At the height of the global financial crisis, major central banks moved in unison. Interest rate cuts to record low levels, in some cases even the experiment with negative interest rates, were common across the board. In addition most central banks, led by the US Federal Reserve, The European Central Bank, Bank of England and the Bank of Japan, embarked on a mission of quantitative easing in order to buy the global economy time to heal. The ultimate goal was to bridge the time until the economy can grow on its own. Inflation was absent and ignored and over the past decade global financial markets were kept alive in an artificially boosted environment.

Trading interest rate differentials plays a major role to many forex traders and as global central banks are slowly reversing a decade long period of lose monetary policy, interest rates may finally matter once again. The US Federal Reserve was the first to cut and now is the first to reverse with two interest rate increases in 2018 to date. The Bank of England may hike rates at least one time this year and the ECB communicated an end to its massive bond buying program by the end of this year. The Bank of Japan and the People’s Bank of China will continue down the path of lose monetary policy.

Central banks in Argentina and Turkey are leading emerging market action with an aggressive stance towards a tight monetary policy. Inflation is creeping up, unemployment rates decreased and economies are expanding. This puts central banks back in play and many forex traders look forward to the trading opportunities which will be created as a result. Swap rates will also play a larger role when executing and maintaining a forex trading strategy. Over the next 18 month’s, all G-7 central banks are expected to increase interest rates with the exception being the Bank of Japan.

Are you ready to profit from the trading opportunities which will arise as a result of central bank actions? While the G-7 will once again move unilateral, BRICS will provide a more interesting mix with the PBOC and South African Reserve Banks expected to leave its monetary policy in place, the central banks of Brazil and India set to raise interest rates and the Bank of Russia predicted to cut its interest rate. Open your PaxForex Trading Account now and join our growing family of profitable forex traders.

Looking towards emerging markets, MINT should be on every forex traders radar screen. The Banco de Mexico is on course to decrease interest rates and the central banks in Turkey and Nigeria are expected to follow suit. The Bank Indonesia is predicted to tighten monetary policy. While Argentina is widely expected to lower interest rates from it current rate of 40.00%, South Korea, Australia, Saudi Arabia and New Zealand are all on course for interest rate increases. The Sveriges Riksbank is likely to be the first central bank amongst those with negative interest rates to hike it back into positive territory. Switzerland and Norway are also predicted to normalize its monetary policy. The global central bank outlook paints an interesting picture over the next 18 months and here are three forex traders worth considering as a result.

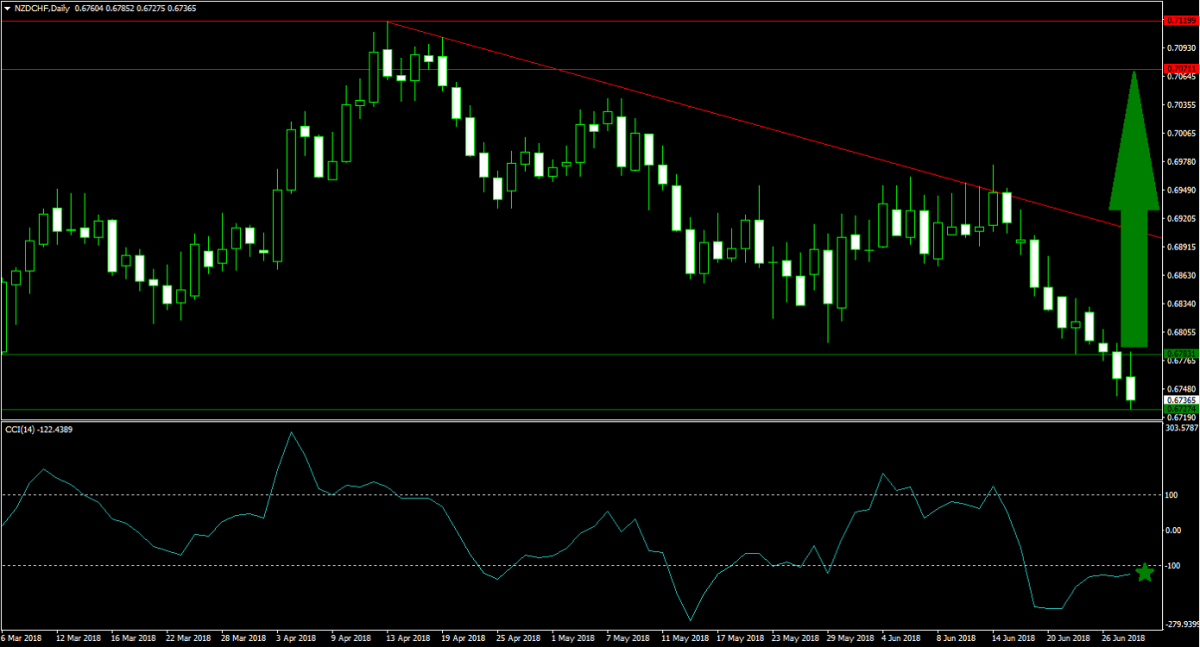

Forex Profit Set-Up #1; Buy NZDCHF - D1 Time-Frame

While both central banks are expected to increase interest rates, the Swiss National Bank will continue to leave its key interest rate in negative territory. This will favor the New Zealand Dollar over the Swiss Franc from an interest rate perspective. From a technical trading point, the NZDCHF is currently trading at a very strong horizontal support area. Forex traders should position their portfolio for a breakout in this currency pair. Momentum may also suffice to push the NZDCHF above its descending resistance level and back into its horizontal resistance area.

The CCI is trading in extreme oversold territory, but is well off of its lows. This led to the formation of a positive divergence which represents a very bullish trading signal. Subscribe to the PaxForex Daily Fundamental Analysis and receive each trading day’s most relevant fundamental trading set-ups. Earn over 500 pips per month simply by following our recommended forex trades.

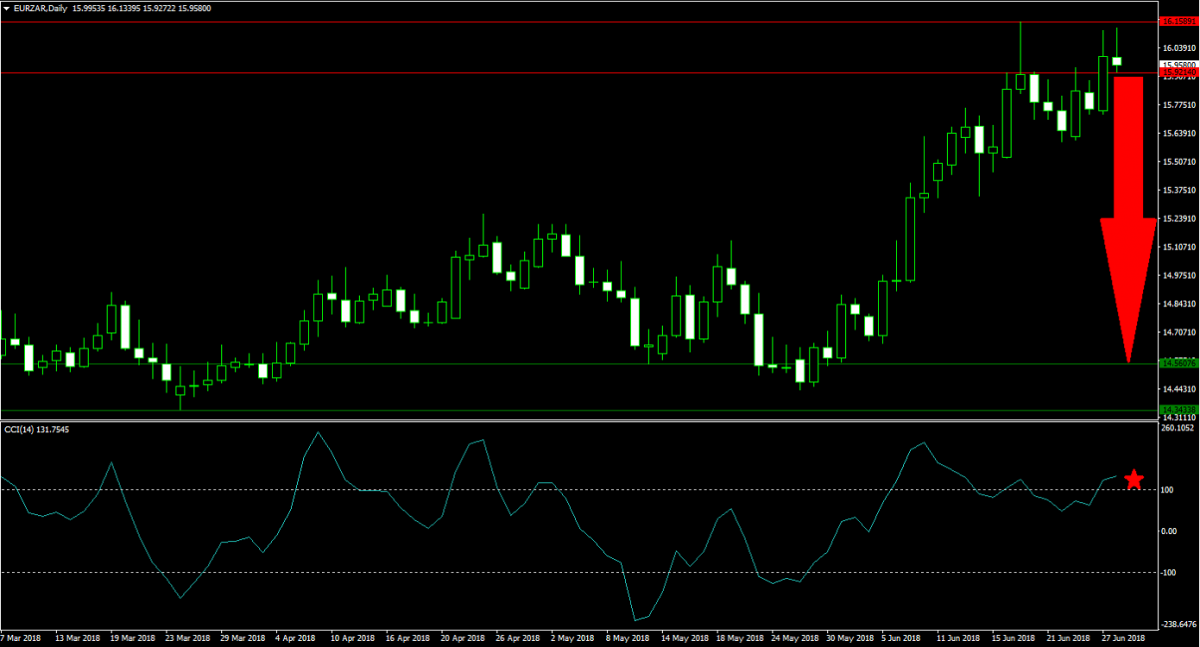

Forex Profit Set-Up #2; Sell EURZAR - D1 Time-Frame

A strong advance took the EURZAR from its horizontal support area into its horizontal resistance area. Momentum was not strong enough to push this currency pair higher and breakdown materialized. This was followed by a bounce and price action is now located back inside of its horizontal resistance area from where bullish momentum is retreating. The EURZAR is expected to complete another breakdown and forex traders are advised to place their sell orders above and below the lower band of its horizontal resistance area.

The CCI has formed a negative divergence in extreme overbought conditions which creates the final bearish trading signal for this currency pair. A breakdown below the 100 mark is further anticipated to attract sell orders. Download your PaxForex MT4 Trading Platform now and enter this trade to your portfolio before price action will accelerate to the downside.

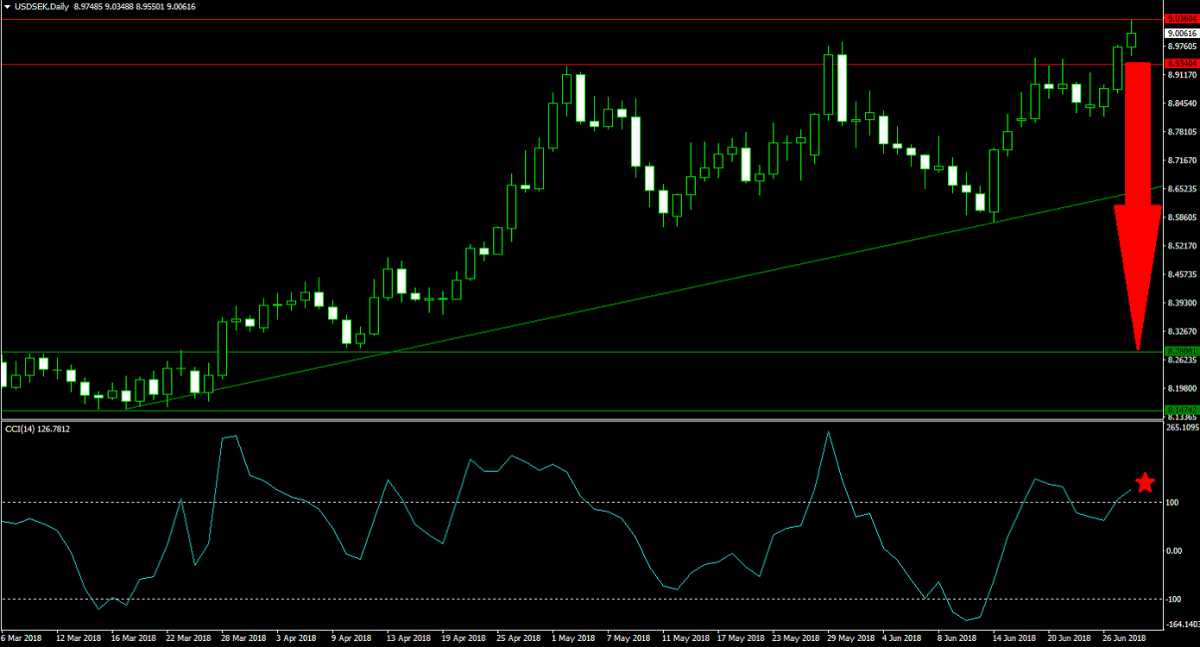

Forex Profit Set-Up #3; Sell USDSEK - D1 Time-Frame

Following a solid advance which was supported by an ascending support level, the USDSEK is once again challenging its horizontal resistance area. The previous two attempts were rebuked and price action reversed. The chances for a third rejection are high as this trade carries limited upside potential from current levels with very attractive downside potential. Forex traders are recommended to spread their sell orders inside the horizontal resistance area.

The CCI is trading in extreme overbought territory where a negative divergence formed. This completes the bearish trading scenario for the USDSEK. Follow the PaxForex Daily Forex Technical Analysis in never miss our technical trading recommendations which are posted by our expert analysts who work tirelessly in order to deliver the most profitable trading set-ups.

To receive new articles instantly Subscribe to updates.