Forex traders received another healthy dose of global PMI reports which spanned from Australian through the Eurozone into the US. The trend which started in 2018 continued as more and more global PMI reports come in below expectations. This all points towards a steeper economic slowdown than many analysts and economists anticipated. A lot of traders have not fully priced in the effects of this slowdown. Central banks are likely to turn more dovish and follow the US Fed 180 degree policy change which will have ripple effects across the global financial system. The forex market may be in for a turbulent 2019 if more disappointing economic data points will be released.

Australia, caught in the crossfire of the US-China trade war, released preliminary February data which showed that its manufacturing sector slowed down its expansion. The more worrisome set was the drop in the service sector below 50 which indicates contraction and employs the majority of the workforce. The Composite PMI also posted a reading below 50 and the Australian Dollar came under selling pressure. This continued despite a solid employment report for the month of January. Adding a more dovish RBA into the mix and forex traders may re-evaluate their positions in the Australian Dollar which also used as a Chinese Yuan proxy trade.

While the Eurozone has printed economic reports which have disappointed for an extended period of time, this trend shows little to no signs of changing. French manufacturing came in slightly better than expected, but the services sector remained in contractionary territory for a second month and so did the Composite PMI. Germany, the Eurozone’s export powerhouse and manufacturing capital, reported an unexpected drop in the manufacturing sector below 50. This helped drag the entire Eurozone Manufacturing PMI below 50. The Services as well as Composite PMI out of Germany and for the Eurozone beat expectations.

The Euro was able to recover from depressed levels, but will this move last or will it reverse quickly? Growth forecasts are being slashed across the global economy and PMI trends indicate that they may need to be lowered again. This will result in plenty of volatility across the forex sector which will bring a great deal of trading opportunities. Open your PaxForex Trading Account now and take the first step in order to increase your profits with the help of our expert analysts!

The Japanese Nikkei Manufacturing PMI for February followed other PMI’s below the 50 mark and therefore indicated contraction in the sector. US PMI data followed in the footsteps of German and Eurozone data with a disappointment in the manufacturing sector, but better than expected service sector data and a higher Composite PMI. Overall economic data, not just PMI data, paints a picture of global economic weakness. This has dragged housing data down and erased the wealth effect for many consumers which in return results in weak economic data. How long will this cycle last? Are we just getting started or are we nearing the end? Global PMI’s extend their slide, but here are three forex trades which will slide those pips right into your trading account!

Forex Profit Set-Up #1; Buy EURUSD - D1 Time-Frame

After a mixed batch of February PMI reports, the Euro staged an advance on the back of short-covering as forex traders picked through the rare glimpses of better than expected data. The EURUSD accelerated from a brief dip into its horizontal support area and bullish momentum from the current short-covering rally is likely to extend this move into its primary descending resistance level. Forex traders are advised to buy the dips in this short-term rally below 1.1350.

The CCI has extended its recovery from extreme oversold territory and has also eclipsed the 0 mark. This resulted in a bullish momentum change and is likely to push the EURUSD further to the upside. Download your PaxForex MT4 Trading Account today and join our fast growing community of successful forex traders!

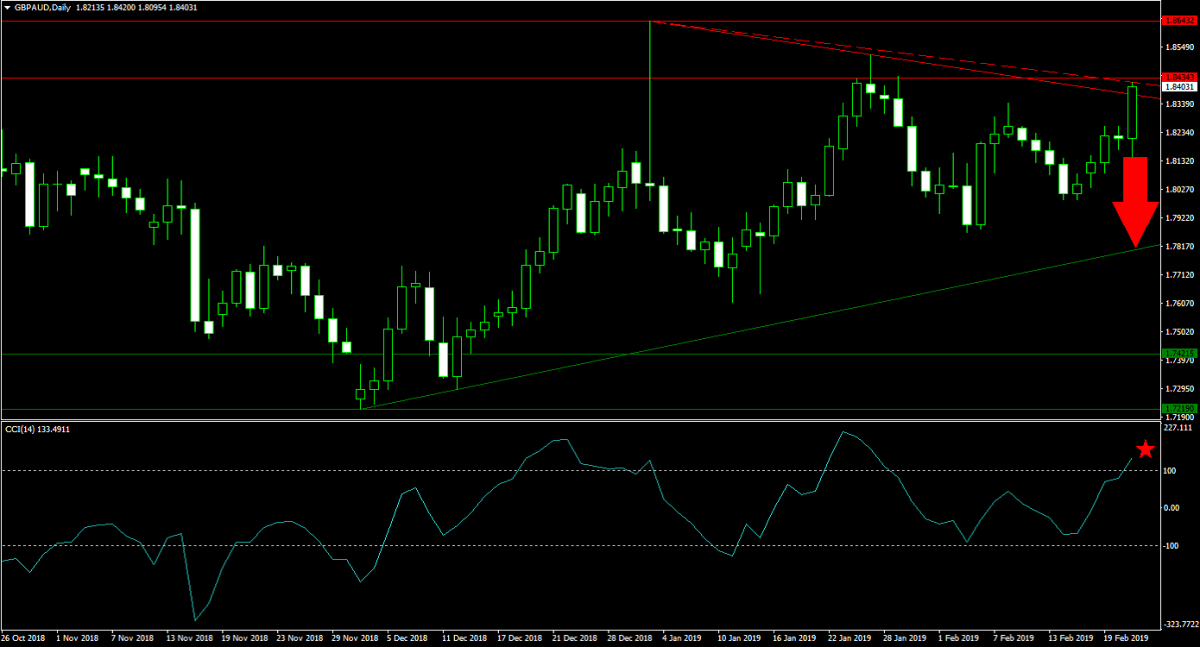

Forex Profit Set-Up #2; Sell GBPAUD - D1 Time-Frame

This currency has enjoyed a solid advance which took it from its horizontal support area into the lower band of its horizontal resistance area. This level is being further enforced by its primary and secondary descending resistance level. While the Australian Dollar came under heavy selling pressure, this made the GBPAUD vulnerable for a profit taking sell-off. Brexit uncertainty may provide the catalyst for traders to realize floating trading profits. A contraction into its primary ascending support level is expected and forex traders are recommended to enter their short positions at current levels.

The CCI has pushed into extreme overbought conditions, but remains off of its previous high. Momentum is expected to reverse and push this technical indicator below the 100 level which may trigger the expected sell-off in the GBPAUD. Follow the PaxForex Daily Fundamental Analysis and earn over 500 pips per month; allow our expert analysts to guide you through the forex market with consistent profitability.

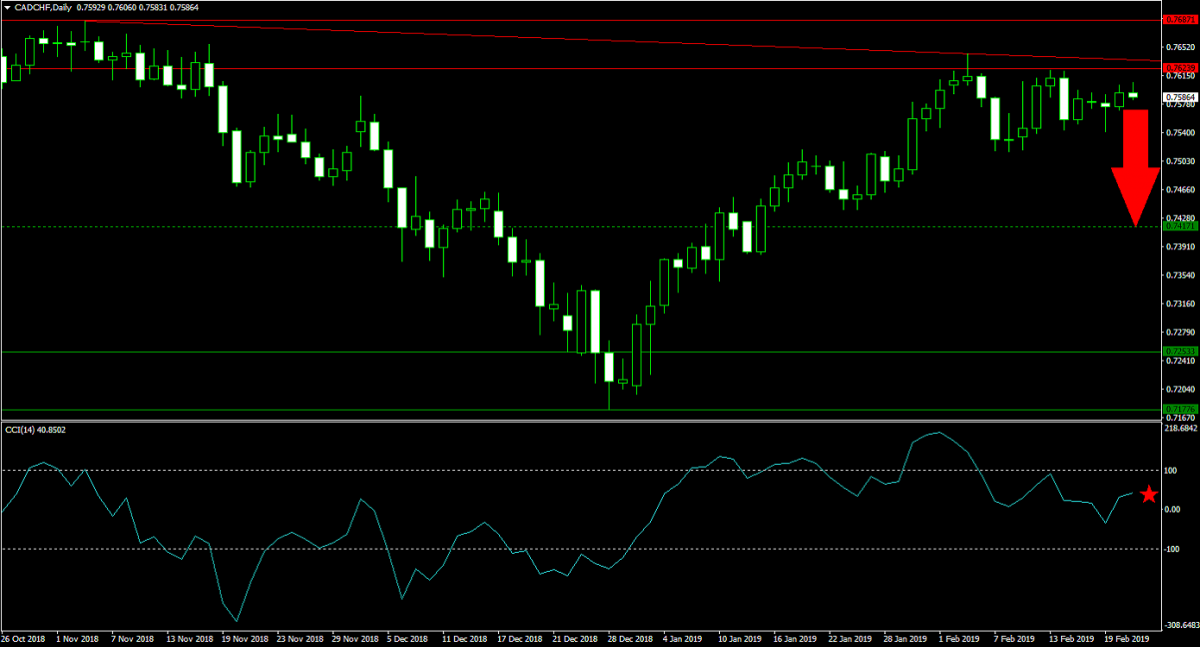

Forex Profit Set-Up #3; Sell CADCHF - D1 Time-Frame

The CADCHF already passed its peak bullish momentum after price action briefly pierced above the lower band of its horizontal resistance area. As this currency pair started to retreat, its primary descending resistance level increased bearish momentum which is now anticipated to push the CADCHF back into its next horizontal support level. The Canadian Dollar is faced with pressures in the commodity sector while the Swiss Franc may enjoy inflows from forex traders who seek a safe haven currency. Selling the rallies into its primary descending resistance level is favored.

The CCI has completed a breakdown from extreme overbought territory and momentum is on track to force a bearish momentum change which a move below the 0 mark. This may further increase selling pressure in this currency pair. Subscribe to the PaxForex Daily Forex Technical Analysis and copy the recommended trades from our expert analysts into your own trading account!

To receive new articles instantly Subscribe to updates.