Minutes from the October 31st - November 1st US Federal Reserve meeting were released yesterday evening and the US Dollar as well as US equity markets were slightly disappointed by the overall tone of the text. Market watchers anticipated a more hawkish statement, or one that is in favor of increasing interest rates faster. The dovish tone of the statement, indicating that the market may have to wait longer for interest rates to start normalizing, caught many by surprise which caused a strong sell-off in the US Dollar. Equity markets initially weakened, but managed to close yesterday’s session barely changed.

Some voting members in the FOMC have expressed concerns about the increase in financial markets, while there was also a discussion about how the US central bank should address inflation which has been rather subdued. There is a big divergence with market expectations for inflation as well as where interest rates will be over the next twelve months and where the US Federal Reserve sees them. One of the two has to be wrong and regardless of who is right, there will be a correction until both are on the same page.

He overall view on the economic prospect of the US remained very positive, but a bubbling equity market is viewed as a big risk to the US economy. This would have a ripple effect into the US Dollar which would sell-off severely. The US labor market, manufacturing as well as consumer spending remain supportive of economic expansion. It was noted that if tax reform will be passed that the US economic outlook would brighten, but there are disagreements on inflation as well as the central banks approach to price stability.

PaxForex allows forex traders to operate a profitable forex portfolio regardless if there is an economic expansion or an economic recession. Open your trading account now and earn from the forex market, no matter if interest rates will be increased, remain unchanged or if they will be increased. Stay up-to-date with our fundamental analysis provided by our PaxForex expert analysts.

Financial imbalances are now the main concern for a few members of the FOMC while others fear that the central bank may wait too long to increase interest rates. The US Federal Reserve has an inflation target of 2.0%, but some on the voting committee are open to changing this. Market participants have priced in an interest rate increase for December, but for 2018 only one or two interest rate hikes are currently expected. Here are three ways to earn money from the US Dollar uncertainty over the next few months.

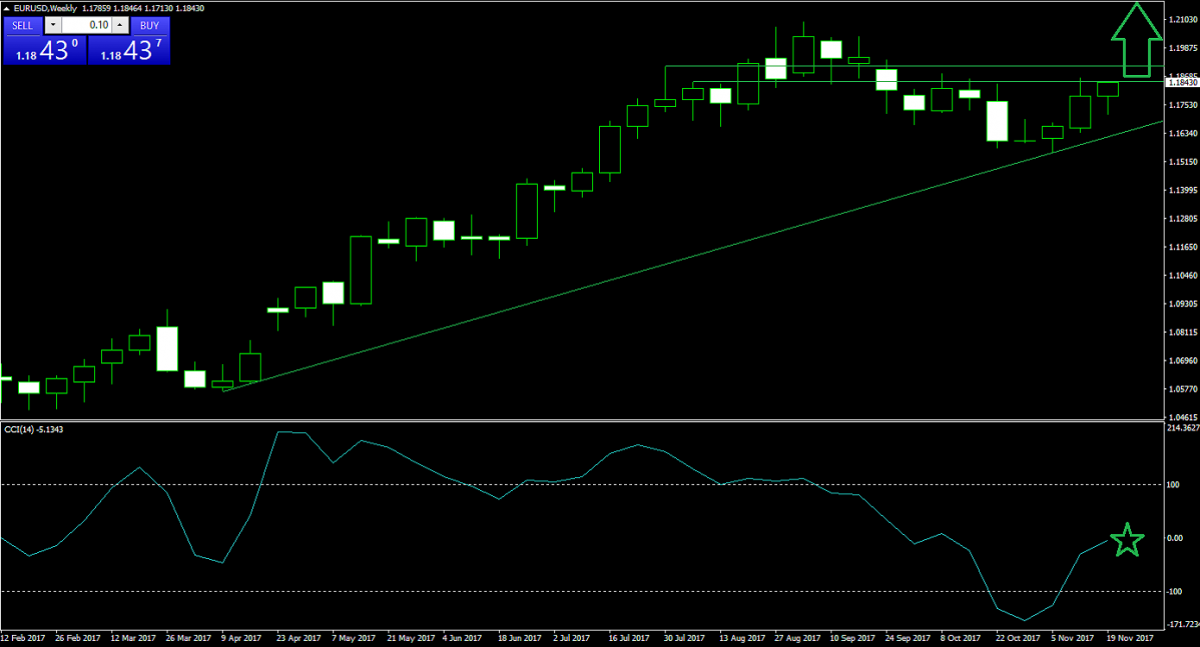

Forex Profit Set-Up #1; Buy EURUSD - W1 Time-Frame

The EURUSD has enjoyed a very strong rally as visible in our W1 chart. While this currency pair is currently near the top of its chart, there are many bullish factors which are expected to force a breakout and open the way for much more upside. An ascending support level is pressuring this currency pair higher, which currently trades just below of a very strong resistance area. A breakout would turn this into solid support from where the EURUSD can resume its strong move to the upside.

The CCI has already completed a breakout above the -100 mark, following a brief a correction, and is currently trading just shy of the 0 level; a move above 0 would confirm a momentum change back to bullish and should see an accelerated move higher. Add the EURUSD to your PaxForex trading account today.

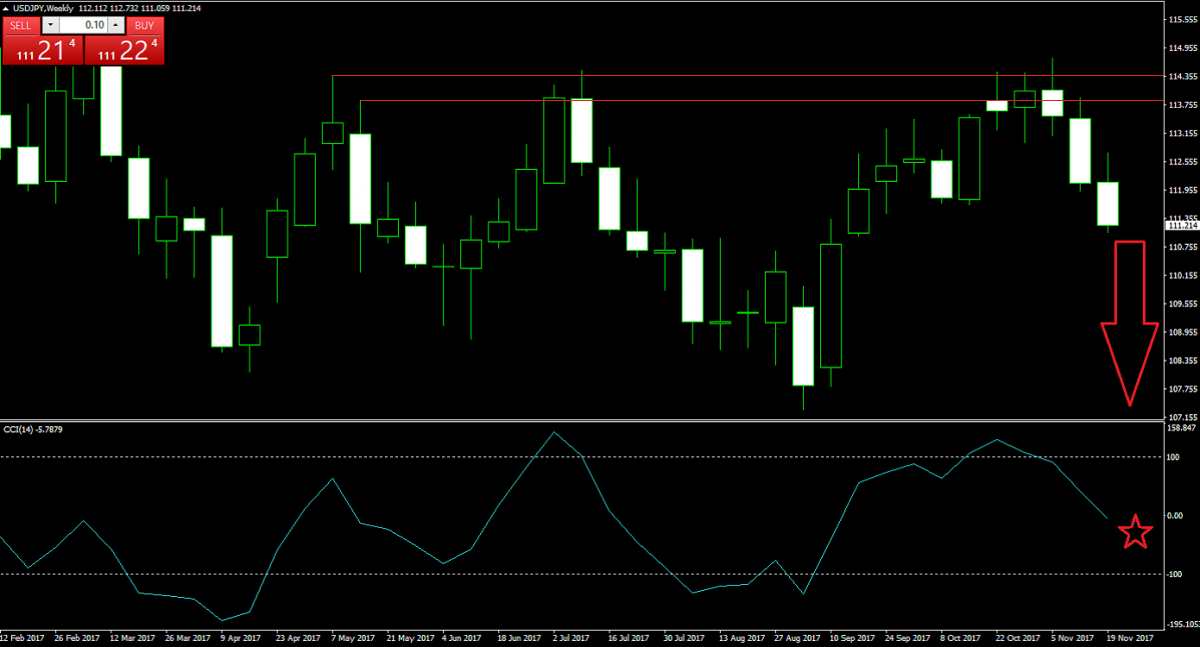

Forex Profit Set-Up #2; Sell USDJPY - W1 Time-Frame

The USDJPY is already in a correction; the last three W1 candlesticks formed a ‘three-white-crows’ pattern which is a very strong bearish indicator. This currency pair already broke down from a major resistance area, formed in the process of a triple top chart pattern which rejected a breakout three times. More downside should be anticipated as a combination of USD weakness and JPY strength are pushing the USDJPY to the downside.

The CCI confirmed bearish momentum with a breakdown below the 100 mark as well as below the 0 mark and new sell orders are expected to enter this trade which will add more downside momentum. Follow PaxForex and receive daily trading advice hot from our analysts’ desk.

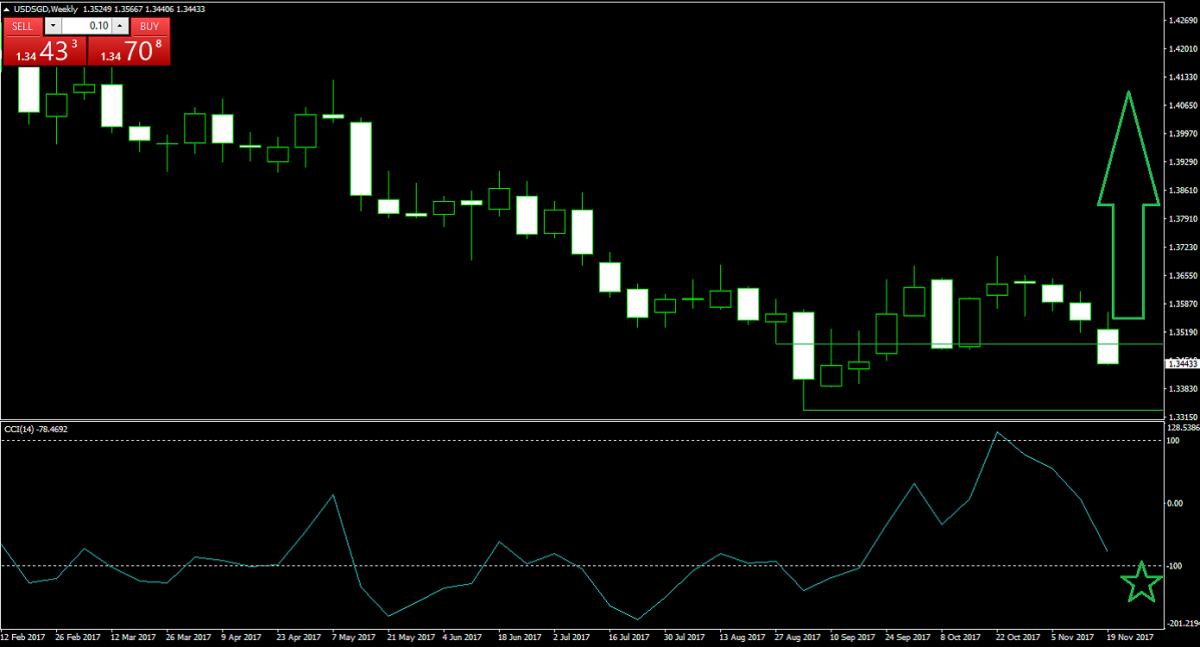

Forex Profit Set-Up #3; Buy USDSGD - W1 Time-Frame

The previous two trades were inspired by USD weakness, but it is always smart to hedge your portfolio. After adding the above two trades, a smart hedge would be a long position in the USDSGD which is a minor currency pair with plenty of potential upside. This currency pair has just broke into a major horizontal resistance area from where further downside potential remains limited as bearish pressures are being deflated.

The CCI is approaching the -100 mark which would confirm an extreme oversold condition. Any breakdown in price action below 1.3400 should be taken advantage of. Download your MT4 trading platform now and get access to PaxForex’ wide range of tradable assets which will allow you to operate a truly sophisticated trading account.

To receive new articles instantly Subscribe to updates.