After months of economic disappointments out of the Eurozone, it was only a matter of time until the EU cold no longer procrastinate what many traders, analysts and fund managers already knew: the Eurozone economy is deteriorating fast. Not only did the European Commission drastically cut its growth forecast for 2019, but it further stated that Brexit as well as the slowing Chinese economy would further decrease growth prospects for the Eurozone. Some of the biggest contributors to the grim growth outlook were political instability in Italy, protests in France and the auto industry slump in Germany.

The EC, which is the EU’s executive branch, now expects the Eurozone economy, 19 countries in total, to expand by only 1.3% annualized for 2019. This represents a decrease of 0.6% as compared to its previous assessment which called for a growth rate of 1.9% annualized. The 2020 growth outlook was lowered by 0.1% to 1.6% annualized from the previous 1.7% level. Italian growth was revised down by the most, 1.0%, to only 0.2% for 2019. The Italian government has a different outlook on its economic prospects, but blames the previous government for the slack.

Pierre Moscovici, the EU Economic Affairs Commissioner, stated that “We need to watch certain situations and the situation in Italy as far as growth is concerned is much worse with 0.2 percent, which is quite significant.” He further added that “Much of the Euro area’s loss of growth momentum can be attributed to fading support from the external environment, including slower global trade growth and high uncertainty regarding trade policies.” The Dutch growth outlook was lowered by 0.7%, the German one by 0.6%, the French one by 0.3% and the Spanish one by 0.1%. A surprise in the report may be the Greek growth outlook for 2019 which was revised up by 0.2%.

The Euro initially weakened, but recovered rather fast. Most of the bad economic news has already been priced in by traders due to the constant flow of indicators which disappointed. Where is the Euro headed over the next few weeks as Brexit looms, EU parliamentary elections are on the horizon and the US-China trade war continues? Open your PaxForex Trading Account today and start adding the recommended trades of our expert analysts to your portfolio for a market beating performance.

The risks to the Eurozone economy are not only domestic as the EC further added that “In the US, the risk of an abrupt fiscal tightening appears to have increased, especially for 2020. The Chinese economy might be slowing more sharply than anticipated while many emerging markets are still vulnerable to sudden changes in global risk sentiment.” The EC also cuts its 2019 inflation outlook by 0.4% to 1.4% annualized from the previously expected 1.8% mark. The EC slashed its 2019 growth outlook for 2019, but here are three forex trades which will keep your account growing.

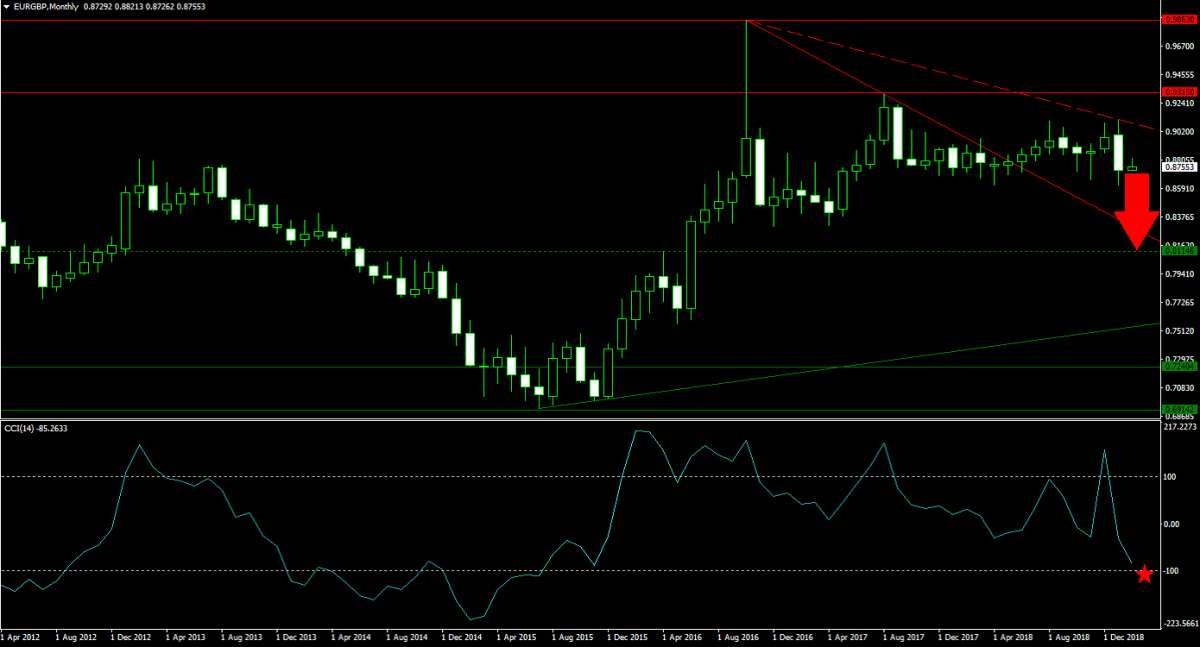

Forex Profit Set-Up #1; Sell EURGBP - M1 Time-Frame

Today we will look at the M1 charts in order to get a better picture of the long-term trends for the Euro. With Brexit roughly 50 days away, the EURGBP will be an interesting trade. Given the failure of this currency pair to complete a breakout and the ongoing economic disappointments out of the Eurozone, a breakdown in price action is expected. The EURGBP is currently trading above its primary descending resistance level, which was turned into support, and below its secondary descending resistance level which adds bearish pressures. A move down into its next horizontal support level is expected and selling the rallies the favored trading approach.

The CCI quickly plunged from extreme overbought conditions, below the 0 mark and is now anticipated to extend its slide into extreme oversold levels. The bearish momentum change has further pressured increased downside pressure. Fund you PaxForex Trading Account now and take the first step to a profitable future.

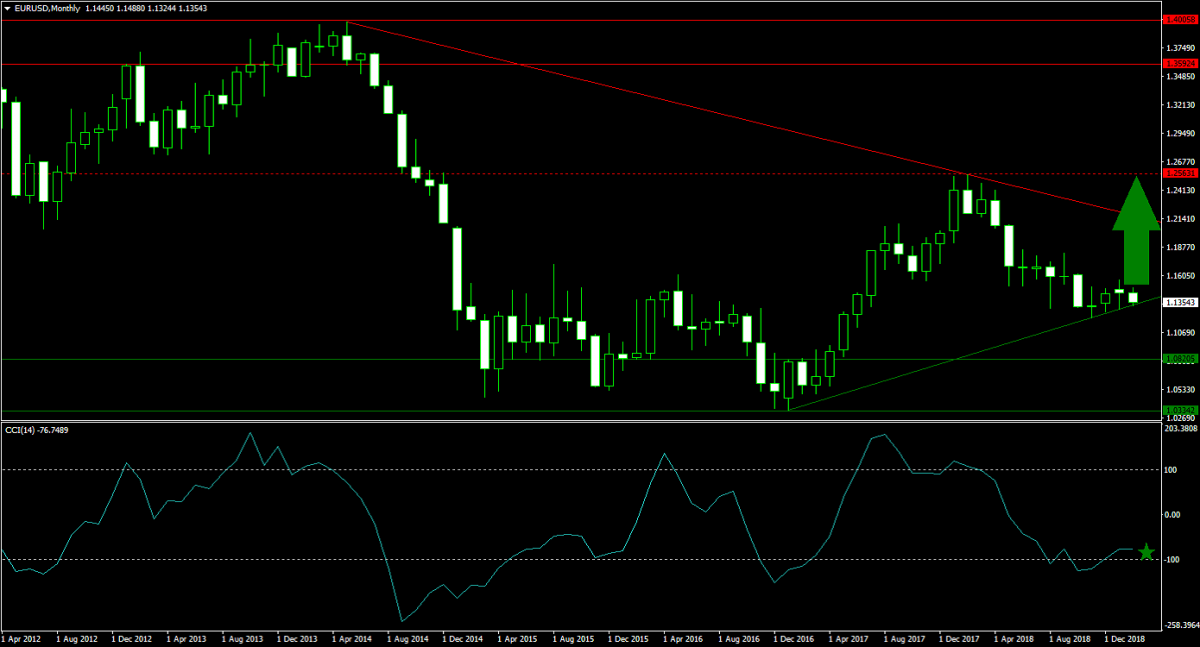

Forex Profit Set-Up #2; Buy EURUSD - M1 Time-Frame

Despite the negative economic data flow, the EURUSD has help up remarkably well. This can be partially attributed to the weakness and concerns in the US economy. After a breakout in price action from the 2017 lows, this currency pair has retraced roughly half its advance and entered a sideways trend for much of 2018. The EURUSD is now receiving a bullish momentum push from its primary ascending support level which is expected to result in a short-covering rally, past its primary descending resistance level and into its next horizontal resistance level. Forex traders are advised to buy the dips near its primary ascending support level.

The CCI briefly dipped into extreme oversold territory, but managed to advance and push above 0. While bullish momentum is weak, a move into positive territory is anticipated. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the market. Receive daily trading recommendation which yield over 500 pips in profits per month!

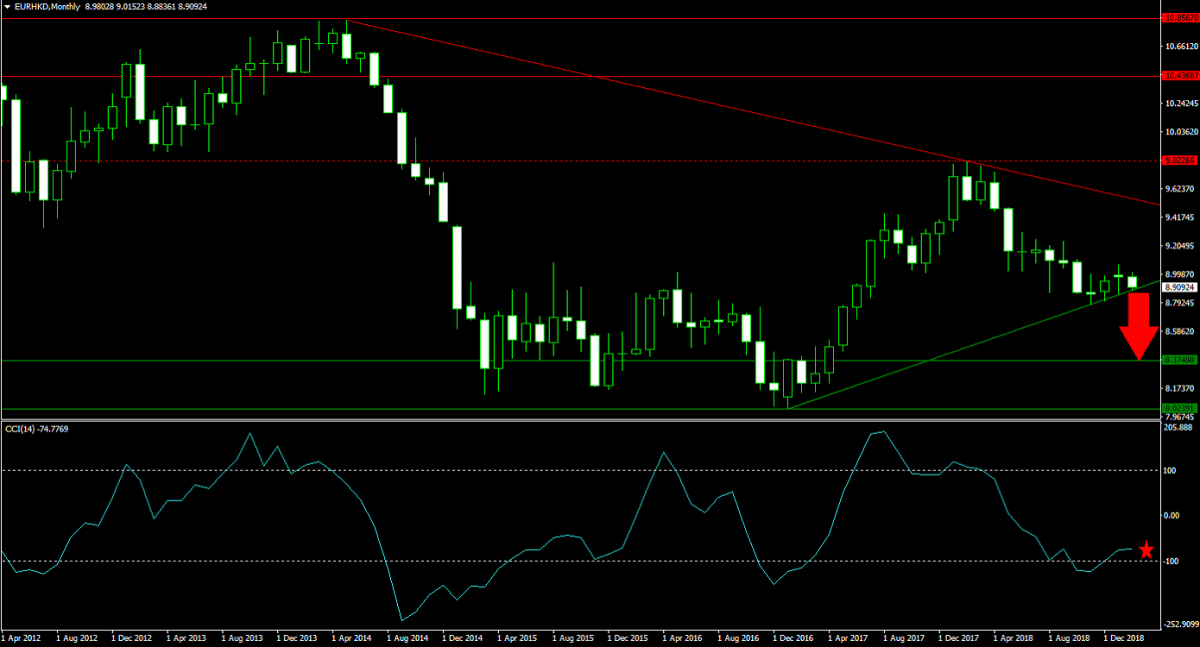

Forex Profit Set-Up #3; Sell EURHKD - M1 Time-Frame

The EURHKD technical picture is identical to that of the EURUSD. The reason for the different outlook is entirely fundamental. The US-China trade war is taking a toll on all sides, but China has more resources available than the US. The PBOC has also been quietly supporting the economy which may have bottomed out while the US economy continues to weaken. Price action is therefore expected to complete a breakdown below its primary ascending support level and forex traders are recommended to place their sell orders just above this level. The EURHKD is likely to test the upper band of its horizontal support area.

The CCI advanced out of extreme oversold conditions, but weak bullish momentum together with the fundamental aspects are expected to push this technical indicator back below the -100 level. Subscribe to the PaxForex Daily Forex Technical Analysis and never miss a daily trading recommendation again. Simply add them to your own forex account an watch your balance increase.

To receive new articles instantly Subscribe to updates.