The past decade, in the aftermath of the last financial crisis, just about everyone has been bullish on everything. A strong bull market in equities, bonds and credit has stunned many bears. The source of this bullishness was huge quantitative easing programs by all major central banks which pumped trillions worth of liquidity into markets. Many state that the market went up not because of fundamentals, but rather because nobody can compete with central banks and their money printing bonanza. Forex traders had to take into account that the fundamentals which used to drive currencies were impacted and trade around it or with it. The forex market was the only market which created many opportunities on both sides.

With this central bank sparked bull market comes one big problem now: valuations. Goldman Sachs strategist Christian Mueller-Glissman together with a few colleagues issued a warning this week to clients stating ‘It has seldom been the case that equities, bonds and credit have been similarly expensive at the same time, only in the Roaring ’20s and the Golden ’50s. All good things must come to an end. There will be a bear market, eventually.’ Since the bull market was sponsored by quantitative easing, the bear market will equally be sponsored by the reduction of the same programs. Central banks have already started to cut which may be the biggest signal that the bears are awakening.

One factor which will impact the strength of the bear market, which averages 17 years over the past decade, would be if the global economy would be hit with a growth shock or a growth shock with a spike in inflation. The forex market would see a big pick-up in volatility as global traders will react to the bear market and adjust their positions. As GDP figures will be adjusted, currencies of those countries will be impacted as well. In addition, central banks may be faced with a sharp rise in inflation which would prompt interest rate increases.

PaxForex gives forex traders access to a wide range of currencies, using the award winning MT4 platform, and traders can utilize leverage in order to further enhance the trading power of their portfolio. Regardless of your level as a trader, the same trading conditions apply to all which levels the playing field.

As central banks accelerate their reduction in quantitative easing and potentially start to increase interest rates in order to normalize their monetary policies, forex traders will enjoy even more trading opportunities as it will cause a divergence in policies. During the bull market, all major central banks were aligned in their monetary policy. As bear markets unfold, central banks tend to cater more to their economies which creates great trading opportunities. This is e specially true for forex traders. Here are three ways to prepare your forex trading account at PaxForex for the start of a bear market as valuations are at or near historic highs.

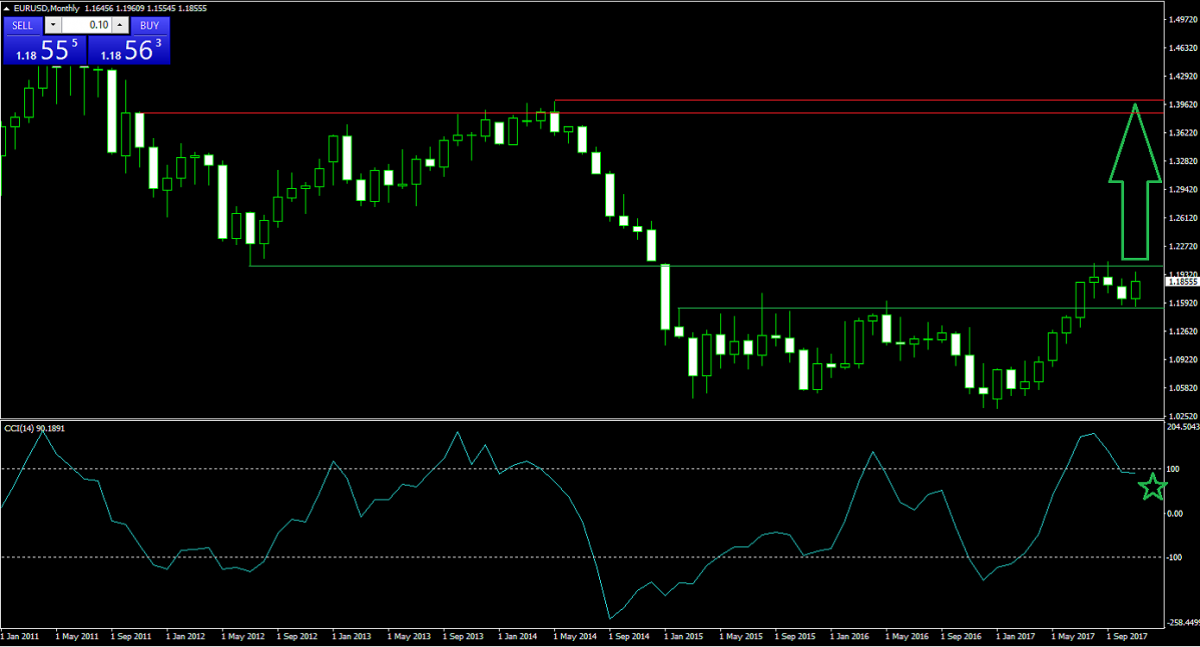

Forex Profit Set-Up #1; Buy EURUSD - MN1 Time-Frame

The EURUSD has been on a steady advance after plunging to near parity. On a MN1 chart the path to the upside remains very attractive and with the US economy expected to lose the most during a bear market, the USD faces many headwinds moving forward. A breakout above 1.20917 would open the way for a strong rally in excess of 2,000 pips. Keep in mind that this a a trade with a long duration in order to capitalize on the pending bear market.

Adding a strong bullish signals is the formation of a positive divergence in the CCI in extreme overbought territory. This suggests that the current advance has more room to run and forex traders should take any dip in the CCI below 100 as a buying opportunity. Open your PaxForex account today and take advantage of this trade.

Forex Profit Set-Up #2; Sell CHFJPY - MN1 Time-Frame

While this currency pair may not enjoy the trading volumes of the EURUSD, it gives forex traders a very nice hedge to any bear market fall-out. The Swiss Franc as well as the Japanese Yen are considered safe haven currencies and the Japanese Yen easily tops this list. As the MN1 chart shows, the CHFJPY has recovered slightly from its most recent sell-off. The descending resistance level is expected to force this currency pair lower down into its next major support area from where a breakdown is possible.

The CCI has reversed from a brief spike into extreme overbought territory above 100 which added to negative momentum. A drop below the 0 mark is set to prompt more sell orders. Download your MT4 platform today and add this trade to your portfolio.

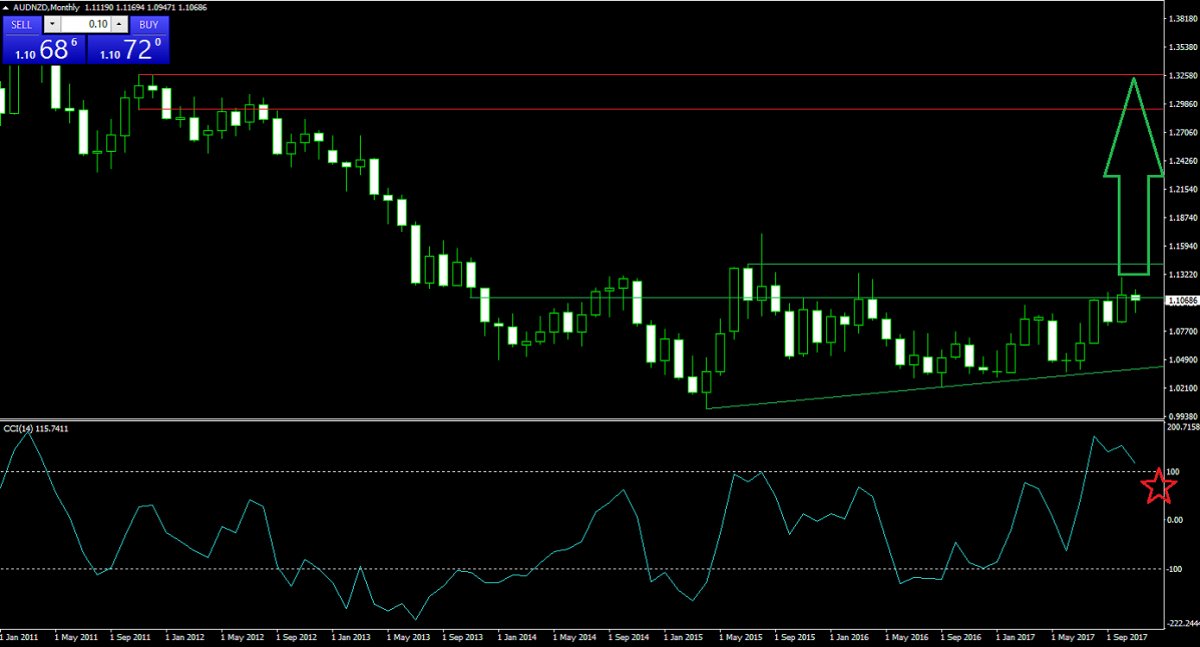

Forex Profit Set-Up #3; Buy AUDNZD - MN1 Time-Frame

The Australian Dollar and the New Zealand Dollar are both commodity currencies which makes the AUDNZD a perfect trade in order to benefit from the decrease in commodity demand as a result of the expected bear market. Since Australia is the bigger economy it can withstand commodity price shocks better, which will see this currency pair soaring. It is currently trying to break into a very strong support area and is being pushed higher by an ascending support level.

The CCI is trading above 100 which puts the AUDNZD firmly into extreme overbought territory, but forex traders are advised to enter their buy orders when this indicator drops below 100. Follow PaxForex expert analysts and get your fundamental analysis and daily trading recommendations, don’t miss out on profitable trades and grow your account balance with the help of PaxForex.

To receive new articles instantly Subscribe to updates.