Most forex traders don’t pay that much attention to the Reserve Bank of Australia and to the Reserve Bank of New Zealand. Both economies are big commodity exporters and have been riding the Chinese hunger for raw materials to the upside. The Australian Dollar and the New Zealand Dollar are both referred to as commodity currencies and forex traders also use them as a Chinese Yuan proxy trade with the Australian Dollar being the top candidate. The AUDNZD currency pair usually receives very little attention and has been trading well above parity.

Things may be about to change and some analysts view parity in this currency pair as a possible outcome. Forex traders started to pay a lot more attention after the RBNZ surprised the markets. After the RBA turned more dovish than anticipated, following in the footsteps of the US Fed, the majority expected the RBNZ to follow suit. It is often assumed that New Zealand will follow its “bigger brother” in most policies. Adrian Orr, the RBNZ Governor, announced that interest rates and monetary policy will remain largely unchanged until the end of 2020.

This took the forex market by surprise and most were positioned long in the AUDNZD. Jeffrey Halley, Senior Analysts at OC, added that “I see the Aussie moving lower against the kiwi from here. The action that we saw on Wednesday showed traders quickly covering their shorts after the RBNZ announcement.” 10-Year New Zealand Bonds rose after the RBNZ surprise and the spread compared to 10-Year Australian Bonds turned negative. Forex traders may now opt to take the short side of the AUDNZD trade as the New Zealand central bank is now positioned more hawkish as compared to the Australian one.

Will the AUDNZD reach parity? Is the time ripe for the New Zealand Dollar to trump the Australian Dollar? Sentiment is changing quickly and this currency pair receives a lot more attention that it has in the past. Open your PaxForex Trading Account now and start creating a profitable portfolio, trade-by-trade; join our growing community of profitable forex traders!

Some analysts believe that despite the surprise out of the RBNZ, the central bank will easy its monetary policy before the RBA. Daniel Been, Strategist at Australia and New Zealand Banking Group, stated that “The squeeze in positioning provides a tactical opportunity to buy the AUDNZD. The trade also provides a good value, lower beta way to trade a more positive risk environment.” Both currencies will benefit from the expected rebound in the Chinese economy as a report showed exports surged in January despite the trade war between the US and China. As commodity currency central banks battle, here are three forex trades to emerge as the victor!

Forex Profit Set-Up #1; Sell AUDNZD - MN Time-Frame

Bearish momentum in this currency pair, as well as curiosity of forex traders, may combine to test parity in the AUDNZD. Price action currently trades above its primary descending resistance level which is acting as support, and below its secondary descending resistance level. An temporary extension of the downtrend may take price action into the upper band of its horizontal support area which is located just above parity. Forex traders are recommended to sell the rallies from current levels.

The CCI is already trading in extreme oversold conditions, but remains well off of its lows. It may attempt to challenge its those once again as the AUDNZD could attempt a test of parity. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market; earn over 500 pips per month in profits!

Forex Profit Set-Up #2; Sell EURNZD - MN Time-Frame

As the Eurozone economy continue to struggle and print weaker and weaker economic figures, the New Zealand economy is expected to benefit from the anticipated recovery in China. The EURNZD has already started its corrective phase after failing to push past the lower band of its horizontal resistance area. Its primary descending resistance level is applying additional bearish pressures. This currency pair is now expected to complete a breakdown below its secondary ascending support level and contract through its horizontal support level into its primary ascending support level. Selling the rallies is the favored trading approach.

The CCI descended into extreme oversold territory, but plenty of downside remains in this momentum indicator in order to test its previous lows. As the EURNZD is anticipated to extend its corrective phase it will result in a lower reading for the CCI. Fund your PaxForex Trading Account today and start adding the recommended trades of our expert analysts to your own trading account!

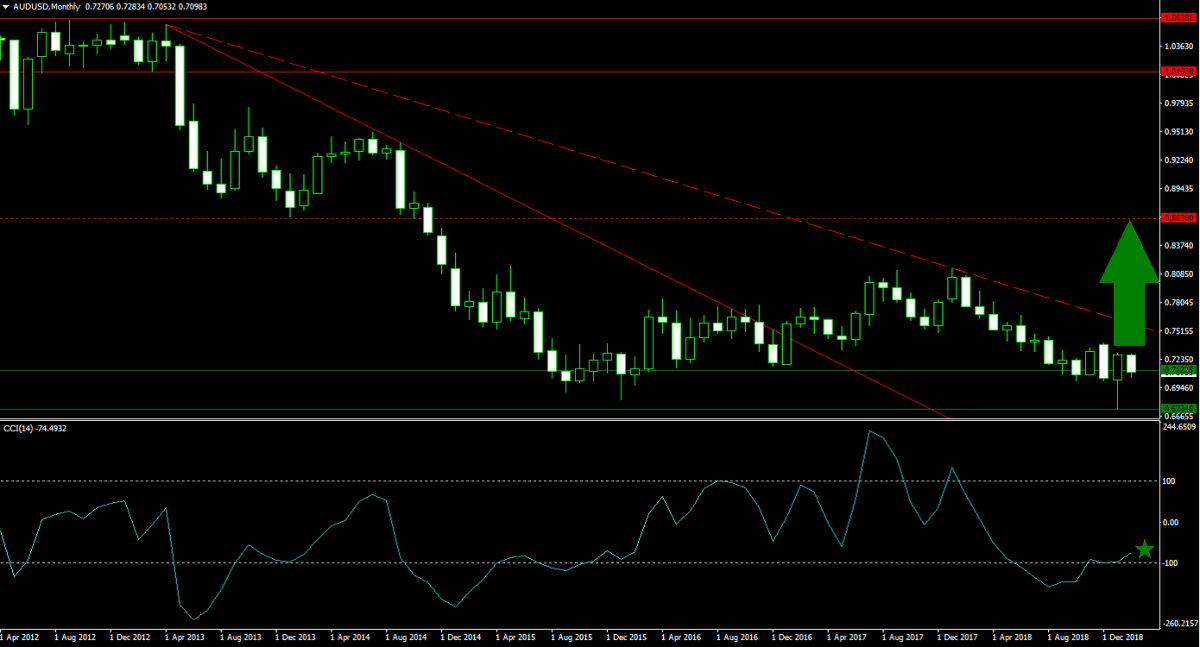

Forex Profit Set-Up #3; Buy AUDUSD - MN Time-Frame

The US Dollar has enjoyed a solid rally, but as the US Fed is has made a U-turn and taken a more dovish stance, the greenback has become vulnerable to profit taking. This is further enhanced with a series of mixed economic reports out of the US with a bearish bias. The AUDUSD has stabilized at the upper band of its horizontal support area as the primary descending resistance level is slowly fading. The secondary descending resistance level is approaching price action. A breakout above it is expected to take this currency pair into its next horizontal resistance level. Forex traders are advised to buy the dips in the AUDUSD.

The CCI already completed a breakout out of extreme oversold conditions and positive momentum is likely to take this technical indicator above the 0 mark. This would result in a bullish momentum change and push price action further to the upside. Follow the PaxForex Daily Forex Technical Analysis and copy the recommended trades of our expert analysts!

To receive new articles instantly Subscribe to updates.