many remember the Greek debt crisis? It lasted almost a decade with many pinning the start at October 4th 2009 after the center-left PASOK party won elections while some EU bureaucrats like to claim victory with the last bailout payment which was supposed to arrive in Athens on August 20th of 2018 at which point Greece exited its bailout. Greek finances where a mess and debt-to GDP ratio soared to nearly 180%.During that period, Greece saw GDP contractions almost every year, unemployment soar and incomes shrink.

Just as Greece officially exited its bailout program six weeks ago and as the EU and ECB congratulated each other on a job well done, Italy is ready to take over as the Eurozone problem number one. Italy’s populist government just passed a budget which will violate the EU’s deficit rule of 2.0% with a deficit of 2.4%. While many may not be concerned with the 0.4% difference, it does make all the difference. Italy is home to the biggest debt load in Europe and also the world’s number three bond market.

Echoes from the Greek debt crisis are loud with European Commission President Jean-Claude Juncker noting that “We have to do everything to avoid a new Greece, this time an Italy, crisis.”, which illustrates the fear in Brussels. Italy’s budget is not acceptable to the world’s largest trading bloc, but Italy’s populist government decided to skirt the EU in favor of delivering on campaign promises made to voters. Giovanni Tria, the Italian Finance Minister, returned from Brussels where he failed to convince the EU of the budget.

The Euro has contracted for five straight trading sessions. Does this represent a good long entry opportunity or will the Euro contract further? Will Italy become the next decades Greece? Open your PaxForex Trading Account today and take advantage of countless, profitable trading opportunities. Take the first step now in order to create a better tomorrow through the exciting world of forex trading.

While Italy believes that it is nowhere near to the Greek drama which unfolded on the continent over the past nine years, the EU differs and draws comparisons coupled with warnings that Italy must respect the rules. Mario Centeno, the Portugese Finance Minister, stated that “Recent announcements by the Italian government have raised concerns about its budgetary course.” Wopke Hoekstra , the Dutch Finance Minister, added that “I’m somewhat less optimistic after having talked to my colleagues than beforehand.” This is turning into a Greek drama made in Italy, here are three forex trades for a happy ending.

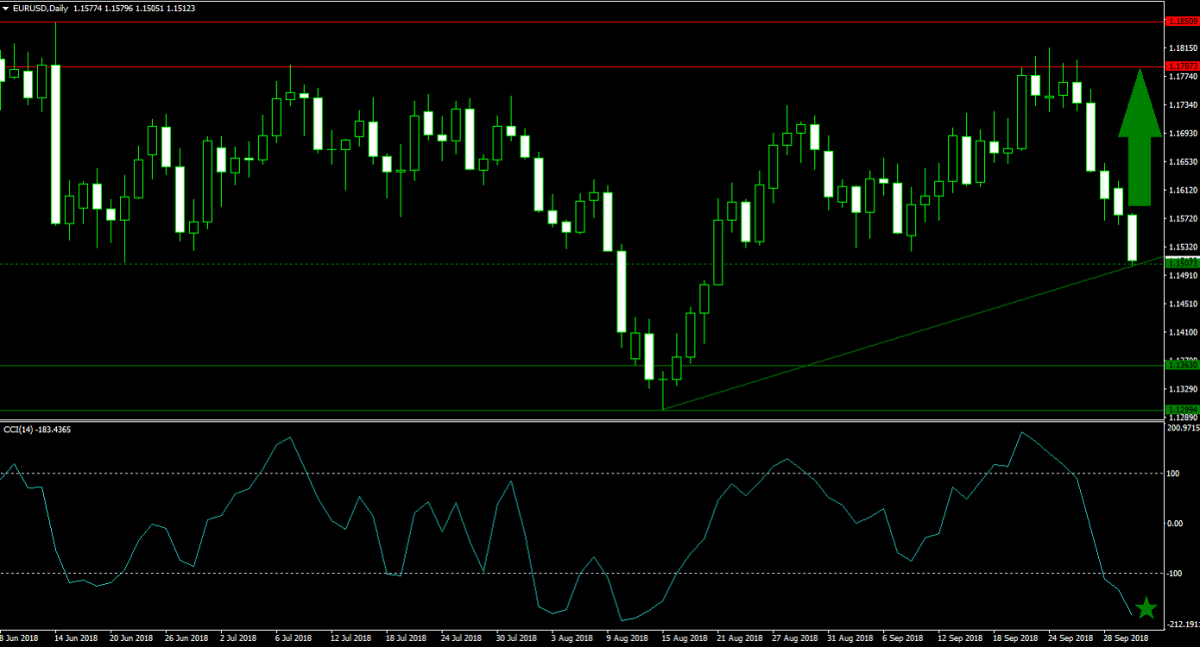

Forex Profit Set-Up #1; Buy EURUSD - D1 Time-Frame

Five days of heavy selling has taken the EURUSD from its horizontal resistance area into its next horizontal support level. This is additionally being enforced by its primary ascending support level and price action is expected to halt as forex traders reassess their positions. This creates a good opportunity for a potential short-covering rally which is expected to take the EURUSD back into the lower band of its horizontal resistance area. Forex traders are advised to buy the dips into the primary ascending support level.

The CCI has plunged deep into extreme oversold territory and is now near its previous lows from where the preceding rally developed. A move back above the -100 level could ignite the anticipated short-covering rally. Download your PaxForex MT4 Trading Platform now and start building a forex portfolio today so that you can harvest the profits tomorrow.

Forex Profit Set-Up #2; Sell EURJPY - D1 Time-Frame

The EURJPY is lagging other currency pairs where the Euro is the base currency and therefore offers a great counter-trade to long positions. Price action just completed a breakdown below its horizontal resistance area and is now approaching its steep, primary ascending support level. Bearish momentum is accelerating which is likely to result in a second breakdown. This would clear the path down into its next horizontal support level. Forex traders are recommended to sell the rallies in the EURJPY.

The CCI descended from extreme overbought conditions and pushed below the 0 mark. This resulted in a bearish momentum change and more downside is now expected from this technical indicator. Subscribe to the PaxForex Daily Forex Technical Analysis and increase your monthly profits, simply by copying the recommended forex trades of our expert analysts.

Forex Profit Set-Up #3; Buy EURSGD - D1 Time-Frame

The quick, but steep sell-off in the EURSGD has taken this currency pair down into its secondary ascending support level. It is located above its horizontal support level and price action is currently not expected to violate it. As bearish momentum is fading, support levels may just be strong enough to invite a price action reversal. Forex traders should spread their buy orders above and below the secondary ascending support level in order to capture the expected upside in the EURSGD.

The CCI slipped into extreme oversold territory and recorded a new low, but has since stabilized and entered a minor bullish bias. An advance above the -100 level may attract new bids and initiate a short-covering rally. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market. Earn over 500 pips per month without the hassle.

To receive new articles instantly Subscribe to updates.