There are a lot of new forex traders who pay little attention to the lot sizes they trade other than when they calculate how much money they could earn. Trading the proper lot size is part of effective risk management and not only important to protect your bottom line, but it also improves your overall trading efficiency as well as trading results which translates into better profits.

While there is no one correct approach to trading the proper lot size in your forex portfolio, just like there is no one proper percentage level for your risk management assessment, there are several guidelines which could assist you in picking the proper lot size.

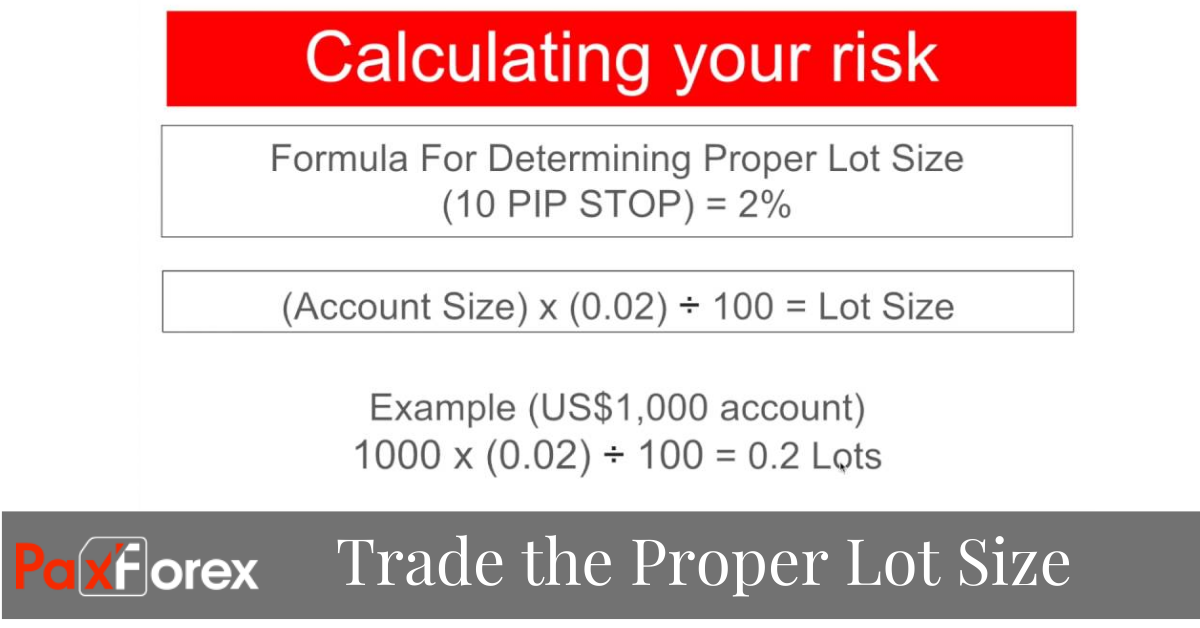

Here is an example of how you could select the optimal lot size for your forex account:

Pick the proper account type for your trading account. This will depend on the amount of trading capital you would like to start with. In this example we will use a $1,000 portfolio which means you would open a mini-account as this would be the proper trading account for your trading capital.

Understand that in a mini-account 1.0 lot equals 10,000 currency units which means that 1 pip equals $1 (or the account equivalent). So 100 pips would equal $100, 200 pips would equal $200, etc.

Most traders prefer to risk between 2% and 5% per trade, so we select 3% risk per trade for our example. 3% from a $1,000 portfolio would mean that you are risking a maximum of $30 per trade.

The next step depends on your trading strategy; most new traders prefer to scalp or keep their stop loss order very tight which is often a big mistake and leads to plenty of their trades being stopped out. You should allow at least 150 pips of movement which will eliminate plenty of trades being stopped out. Since you only risk 3% or $30; 150 pips should equal $30. Just divide $30 by 150 pips and you will get 0.20 lots. This means you should trade no more than 0.20 lots. This figure will change depending on your risk management preference and how big of a pip movement you are comfortable with.

The above example should be taken as a guideline in order for you to calculate the proper lot size to trade. While a scalper or trader who prefers to place a stop loss order 30 pips away from their entry price may have selected 1.0 lot, they most likely would be stopped out form their trades and in the end run around guessing and hoping to get one more right.

Operating a trading account based on hope will eventually lead to a complete loss and while selecting the lot size depends on the trader’s preference it is advised to select one which allows for the proper execution of your trading strategy. It may result in smaller profits due to the reduced lot size, but over a longer time period trading with the proper lot size actually increases profits.