US President Trump delivered fresh sanctions against Iran after the downing of a US spy drone. In an effort to annoy Iran, the sanctions include Iranian Supreme Leader Ayatollah Ali Khamenei as well as eight senior military commanders. Iranian Foreign Minister Javad Zarif will be sanction later this week. US President Trump noted “The supreme leader of Iran is the one who ultimately is responsible for the hostile conduct of the regime.” This has further escalated tensions between the US and Iran which started in 2015 after Trump pulled the US out of the Iran nuclear deal which is supported by China, Russia, the UK, France and Germany. Trump wanted a better deal and has since pushed his aggressive policies in order to force other countries his way.

Trump’s approach has had limited success so far as he is also waging a trade war with China for over a year, applied tariffs and threats of tariffs on allies and uses them together with sanctions to force changes. Oil and Gold prices have surged since the tensions with Iran escalated and after the latest round of sanctions, a diplomatic solution has been pushed further into the distance. The US also revoked special waivers to allies who purchased Iranian oil and has now sanctioned over 1,000 Iranian banks, individuals and other companies in order to choke off the economy and force negotiations. How to trade forex during current developments is a question many traders ask right now.

Abbas Mousavi, spokesman for the Iranian Foreign Ministry, added “The futile sanctions against the Iranian leader and the country’s chief diplomat mean the permanent closure of the diplomatic path with the government of the United States. The Trump government is in the process of destroying all the established international mechanisms for the maintaining global peace and security.” Traders remain nervous as uncertainty is on the rise together with risk for a military confrontation. Last Thursday Trump approved military action against Iranian targets, but halted them last minute.

The increase in geopolitical risk has increased appetite for safe haven currencies like the Japanese Yen and the Swiss Franc. Will this trend continue or should forex traders prepare for a count-trend reversal on the back of a short-covering rally? Open your PaxForex Trading Account today and find out why more and more profitable forex traders call PaxForex their prime forex broker!

As Trump is applying new sanctions, he adds that he is willing to negotiate with Iran. Trump stated “A lot of restraint has been shown by us, a lot of restraint. And that doesn’t mean we are going to show it in the future, but I thought that we want to give this a chance.” While he prefers one-on-one talks, Iranian Ambassador to the UN Majid Takht Ravanchi ruled them out. Iran prefers the UN to organize talks and Ravanchi added “You cannot start dialogue with someone who is threatening you, who is intimidating you.” The global economy is cooling fast, but how will additional tensions disrupt the supply chain and the forex market? Fresh US sanctions against Iran are in effect and here are three forex trades which will allow you to earn from the ripple effects!

Forex Profit Set-Up #1; Buy CADCHF - D1 Time-Frame

The Swiss Franc has enjoyed a strong rally as forex traders loaded up on the currency for its safe haven status as well as the outperformance of the Swiss economy. A short-term reversal on the back of a short-covering rally is expected and the CADCHF is poised to advance. The US-Iran tensions have boosted the commodity prices such as oil and gold which is bullish for the Canadian Dollar. Price action pushed above its horizontal support area today and is now favored to extend its advance above its secondary descending resistance level and back into its next horizontal resistance level. Forex traders are advised to buy any dips in the CADCHF down into the lower band of its horizontal support area.

The CCI continues to trade in extreme oversold territory, but remains well off of its previous low. A move above -100 is expected to provide the next wave of buy orders for this currency pair. Download your PaxForex MT4 Trading Platform and join our fast growing community of profitable forex traders.

Forex Profit Set-Up #2; Buy NZDJPY - D1 Time-Frame

The Japanese Yen, just like the Swiss Franc, has attracted buyers due to its safe haven status. With the Japanese economy struggling and the Bank of Japan weighing more stimulus, profit taking in the Japanese currency is expected. Price action in the NZDJPY is advancing inside of its horizontal support area, further strengthened by its primary ascending support level. This currency pair is now on the verge of pushing above its secondary descending resistance level from where a bigger rally into its primary descending resistance level is anticipated. Buying and dips in the NZDJPY into the lower band of its horizontal support area remains the favored trading approach.

The CCI spiked out of extreme oversold conditions and momentum is strong enough which is driving this technical indicator towards a bullish momentum crossover. A move above 0 will further advance this currency pair. Subscribe to the PaxForex Daily Fundamental Analysis and earn over 500 pips per month with the guidance of our expert analysts!

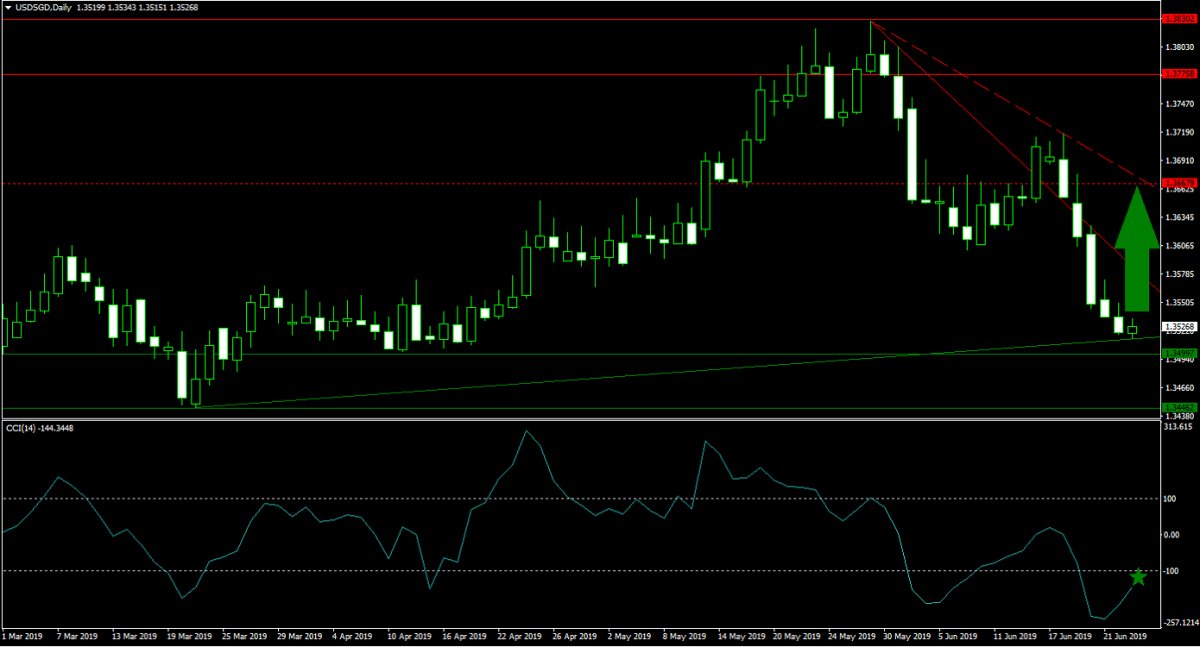

Forex Profit Set-Up #3; Buy USDSGD - D1 Time-Frame

Over the course of the trade war which the US started with China, the US Dollar has defied expectations and joined the Swiss Franc and Japanese Yen as a safe haven trade. With a dovish Fed, this is expected to reverse over the summer but not before a short-covering rally will create the proper conditions. The USDSGD has exhausted its move to the downside and halted its slide just above its horizontal support area. A price action reversal into its next horizontal resistance level is expected which will push the USDSGD above its primary as well as secondary descending resistance levels. Forex traders area recommended to buy and dips down to the lower band of its horizontal support area.

The CCI is trading in extreme oversold territory, but recovering from its new intra-day low. This momentum indicator is now favored to eclipse above the -100 level which will further apply upside pressure on price action. Follow the PaxForex Daily Forex Technical Analysis and simply copy the recommended forex trades into your own account!

To receive new articles instantly Subscribe to updates.