The Government of China had to go on the offensive on the underground banking system, which were developed in recent years. Country's central bank is trying to rein in excessive lending, which may soon get out of control.

The Government of China had to go on the offensive on the underground banking system, which were developed in recent years. Country's central bank is trying to rein in excessive lending, which may soon get out of control.

The People's Bank of China earlier this week called on private banks to stop losing billions on speculation, to adequately assess the risks and improve the quality of financial management of depositors. All this must be done to avoid panic, which can be very costly to the country’s economy.

This order Chinese private banks received a week ago, before it became known to the public. This led to the acceleration of a downtrend of bank liquidity and to the strong growth rates. In fact, the central bank of China has carried out an attack on the banks that participated in complex transactions involving the concealment of credit risks.

This caused panic among investors, who fear that these measures will slow the Chinese economy even stronger. In the end, the decision of the People's Bank has led to the sale of assets in the market.

The second, after the U.S., economy has a tremendous impact on the situation in the global economic sphere, so analysts and investors are closely watching the decisions of financial regulators. China's financial system remains nontransparent for both foreigners and Chinese themselves.

This puts the Bank of China before the difficult dilemma: on the one hand, it is necessary to control the flow of funds of private banks in the country, and on the other hand, it is necessary to carry out a radical reform of the banking system, which is currently too dependent on government decisions.

China’s leaders have acknowledged problems with its financial system, and President Xi Jinping has vowed to reform the country’s economy in sweeping ways that rebalance China’s sources of growth, from an economy dependent on speculative investment and real estate to one that relies more heavily on consumption.

But there’s some disagreement on how much China’s leaders are actually in control of the situation, and how well they can manage the political perils if people are out of work or see their wealth stop growing.

Meanwhile, last week it became known about massive falsification of economic data in China, which caused a scandal. It was found that in a large city Henlan, which is one of the most developed cities of Guangdong province, the industrial production data were deliberately inflated by almost four times. This case has once again stirred up doubts about the credibility of statistics coming out from China.

By the way, until the Middle Ages, China was one of the most accurate countries on statistics. Country was ruled by a large class of well-educated officials and the size of the statistical documents turnover was much higher than in any other country in the world. Of course, there were “games” with data too but the overall picture of the state of affairs of the country was sufficiently accurate for the time.

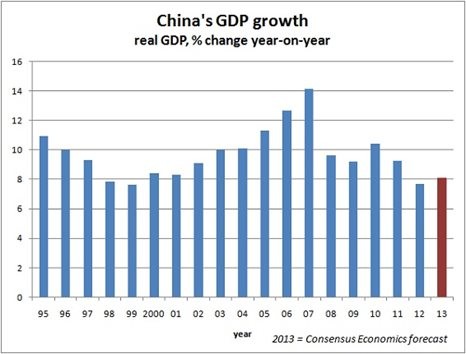

Graphics: China’s GDP data