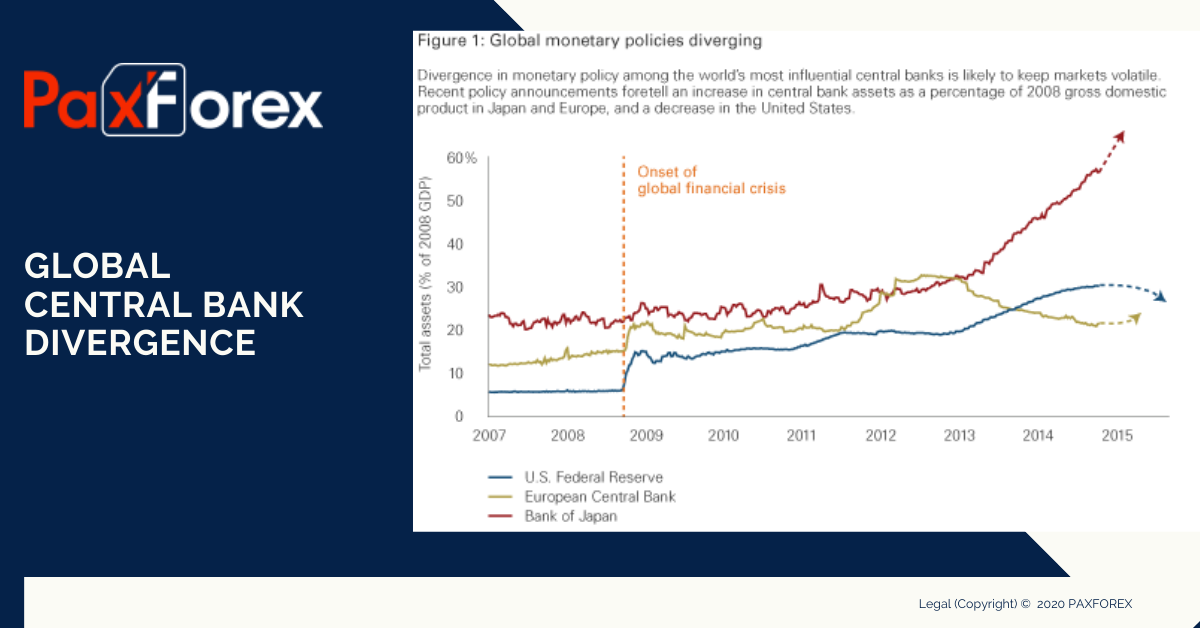

Price action across the forex market is getting more exciting as global central banks are diverging on their monetary policies which ends a decade of universal loose monetary policy. Quantitative easing and ultra-low interest rates have guided the world economy from its last global financial crisis and the Great Recession into what is now expected to become the next global recession. This has started to attract more economists and analysts to question the long-term impact of quantitative easing and how global central banks will react as the next recession is on the horizon, especially with a depleted arsenal at their disposal.

The US Fed yesterday cleared that path to cut interest rates as soon as their next policy meeting, in a full reversal of their 2018 policy and a Trump victory. The key was the removal of the word “patient” from the released statement, a move the markets expected. This was intended in order to await the outcome of the scheduled meeting between US President Trump and Chinese President Xi on the sidelines of the G-20 summit in Japan at the end of June. It is widely expected that no trade deal will be signed which would clear the way for a 25 basis point interest rate cut by the Fed in July. The US Dollar came under pressure which is anticipated to extend and how to trade forex in this new environment is now being analyzed across the globe.

After the Fed statement, bond yields plunged and Gold extended its gains. The US central bank will have the ECB on its side when its comes to a renewed round of quantitative easing. Luis de Guindos, the Vice President of the ECB, communicated that “We expect inflation to continue decelerating in the coming months. Risks are clearly biased downward, and if there is an additional deterioration of perspectives, the ECB is prepared to act.” Olli Rehn, a ECB Governing Council member, added that “We will consider the whole range of measures within our toolbox in our forthcoming meetings.” The Euro came under selling pressure since last Thursday when ECB President Mario Draghi opened the door to more monetary easing.

Is your forex investment configured to profit from the emerging global central bank divergence? With the US Dollar and the Euro under pressure from their respective central bank’s easy monetary policy and new stimulus plans, which currencies are set to benefit the most? Open your PaxForex Trading Account now and create a market beating portfolio with the help of our expert analysts!

On the other side sits the Norwegian central bank, the Norges Bank, which increased interest rates for a third time since last September and announced more are on the way. Even the Bank of England is preparing a more hawkish monetary policy, often ignored by the markets who believe the British central bank only focuses on Brexit and will cut interest rates. As inflation has picked up in the British economy and with commentary from MPC members stating that their mandate is not Brexit, a 25 basis point hike could be delivered much sooner that currently priced in. Emerging market central banks are also diverging with some following the US into interest rate cuts, such as Indonesia, while others favor to remain on the sidelines, such as the Philippines. Then there is the mother of all QE central banks, the Bank of Japan, which is waking up to a country which dislikes its easy monetary policy in place for two decades. Global central bank divergence will only accelerate, and here are three forex trades to accelerate your profits!

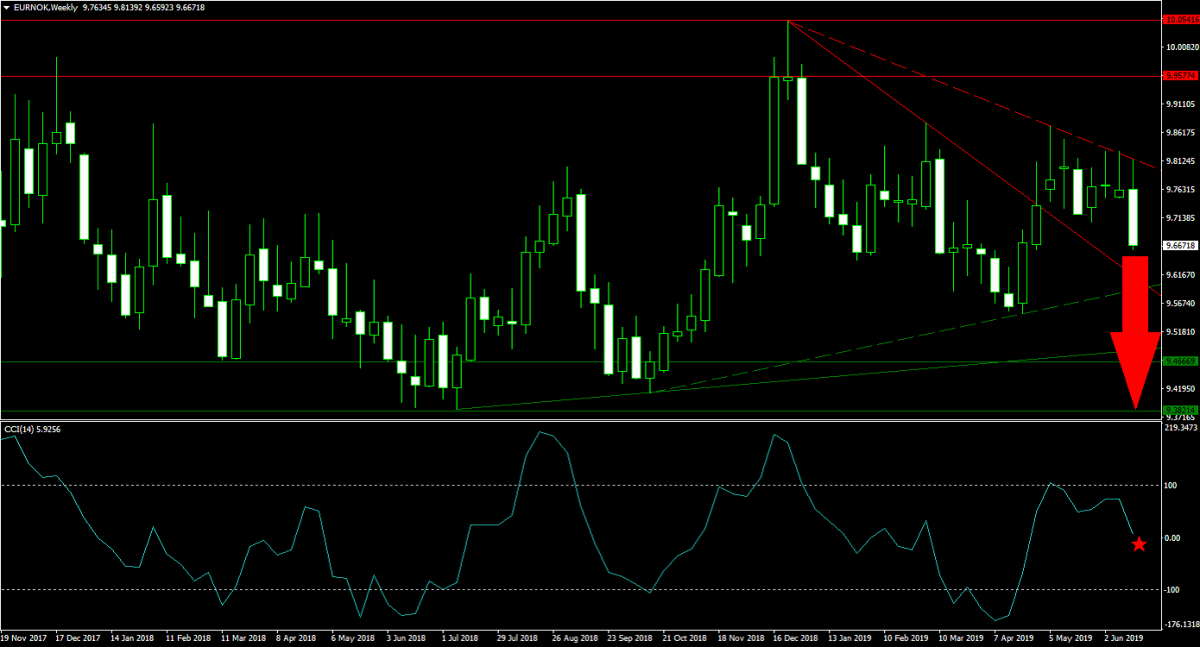

Forex Profit Set-Up #1; Sell EURNOK - W1 Time-Frame

The ECB is poised to introduce more stimulus as its economy is slowing down and inflationary pressures are absent. At the same time the Norges Bank is hiking interest rates and will continue to do so. This will continue to push the EURNOK to the downside. Price action is currently trading above its primary descending resistance level, which now acts as temporary support, and below its secondary descending resistance level. This formation is anticipated to guide the EURNOK back down into its horizontal support area and forex traders are recommended to sell and rallies in this currency pair up into its secondary descending resistance level.

The CCI briefly spiked into extreme overbought conditions, but has since reversed course and is now on track to complete a bearish momentum crossover with a move below the 0 mark. This is likely to attract the next wave of sell orders. Download your PaxForex MT4 Trading Platform today and join our fast growing community of profitable forex traders.

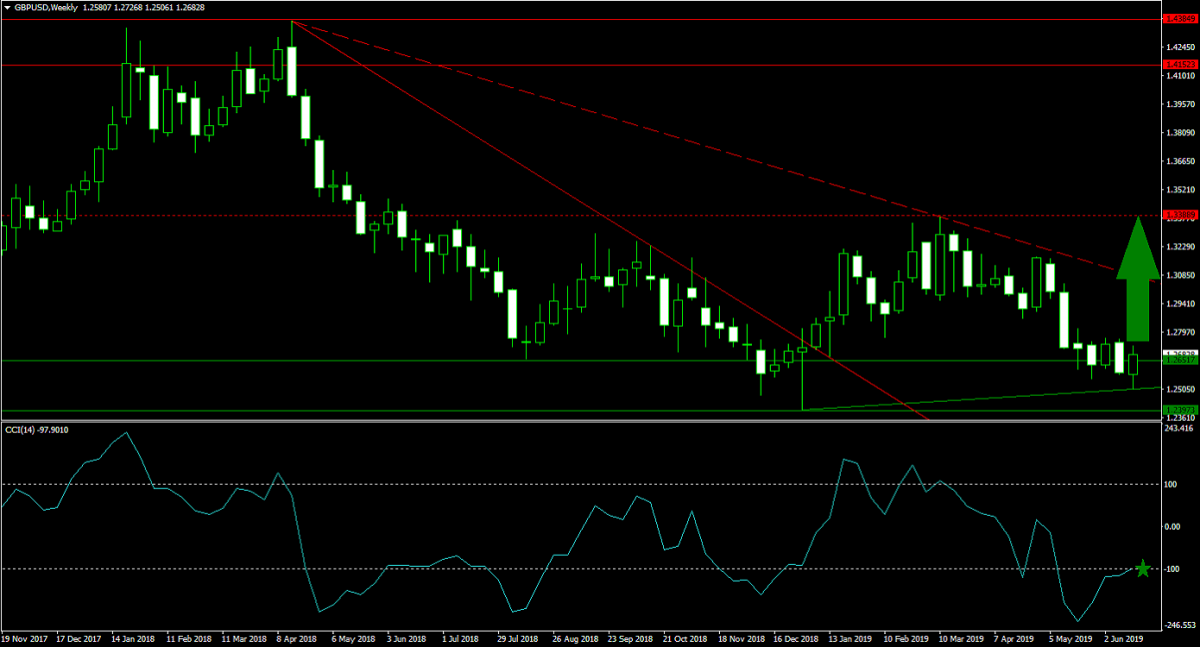

Forex Profit Set-Up #2; Buy GBPUSD - W1 Time-Frame

With the US Fed in reversal mode which could come with up to four interest rate cuts and the Bank of England focused on inflationary pressures, the GBPUSD is poised for an advance. Price action recorded a higher low in a strong bullish signal which pushed this currency pair back above its horizontal support area. The prospects of an interest rate increase by the Bank of England are on the rise which has resulted in a rise in bullish momentum. Th GBPUSD is expected to accelerate to the upside until it can test its next horizontal resistance level, a breakout above its secondary descending resistance level will precede this moth. Buying any dips in price action down to the lower band of its horizontal support area remains the favored trading approach.

The CCI has just pushed out of extreme oversold territory which is further increasing bids in this currency pair. A short-covering rally is anticipated to provide the next spike higher. Follow the PaxForex Daily Fundamental Analysis and allow out expert analysts to guide you to over 500 pips in monthly profits!

Forex Profit Set-Up #3; Buy CHFJPY - W1 Time-Frame

The Swiss economy is outperforming its peers which has given a boost to the Swiss Franc. As the global economy is slowing down further, the Swiss currency is also attracting a higher volume of safe haven bids and competes against the Japanese Yen in this space. Price action in the CHFJPY has already bounced off of the upper band of its horizontal support area and momentum pushed this currency pair above its primary ascending support level. The path is now clear for an extension of the advance until the CHFJPY can test the strength of its next horizontal resistance level. Forex traders are advised to buy and dips in price action down into its secondary descending resistance level.

The CCI exited extreme oversold territory and this momentum indicator is now expected to move higher until it can complete a bullish momentum crossover. This is favored to push price action higher. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own forex trading account!