Mario Draghi, the President of the European Central Bank (ECB) does not use the term of tapering when he refers to adjustments to the central banks €60 billion per month quantitative easing program in the form of bond purchases. The consensus for today’s ECB meeting was that the deposit rate facility will remain unchanged at -0.40%, the central bank rate to remain unchanged at 0.00% and that the marginal lending facility will remain unchanged at 0.25%. The consensus was correct and the ECB announced just that, the focus was more on the announcement about the QE taper starting in January of 2018.

President Draghi further announced that interest rates will remain unchanged for an extended period of time and well beyond the end of its QE program; a dovish statement which send the Euro lower after the announcement. QE for this year will remain, as previously announced, at €60 billion per month. When it comes to the taper, or the recalibration as President Draghi prefers to call it, the majority of professionals expected a cut to €30 billion per month until September. Once again, Mario Draghi delivered exactly as expected and announced the recalibration down to €30 billion per month starting in January and ending in September.

On top of this, the proceeds from expiring bonds will also be reinvested and the ECB kept the option open to increase the size of QE as well as the duration and keep them in place as long as they believe it will be necessary. Some question if today’s announcement was due to technical reasons of the program or due to better economic data. The ECB was buying primarily German bonds, or Bunds, and the decreasing amount of available Bunds has likely contributed to the announcement today. The ECB as well as Mario Draghi have one big problem which appears to have manifested itself in the Eurozone; inflation or better the lack thereof.

Did you know you can earn more money per trade if you trade at PaxForex thanks to tight spreads? Each pip matters, especially if you trade frequently and place multiple orders per day. Tight spreads can add hundreds if not thousands to your account balance so make the switch today and grow your portfolio faster!

Draghi’s term is set to expiry in 2019 and the ECB is very far away from its inflation target; one it may not reach this decade. Economic data out of Europe and especially the Eurozone has been very good, but at the same time the next crisis may be around the corner. With not many options to combat another crisis and with the economy, apparently, not as strong as the ECB would like it to be (otherwise why not taper faster and end sooner?), forex traders are left wondering as to how strong the Eurozone economy really is according to the central bank.

So the unanswered question remains: Do you Euro?

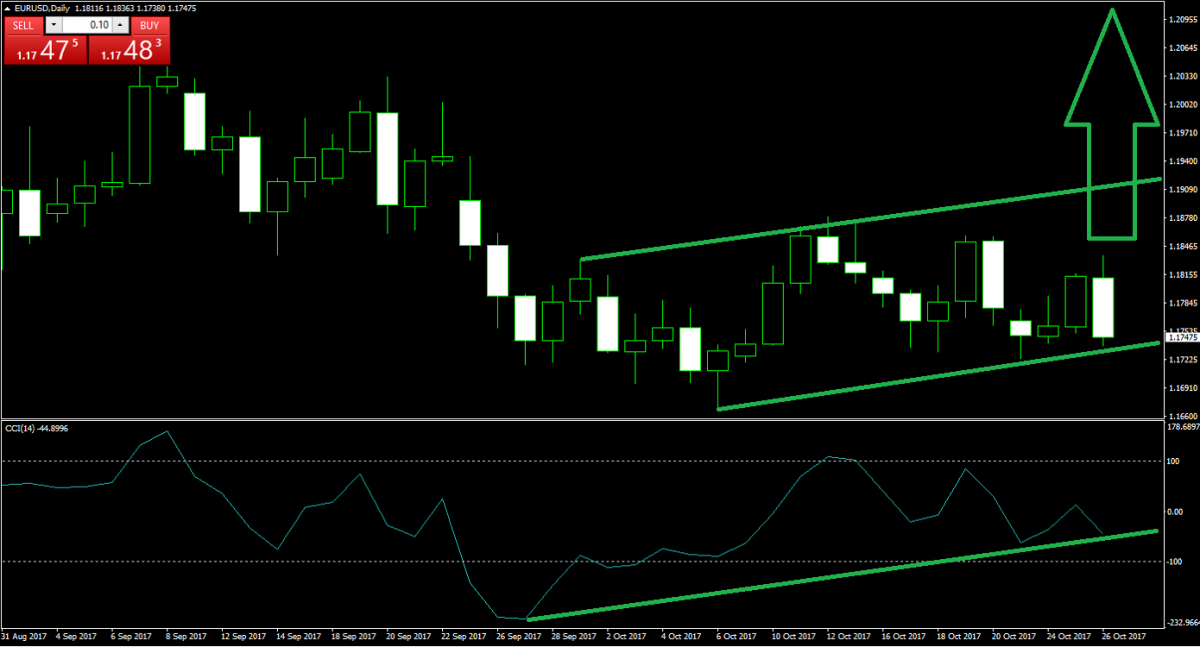

Forex Profit Set-Up #1; Buy EURUSD - D1 Time-Frame

This one takes you right into the heart of the action with the most traded currency pair. The medium-trend for the Euro remains up which makes today’s drop after the ECB announcement a good entry opportunity anywhere between 1.1670 and 1.1770. It is a wide range, but perfect to stagger a medium to long-term EURUSD long position. In addition the CCI dropped into its ascending trendline and this currency pair is trading in an overall bullish price channel which delivers the final buy signal.

Make sure to further raise your profit potential with leverage offered by PaxForex to all traders which can be adjusted according to individual needs.

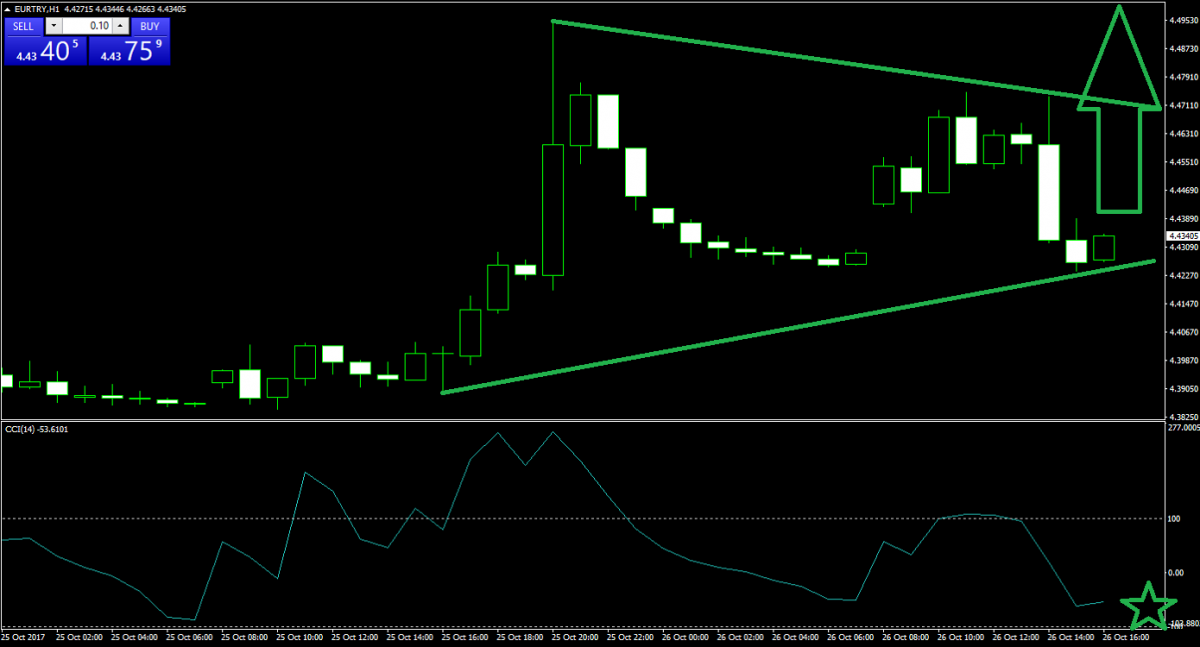

Forex Profit Set-Up #2; Buy EURTRY - H1 Time-Frame

Now we are going a bit exotic here with the EURTRY currency pair on the H1. As mentioned above, the medium to long-term trend for the Euro is biased to the upside which is the first buy signal; the second one comes from the increase in tensions between Germany, the Eurozone largest economy and exporter, with Turkey. German Chancellor Angela Merkel want to apply more pressure on Turkey which could pressure the Turkish Lira lower and therefore the EURTKY higher from current levels. A symmetrical triangle has formed as a chart pattern which is a continuation pattern while the CCI is approaching the -100 level, an oversold sign.

Open your trading account today at PaxForex, a broker which has been created by traders who understand what traders need in order to succeed.

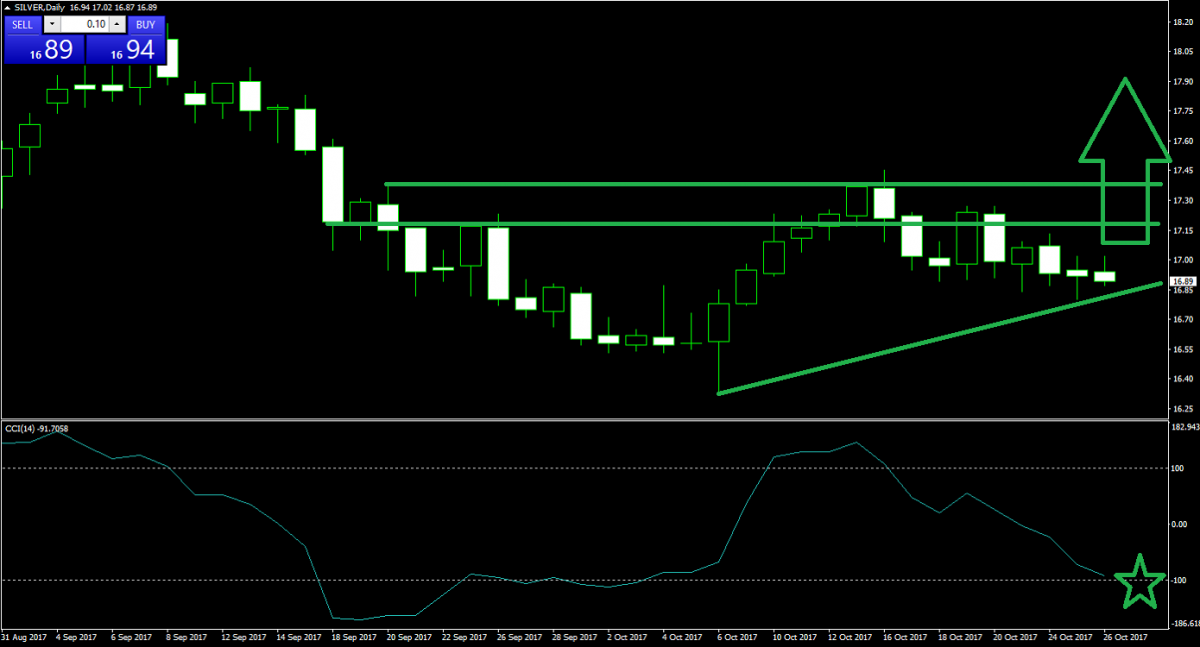

Forex Profit Set-Up #3; Buy Silver D1 Time-Frame

This one is a bit out-of-the-box, but worth the around-the-corner-thought. As the EURUSD is expected to advance due to a combination of Euro strength mixed with US Dollar weakness, commodities which are trades in US Dollars may advance. In general there is an inverse correlation between the price of the USD and the price of commodities. The CCI is less than 10 points away from the key -100 oversold level and this commodity indicates an ascending triangle formation, a bullish pattern, which makes Silver a breakout candidate from current levels.

The Euro could witness more volatility, especially as more inflation data will be released. Forex traders should stay subscribed to our analysis in order to get the latest developments as well as potential adjustments to price action for longer term trades. New trading signals are created daily in order to give every trader a well balanced portfolio. Now you can tell your friends that you do Euro!

To receive new articles instantly Subscribe to updates.