The US is entrenched in a trade war with China and it appears as this could last for years or longer. Some compare it to the start of a new cold war as tensions rise, both economies compete against each other and China is boosting its reach across the globe. This is by far the only trade related conflict the US is currently stirring up. This year in May, the Trump administration withdrew from the Iran accord and asked its allies to do the same. The EU, China and Russia have different plans in order to create legitimate trade with Iran, sidestepping US sanctions.

This move was announced in New York late Monday evening by Federica Mogherini, the EU Foreign Affairs Chief. Inside the EU, France and Germany led the initiative to create a new tool which will allow it to engage into trade with Iran. Mogherini stated that “This will be in accordance with European Union law, and could be opened to other partners in the world.”, and met with officials from the UK, France, Germany, Russia, China and Iran. Trump’s withdrawal from the Iran accord has brought other countries closer together in order to create an alternative solution.

Mogherini further noted that “In practical terms this will mean that EU member states will set up a legal entity to facilitate legitimate financial transactions with Iran, and this will allow European companies to continue trade with Iran.”. The Trump administration is pursuing its “America First” foreign and domestic policy which has alienated long-term allies and forged new alliances which exclude the US. The Euro is expected to benefit as Iranian oil may be settled in Euros under new special purpose vehicles.

The EU has long sought to ensure that the Euro will play a larger role in international markets and present it as an alternative to the US Dollar. The US will reimpose sanctions against Iranian oil exports and Trump has told countries that they need to decide if they want to do business with the US or Iran, but not with both countries. Open your PaxForex Trading Account now and build a market beating portfolio with the help of our expert analysts.

Iran currently exports 26% of its crude oil to China, 23% to India, 20% to the European Union, 11% to South Korea, 7% to Iran and 5% to Japan. The European Investment Bank, EIB, won’t be able to be involved due to its exposure to the US. Heiko Maas, the German Foreign Minister, added that “To keep the deal alive we need concrete solutions so that payment channels can be kept open and trade with Iran remains possible. We’re working hard on this with our European partners.”. Frenemies unite and sidestep US Iran sanctions and here are three forex trades to look at in order to reap the rewards.

Forex Profit Set-Up #1; Buy USDCAD - D1 Time-Frame

The Canadian Dollar is referred to as a commodity currency due to the economy’s heavy dependence on exports and the price of commodities. As Iranian oil will flow, it is expected to pressure oil prices lower and drag the Canadian currency with it. Price action in the USDCAD just pushed above its horizontal support area and is now facing its primary descending resistance level. A breakout is expected to materialize and take the USDCAD back into its next horizontal resistance level which is being intersected by its secondary descending resistance level. Buy orders are recommended in this currency pair.

The CCI moved out of extreme oversold conditions and momentum is likely to carry it above the 0 mark which will result in a bullish momentum change. This support an increase in price action. Download your PaxForex MT4 Trading Platform and fund your PaxForex trading account today. You can even use Bitcoin and Ethereum in order to diversify your digital assets and earn create a new forex revenue stream.

Forex Profit Set-Up #2; Buy AUDCHF - D1 Time-Frame

Another beneficiary of the sidestepping US sanctions against Iran will be the Australian Dollar as it relies more on non-oil commodity exports. The AUDCHF already completed a breakout above its horizontal support area as well as above its secondary descending resistance level. The acceleration in bullish sentiment is anticipated to extend the current advance until the AUDCHF can challenge its next horizontal resistance level, intersected by its primary descending resistance level. Forex traders are recommended to buy the dips.

The CCI reached extreme overbought territory, but remains well off its previous highs. This suggests a further increase in this technical indicator should not be ruled out. Follow the PaxForex Daily Forex Technical Analysis and don’t miss out on profitable trading opportunities which are analyzed every day by our expert analysts. Trade at PaxForex now and join our growing community of profitable forex traders.

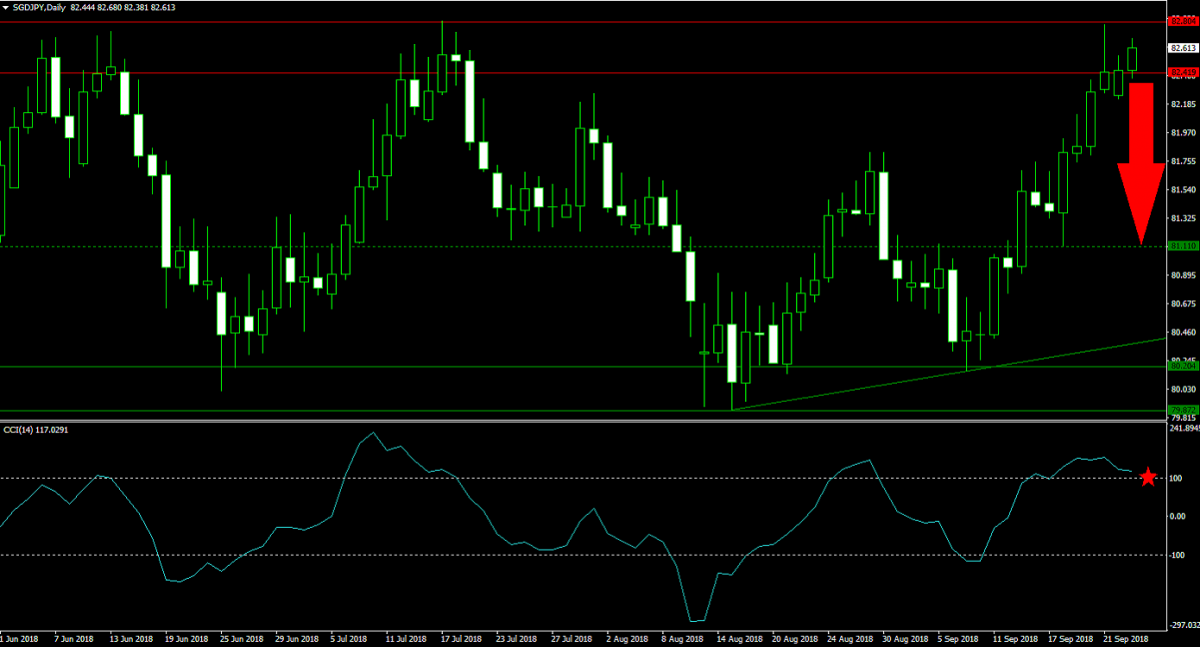

Forex Profit Set-Up #3; Sell SGDJPY - D1 Time-Frame

As uncertainty remains elevated and tensions rise, the Japanese Yen is expected to mount a comeback as a safe haven currency. The SGDJPY has moved into its horizontal resistance area where a price action developed a double top formation, a bearish chart pattern. This currency pair is expected to complete a breakdown from current levels, on the back of profit taking, and accelerate to the downside until it will reach its next horizontal support level. Forex traders are advised to sell the SGDJPY at current levels.

The CCI has peaked in extreme overbought conditions and a move below the 100 level is expected to attract fresh sell orders in this currency pair. Subscribe to the PaxForex Fundamental Analysis and let our expert analysts guide your forex portfolio. PaxForex does the hard work so that you may reap the rewards. Earn over 500 pips per month simply by adding our recommended forex trades into your own portfolio.

To receive new articles instantly Subscribe to updates.