Just as many big banks have increased their bullish calls on the Euro on the back of an expected pick-up in economic activity, hard data pointed to the opposite. April PMI data was anticipated to point towards a rebound following a weak first-quarter, but today’s release pointed towards further contraction across key industries. Germany, the leader of the export oriented Eurozone economy, saw its Manufacturing PMI clock in at 44.5, below the expected reading of 45.0 and little changed from the 44.1 reported in March. Germany relies heavily on manufacturing for exports which drives the entire Eurozone and today’s disappointment pressured the Euro to the downside after the announcement.

The German government has now cut its 2019 GDP forecast to just 0.5% which would represent the smallest expansion in the past six years at a very critical junction for Europe’s largest economy. This compares to last year’s GDP growth forecast of 2.1% for 2019 and for 2020 the German government now expects a 1.5% expansion. The European Commission now predicts Germany will be the EU’s worst performing economy after Italy which is predicted to expand just 0.2% this year. The EU’s and the Eurozone’s second biggest economy, France, is only two spots above Germany with a predicted growth rate of 1.3%. This points towards more challenges than previously anticipated.

Europe’s growth engine, Germany, is sputtering to a near standstill with the back-up engine, France, not far behind. This is very likely to ripple through the rest of Europe. Economists expected that an increase in China will benefit Europe, but so far the data reported fails to confirm this theory. Calls for more government stimulus in Germany have increase, but with Germany already stretched thin it would require a change to the fiscal policy in order to legally pump more capital into the economy. So far policy makers have refused to admit that more stimulus is required, but as data suggests it will be only a matter of time until they have to give in. As Germany is approaching its next elections which will see current Chancellor Merkel replaced, it has tuned into a very sensitive issue for the ruling CDU coalition.

France posted a slight increase in its Composite PMI for April as impacts from the “Gilets Jaunes” protests have decreased, but new orders posted their fifth consecutive monthly contraction. The Euro extended its slide throughout today’s trading session and is now challenging key support levels. Is it the right time to buy the Euro or should forex traders sell the rallies? Open your PaxForex Trading Account now and join our fast growing community of profitable forex traders!

The clearest sign for extended weakness in the Eurozone was presented today by ECB President Mario Draghi. He stated that the “Governing Council members are acknowledging the weakening of the cycle, the weakening of the economy, the fact that this weakening will extend into rest of the year.” This suggests that the ECB doesn’t expect an economic rebound in 2019. In order to prevent a steeper sell-off Draghi added “They acknowledged also the underlying strength of the economy, the fact that some of these temporary factors are unwinding.” It appears that the ECB is ready to pump more stimulus into the economy which some suggest could involve loading up the balance sheet with equity purchases. Overall it appears that global economy should be prepared for more crisis management. As Eurozone economic worries deepen, here are three forex trades to heighten your profits!

Forex Profit Set-Up #1; Sell EURCHF - D1 Time-Frame

The Swiss Franc, a safe-haven currency, has been under pressure as risk appetite increased on the back of a rise in optimism. As economic data suggests, this optimism may have been misplaced especially in the EURCHF. Price action has been pushed into its horizontal resistance area which is being enforced by its primary descending resistance level. Given the continued negative economic news flow out of the Eurozone, a price action reversal is expected to take this currency pair back down into its next horizontal support level. Forex traders are advised to sell any rallies in the EURCHF up into the upper band of its horizontal resistance area.

The CCI is trading in extreme overbought territory, bur started to lose momentum and retreat from its high. A move below the 100 mark is likely to trigger a short-covering rally which will accelerate to the downside. Download your PaxForex MT4 Trading Platform today and start building a profitable forex account with the help of our expert analysts!

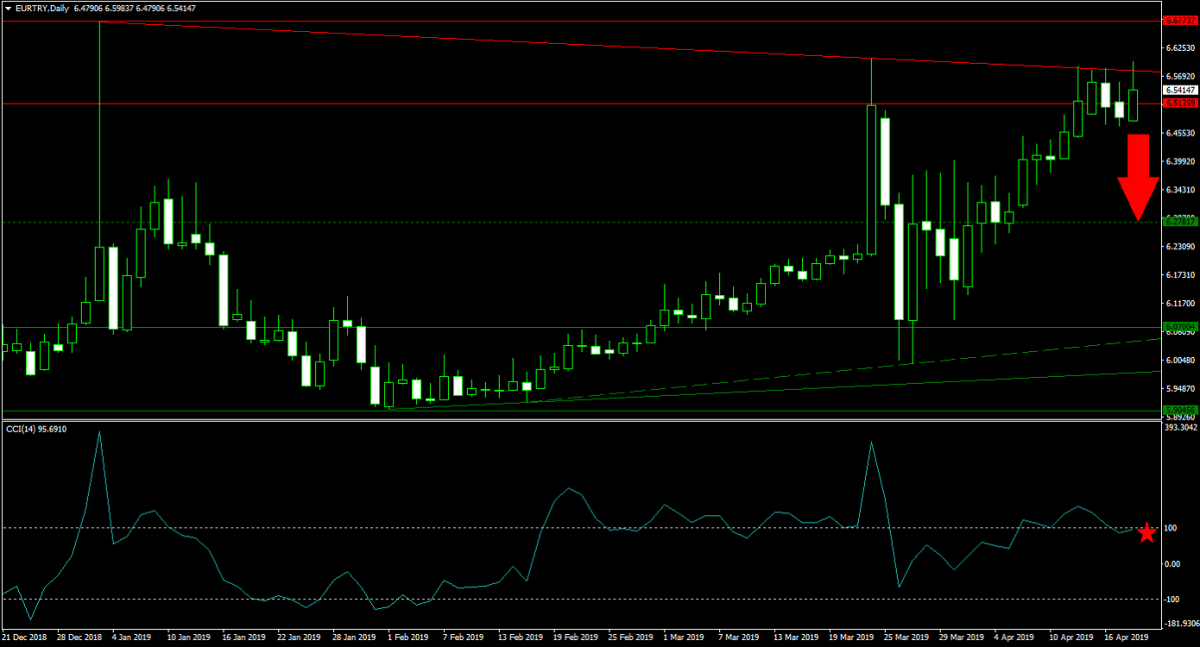

Forex Profit Set-Up #2; Sell EURTRY - D1 Time-Frame

Over the past trading month, the Turkish Lira has experienced a spike in volatility which saw the currency weaken overall. As the Eurozone economy is mired in economic woes, the EURTRY is ripe for a move to the downside. This currency pair has once again reached its horizontal resistance area, intersected by its primary descending resistance level, where a double top formation is materializing. The rise in bearish pressures is favored to lead to a short-covering rally which will extend into its next horizontal support level. Forex traders are recommended to spread their EURTRY sell orders inside its horizontal resistance area.

The CCI is trading in-and-out of extreme overbought conditions with a contraction in bullish pressures. This momentum indicator is now anticipated to maintain a downward trend which will drag price action down with it. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market.

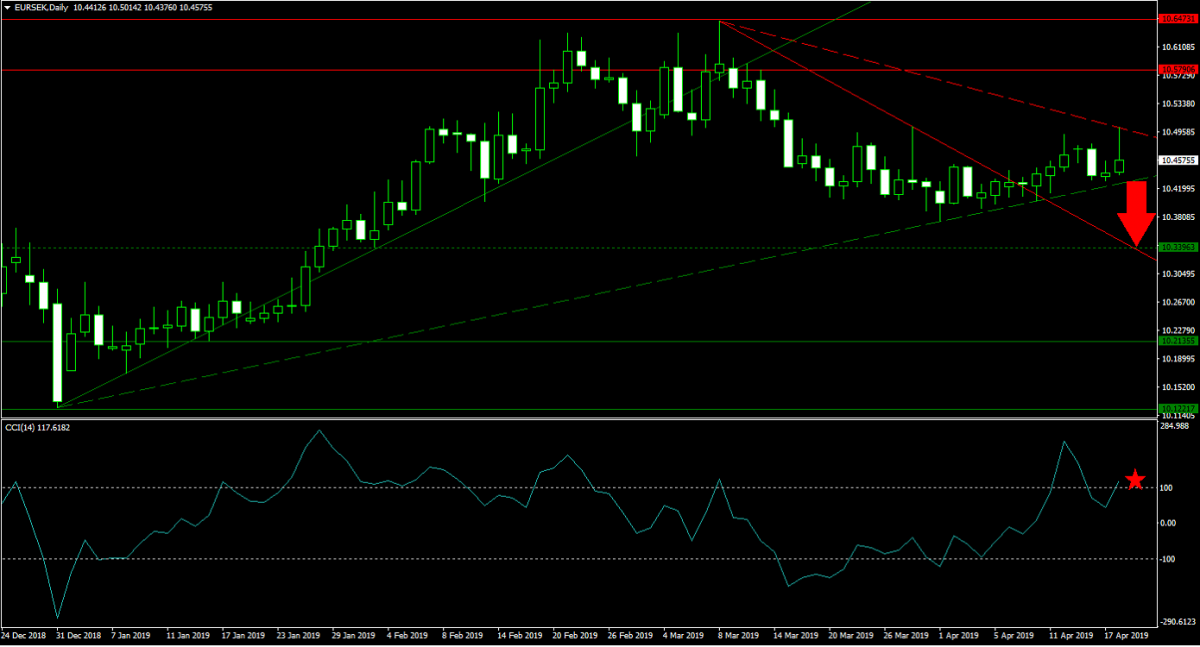

Forex Profit Set-Up #3; Sell EURSEK - D1 Time-Frame

Another currency pair which flashes Euro weakness is the EURSEK. Following a rejection by its horizontal resistance area, price action has trended lower. The secondary ascending support level has prevented a further contraction, but the secondary descending resistance level is increasing bearish pressures which is expected to lead to a breakdown. This would allow a move to the downside until the EURSEK will reach its next horizontal support level which is being intersected by its primary descending resistance level acting as temporary support. Selling any potential rallies from current levels and into its secondary descending resistance levels is the favored trading recommendation.

The CCI has advanced back into extreme overbought territory, but remains well off of its previous high. This technical indicator is now favored to reverse and challenge the 0 level from where a bearish momentum shift may follow. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts.

To receive new articles instantly Subscribe to updates.