Bond investors around the globe have enjoyed a bull market which lasted for over 30 years, but as will all assets which go up they will eventually come down. While an overall long-term advance is normal, nothing can advance in a straight line. Usually, the longer a bull market lasts the steeper and more powerful the correction will be. In addition, if there is no corrective phase many forget how to act and react once one begins which results in panic. This panic fuels the sell-off and floating profits are replaced by actual losses.

China has now rattled the bull cage once again after senior government officials conducted a review of the country’s foreign exchange holdings. The recommendation was for China to either reduce the purchases of US Treasuries or to abandon them altogether. China holds the world’s largest currency reserves valued at $3.1 trillion and the news certainly will get the attention in Washington. It is not yet clear if the recommendation given will be implemented, but yields on US Treasuries rose for the fifth consecutive day and settled at the highest level since March of 2017.

The news come as US Treasuries were already under pressure due to central banks reducing quantitative easing which has driven bond prices higher. The potential decrease in Chinese appetite for US Treasuries would coincide with the US in need to increase its debt as the US Federal Reserve is reducing its balance sheet and the US twin deficits are set to increase. Commerzbank strategist Michael Leister noted that ‘With markets already dealing with supply indigestion, headlines regarding potentially lower Chinese demand for Treasuries are renewing bearish dynamics. Today’s headlines will underscore concerns that the fading global quantitative-easing bid will trigger lasting upside pressure on developed-market yields.’

Forex traders should monitor key developments in the global bond market as a significant change will create a ripple in financial markets and contribute to price action in currency pairs. PaxForex keeps its traders informed which allows them to make profitable trading decisions. Open your PaxForex Trading Account today and join tens of thousands of profitable forex traders.

Adding to the notion that China is likely to diversify and therefore sell US Treasuries was Charles Wyplosz, Professor of International Economics at the Graduate Institute of International and Development Studies in Geneva who stated that ‘It’s a complicated chess game as with everything the Chinese do. For years they have been bothered by the fact that they are so heavily invested in one particular class of US bonds, so it’s just a question of time before they would try to diversify.’ Another reason for the potential change of course could be a looming trade war between China and the US. The Chinese reduction in US Treasuries and your forex trades can combine for a pip heavy outcome and here are our three forex trades which will help you profit.

Forex Profit Set-Up #1; Sell USDMXN - D1 Time-Frame

The USDMXN has already a completed a breakdown below its horizontal resistance area which ended the up-trend. An ascending support level is adding to bullish pressures, but is unlikely to be strong enough to prevent a sustained move to the downside. Forex traders should monitor price action for an additional breakdown below the ascending support level which will trigger profit taking and clear the way to the downside for this currency pair. Any level between 19.3000 and 19.6000 represents a good short entry opportunity.

The CCI descended from above 100, which signals extreme overbought conditions, to below 0 which marks a momentum change from bullish to bearish. More downside is expected from this indicator. Download your MT4 Trading Platform today in order to take advantage from the profit potential in the USDMXN.

Forex Profit Set-Up #2; Buy AUDUSD - MN Time-Frame

The AUDUSD enjoys a double dose of bullish momentum. The first part is provided after this currency pair broke out above its horizontal resistance area which resulted in a momentum shift. The second part is being provided by an ascending support level which originated at the low of its most recent horizontal support area and which is pushing the AUDUSD to the upside. The lack of any major resistance gives this trade plenty of upside potential over the long-term with limited downside risk. Forex traders are advised to stagger their long entries between 0.7680 and 0.7860.

The CCI is currently approaching the 100 mark. Any short-term retreat in price action will bring this indicator closer to the 50 mark which will coincide with excellent buying opportunities in this currency pair below the 0.7770 level. Forex Recommendations are provided by PaxForex analysts every day in order to make sure all clients will be presented with the most profitable trades.

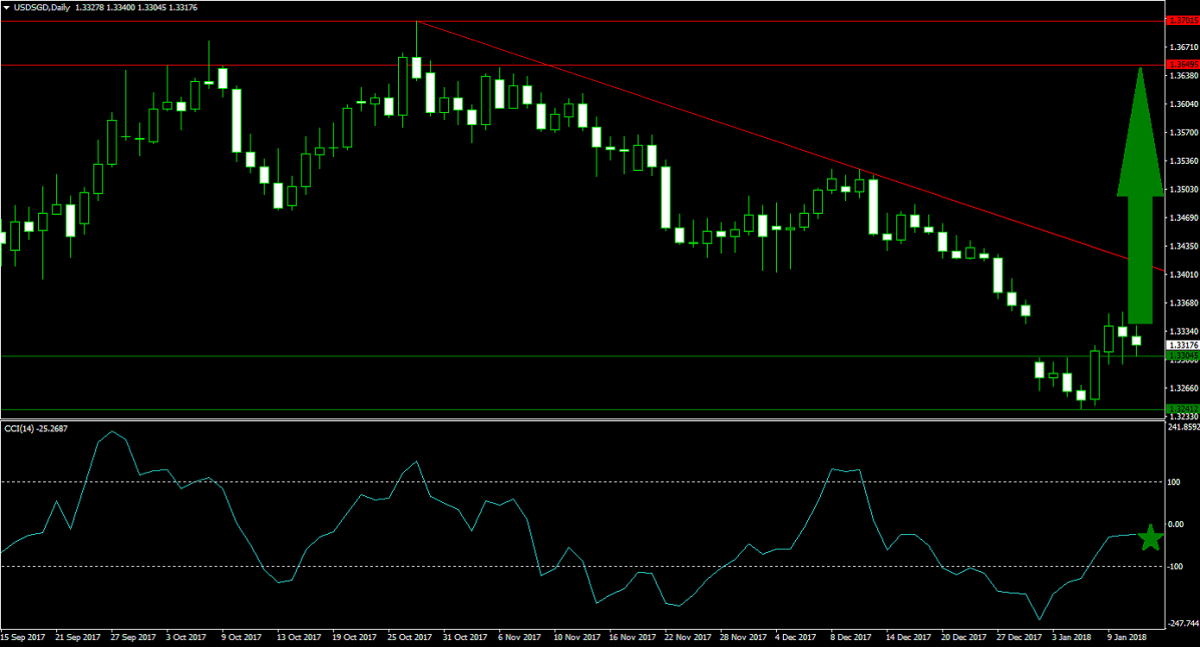

Forex Profit Set-Up #3; Buy USDSGD - D1 Time-Frame

A good way to reduce downside risk to the US Dollar short-trade as well as to shield your forex account from unexpected positive surprises is a long position in the USDSGD. This currency pair just pushed above its horizontal support area and price action is now met with a descending resistance level. Momentum from the breakout should be strong enough for a second breakout which will see the USDSGD advance until it can challenge its next horizontal resistance area. Long entries between 1.3300 and 1.3350 are viewed as favourable entry levels.

The CCI has confirmed the momentum change from bearish to bullish with a breakout above the -100 level, which represents extreme oversold conditions, and this indicator is now set to breach the 0 level to the upside. The PaxForex Forex Fundamental Analysis section offers forex traders insights into the best forex trades for the session; add over 500 pips to your portfolio every month.

To receive new articles instantly Subscribe to updates.