The Chinese leadership has lowered its GDP growth target range for 2019 to between 6.0% and 6.5%. This is down from the previous estimate of a growth figure of 6.6% annualized. The adoption of a target range instead of a fixed GDP figure gives Chinese policy makers more room to maneuver through difficult economic times. The Chinese economy is faced with a rising debt level at a time when the economy is slowing down and maturing from an emerging market to a developed one. The new growth range was presented by Chinese Premier Li Keqiang to the National People’s Congress.

The Chinese economy has been slowing down for years as China is now focused on reducing debt levels, environmental impacts as well as poverty. In order to combat the extended slowdown, Premier Li Keqiang announced a 2 Trillion Yuan worth of tax cuts in order to stimulate the economy and boost lending to by large banks to small and medium sized private business which remains the job engine of the economy. This will increase debt levels of China which are currently approaching 300% of GDP and may face a bigger issue down the road.

During this year’s report, no targets for retail sales figures or fixed-asset investment were presented. Reserve ratio cuts for smaller banks are expected to follow and the VAT will be lowered in order to assist industries who are expected to face the most exposure the the economic situation. Premier Li noted that China will “improve the exchange rate mechanism and keep the Yuan generally stable and at an adaptive and balanced level.” He further added that “China will face a graver and more complicated environment as well as risks and challenges that are greater in number and size. China must be fully prepared for a tough struggle.”

As a result of the economic slide and the planned official stimulus, the 2019 target budget deficit was raised to 2.9%, up 0.3% from 2018’s deficit target of 2.6%. Chinese PMI readings for 2019 showed signs of stabilizing in contractionary territory. Will the Chinese economy bottom out in 2019 and accelerate into the new decade? How will commodity currencies be impacted? Open your PaxForex Trading Account today and start building a profitable forex portfolio with the help of our expert analysts!

Chinese policy makers have already implemented what many economists called a stealth stimulus, but more is expected in order to halt the slowdown. Natixis Economist Alicia Garcia Herrero stated that “These targets accommodate structural deceleration but not cyclical, which means that policy makers will need to flex their muscles to stimulate the economy. It’s good news for the market in the short term; bad news for China in the medium term as more leverage will need to be piled up.” China’s Premier Li lowered the economic growth forecast, but here are three forex trades which will increase your pips!

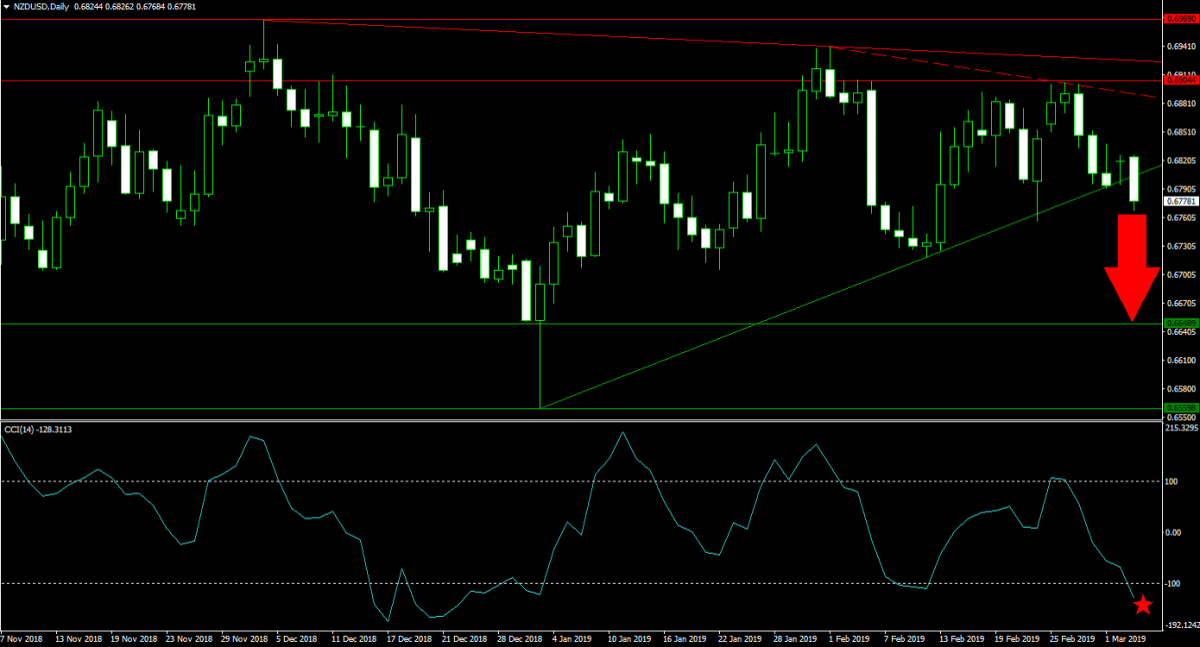

Forex Profit Set-Up #1; Sell NZDUSD - D1 Time-Frame

Commodity currencies, such as the New Zealand Dollar, are already feeling the impacts of the downward revision to the Chinese 2019 GDP growth target. The NZDUSD started to weaken after price action was rejected by the lower band of its horizontal resistance area which is being enforced by its primary and secondary descending resistance levels. This currency pair accelerated to the downside after today’s downgrade and completed a breakdown below its primary ascending support level which cleared the path down into the upper band of its horizontal support area. Selling any rallies into its primary ascending support level, which now acts as temporary resistance, is the favored trading approach.

The CCI dropped into extreme oversold conditions, but remains well off of its previous lows. The build-up in bearish momentum is anticipated to push this technical indicator further to the downside. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market yielding over 500 pips in profits!

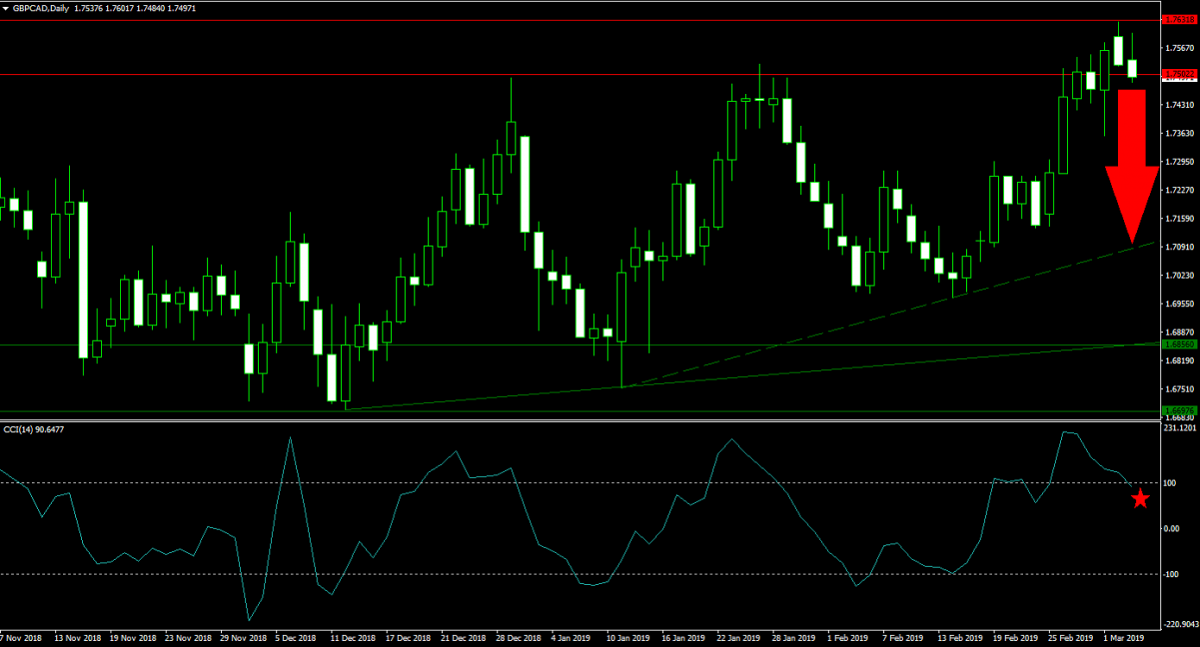

Forex Profit Set-Up #2; Sell GBPCAD - D1 Time-Frame

While the Canadian Dollar is a commodity currency as well, price action in the GBPCAD has surged as forex traders raised their optimism for a Brexit deal or delay by the end of the month. This currency pair was pushed into its horizontal resistance area, but today’s news gave traders an excuse to realize floating trading profits. A breakdown below the lower band of its horizontal resistance area is anticipated to accelerate a sell-off in the GBPCAD down into its secondary ascending support level. Forex traders are advised to place their sell orders above and below the lower band of its horizontal resistance area.

The CCI already pushed below the 100 mark and out of extreme overbought territory. This is expected to increase the pace of selling as bearish momentum will rise while the price action reversal develops. Subscribe to the PaxForex Daily Forex Technical Analysis and copy the technical trading recommendations posted by our expert analysts into your own account!

Forex Profit Set-Up #3; Buy USDSGD - D1 Time-Frame

Asian economies are likely to feel the biggest impact from a ongoing Chinese slowdown and financial hub Singapore could come under pressure. The Singapore Dollar has been strengthening against the US Dollar, but a price action reversal is gaining steam. The rise in bullish momentum from the short-covering rally is expected to push the USDSGD above its secondary descending resistance level and back into its next horizontal resistance level. Forex traders are recommended to buy the dips in the USDSGD down into the upper band of its horizontal support area.

The CCI, after the formation of a positive divergence, accelerated from extreme oversold conditions through the 0 level and is now anticipated to extend its advance. The bullish momentum shift has contributed to the rise. Download your PaxForex MT4 Trading Platform now and started planting the seed for a better tomorrow with the help of our expert analysts!

To receive new articles instantly Subscribe to updates.