Economic data out of the Eurozone released this morning showed economic confidence posted its 12th consecutive contraction in the month of December. This represented a decrease in every single month for 2018 and the worst such streak since the global financial crisis in 2008. The Eurozone Economic Sentiment Index, which includes confidence data from households as well as companies, dropped to a two-year low. The trade war between the US and China, end of ECB stimulus, political issues out of Italy as well as the periphery and Brexit uncertainty have all contributed to the loss in economic confidence.

The drop in confidence was broad-based and the top five Eurozone economies shrank in unison. The most pessimistic readings were found in production expectations, industry order books, future service sector demand and construction employment. Adding to the mix the surprise drop in German industrial output which plunged in November for a third consecutive month and recorded its worst annualized contraction since the 2008 financial crisis, and Euro bulls have a tough case to make. The risks for a German recession have now increased drastically which has not been priced into the market as of yet.

Germany’s auto sector has not fully recovered from the emission scandal and the new testing procedures which have been implemented. US President Trump has also repeatedly indicated that he may launch a trade war on the German auto sector. Despite the data, the ECB remains confident and Governing Council Member Ardo Hansson stated that “For every bit of bad news, you get a bit of better news, and on balance I don’t see this creates risks that shift the balance of risks.”

Recession talk out of Germany has increased, bit traders have so far largely dismissed the prospects of it. Can the Euro handle a German recession? The US Dollar is expected to weaken in 2019, but how will the Euro trade with headwinds increasing? Open your PaxForex Trading Account today and plant the seed for a profitable forex portfolio nurtured with the help of our expert analysts!

Striking a more optimistic note on German economic prospects is one of its biggest lenders, Commerzbank. Analyst Marco Wagner noted that “Carmakers are likely to catch up on their production, the ECB’s monetary policy remains investment-friendly, and China’s economic stimulus program is likely to boost the local economy, which will also benefit the German economy.” Commerzbank also view manufacturing data as strong while ING analysts believe that private and public consumption will prevent a recession in Germany and remains optimistic on the industry order book. GDP growth for 2019 is currently expected at 1.6%, the same as in 2018. Can the Euro handle a German recession? Here are three forex trades to boost your portfolio.

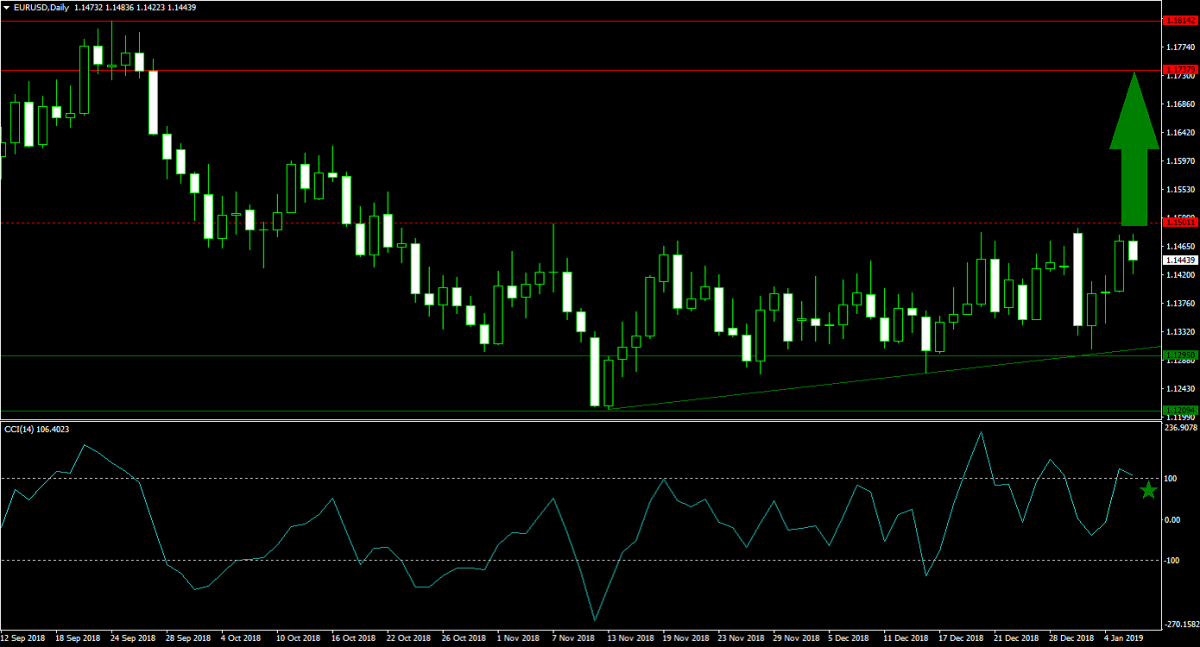

Forex Profit Set-Up #1; Buy EURUSD - D1 Time-Frame

The EURUSD has traded in a narrow range between its horizontal resistance area and its horizontal support level. With the US Dollar poised for a 2019 slowdown, forex traders have to weigh the depth of the expected slowdown against the worries out of the Eurozone for the Euro. It is expected that price action will be able to complete a breakout above its horizontal resistance level which will clear the path for a rally back into the lower band of its next horizontal resistance area. Buying the dips down to its primary ascending support level is favored.

The CCI is currently trading in extreme overbought conditions, but as the EURUSD will temporarily contract, this technical indicator will move below 100 which would represent a good long entry opportunity. Download your PaxForex MT4 Trading Platform and take the first step for a bright forex income stream.

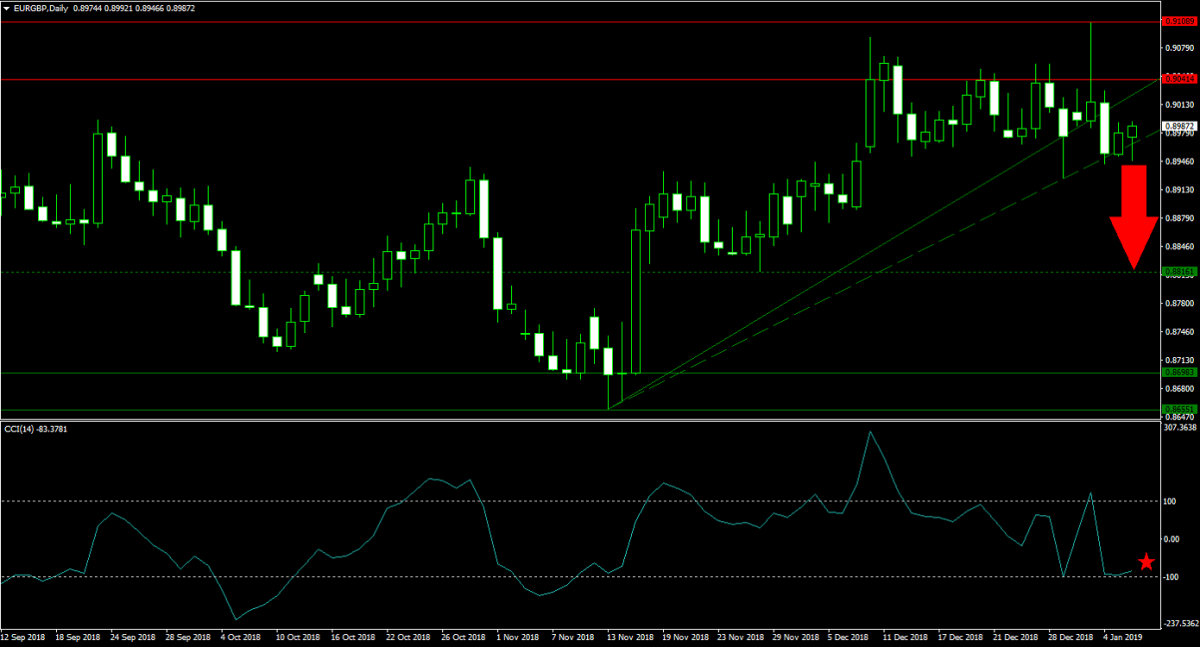

Forex Profit Set-Up #2; Sell EURGBP - D1 Time-Frame

Brexit is approaching and while preparations for a no deal on both sides of the Channel have been increased, a growing number of UK cross-party MPs are trying to push for a resolution which takes a no deal Brexit of the table. The EURGBP started to retreat after a brief spike in its horizontal resistance area. This trend is likely to continue following the breakdown below its primary ascending support level. A push below its secondary ascending support level will clear the path for a correction down into its next horizontal support level. Forex traders are advised to sell the rallies in the EURGBP.

After the CCI advanced into extreme overbought territory, it quickly reversed course and crashed below the 0 mark which resulted in a bearish momentum shift. A further contraction into extreme oversold conditions is expected. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide your portfolio through the forex market.

Forex Profit Set-Up #3; Sell EURNZD - D1 Time-Frame

Bullish momentum in the EURNZD faded after this currency pair accelerated from its horizontal support area and recovered roughly half of its preceding contraction. This move pushed price action above its primary descending resistance level, but the most recent reversal marked a new horizontal resistance level. In addition its secondary descending resistance level is applying further downside pressure on the EURNZD. An extension of the sell-off into the upper band of its horizontal support area is anticipated. Forex traders are recommended to sell the rallies into its secondary descending resistance level.

The CCI already pushed below extreme overbought conditions, and the downtrend in this momentum indicator is expected to continue below the 0 level and down into extreme oversold territory. Subscribe to the PaxForex Daily Forex Technical Analysis and copy the recommended trades of our expert analysts into your own forex trading account.

To receive new articles instantly Subscribe to updates.