- Why Do You Need A Trading Strategy

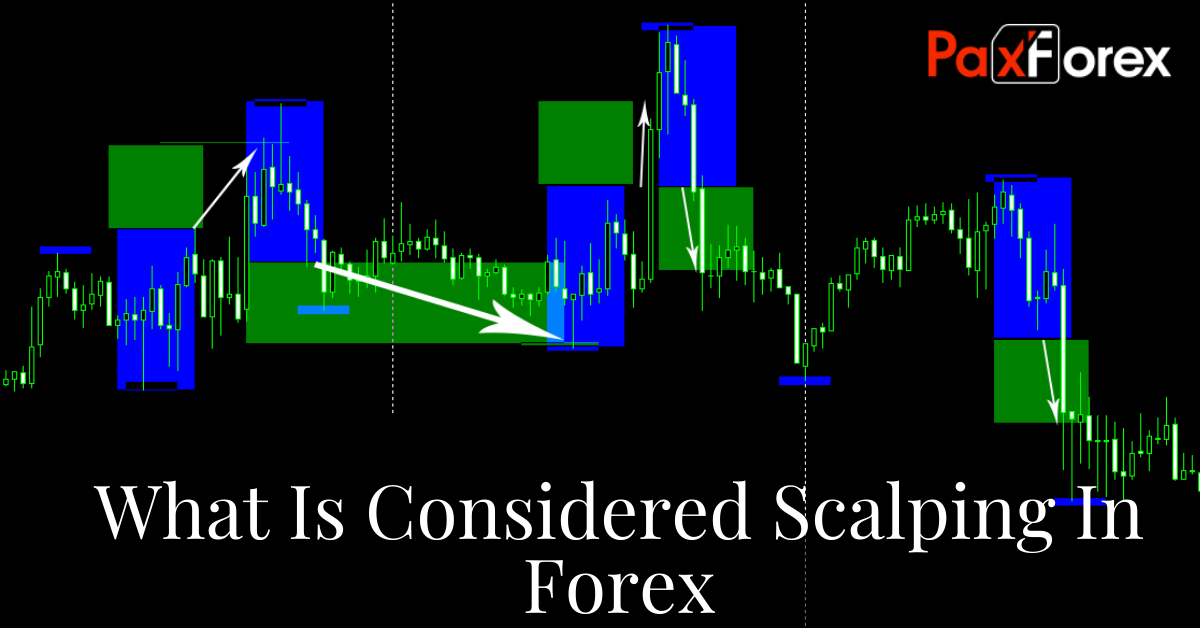

- What Is Considered Scalping In Forex

- Key Qualities Of Successful Forex Scalpers

- Advantages of scalping strategies

- Disadvantages of scalping strategies

- Scalping Strategies for Forex Trading

- Best Tools For Forex Scalping

- 5 pro tips for Forex scalpers

- Practice Scalping for Free in Demo

- Profitable Forex Scalping: Final Thoughts

Why learn about Forex scalping? How can such a simple strategy become a ticket to success? We say - easily. Let’s talk about that.

There are nearly 10 million active Forex traders around the world. And each and single one of them have a different view of the foreign exchange scene, different expectations and different preferences in terms of the trading process. While some focus on studying politics and economics of major governments, others crack the numbers and build multi-layer algorithms.

Many approaches - same goal. We enter the Forex market to gain profit by exchanging currencies among each other. What’s more, a profitable currency exchange market career is no longer a myth. A lot of successful traders gladly share their success stories, tips and thoughts. It is simply unwise to ignore the informational load and with it an opportunity to make Forex your source of income.

But having this ocean of data before our eyes can definitely be overwhelming. That is why we like to take a one step at a time approach and go over every major topic in the fullest detail, providing helpful suggestions and solutions along the way.

Today our focus lays around Forex scalping strategies. This method of trading keeps gaining popularity and has the highest count of devoted followers. To fully understand how does it work and what does one need to become a successful Forex scalper, we will discuss the following:

Why is it important to choose your trading strategy early on

What is considered scalping in Forex

Who are Forex scalpers and how to become one

Advantages and disadvantages of scalping Forex

Forex scalping strategies that actually work

Tools for convenient and profitable scalping of the market

Pro tips for scalping beginners

Let’s begin!

Why Do You Need A Trading Strategy

First things first - every successful trader has a strategy. Despite the common misconception of Forex being a place where luck plays a big role, the most profitable traders will actually tell you the opposite. Forex is not a casino. It is a complex financial platform with a variety of contributing factors.

On one hand the significance of the foreign exchange market can seem like a lot to take in. But on the other hand, with the right choice of attitude and systematic approach - every trading strategy can be mastered. Having a structured trading method serves many purposes, including these five:

Consistency is key. The money market runs in patterns. And more often than not these patterns repeat themselves over and over again. For traders this means that sticking to the same path of action will benefit more than jumping from place to place trying to catch the right moment.

Stress reduction. Everyone knows that trading is a stressful process. However, if you choose a specific set of steps to follow, it will give you a peace of mind, simply because you have a clear instruction for all scenarios. This virtually eliminates any reason to panic and allows the trader to keep thinking clearly throughout the entire process.

Risk management. A good strategy always involves the implementation of one or several risk management techniques. Being aware of the risks you are taking and planning the trading process accordingly is the smartest approach to money management. Additionally, by covering all fronts with the assistance from risk management practices, you can contribute the time you would otherwise spend worrying to something more productive.

Selection of choices. We have already mentioned that different traders have different styles of dealing with the foreign exchange market. This means that a new trader has a wide spread of options when it comes to choosing a trading method. Plus, after you have gained some experience at the market, you can go ahead and create your very own strategy which will be specific to your individual needs and preferences.

Time and effort efficiency. When you know exactly how you will act, you save yourself a ton of time. The longer you stick to the same strategy, the better you will become at using the supporting tools, involved in the process. And don’t forget about the most rewarding type of motivation - the financial profit that usually comes as a result of organized and thought-through trading.

As you can see having a specific trading strategy is a win-win on so many levels. You can learn more about other trading strategies in our blog. For now, let’s focus on the main topic today - Forex scalping trading methods.

What Is Considered Scalping In Forex

Trading strategies can vary in many aspects. One of the basics, however, is always the length of each trade. The longest type of trading is the investment style, when a single position can remain open for weeks and even months. In this case a trader purchases an asset and forecasts that its value will significantly rise over the long period of time. After the asset in question reaches the desired value - investor proceeds to sell the entire possession or just a part of it to benefit from the difference in price.

One tier down is swing trading - a strategy, during which traders try to outline short segments of larger trends and benefit from the difference between the extreme price points in those segments. Swing trading is a very popular approach for new traders, as it balances in the segment of less fast-paced environment strategies, compared to more rapid methods, but still has plenty of dynamic, when compared to any long-term strategy.

Then there is day trading. Day traders tend to only have their positions open within one day, hence the name. There are two main reasons why this strategy is popular: it is fast-paced and does not require too much time for trading and the day traders are not subjected to swap fees. Swaps are charged on the account when the position is carried over to the next day. Often for long-term investors and swing traders the accumulated swaps results in the significant withdrawal from their account. And the day traders are not concerned about it at all.

Last but not least, we have scalping - the practice of shaving off the mere pips from the chart with the ultimate goal of adding up the small profits into one big gain. Forex scalpers focus on tiny rewards, which means their positions sometimes only live for several minutes up to an hour. At the end of the day the profit usually gathers into a certain amount, however it will usually be more visible after a longer period of time, such as a week.

Even considering its very straightforward nature, scalping on Forex is not for everyone. Next we will talk about the qualities of a trader who is fit to become a scalper.

Key Qualities Of Successful Forex Scalpers

Scalping is the fastest moving strategy type and this means that it can be pretty nerve-wrecking. Before considering becoming a profitable Forex scalper, a trader should begin by testing their skills in a less hectic environment, such as swing trading, for instance. And after you gain some knowledge about how the market operates in general, how the charts tend to act and what tools are there to assist you during the trading process, feel free to try out scalping methods and see if this type of trading is for you. As a general rule a productive Forex scalper will match these criteria:

Impeccable attention to detail. Since scalping normally takes place on the smallest timeframes - traders have to pay very close attention to each element on the chart. The necessary move on the graph can occur in a matter of seconds and the action needs to be taken immediately.

Ability to control emotions. Scalpers have to stay as cold minded and as concentrated as possible at all times. Chasing your greed can lead to a very unfortunate outcome. That is why traders who choose fast-paced strategies should master the art of letting go and breathing through heated situations.

Patience. Winning a profit worth several pips a day is already a win, but it will definitely be some time before the account balance is going to visibly reflect those many victories. If you are more of an everything at once kind of person - scalping might not feel too great. However, if you adopt a more philosophical approach and mentally celebrate every victory disregarding its size - you will become one of the greatest scalpers.

Considering all the above, it would make sense to spend the next couple of moments specifically on the advantages and disadvantages of Forex scalping methods.

Advantages of scalping strategies

Scalping would not be so popular if it didn’t have several strong advantages over other trading approaches. Considering both ups and downs is very important to the selection process of the right trading method. Let’s start with what makes scalping one of the greatest Forex trading styles:

It requires a minimal amount of time. While for some trading is a full time job, for others it can simply be a side hustle or even just a hobby. With commitments to work, school, family, friends and others, finding the appropriate amount of time to analyze the market and trade can be tricky. In scalping, the actual trading part takes up literal minutes and the analysis can also be considered minimal, since the traders only have to work with one or two timeframes. This makes it a great choice for anyone who does not have a lot of time for trading currencies.

It’s very technical. Fundamental factors usually play a pretty big role in the formation of the price, but they rarely affect small price fluctuations. Scalpers profit off a specific characteristic of the market. This characteristic can often be referred to as “noise” by the longer term traders. So, a scalper can easily survive with a very basic set of technical analysis tools and not worry about politics and economics too much. With that said, it is also important to mention that looking over to the big picture from time to time can benefit all types of traders, including the scalpers. Knowing what is happening at the market in general can help aim for larger profits.

It’s exciting. The truth is, getting fast results sounds good to anyone. And watching the trophy reward contribute into your account after only spending several minutes trading is a whole other level of trading high. The traders, who have mastered scalping, often say that they cannot picture having to wait for a long trend to play out, locking their eyes to the monitor for days and spending hours on analysis. The truth is - they don’t really have to do any of these, as they are perfectly fine gathering a reward after a reward, even if they seem insignificant individually.

It’s really popular. The fact that so many traders are devoted to scalping as their main trading style means two things. Firstly it means that scalping actually works. And secondly - the amount of strategy followers also contributes to the fact that the discussion of most effective tools and approaches to scalping always remains open. For the trader it will mean endless sources of information, tutorials, contests, signals and more. As long as you have checked your info source in regards of trustworthiness - you will be getting something new to consider and try out nearly every day.

It’s nearly universal. Scalping works best on major currency pairs, just like any other strategy. However, it is also perfectly applicable to the pairs from any other category. Once again, the reason for the effectiveness is the timeframe - no matter how volatile is the pair and how much attention it’s getting, the chart will still go as it always does: forming a mixture of bullish and bearish elements, one after another. So in the scenario, where you have set your mind on trading an exotic pair but still want to implement scalping strategies - definitely give that idea a go. It might not progress as quickly as with a major pair, but it will still work on some levels.

From all the above we can easily draw to a conclusion that even if scalping method might not exactly work for everyone, it is worth trying. Moreover, traders who usually tend to implement other trading styles can occasionally use scalping techniques to optimize their profits. With that in mind, let’s also consider some of the potential downsides of scalping Forex.

Disadvantages of scalping strategies

If there was a strategy that worked for everyone and did not have any flaws, we wouldn’t have such a variety of trading methods as we have now. But the important thing here is that these so-called disadvantages are not applicable to everyone. Same as with swap charges: day traders avoid them at all costs, but long-term traders nearly disregard them due to the overall success of the trade. This teaches us that the downsides of any trading strategy can be highly subjective and therefore have a number of solutions to be resolved. Here are some of the aspects of scaling that can be considered disadvantages:

The learning process will take time. Although scalping is the fastest trading method out there, learning and mastering the techniques might actually take up some time. In theory, everything is pretty straightforward, but in reality the market can be very volatile and aggressive. The real challenge for a Forex scalper will be to notice the necessary chart formations and have a correct solution for all scenarios in a matter of seconds. Good news here is that everything can be perfected with practice. Later on we will talk about practicing scalping for free and without investing any money.

Spread charges. Spread is the difference between the bid price and the ask price. In simpler words, it can be considered a transactional cost for the trader to place a position. Depending on the type of account you have and on the currency pair you are trading, the spread will vary. Usually, it is just a few pips. However, for scalpers few pips can take up a good portion of their winnings. The general rule to solve this is to set your target reward at least twice as big as your spread charge. Alternatively, consider switching to the trading account type that offers lower spread charges.

Go big or go home. To see big results from scalping, you will need to invest accordingly. Scalping will not grow $100 into $10,000, but it can easily help you achieve $5,000 from $1,000. Obviously, not everyone is considering an option to enter the market with a big load from the very start. And it is actually wise. Start small and work out all the imperfections of your trading skills, then consider gaining larger capital using a different strategy or invest additional funds to go into scalping right away. You could also consider using leverage from the broker, one of the helpful tools for scalping strategies, which we will discuss further on.

As you can see, none of the disadvantages described here are catastrophic. But it is still important to keep in mind that you have to be absolutely comfortable with the trading method you adopt in order to become successful in it. If any of the three cons seem like they would make your trading journey unpleasant - don’t worry as there are still so many strategies and techniques to choose from.

Next let’s talk about some of the trading strategies for scalping Forex that in our opinion deserve the most attention.

Scalping Strategies for Forex Trading

There are several dozen existing scalping strategies that are commonly used. And the number of individual strategies for escaping, created by traders, cannot even be estimated. Here we have gathered the guidelines for three most common scalping strategies that you can either use as is or turn them into an element of your own strategy. There are no particular rules on Forex when it comes to organizing your trading process, as long as the trader is profitable and comfortable.

The main difference between the below listed strategies are the tools used in the process. Every strategy dictates the usage of a particular set of technical indicators. The indicators are irreplaceable in trading and it is always a good idea to get to know how most of them work. Without any further ado, here are the most attention worthy scalping strategies for Forex:

Bollinger Bands scalping

Instruments: major pairs, mainly USD/EUR, GBP/USD and GBP/JPY

Timeframe: 5 minutes

Trading sessions: New York and London

Indicators used: Bollinger Bands on default setting

Bollinger Bands (BB) are an incredibly helpful volatility indicator. They are positioned above and below the traditional Moving Average and widen and narrow according to the levels of volatility.

To buy (go long) using this strategy the BB have to incline and the position can be open when the price value reaches the middle band from top. Stop loss can be set either at the lower band or at 15 pips, whichever occurs first, while take profit will be set at the upper band.

To sell (go short), wait for the BB to decline and open a position when the price reaches the middle band from below. Stop loss is set at the top band or at 15 pips, whichever occurs first. Take profits is set at the lower band.

A good idea for this strategy is to complement it with the Moving Average Convergence Divergence (MACD) indicator to predict the moment when the price will reverse.

1 minute scalping strategy

Instruments: all pairs

Timeframe: 1 minute

Trading sessions: New York and London

Indicators used: Exponential Moving Average 50, 100, Stochastic 5, 3, 3

Exponential Moving Average (EMA) is a slightly advanced version of the simple MA and the Stochastic is there to measure the momentum. To see everything at its clearest, it might be a good idea to give different colors to both EMAs.

To open a long position wait for the moment when 50 EMA passes the 100 EMA and the Stochastic gets higher than the 20 level. Stop loss is normally set 2 pips under the previous low of the current swing and take profit may range between 6 and 12 pips from the entry point, depending on the instruments.

To go short wait for 50 EMA to go under the 100 EMA and the Stochastic to go below the 80 level. Stop loss is set 2 pips above the previous high of the current swing and take profit is once again between 6 and 12 pips from the entry price, depending on the instrument.

Trend following freestyle

Instruments: major pairs

Timeframe: 5 minutes or 15 minutes

Trading sessions: any

Indicators used: Laguerre Filter, Color RSI 53, 47, QQE, MA 3

Going long is simple, but requires the combination of all the following: the price candle has closed above the Laguerre line, the Color RSI is blue and located higher than 53 and QQE (Qualitative Quantitative Estimation) crossed the horizontal black line at 50 from above. Stop loss is chosen with consideration of the instrument and the spread, take profit is set between 10 and 15 pips from the entry price.

And going short is pretty much the opposite to the above: the price candle has closed below the Laguerre line, the color RSI is red and located below 53 and QQE has crossed the black line at 50 from below. Stop loss is chosen with consideration of the instrument and the spread, take profit is set between 10 and 15 pips from the entry price.

The main perk of this approach is flexibility in terms of the exit points as it is based on following an overall trend. If the trader feels like keeping a position open a little while longer, they are absolutely free to do so, as long as all of the risk management practices are in place.

Now that we know how scalping strategies look in action, it is time to discuss some of the instruments that the traders will use in the process. The following segment will briefly go over the absolute necessities for any successful scalper as well as some optional supporting tools that might come in handy in the process.

Best Tools For Forex Scalping

As always, the first tool that immediately comes to mind when we discuss online currency trading is the trading platform. Trading platforms allow traders to perform analysis, observe the market and trade. Choosing the right platform is crucial to a successful experience, however it is not very tricky. The broker you are working will automatically supply you with the link to download their preferable platform. In most cases that platform is Metatrader 4 (MT4 for short).

MT4 is both highly functional and easy to use. It includes all the necessary tools and set-ups by default and easily allows adding various plug-ins and algorithms, such as automated trading robots, for example. You can adjust the set up to fit you better and experiment with quick buttons and charts to optimize the trading process.

Metatrader also offers a very wide selection of technical indicators. To better understand the function of each one of them you could neither read an indicator guide or actually try them one by one while trading or in the demo account. Different indicators are designed to detect, confirm, predict and measure trends, and they are virtually irreplaceable when it comes to technical analysis of the Forex market. From above, you already know that the indicators often used for scalping are MA, EMA, MACD, BB, RSI and Stochastic. However, you should not feel limited by the specific set of indicators, described above. Once you become comfortable with the way charts form, you will most likely select several indicators that work great for you specifically, disregarding their popularity.

Leverage is definitely another tool that is worth mentioning. Brokers provide their clients with leverage to help them achieve visible results faster and trade on higher levels. Using the leverage can benefit anyone, but the scalpers are the ones who would use it the most. That is mostly due to the fact that each profit from scalping is not as significant in terms of quantity. And the only way to achieve large outcomes sooner is by increasing the invested amount. Leverage is a good option to increase the traded amounts in those cases when trader is either not able to invest more or wishes to operate with higher amounts to maximize the profits.

Other tools for scalping might include automated trading robots, trustworthy signal sources, provided by the broker, note taking software that can be used for documenting the results of all trades and more. Choosing the correct tool set largely depends on the trading style, the amount of trades that are being processed, availability and the learning preferences of the trader.

Let’s continue by going over some of the tips that can be used by scalpers, both professionals and beginners.

5 pro tips for Forex scalpers

Here are 5 tips for traders who chose scalping as their primary strategy. It is important to note that although we are looking at these suggestions from the scalping perspective, some of them can easily be applied to any other trading method.

Choose the right pair. We have briefly mentioned that the best pairs to scalp are the major ones, since they are the most volatile. However, choosing your trading instruments also depends on the factors like the physical location of the trader, the knowledge of the certain currency and the comfort level of trading with the pair in question. At first, everyone should start with one of the major pairs, such as USD/EUR, but as you look for additional instruments to widen your portfolio - choose wisely.

Consider the time. For scalpers the best time to trade is when the volume is high. This results in both high volatility and lower spread costs. Usually the market is the most active during the opens and closes of the London and New York markets, however for some pairs, the open of Tokyo is also very important. The best way to figure out when to trade Forex is by observing the market and spotting the areas of the most activity.

Practice discipline. All Forex trading strategies require consistency, but for scalpers an ability to control emotions and act in accordance with the plan can be vital. Remember that the skill of keeping the head cold will not come overnight. Start by learning to accept failures. Whether it is a minor setback or a significant wrong move - it is all part of the process and the only way to act is to evaluate the outcome and move on. Follow the steps of your strategy religiously - if your goal per trade is 10 pips, it should always stay this way, even if the market promises you a 100 instead of 10. And when the conditions do not seem very suitable for scalping - consider taking a break from trading and come back later.

Stay mobile. It is always a good idea to download the smartphone version of your platform to have access to the market anywhere at any time. Scalpers sometimes process over 50 trades per day, but this doesn’t mean that they have to stay chained to their PC throughout the day. Having an MT4 app will allow you to move around freely, while still having an option to access your trading account and process the required trade at any time.

Choose the right trading account. Trading accounts vary on the size of the lots that are being traded as well as on the spread charges and additional services. Get to know all of the trading account options offered by your broker and open the one that fits you the most. Feel free to start small as you can always upgrade later on. Once again the most important things are profits and comfort.

Just before we wrap up, let’s talk about a special type of trading accounts. This account type allows traders to study the market and practice all possible strategies completely risk free and without depositing actual money.

Practice Scalping for Free in Demo

Demo accounts are ideal for anyone who is just starting to trade currencies. They are exact copies of live trading accounts, including all the settings, every tool, ability to open and close positions and even the real time price quotations for all currencies. Traders can use their initial capital to trade and watch it grow or decrease based on the decisions they make. In demo everything happens in simulation mode, which means that anything that happens to your virtual account balance will not reflect any actual gains or losses.

On one hand it is upsetting that the effort you put into practice does not reflect on your profit, but on the other hand it also means that no money is risked in the process. The knowledge you gain through demo trading is, however, priceless and can be applied to the real market conditions to gain actual rewards.

Opening a demo account is free and it can be used for as long as needed. Forex scalpers should definitely consider starting to trade in demo first, in order to work out all of the aspects of the chosen trading approach, come up with their own tricks on trading the specific currencies and come up with a whole new strategy that will fit them personally.

Additionally, the market pros can always come back to demo in case they would like to test out a new strategy or switch their trading style altogether. Demonstration trading is also widely used for educational purposes, such as tutorials and contests among beginners, hosted by experienced traders. Try a demo account today to get the right idea of what currency trading is all about and learn to conquer the market both risk free and stress free.

Profitable Forex Scalping: Final Thoughts

Becoming a Forex scalper is not an easy task. So many factors need to be considered and so many techniques learned. However, this does not stop literal millions of traders from using this approach effectively on a daily basis. Take your sweet time learning as much as you can and applying the newly obtained knowledge first in demo and then on the actual market. With the right amount of patience and consistency - anything is possible.