The European Central Bank (ECB) will stop its purchases of EU government bonds which has been in place since 2015 despite criticism from Germany. The ECB added over €2 trillion worth of assets to its balance sheet during that period which includes €180 billion of corporate bonds. While the ECB will stop purchasing bonds at the end of this month, it may reinvest proceeds. In addition, interest rates are on track to remain at current levels for much longer than previously expect. The current economic slowdown across the Eurozone and lack of inflationary pressures are likely to keep an interest rate increase by the ECB on hold.

This will put downward pressure on the Euro, but as the ECB ends its bond purchases there will be plenty of trading opportunities as countries will have to deal with the fallout. The ECB has funnelled billions of Euros into high yielding EU markets such as Poland and Hungary. This has allowed both central banks to delay interest rate increases as plenty of capital was directed to them as a result of EU bond purchases. With the end of the ECB QE, policy makers in Poland and Hungary may have to increase interest rates which is likely to strengthen their currencies, the Polish Zloty and the Hungarian Forint.

With the 2019 global economic outlook worsening, the Eurozone may come under even more stress as it deals with the exodus of ECB support. While those companies who took advantage of ECB corporate bond purchases were able to replace high-cost bonds with low-cost bonds, it may not be enough to navigate through a volatile 2019 and beyond. The ECB has exhausted its arsenal and can do little to assist the economy during the next recession. Will the ECB restart QE as the Eurozone economy deteriorates further? How will this impact the Euro?

Forex traders made their peace with no interest rate increases out of the ECB, but any move to further stimulate the economy is likely to result in a new sell-off in the Euro. This helped Gold prices soar. Are you prepared to take advantage of a 2019 filled with profitable trading opportunities? Take the first step now by opening your PaxForex Trading Account!

A growing number of asset managers warn about the 2019 global economic outlook. Many analysts have not adjusted their models to a much weaker performance and forex traders may be the first to act. Pimco Emerging Markets Portfolio Manager Roland Mieth noted that “Both in Asia and globally, we’re looking to maintain exposure to high-liquid portions of the market as well as increasing cash. We are looking for opportunities in the short-end of the curve as part of our cash-management strategy. We are looking to keep the powder dry.” The ECB will start 2019 with no more QE in place to support the economy, but here are three forex trades to support you profits.

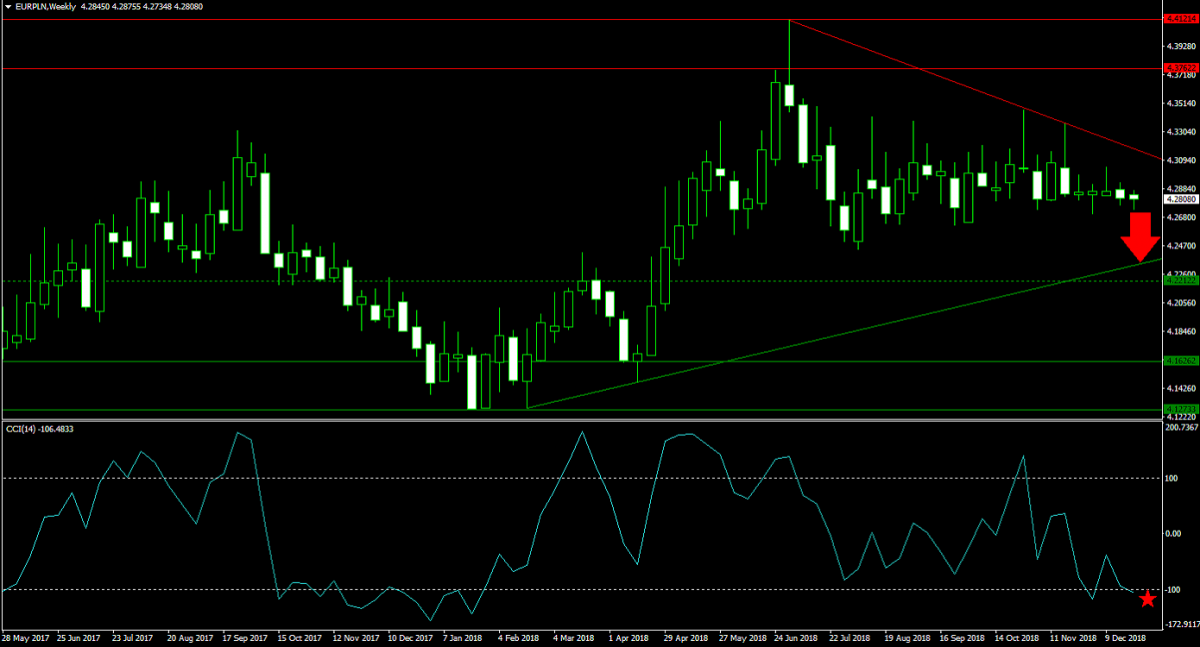

Forex Profit Set-Up #1; Sell EURPLN - MN Time-Frame

The Euro started to weaken against the Polish Zloty this summer with a breakdown below its horizontal resistance area. Prospects of an interest rate increase out of Poland are on the rise and the primary descending resistance level is pressuring the EURPLN lower. This currency pair is now expected to extend its sell-off until it will reach its primary ascending support level. Forex traders are recommended to sell the rallies in the EURPLN up into its primary descending resistance level.

The CCI is trading just above extreme oversold territory, but with bearish momentum on the rise a push below the -100 level is anticipated. This could further increase short-term selling pressure. Download your PaxForex MT Trading Platform today and join our growing community of profitable forex traders!

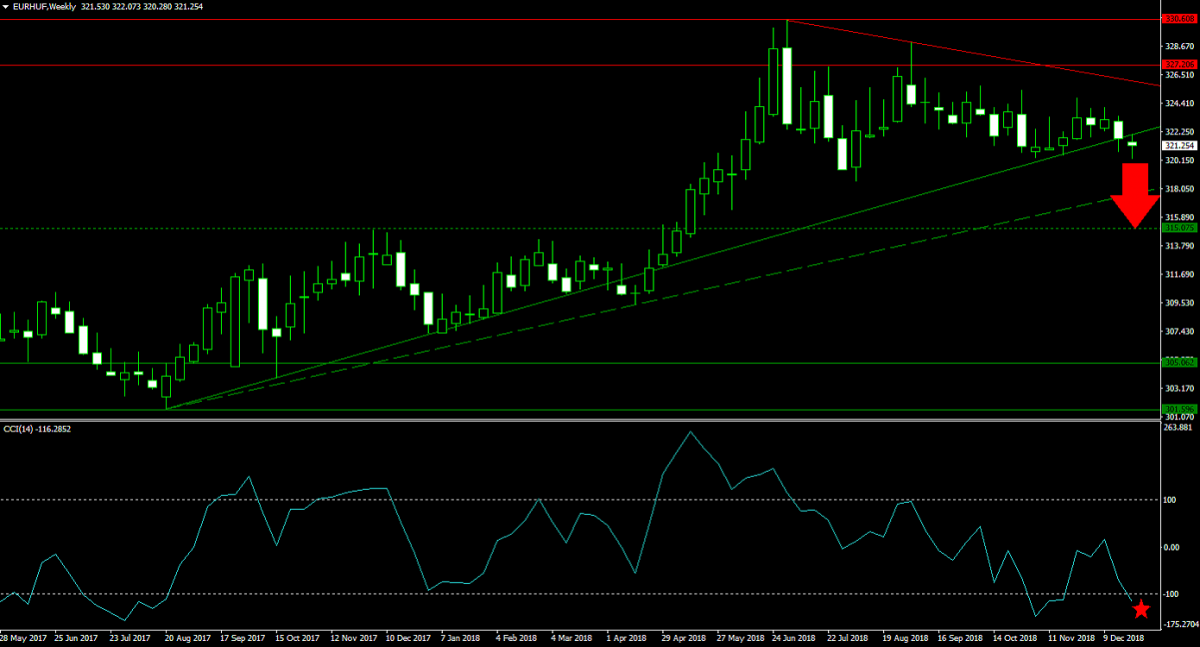

Forex Profit Set-Up #2; Sell EURHUF - MN Time-Frame

The EURHUF enjoys similar circumstances as the EURPLN, but with more bearish sentiment as this currency pair completed a breakdown below its horizontal resistance area as well as below its primary ascending support level. An extension of the contraction in likely to push price action below its secondary ascending support level and down into its next horizontal support level. Forex traders are advised to sell the rallies in the EURHUF into its primary ascending support level which now acts as resistance.

While the CCI already moved into extreme oversold conditions, it remains off of its previous low and has more room to contract. This supports an extension of the current sell-off. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market; earn over 500 pips per month.

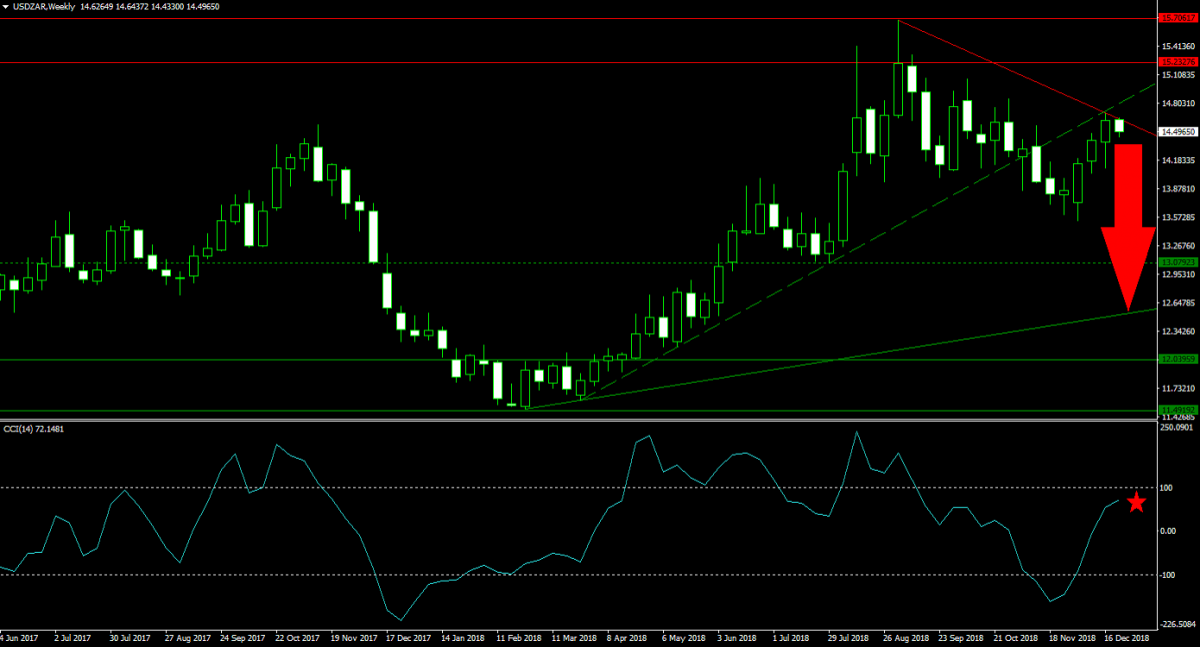

Forex Profit Set-Up #3; Sell USDZAR - MN Time-Frame

Ripple effects of the end of QE from central banks in the Western world will have far reaching impacts globally. The USDZAR started its downtrend with the breakdown below its horizontal resistance area and enforced it with a breakdown below its secondary ascending support level. Price action entered a reversal which took the USDZAR back into its primary descending resistance level from where a new sell-off is anticipated on the back of US Dollar weakness. The move may be extended into its primary ascending support level and selling the rallies is favored.

The CCI recovered from extreme oversold territory and pushed above the 0 mark. It currently hovers in bullish conditions, but shows signs of exhaustion which make this momentum indicator ripe for a reversal. Follow the PaxForex Daily Forex Technical Analysis and copy the recommended trades from our expert analysts into your own forex trading account; we do the hard work so that you may earn the easy profits.

To receive new articles instantly Subscribe to updates.