The US Dollar is the world’s reserve currency and while that is unlikely to change over the next decade, forex traders should be prepared for an outflow of assets. Global central banks are due to shift $500 billion worth of reserve assets from the US Dollar into the Euro. This is only a small percentage from the global reserve pool which is estimated at $11.3 trillion. As central banks decide to shift assets out of the US Dollar, ripple effects will be felt around the forex market and traders can capitalize from this event if they are properly prepared.

Currently 64% of the $11.3 trillion reserve assets are held in US Dollars and only 20% in Euros. Other noteworthy reserve currencies are the British Pound, the Japanese Yen and the Canadian Dollar. Since the Euro was introduced in 1999, US Dollar reserve assets have declined and other countries led by Asian powerhouse China have called on more diversification. The Chinese Yuan, the Russian Ruble, The Brazilian Real, the Indian Rupee and the South African Rand command a larger share as their economies capture a larger share of the global economy.

As US protectionism is on the rise, a trade war between the US and China on the brink and an increase in uncertainty over where US policies are headed due to the continuous cabinet reshuffles, an asset reallocation makes perfect sense. The Euro is set to attract most if not all the outflows. The Eurozone economy expanded by 2.3% last year and economists predict a bigger expansion rate for this year. Politics in Brussels are a lot calmer than in Washington and the exchange rate of the Euro has been on the rise since the start of 2017. The combination of those three factors are set to power the Euro higher throughout 2018.

Are you ready to profit from the expected continuation of the Euro advance, especially against the US Dollar? Open your PaxForex Trading Account today and position your forex account for growth in 2018, not only from the Euro but from other currencies as well. Allow our expert analysts to deliver the most profitable trading set-ups to your inbox every day. PaxForex has price action covered from a technical as well as a fundamental perspective.

As the EU total trade volume with China is about to surpass that of the US with China, the Euro could see even more inflows. This will keep price pressure to the upside and provide a floor to short-term price corrections. Central banks in Saudi Arabia as well as Brazil have very little to no exposure to the Euro, but with the global atmosphere changing are poised to enter the trade before it further accelerates at the time their US Dollar assets are shrinking in value. The Euro is poised for a central bank boost and here are three forex trades to get you in on the action.

Forex Profit Set-Up #1; Buy EURJPY - D1 Time-Frame

This currency pair just completed a breakout above its horizontal support area which resulted in a halt from its preceding downtrend. The EURJPY is now poised for a counter-trend advance, partially fueled by a short-covering rally and partially as a result of the bearish momentum break. An advance into its horizontal resistance area should not be ruled out and forex traders are therefore recommended to place their buy orders between the 130.100 and 131.000 zone.

The CCI has spiked higher after plunging well below the -100 level, an indication of extreme oversold conditions. More upside is expected as bullish bets on the Euro are set to push the EURJPY higher in the near term. Download your PaxForex MT4 Trading Terminal now and profit from the pending advance in this currency pair.

Forex Profit Set-Up #2; Buy EURPLN - W1 Time-Frame

The EURPLN has eclipsed its horizontal support area which resulted in a momentum change from bearish to bullish. Price action is now trading at its descending resistance level from where a breakout is predicted to materialize. This would push this currency pair further to the upside with a sharp increase in bullish momentum. Forex traders are advised to seek buy entries just beneath its descending resistance level.

The CCI is currently trading in extreme overbought conditions above 100, but short-term contractions in the EURPLN will take this technical indicator back into neutral territory and normalize price conditions. Take advantage of the PaxForex Daily Forex Technical Analysis where our expert analysts highlight the best technical trading set-ups with the best profit potential.

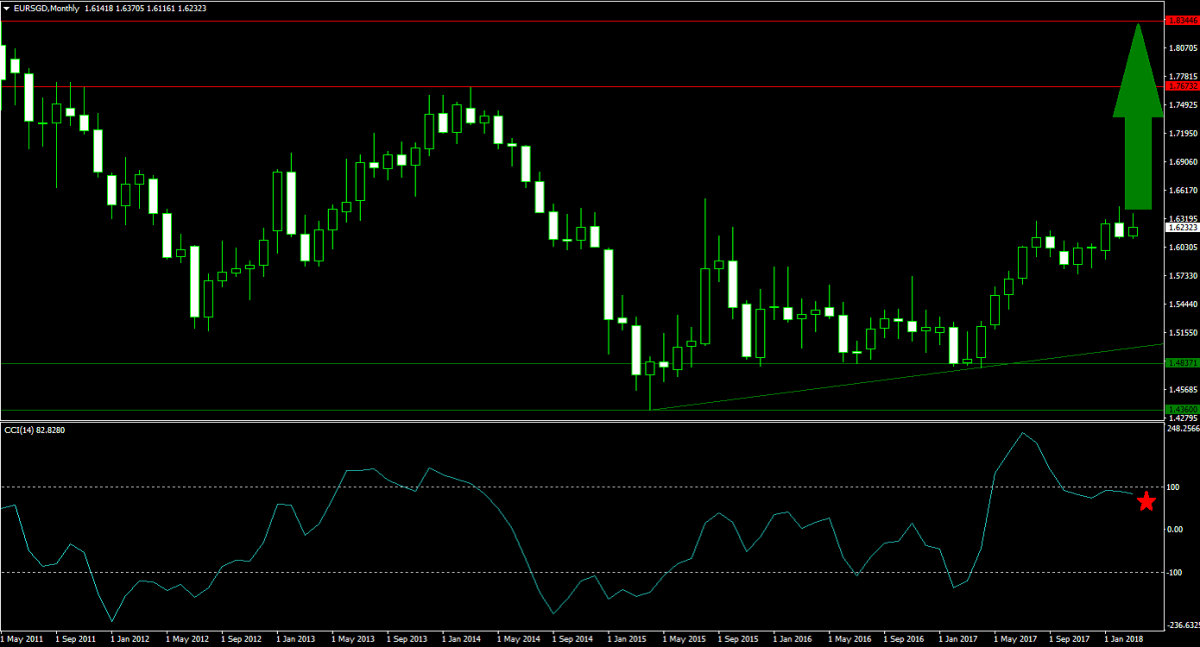

Forex Profit Set-Up #3; Buy EURSGD - MN Time-Frame

Price action in this currency pair is at a more advanced staged of its move to the upside, but there is more room to the upside. After a successful breakout above its horizontal support area, this currency pair has an ascending support level which provides bullish pressures on the EURSGD. This also reduces downside risk as an advance into its horizontal resistance area is expected. Forex traders are advised to buy the dips below 1.6200.

The CCI has moved away from extreme overbought conditions above 100 and is now trading in neutral conditions. Minor contractions in the EURSGD will further move this momentum indicator in favorable buy territory. Earn over 500 pips per month with the assistance of the PaxForex Daily Fundamental Analysis where our expert analysts outline each trading day’s most profitable fundamental trades.

To receive new articles instantly Subscribe to updates.